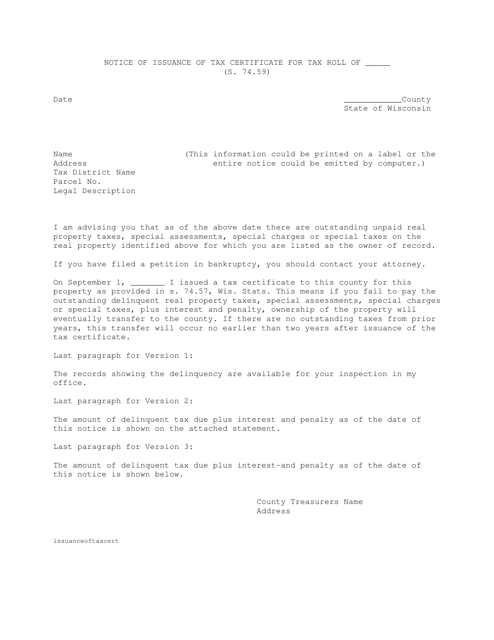

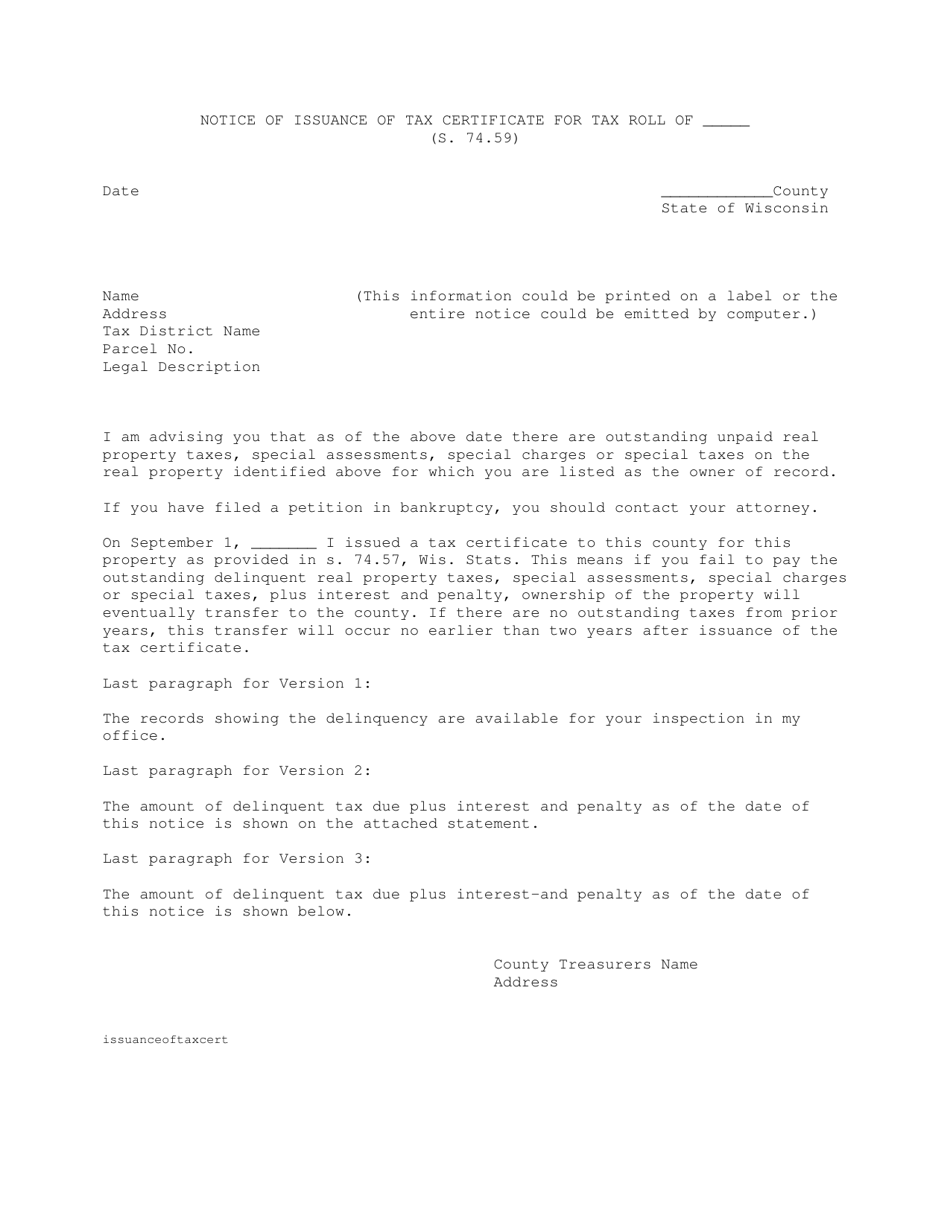

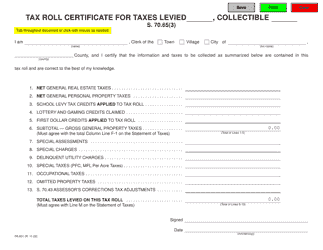

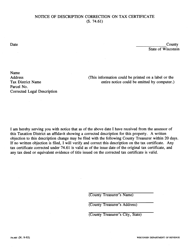

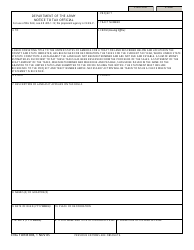

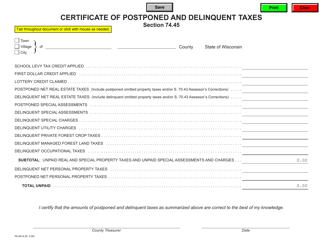

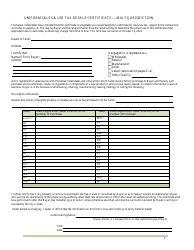

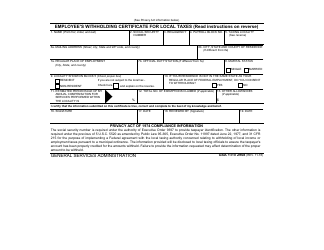

Notice of Issuance of Tax Certificate - Wisconsin

Notice of Issuance of Tax Certificate is a legal document that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin.

FAQ

Q: What is a Notice of Issuance of Tax Certificate?

A: A Notice of Issuance of Tax Certificate is a document issued by the state of Wisconsin to notify taxpayers of the issuance of a tax certificate for unpaid taxes on a specific property.

Q: What does a tax certificate represent?

A: A tax certificate represents a lien on the property for unpaid taxes.

Q: Why would a tax certificate be issued?

A: A tax certificate can be issued when a property owner fails to pay their property taxes.

Q: What are the consequences of having a tax certificate issued?

A: Having a tax certificate issued can result in additional fees, interest, and potentially the loss of the property if the taxes remain unpaid.

Q: What should I do if I receive a Notice of Issuance of Tax Certificate?

A: If you receive a Notice of Issuance of Tax Certificate, you should contact the appropriate tax authority to discuss payment options and resolve the outstanding tax issue.

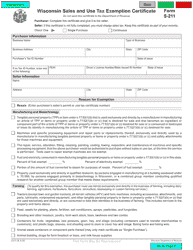

Form Details:

- The latest edition currently provided by the Wisconsin Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.