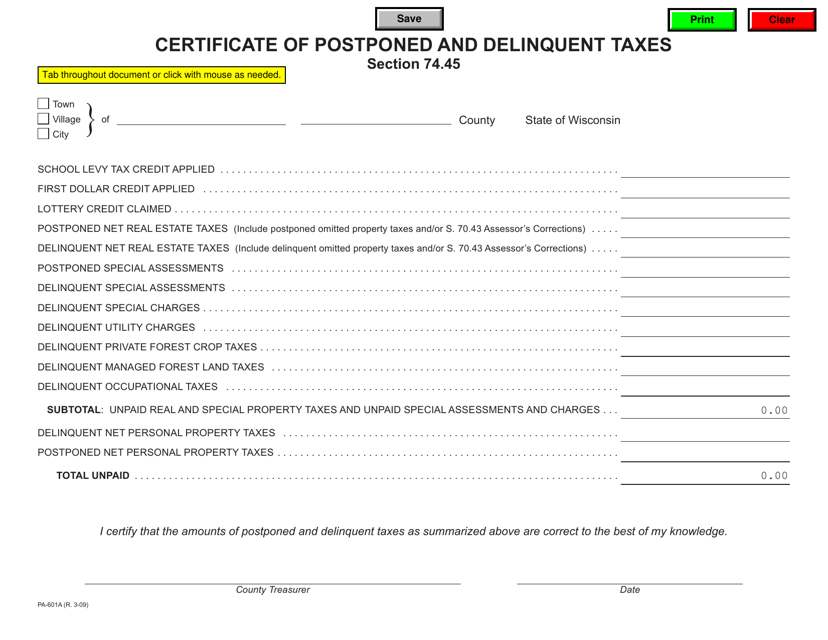

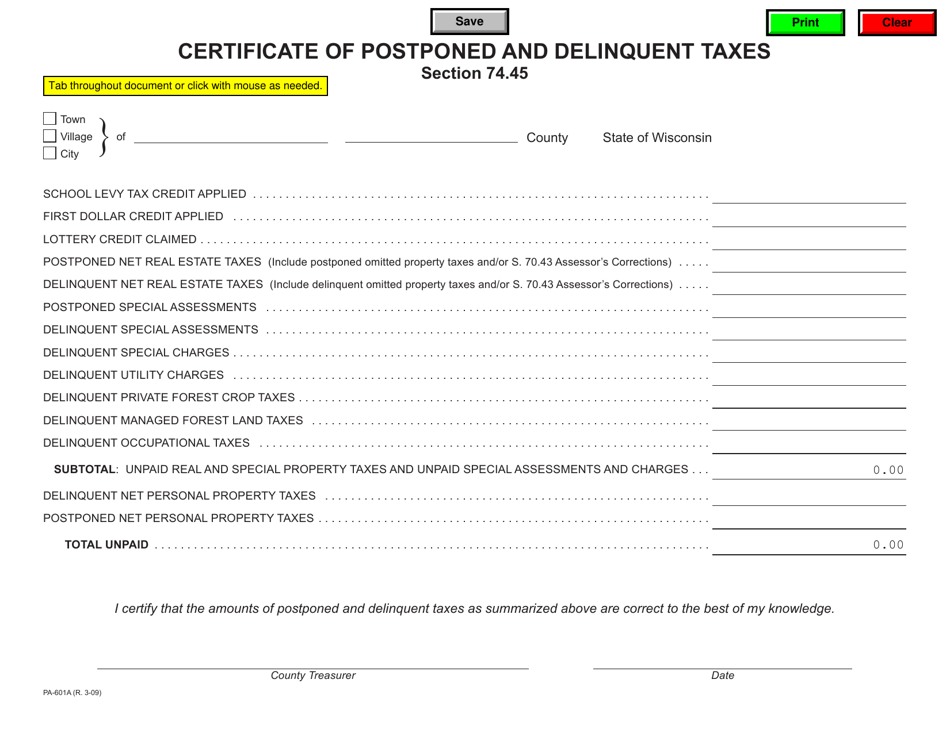

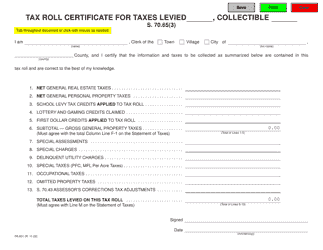

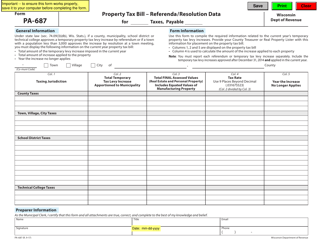

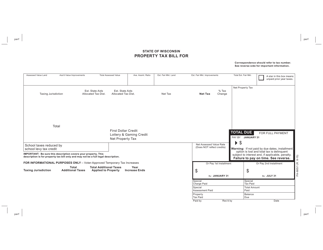

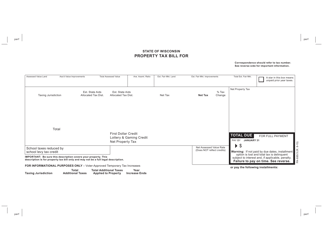

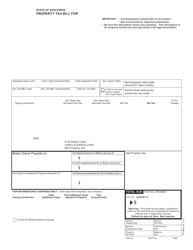

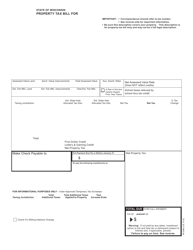

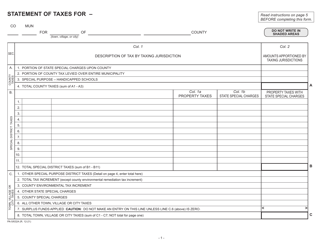

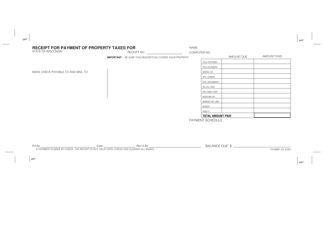

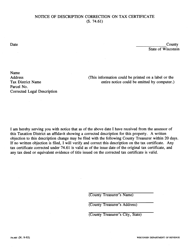

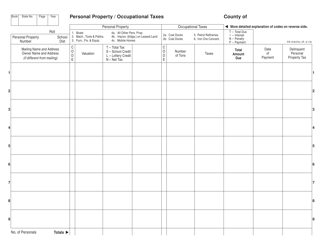

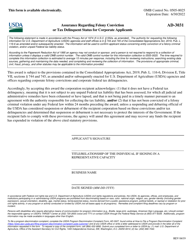

Form PA-601A Certificate of Postponed and Delinquent Taxes - Wisconsin

What Is Form PA-601A?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

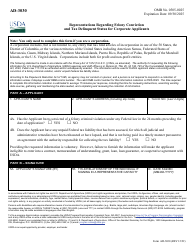

Q: What is Form PA-601A?

A: Form PA-601A is the Certificate of Postponed and Delinquent Taxes for the state of Wisconsin.

Q: Why is Form PA-601A used?

A: Form PA-601A is used to report and pay postponed and delinquent taxes in Wisconsin.

Q: Who needs to file Form PA-601A?

A: Any individual or business that has postponed or delinquent taxes in Wisconsin needs to file Form PA-601A.

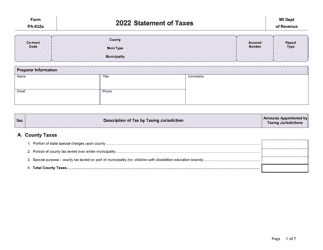

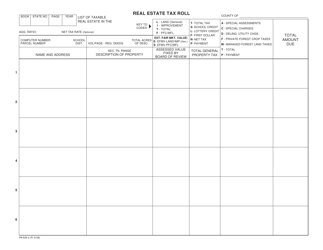

Q: What information is required on Form PA-601A?

A: Form PA-601A requires information such as the taxpayer's name, address, tax identification number, and details of the postponed or delinquent taxes.

Q: Are there any penalties for late filing of Form PA-601A?

A: Yes, there may be penalties for late filing of Form PA-601A. It is advisable to file the form as soon as possible to avoid any penalties or additional fees.

Form Details:

- Released on March 1, 2009;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-601A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.