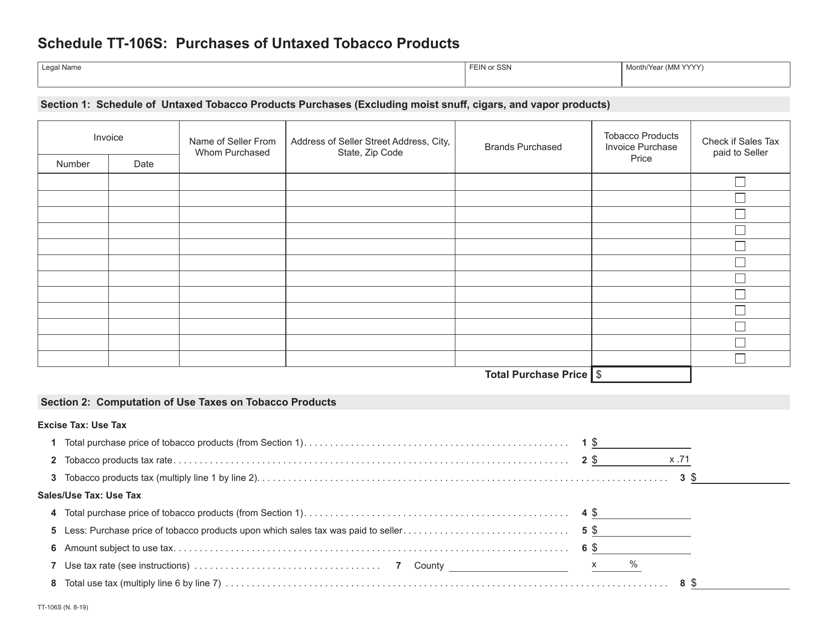

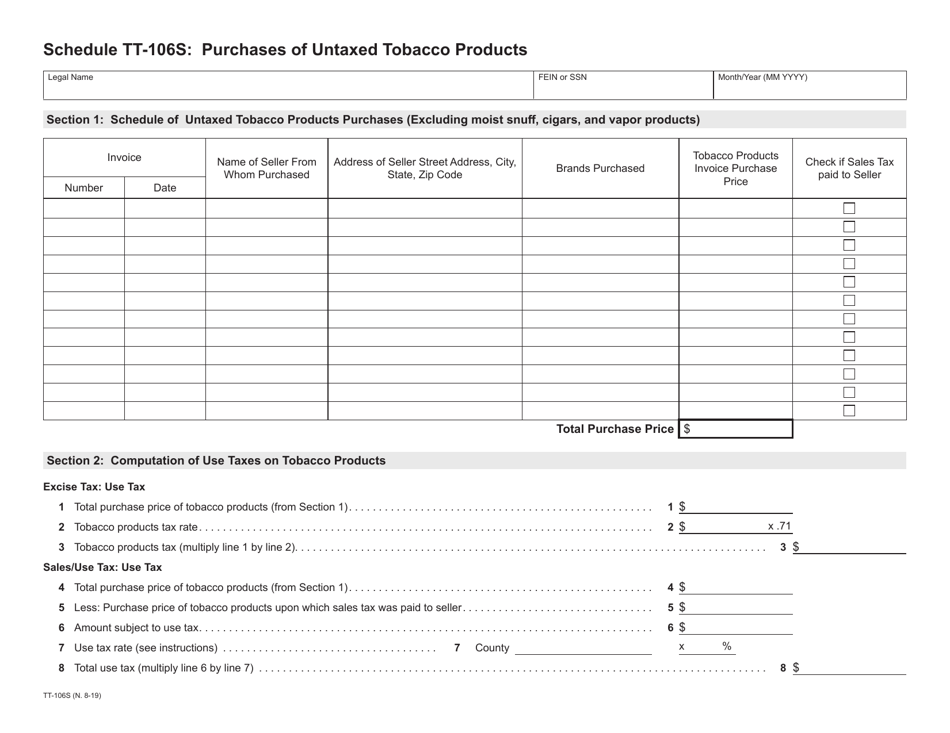

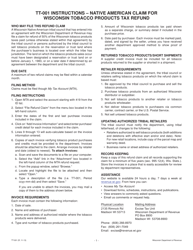

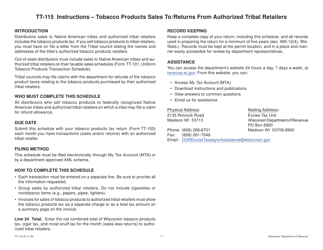

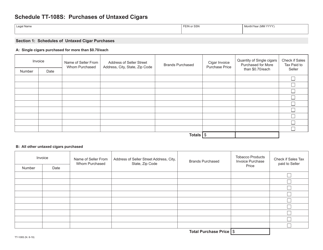

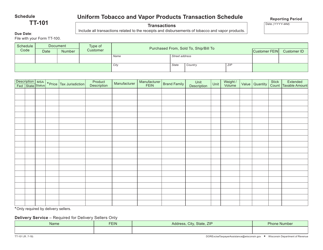

Schedule TT-106S Purchases of Untaxed Tobacco Products - Wisconsin

What Is Schedule TT-106S?

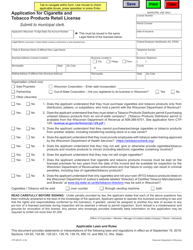

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule TT-106S?

A: Schedule TT-106S is a form used in Wisconsin to report purchases of untaxed tobacco products.

Q: Who is required to file Schedule TT-106S?

A: Retailers and distributors of tobacco products in Wisconsin are required to file Schedule TT-106S.

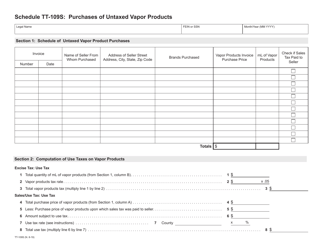

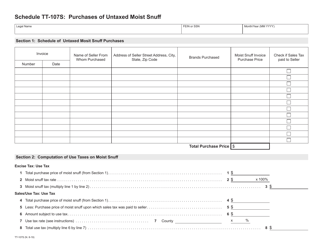

Q: What information is reported on Schedule TT-106S?

A: Schedule TT-106S includes information about the purchases of untaxed tobacco products, such as the name and address of the seller, the date and amount of the purchase, and the type of tobacco product.

Q: Why is Schedule TT-106S important?

A: Schedule TT-106S is important for tracking the sales and distribution of untaxed tobacco products in Wisconsin.

Q: Are there any penalties for not filing Schedule TT-106S?

A: Yes, failure to file Schedule TT-106S or providing false information can result in penalties, including fines and potential legal consequences.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule TT-106S by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.