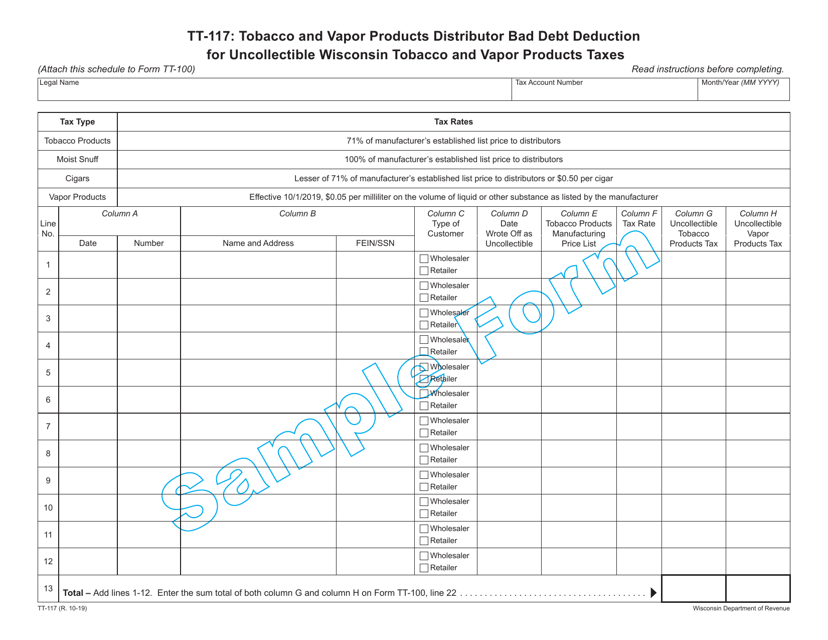

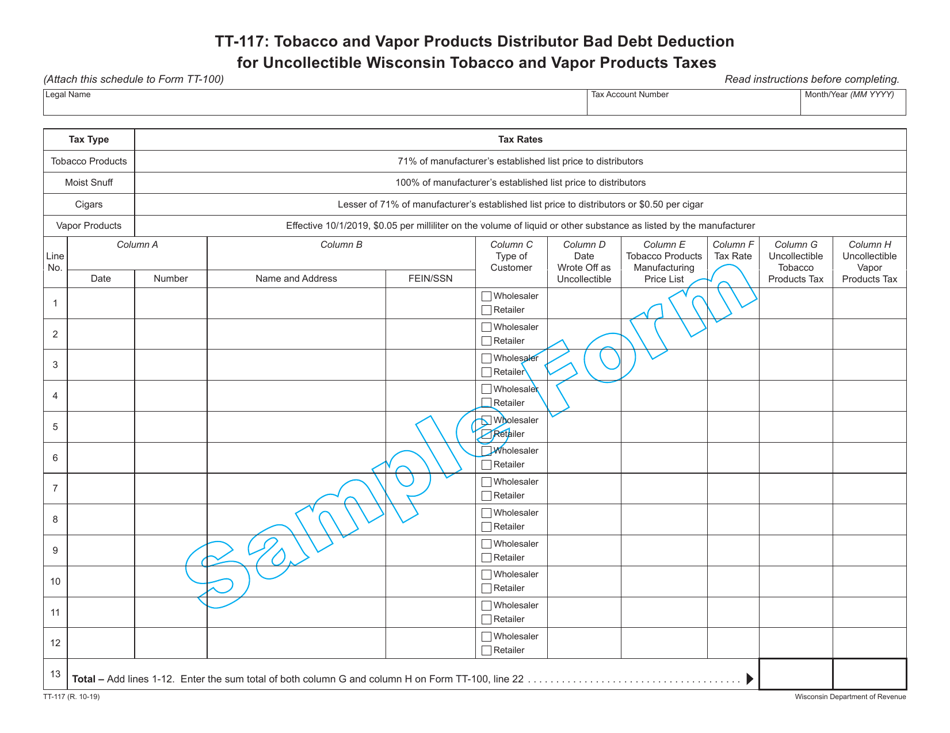

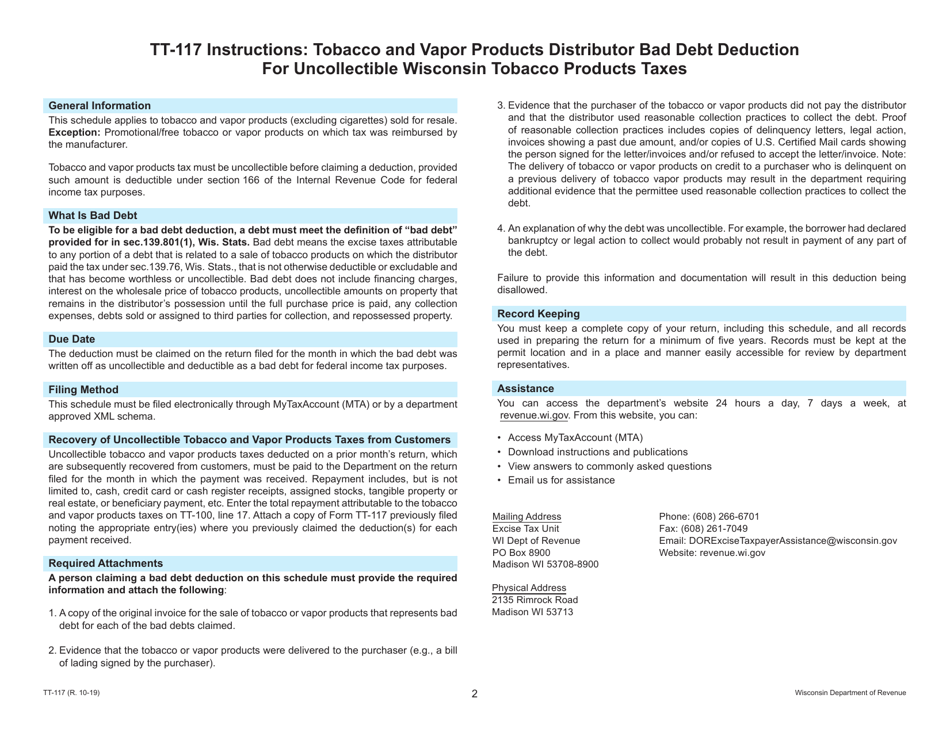

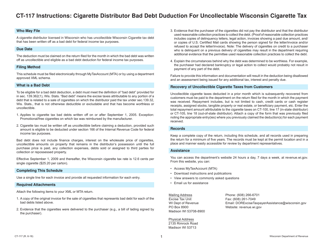

Form TT-117 Tobacco and Vapor Products Distributor Bad Debt Deduction for Uncollectible Wi Tobacco Products Taxes - Wisconsin

What Is Form TT-117?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TT-117?

A: Form TT-117 is a form used by tobacco and vapor products distributors in Wisconsin to claim a bad debt deduction for uncollectible Wisconsin tobacco product taxes.

Q: Who can use Form TT-117?

A: Tobacco and vapor products distributors in Wisconsin can use Form TT-117.

Q: What is the purpose of Form TT-117?

A: The purpose of Form TT-117 is to allow distributors to claim a deduction for uncollectible Wisconsin tobacco product taxes that they are unable to collect from customers.

Q: What is a bad debt deduction?

A: A bad debt deduction is a deduction allowed for business debts that have become uncollectible.

Q: When should Form TT-117 be filed?

A: Form TT-117 should be filed on a quarterly basis, along with the distributor's quarterly return.

Q: Can Form TT-117 be used to claim bad debt deductions for other taxes?

A: No, Form TT-117 can only be used to claim bad debt deductions for uncollectible Wisconsin tobacco product taxes.

Q: Is there a deadline for filing Form TT-117?

A: Yes, Form TT-117 must be filed by the due date of the distributor's quarterly return.

Q: Are there any requirements for claiming a bad debt deduction using Form TT-117?

A: Yes, there are certain requirements that must be met in order to claim a bad debt deduction using Form TT-117. These requirements are outlined in the instructions for the form.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TT-117 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.