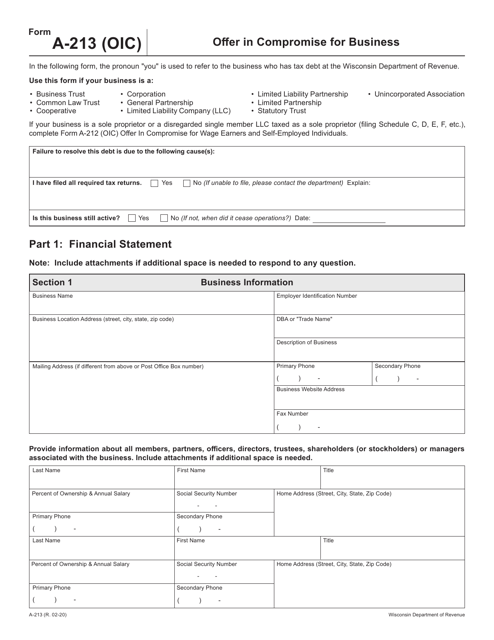

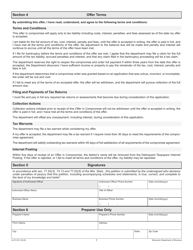

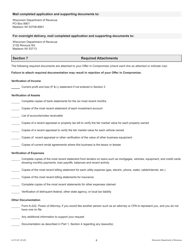

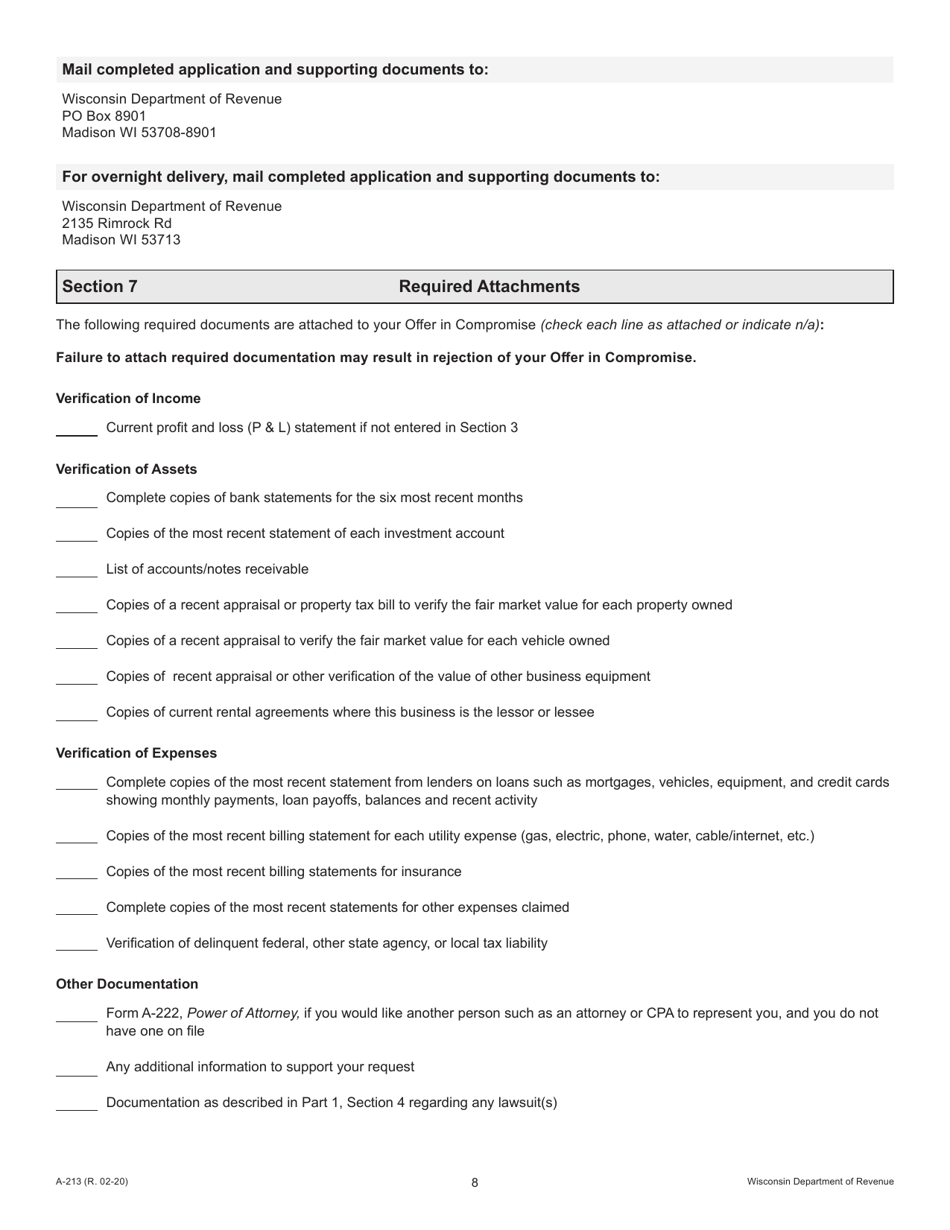

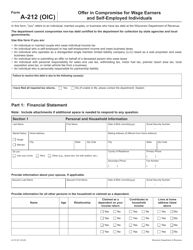

Form A-213 Offer in Compromise for Business - Wisconsin

What Is Form A-213?

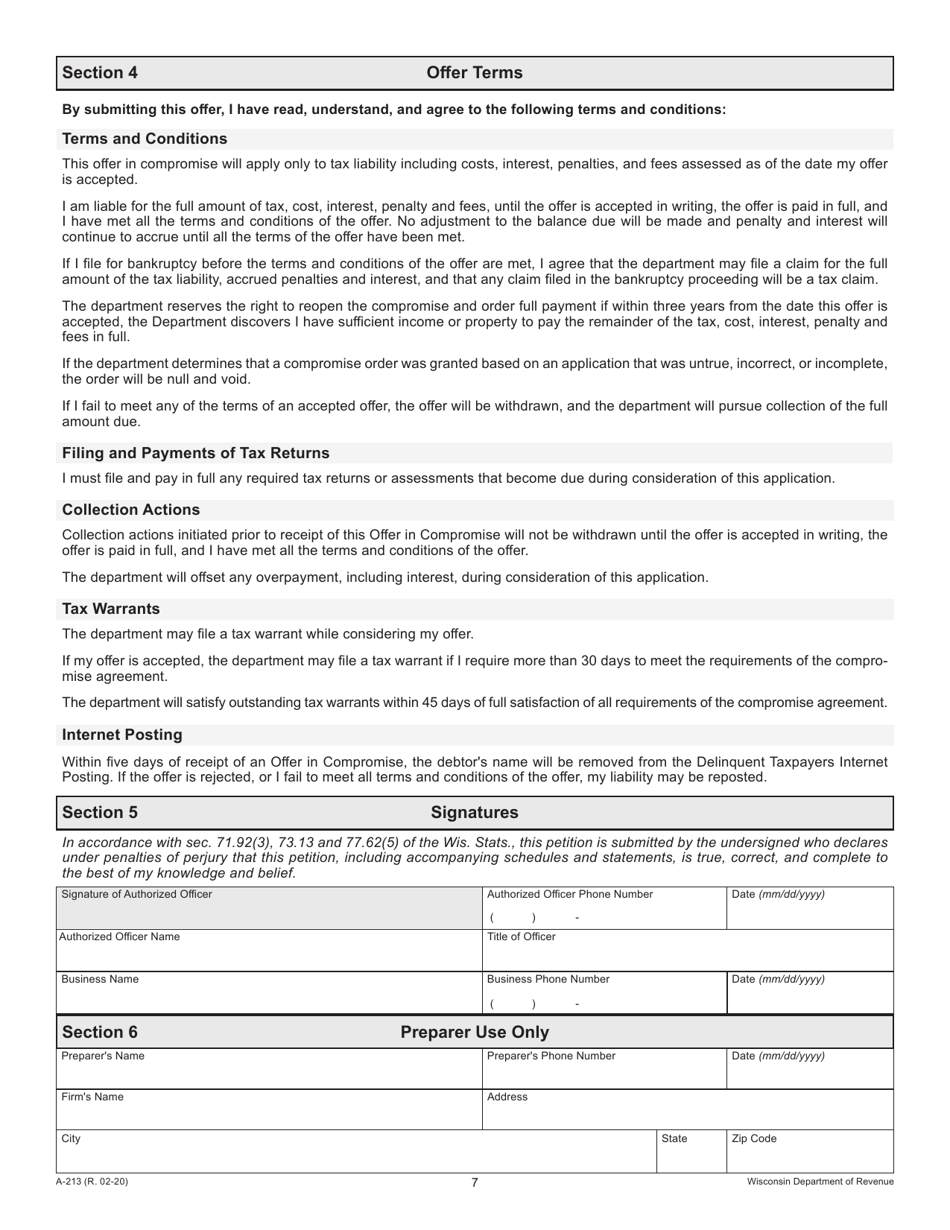

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-213?

A: Form A-213 is an Offer in Compromise for Business in Wisconsin.

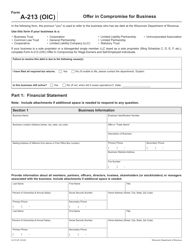

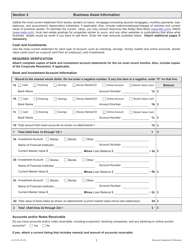

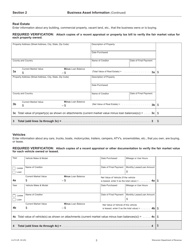

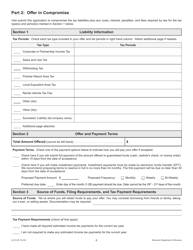

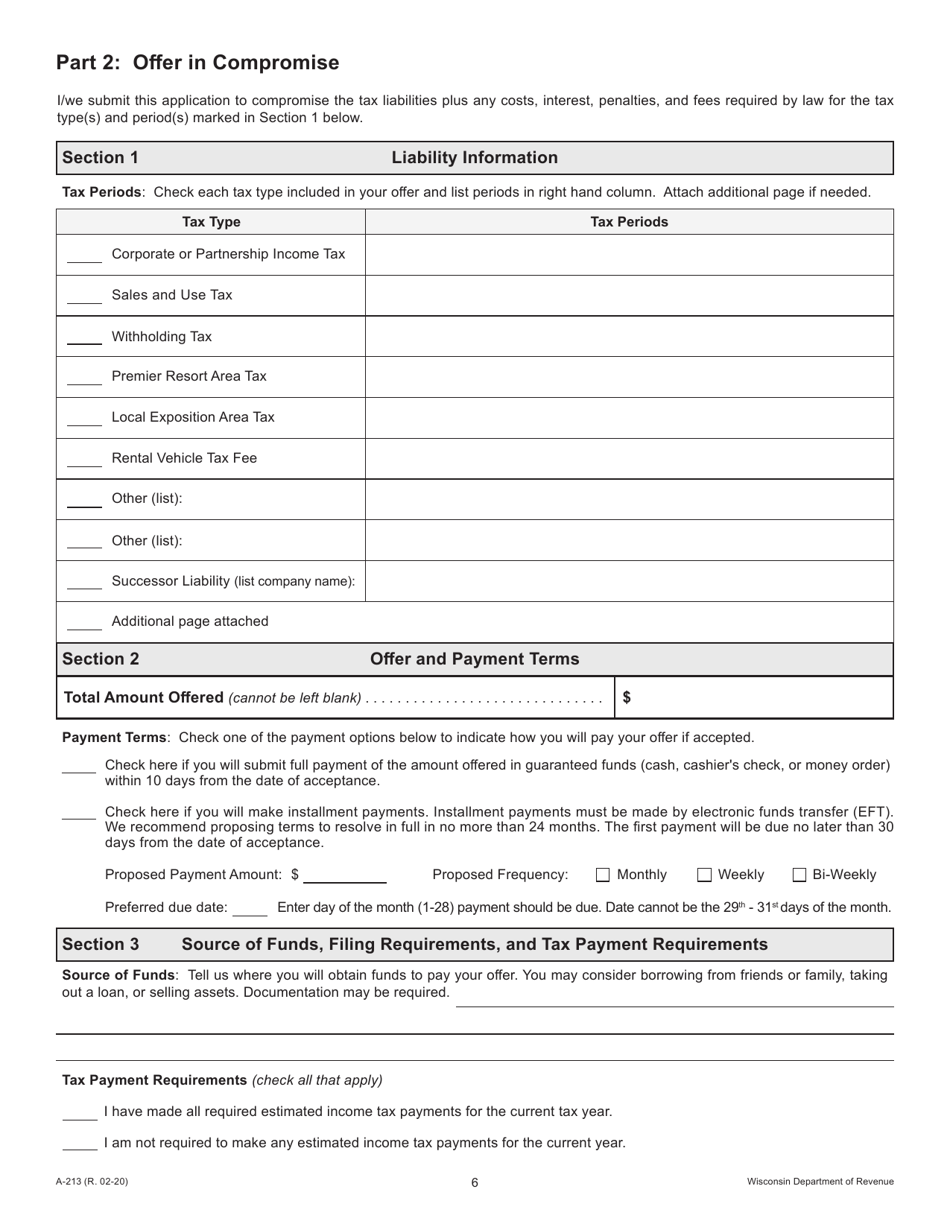

Q: What is an Offer in Compromise?

A: An Offer in Compromise is an agreement between a taxpayer and the government to settle a tax debt for less than the full amount owed.

Q: Who can use Form A-213?

A: Form A-213 is specifically for business taxpayers in Wisconsin.

Q: What is the purpose of Form A-213?

A: The purpose of Form A-213 is to provide a means for businesses to propose a compromise on their tax debt.

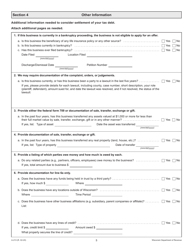

Q: Are there any eligibility requirements for using Form A-213?

A: Yes, there are eligibility requirements that must be met in order to use Form A-213. These include being up to date on all required tax returns and payments, demonstrating financial hardship, and being unable to pay the full amount owed.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form A-213 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.