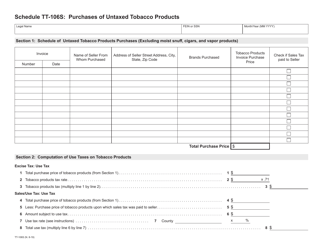

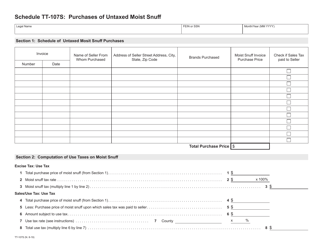

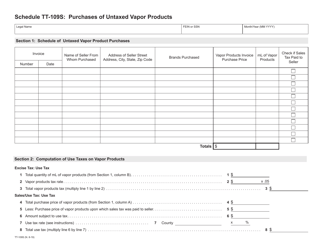

Schedule TT-108S Purchases of Untaxed Cigars - Wisconsin

What Is Schedule TT-108S?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule TT-108S?

A: Schedule TT-108S is a form used in Wisconsin to report purchases of untaxed cigars.

Q: Who is required to file Schedule TT-108S?

A: Any individual or business who purchases untaxed cigars in Wisconsin is required to file Schedule TT-108S.

Q: Why is Schedule TT-108S important?

A: Schedule TT-108S is important because it helps the state of Wisconsin track the purchase of untaxed cigars and ensure compliance with tobacco tax laws.

Q: When is Schedule TT-108S due?

A: Schedule TT-108S is typically due on a monthly basis, with the due date falling on the last day of the month following the reporting period.

Q: Are there any penalties for not filing Schedule TT-108S?

A: Yes, there are penalties for failing to file Schedule TT-108S, including late filing penalties and potential fines for non-compliance.

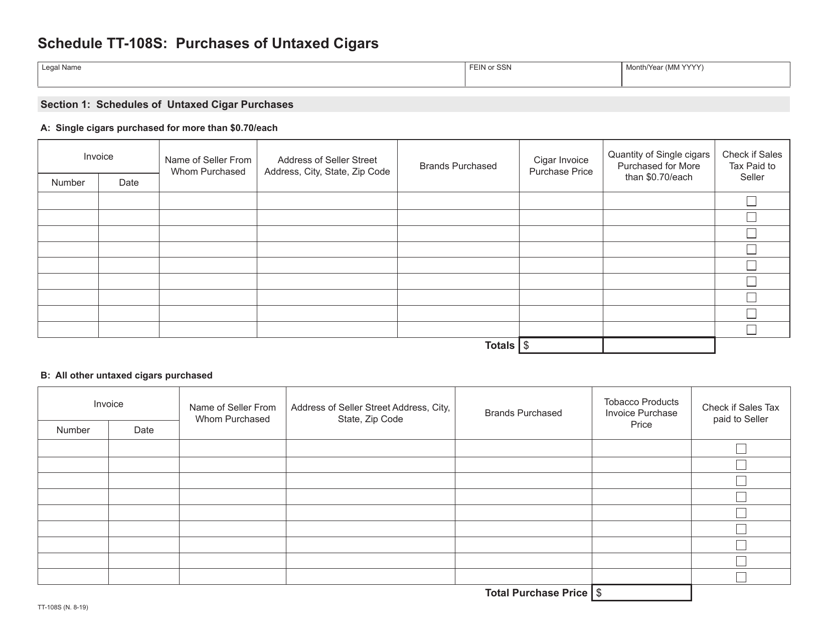

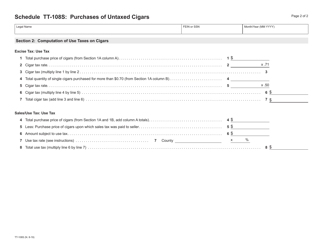

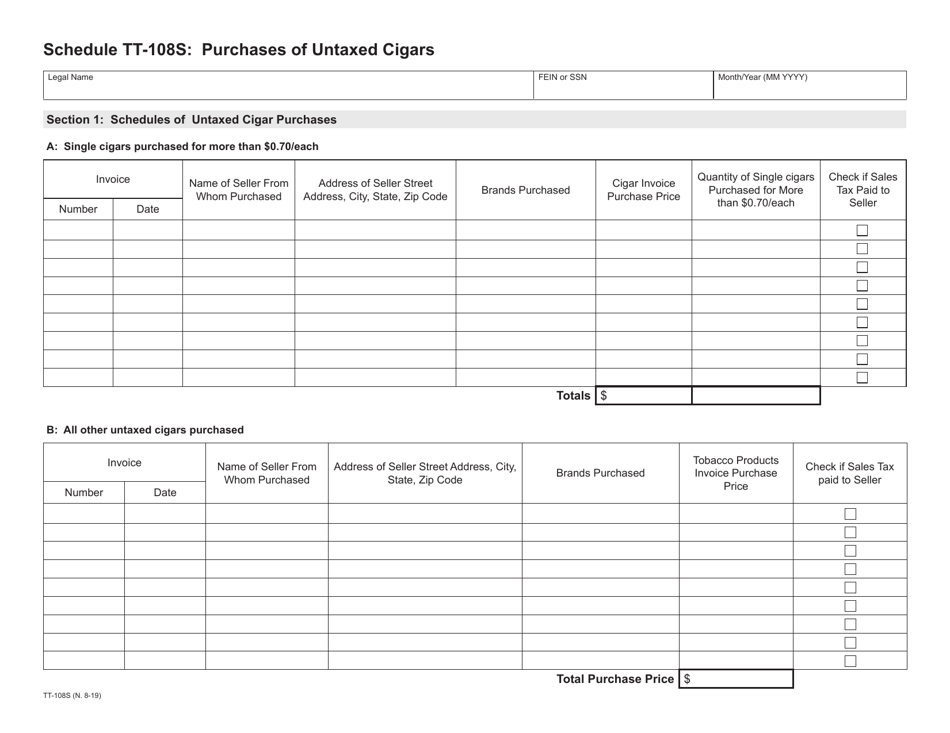

Q: What information is required on Schedule TT-108S?

A: Schedule TT-108S requires information such as the quantity of untaxed cigars purchased, the name and address of the seller, and the date of purchase.

Q: Is there a fee for filing Schedule TT-108S?

A: There is no fee for filing Schedule TT-108S, it is a reporting requirement.

Q: What should I do if I made an error on Schedule TT-108S?

A: If you made an error on Schedule TT-108S, you should contact the Wisconsin Department of Revenue to discuss how to correct the mistake.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule TT-108S by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.