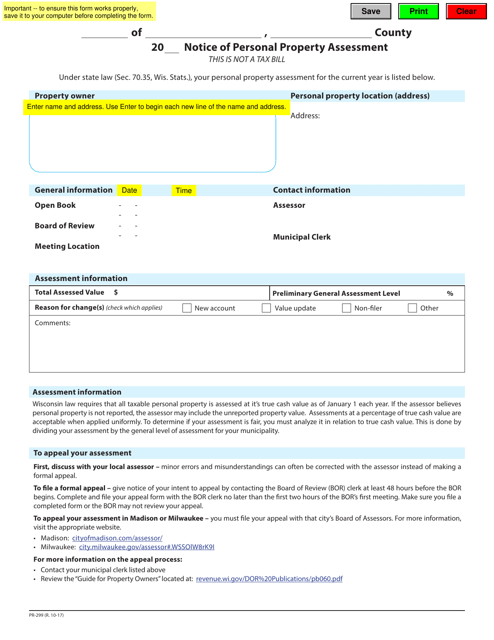

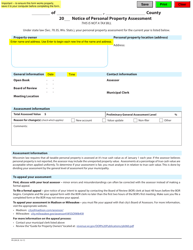

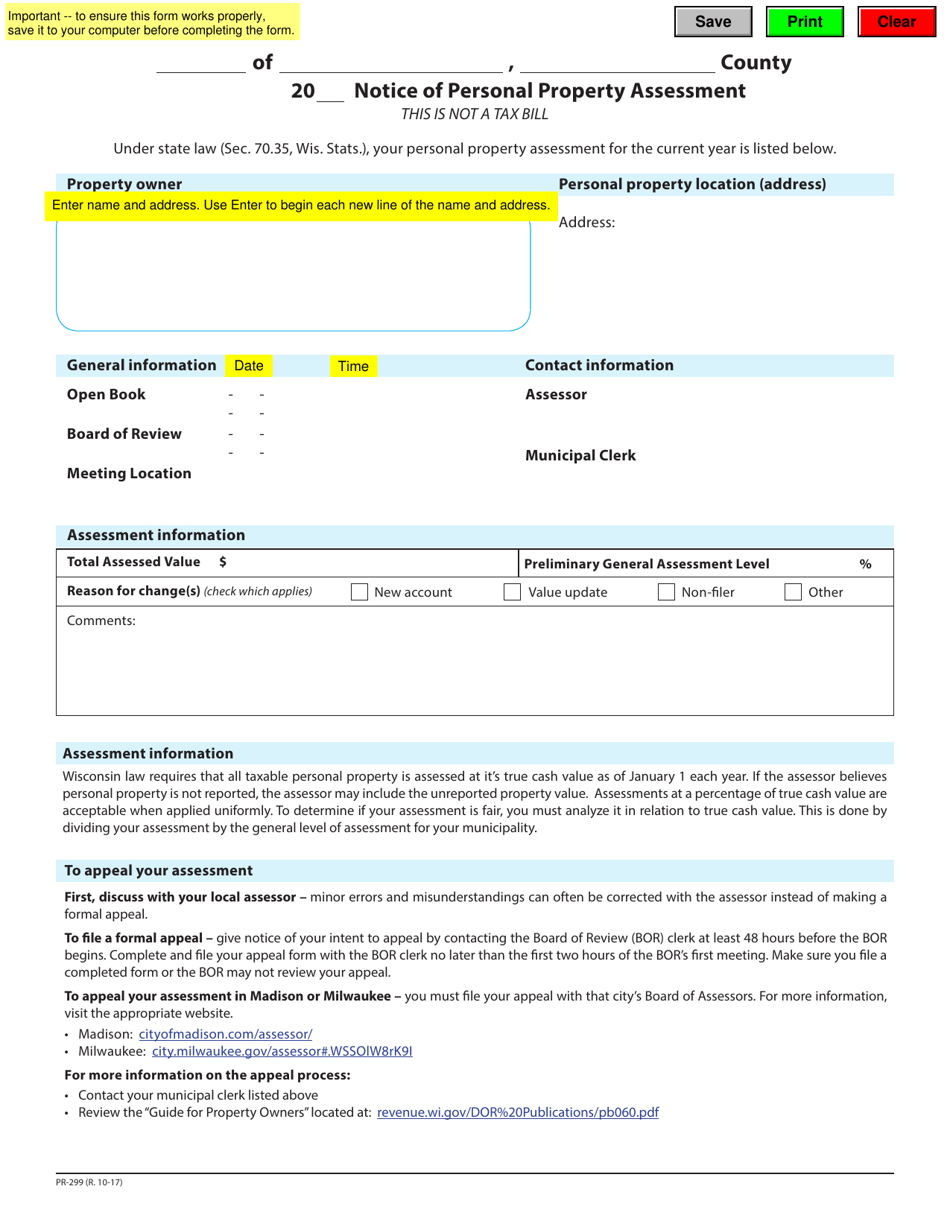

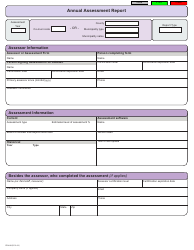

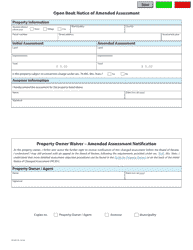

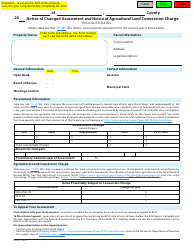

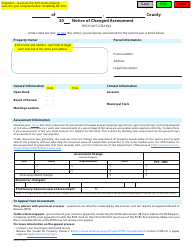

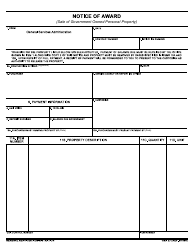

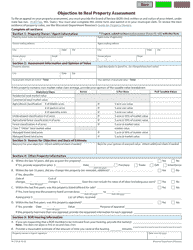

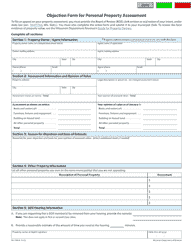

Form PR-299 Notice of Personal Property Assessment - Wisconsin

What Is Form PR-299?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form PR-299?

A: Form PR-299 is the Notice of Personal Property Assessment used in Wisconsin.

Q: Who is required to file form PR-299?

A: Businesses and individuals who own personal property that is subject to taxation in Wisconsin are required to file form PR-299.

Q: What is personal property?

A: Personal property includes items such as furniture, equipment, inventory, and supplies that are used in a business.

Q: When is form PR-299 due?

A: Form PR-299 is due on March 1st of each year.

Q: What information is needed to complete form PR-299?

A: You will need to provide details about your personal property, such as its description, cost, and acquisition date.

Q: Are there any penalties for not filing form PR-299?

A: Yes, there are penalties for not filing form PR-299, including the assessment of additional taxes and interest.

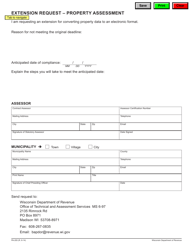

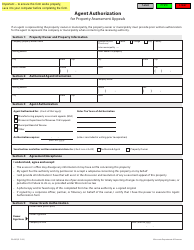

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PR-299 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.