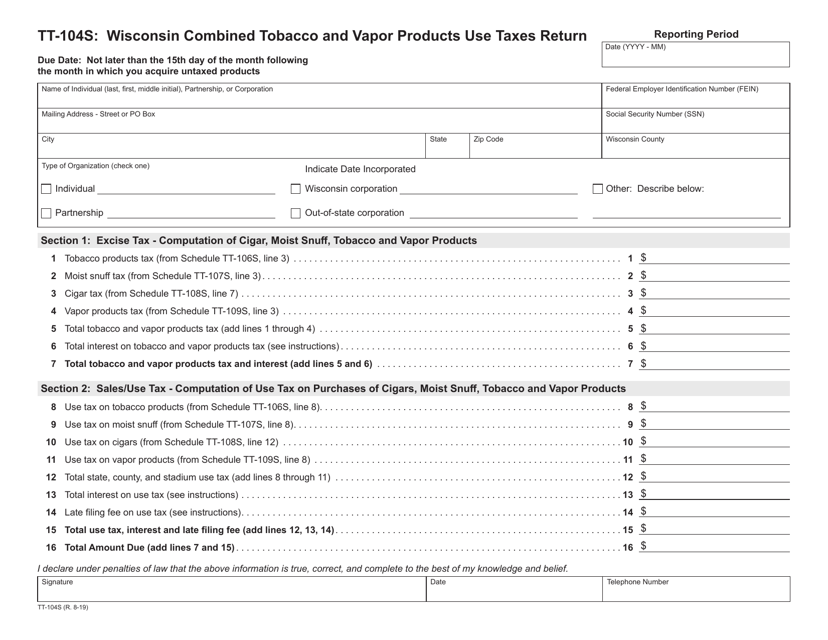

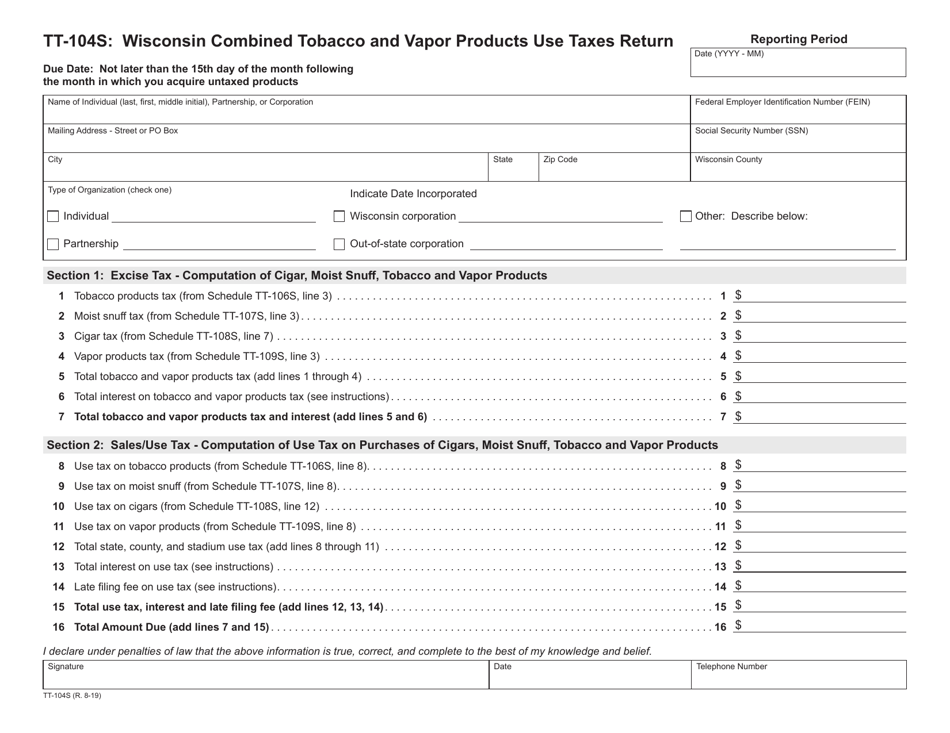

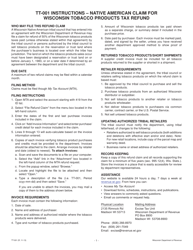

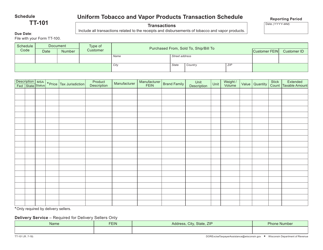

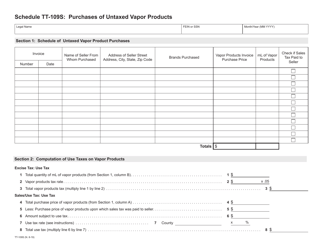

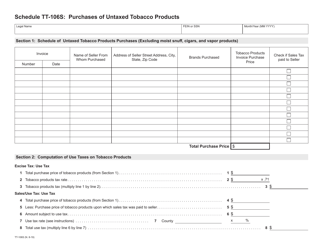

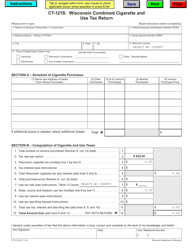

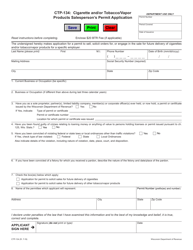

Form TT-104S Wisconsin Combined Tobacco and Vapor Products Use Taxes Return - Wisconsin

What Is Form TT-104S?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form TT-104S?

A: Form TT-104S is the Wisconsin Combined Tobacco and Vapor Products Use Taxes Return.

Q: Who needs to file Form TT-104S?

A: Anyone who sells tobacco or vapor products in Wisconsin needs to file Form TT-104S.

Q: What is the purpose of Form TT-104S?

A: Form TT-104S is used to report and pay the combined tobacco and vapor products use taxes owed to the state of Wisconsin.

Q: When should Form TT-104S be filed?

A: Form TT-104S should be filed on a quarterly basis. The due dates for filing are April 30th, July 31st, October 31st, and January 31st.

Q: Do I need to include payment with Form TT-104S?

A: Yes, you need to include payment for the taxes owed with Form TT-104S.

Q: Are there any penalties for late filing of Form TT-104S?

A: Yes, there are penalties for late filing and late payment of the combined tobacco and vapor products use taxes.

Q: Can I file Form TT-104S electronically?

A: Yes, you can file Form TT-104S electronically through the Wisconsin Department of Revenue's e-file system.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TT-104S by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.