This version of the form is not currently in use and is provided for reference only. Download this version of

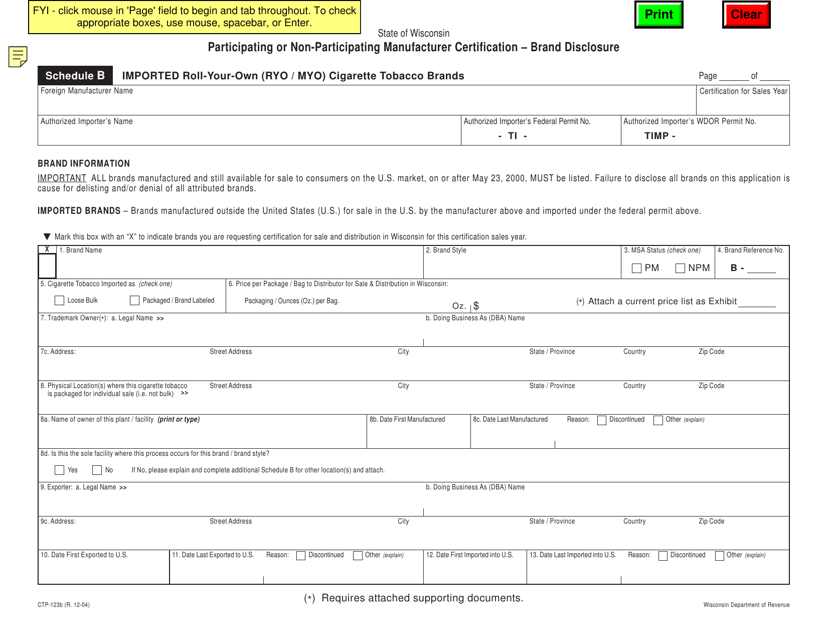

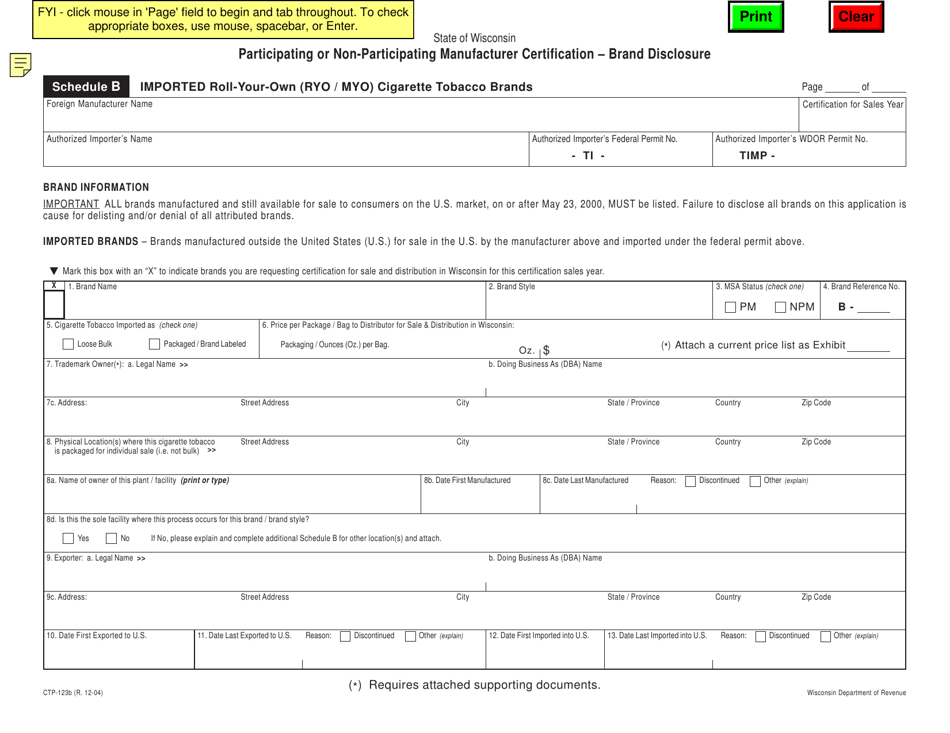

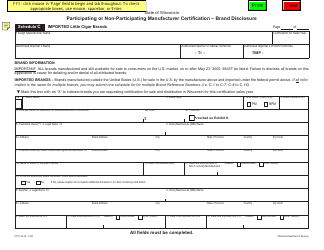

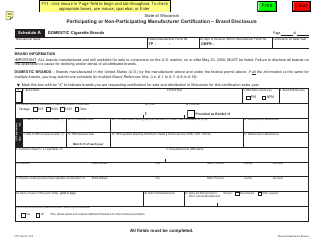

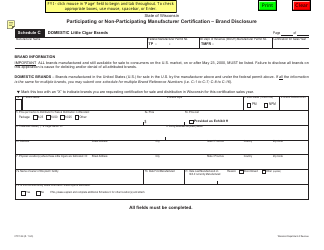

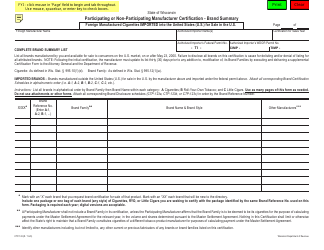

Form CTP-123B Schedule B

for the current year.

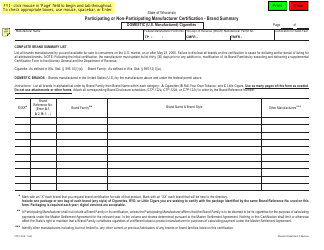

Form CTP-123B Schedule B Brand Disclosure - Imported Roll-Your-Own - Wisconsin

What Is Form CTP-123B Schedule B?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CTP-123B?

A: Form CTP-123B is a tax form used for Brand Disclosure - Imported Roll-Your-Own tobacco in Wisconsin.

Q: Who needs to file Form CTP-123B?

A: Importers of Roll-Your-Own tobacco in Wisconsin need to file Form CTP-123B.

Q: What is Schedule B on Form CTP-123B?

A: Schedule B on Form CTP-123B is used for Brand Disclosure of imported Roll-Your-Own tobacco.

Q: What information is required in Schedule B?

A: Schedule B requires information about the brands of imported Roll-Your-Own tobacco.

Q: Is Form CTP-123B specific to Wisconsin?

A: Yes, Form CTP-123B is specific to Wisconsin and is used for tax purposes in the state.

Q: Is Form CTP-123B for personal or business use?

A: Form CTP-123B is used for business purposes by importers of Roll-Your-Own tobacco.

Q: Are there any filing fees for Form CTP-123B?

A: There are no filing fees associated with Form CTP-123B.

Q: What is the deadline for filing Form CTP-123B?

A: The deadline for filing Form CTP-123B is determined by the Wisconsin Department of Revenue.

Form Details:

- Released on December 1, 2004;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CTP-123B Schedule B by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.