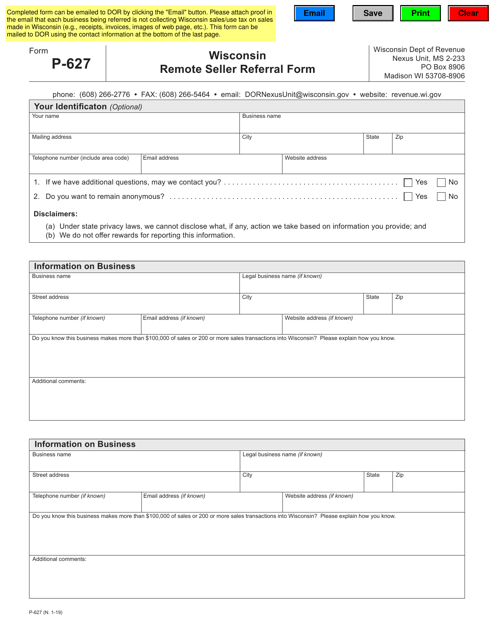

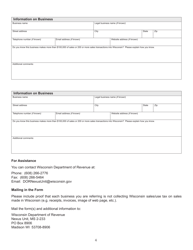

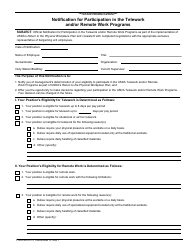

Form P-627 Wisconsin Remote Seller Referral Form - Wisconsin

What Is Form P-627?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-627?

A: Form P-627 is the Wisconsin Remote Seller Referral Form.

Q: Who should file Form P-627?

A: Remote sellers who have referrals from in-state entities should file Form P-627.

Q: What is the purpose of Form P-627?

A: The purpose of Form P-627 is to report referrals made by in-state entities to remote sellers.

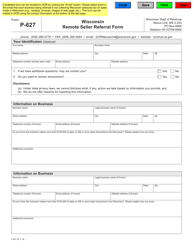

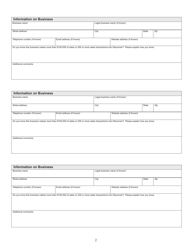

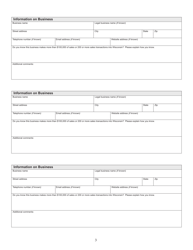

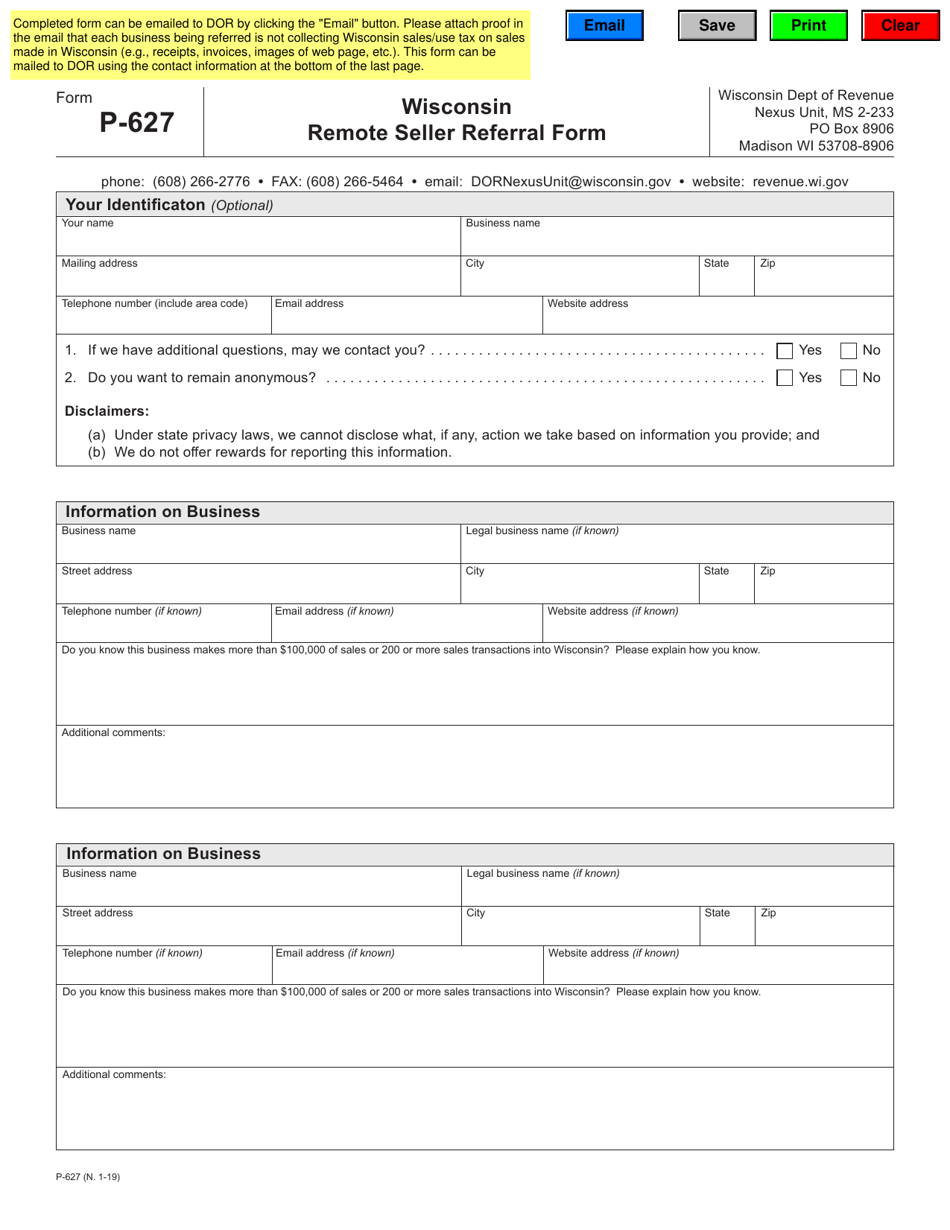

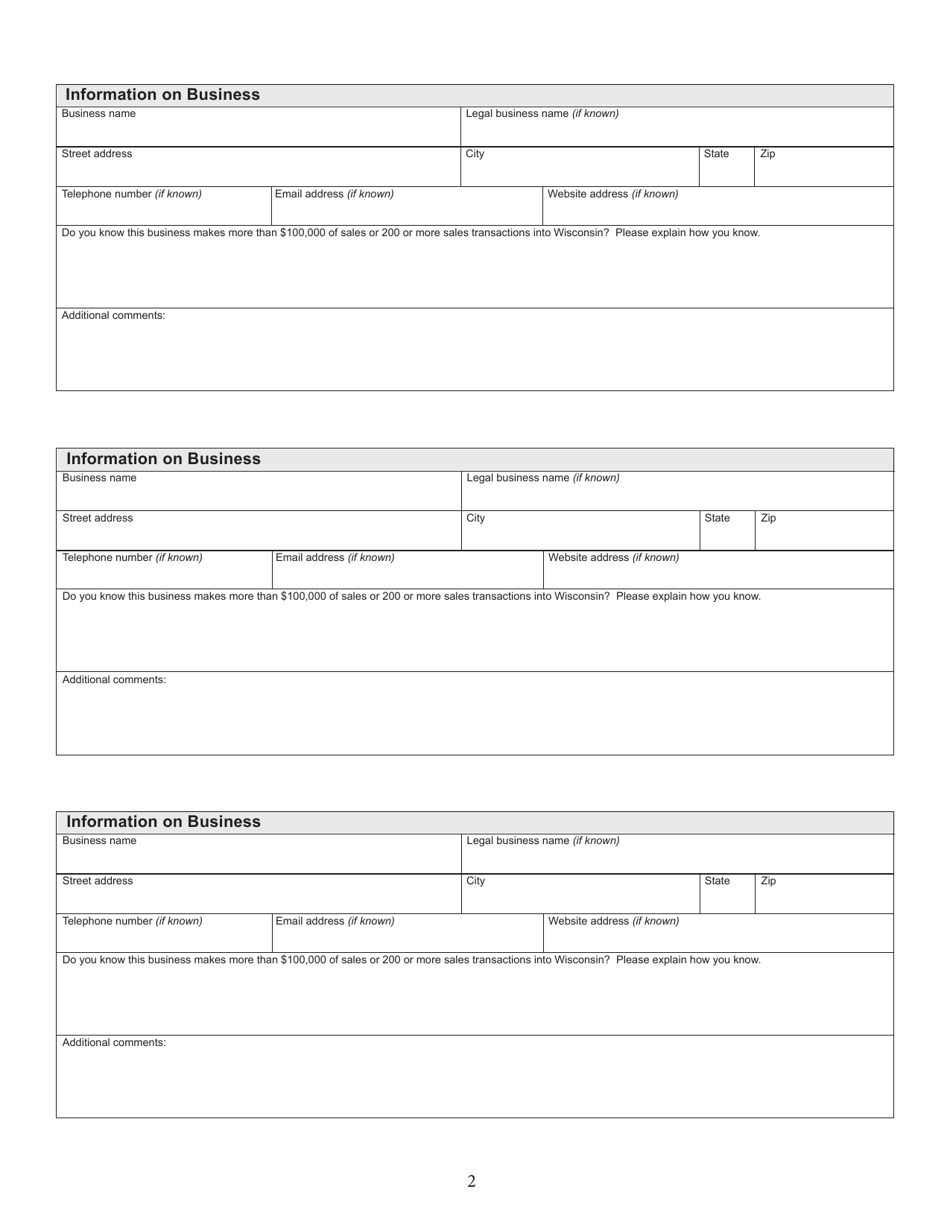

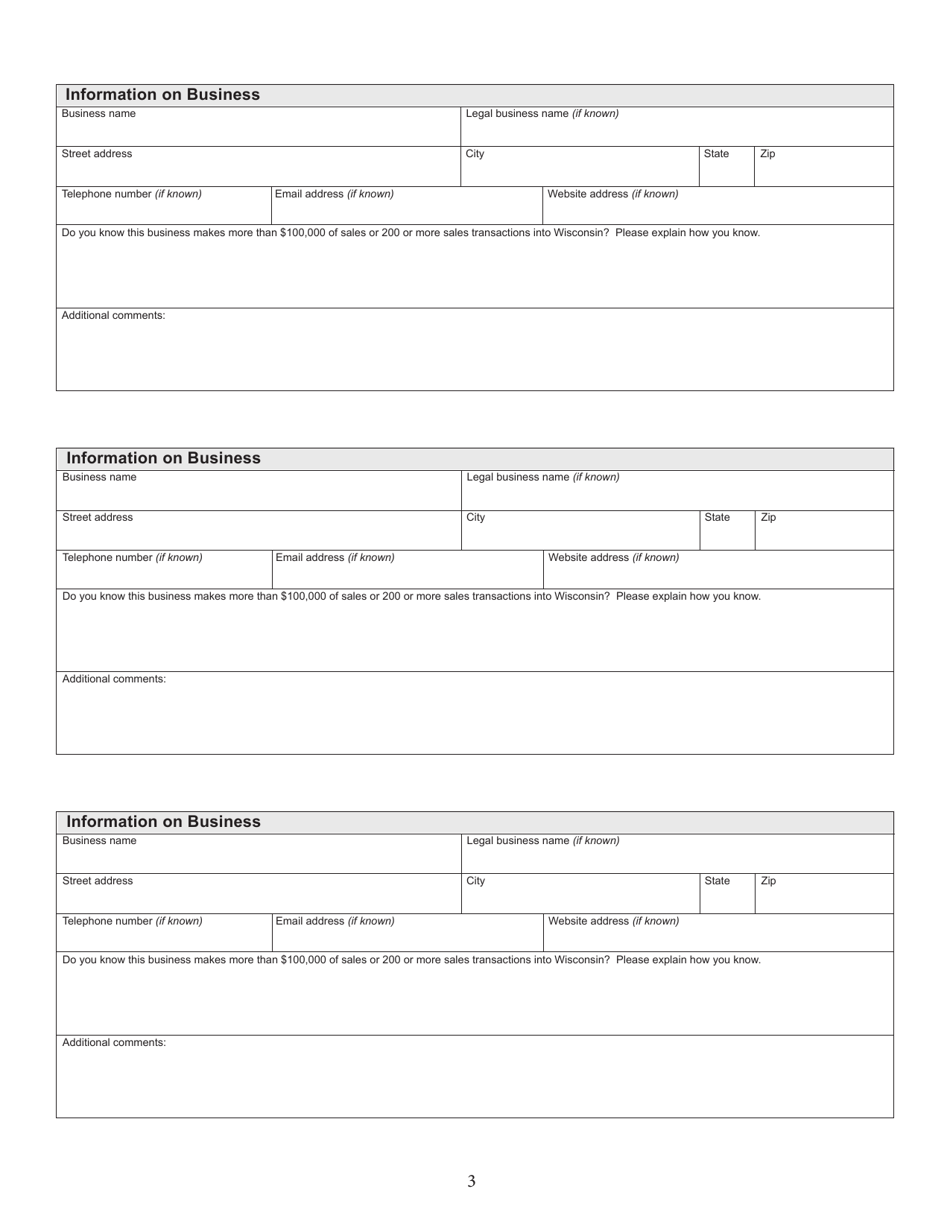

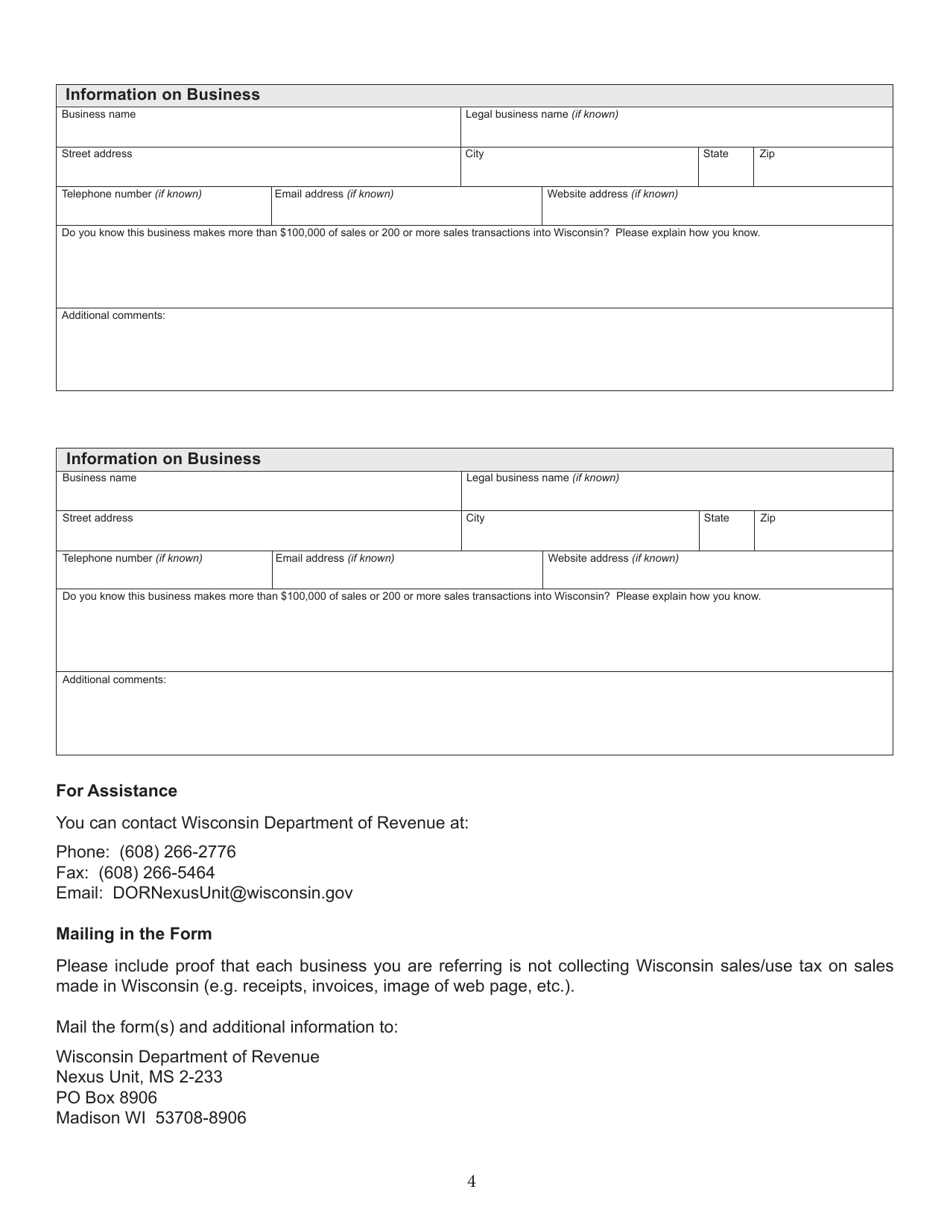

Q: What information is required on Form P-627?

A: Form P-627 requires the remote seller's information, details of the referral, and relevant sales information.

Q: When is Form P-627 due?

A: Form P-627 is due on or before the last day of the month following the end of the calendar quarter in which the referral occurred.

Q: Are there any penalties for late filing of Form P-627?

A: Yes, there are penalties for late filing of Form P-627. It is important to file the form on time to avoid penalties.

Q: Are there any exemptions from filing Form P-627?

A: There are no specific exemptions mentioned for filing Form P-627. All remote sellers with referrals from in-state entities should file the form.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-627 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.