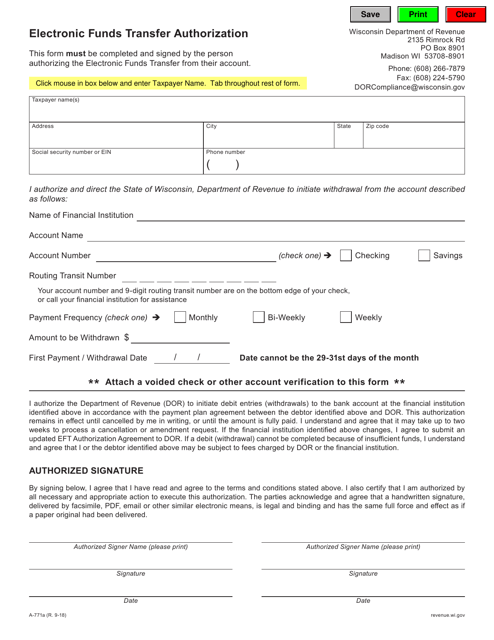

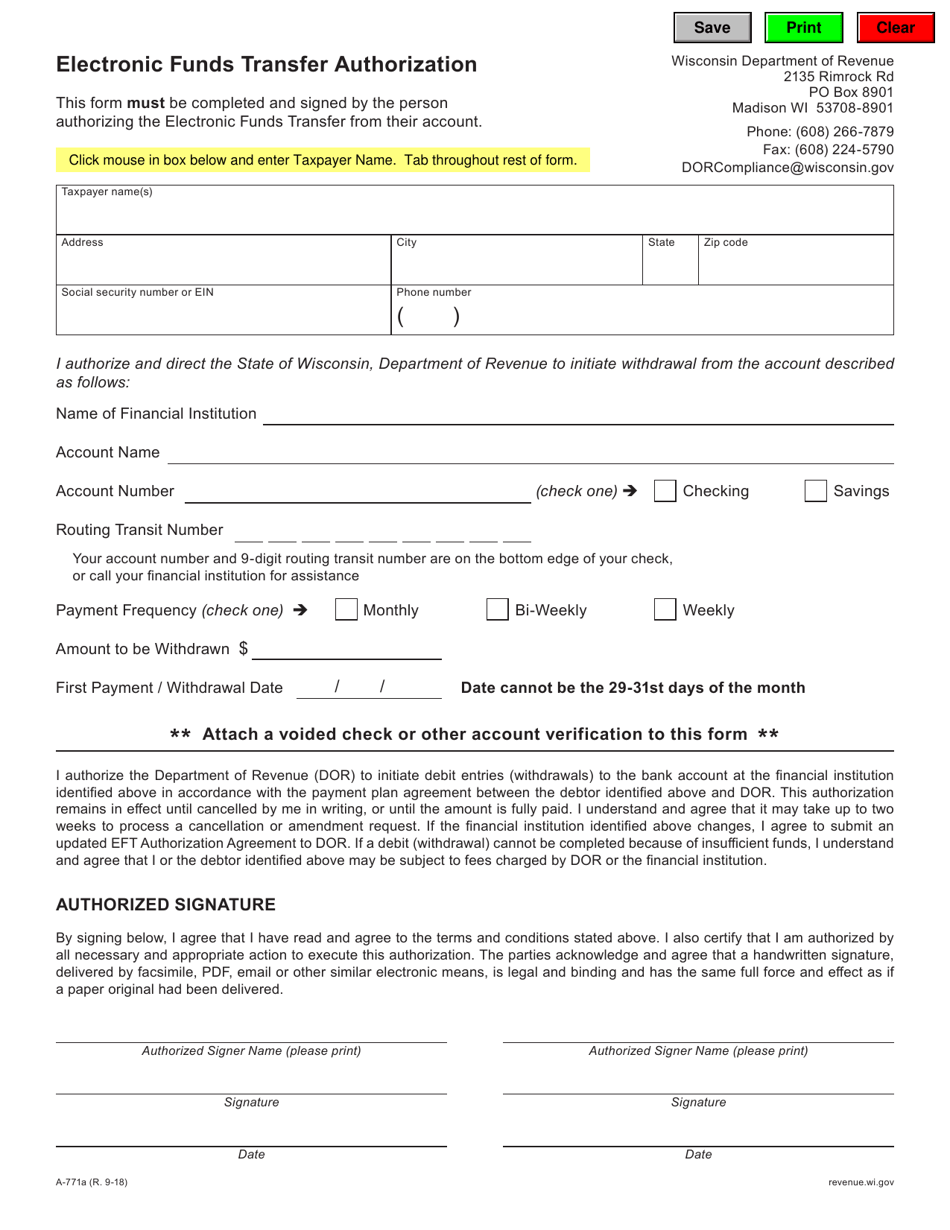

This version of the form is not currently in use and is provided for reference only. Download this version of

Form A-771A

for the current year.

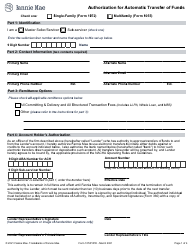

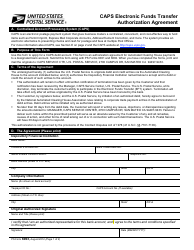

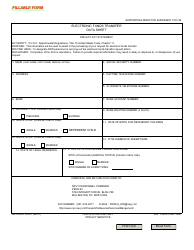

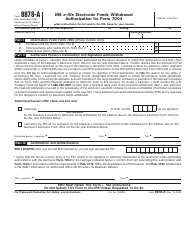

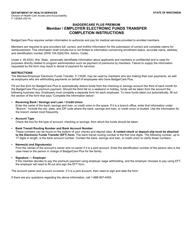

Form A-771A Electronic Funds Transfer Authorization - Wisconsin

What Is Form A-771A?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-771A?

A: Form A-771A is an Electronic Funds Transfer Authorization for Wisconsin.

Q: What is the purpose of Form A-771A?

A: The purpose of Form A-771A is to authorize electronic funds transfers for Wisconsin.

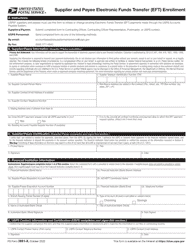

Q: Who needs to fill out Form A-771A?

A: Anyone who wants to authorize electronic funds transfers in Wisconsin needs to fill out Form A-771A.

Q: Is Form A-771A mandatory in Wisconsin?

A: No, Form A-771A is not mandatory in Wisconsin, but it is recommended for convenience.

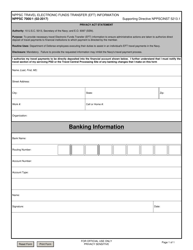

Q: What information do I need to provide on Form A-771A?

A: You will need to provide your personal information, bank account details, and authorization for electronic funds transfers.

Q: Can I cancel or modify my electronic funds transfer authorization?

A: Yes, you can cancel or modify your electronic funds transfer authorization by submitting a new Form A-771A.

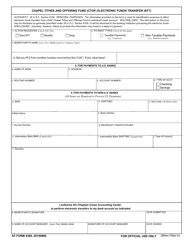

Q: Are there any fees associated with electronic funds transfers?

A: The Wisconsin Department of Revenue does not charge any fees for electronic funds transfers, but your bank may have its own fees.

Q: How long does it take for electronic funds transfers to take effect?

A: It usually takes about one to two weeks for electronic funds transfers to take effect after submitting Form A-771A.

Q: Can I still receive paper checks if I authorize electronic funds transfers?

A: Yes, you can still receive paper checks if you authorize electronic funds transfers.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-771A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.