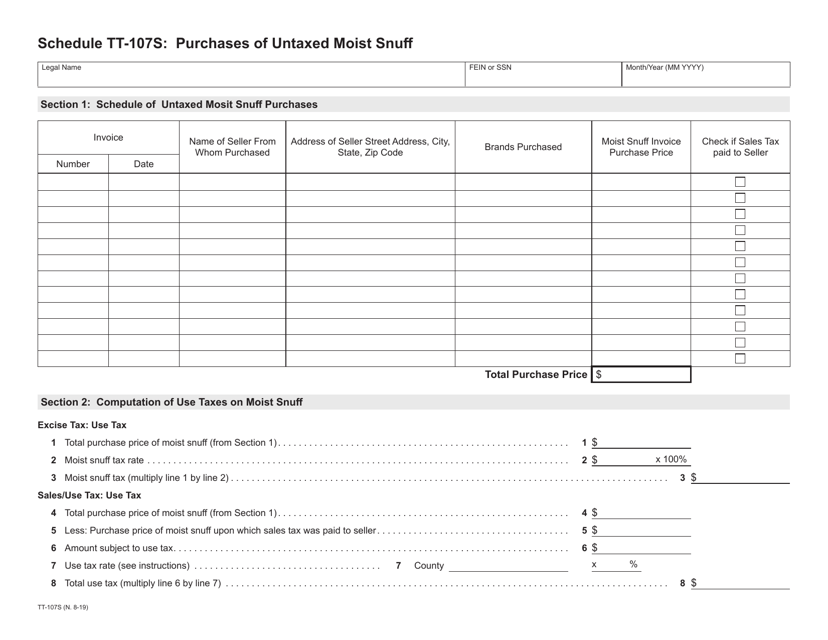

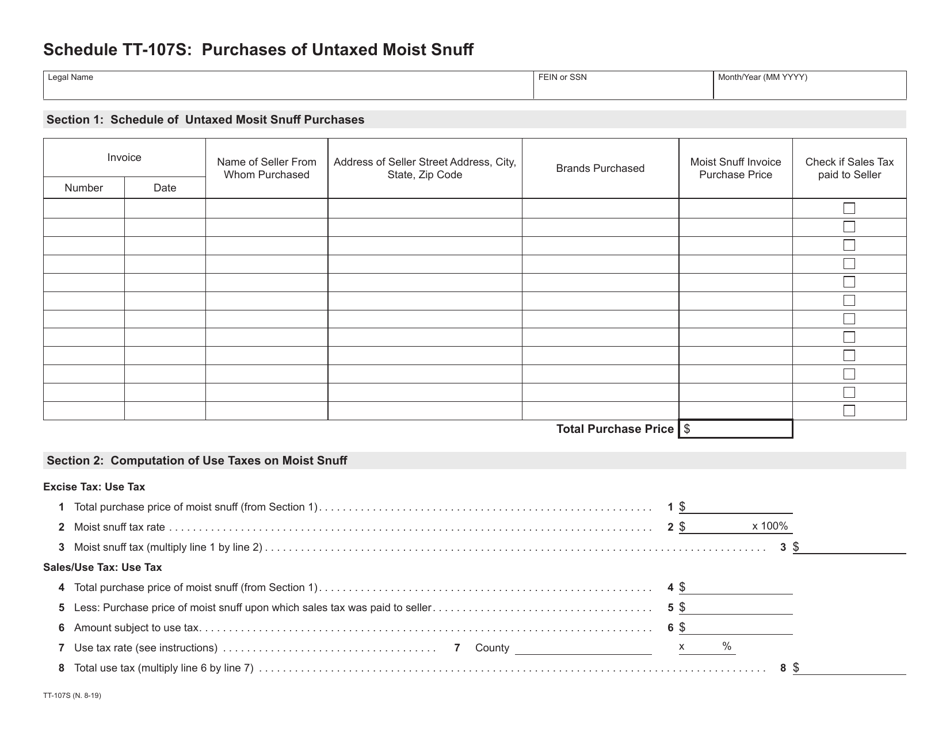

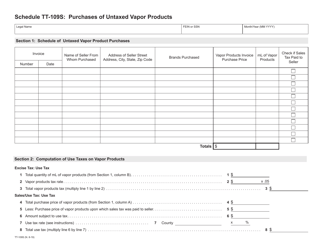

Schedule TT-107S Purchases of Untaxed Moist Snuff - Wisconsin

What Is Schedule TT-107S?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TT-107S?

A: TT-107S is a schedule form for reporting the purchases of untaxed moist snuff in Wisconsin.

Q: What does TT-107S pertain to?

A: TT-107S pertains to the purchases of untaxed moist snuff in Wisconsin.

Q: What is untaxed moist snuff?

A: Untaxed moist snuff refers to moist snuff products that have not had the appropriate taxes paid on them.

Q: Who is required to file TT-107S?

A: Anyone who purchases untaxed moist snuff in Wisconsin is required to file TT-107S.

Q: What information is needed to complete TT-107S?

A: To complete TT-107S, you will need to provide details about your purchases of untaxed moist snuff, including the quantities purchased and the sellers from whom you made the purchases.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule TT-107S by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.