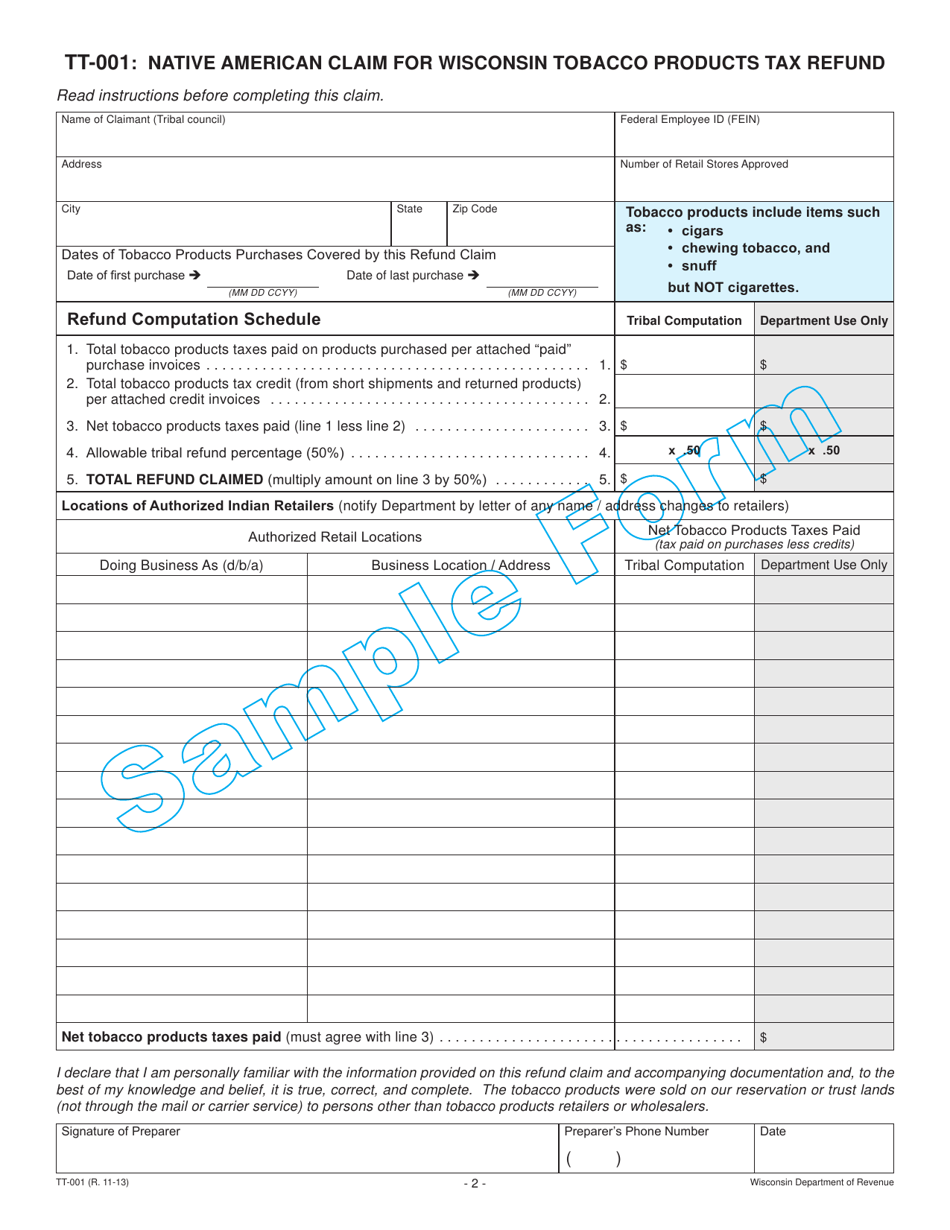

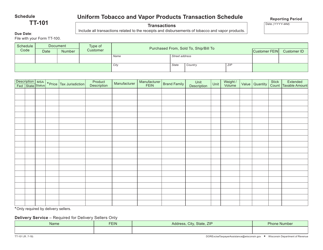

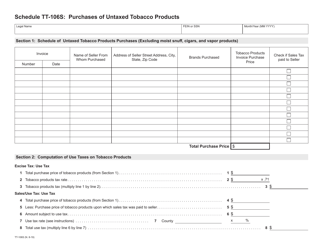

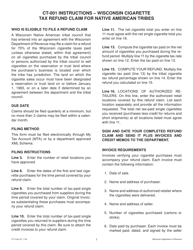

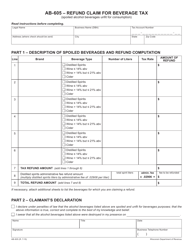

Form TT-001 Native American Claim for Wisconsin Tobacco Products Tax Refund - Wisconsin

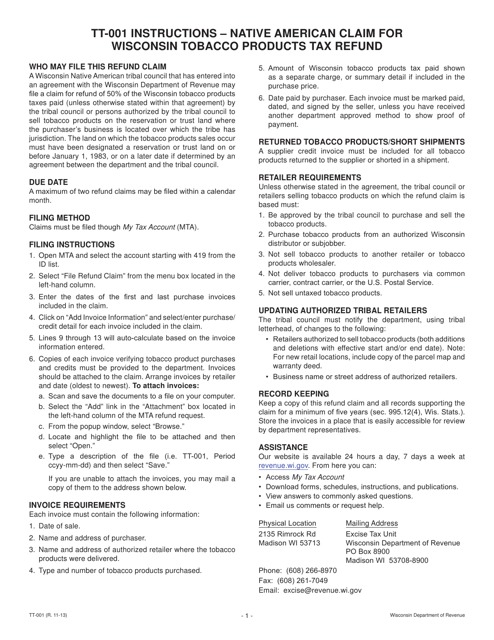

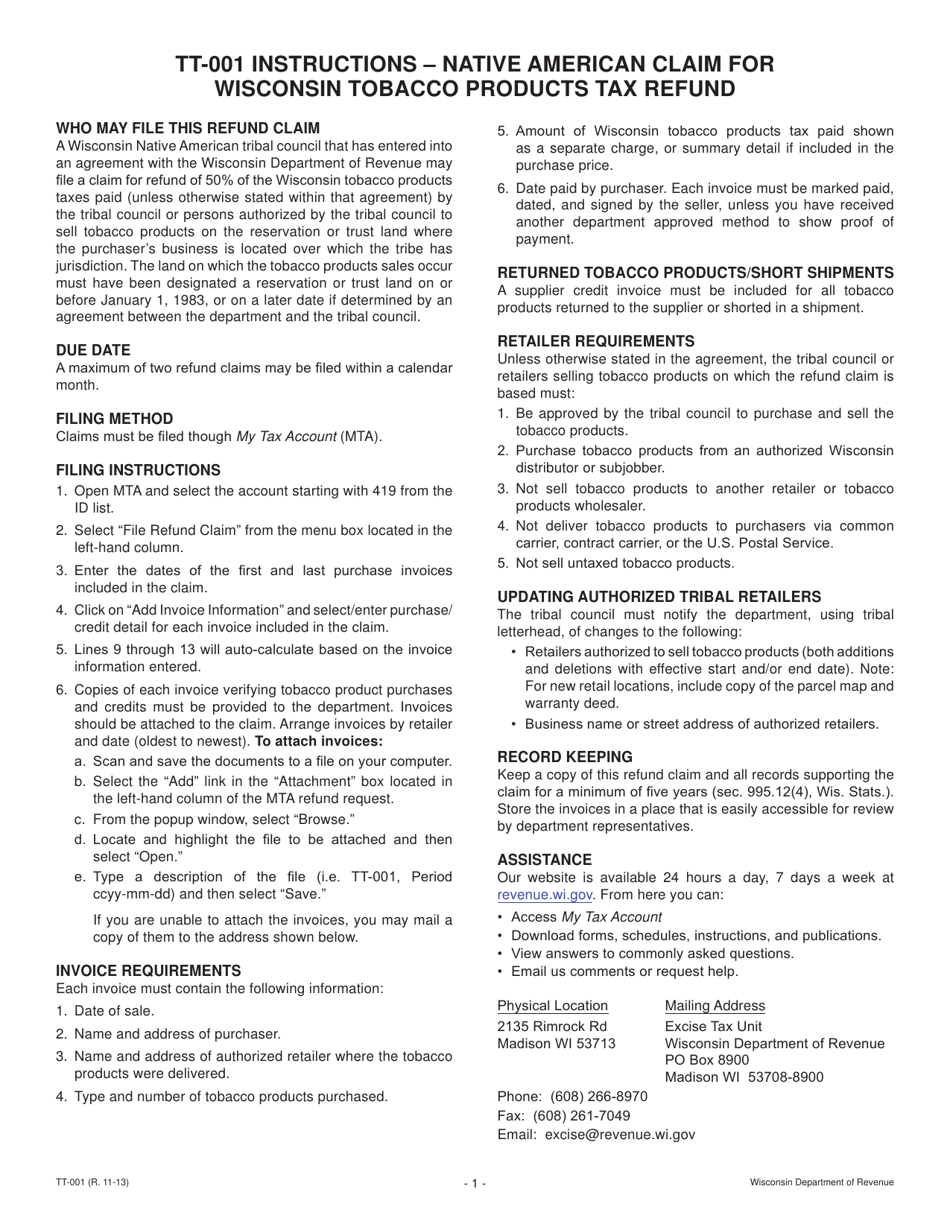

What Is Form TT-001?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TT-001?

A: Form TT-001 is the Native American Claim for Wisconsin Tobacco Products Tax Refund.

Q: Who can use Form TT-001?

A: Native Americans can use Form TT-001 to claim a refund for Wisconsin tobacco products tax.

Q: What is the purpose of Form TT-001?

A: The purpose of Form TT-001 is to provide Native Americans with a mechanism to request a refund on the tobacco products tax paid.

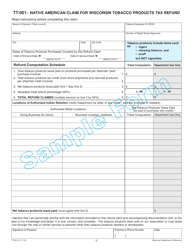

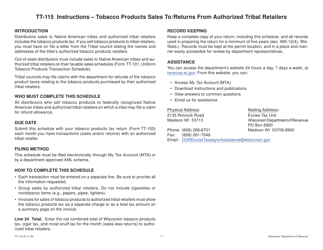

Q: How do I complete Form TT-001?

A: To complete Form TT-001, you need to provide your personal information, details about the tobacco products purchased, and calculate the refund amount.

Q: When should I submit Form TT-001?

A: Form TT-001 should be submitted within three years from the date of purchase or date on which the tax was paid.

Q: Is there a deadline for submitting Form TT-001?

A: Yes, Form TT-001 must be submitted by April 15 of the year following the year in which the tobacco products were purchased.

Q: Can I submit Form TT-001 electronically?

A: No, Form TT-001 must be submitted by mail or in person to the Wisconsin Department of Revenue.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TT-001 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.