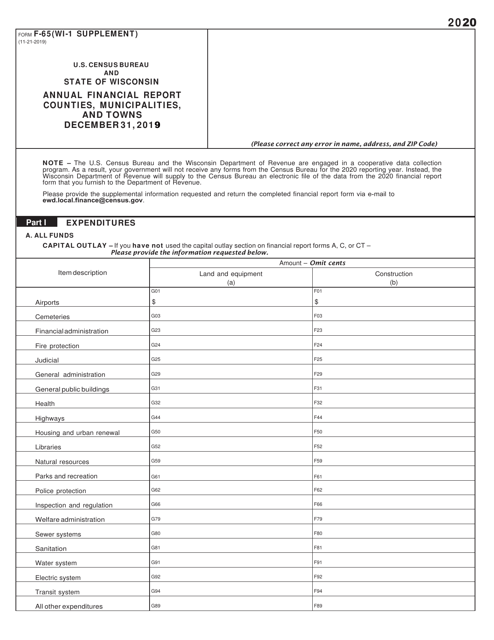

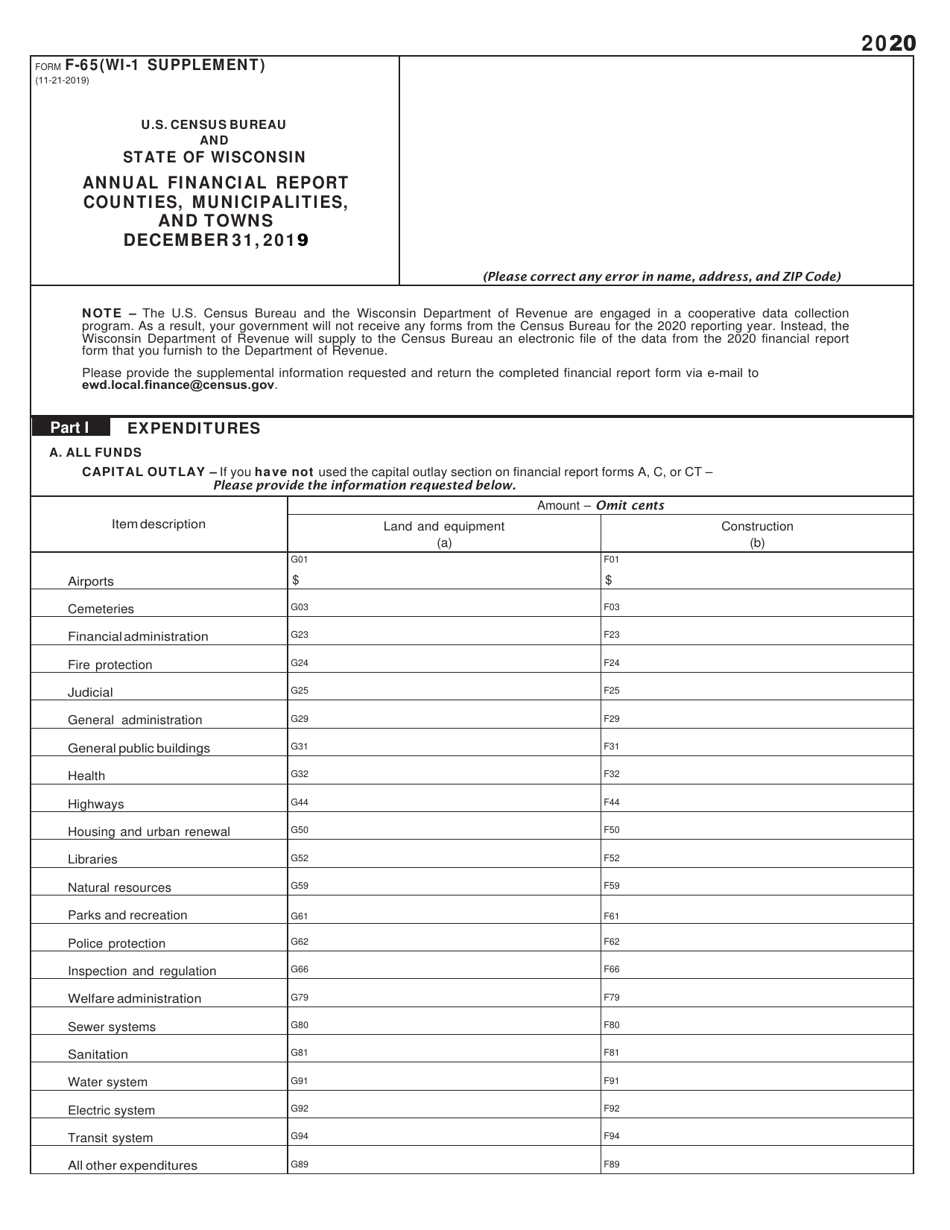

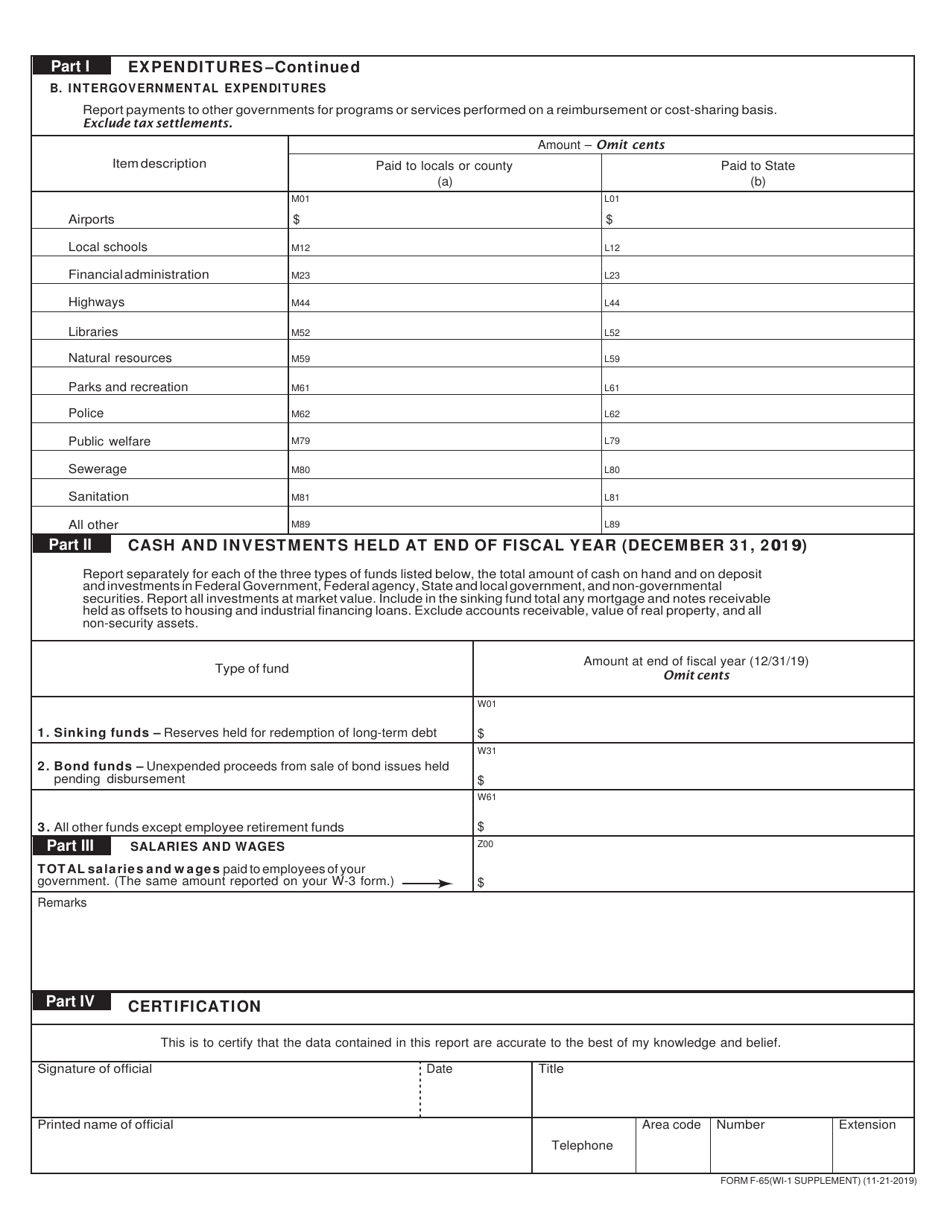

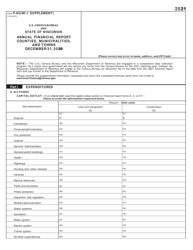

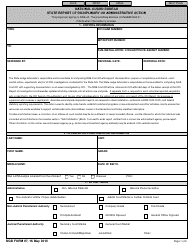

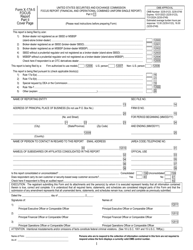

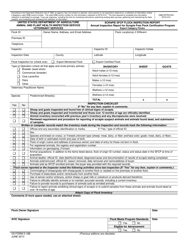

Form F-65 U.S. Census Bureau Annual Financial Report - Wisconsin

What Is Form F-65?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form F-65?

A: Form F-65 is the U.S. Census Bureau Annual Financial Report.

Q: What does this report cover?

A: This report covers the financial information of the state of Wisconsin.

Q: Who prepares the Form F-65?

A: The U.S. Census Bureau prepares the Form F-65.

Q: What is the purpose of this report?

A: The purpose of this report is to provide an overview of the financial activities and condition of Wisconsin.

Q: Is this report available to the public?

A: Yes, this report is public information and can be accessed by anyone interested in the financial status of Wisconsin.

Q: Does this report include detailed financial data?

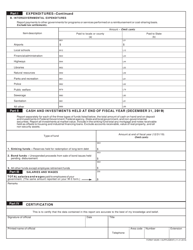

A: Yes, this report includes detailed financial data such as revenues, expenditures, assets, and liabilities of Wisconsin.

Q: Why is the U.S. Census Bureau involved in financial reporting?

A: The U.S. Census Bureau plays a role in collecting and analyzing data related to the financial activities of government entities, including states like Wisconsin.

Q: Are there any other documents related to Wisconsin's financial information?

A: Yes, there may be other financial reports or documents specific to Wisconsin's state government or agencies.

Q: Can this report be used for financial analysis or budget planning?

A: Yes, this report can be used for financial analysis and budget planning purposes by various stakeholders, including government officials, researchers, and financial analysts.

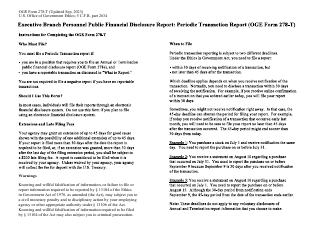

Form Details:

- Released on November 21, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-65 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.