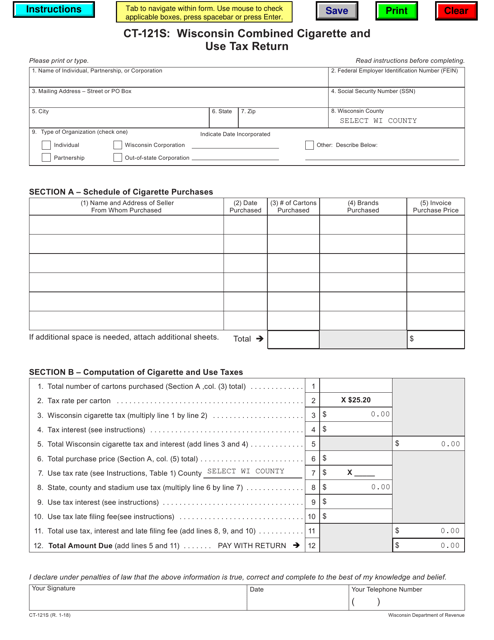

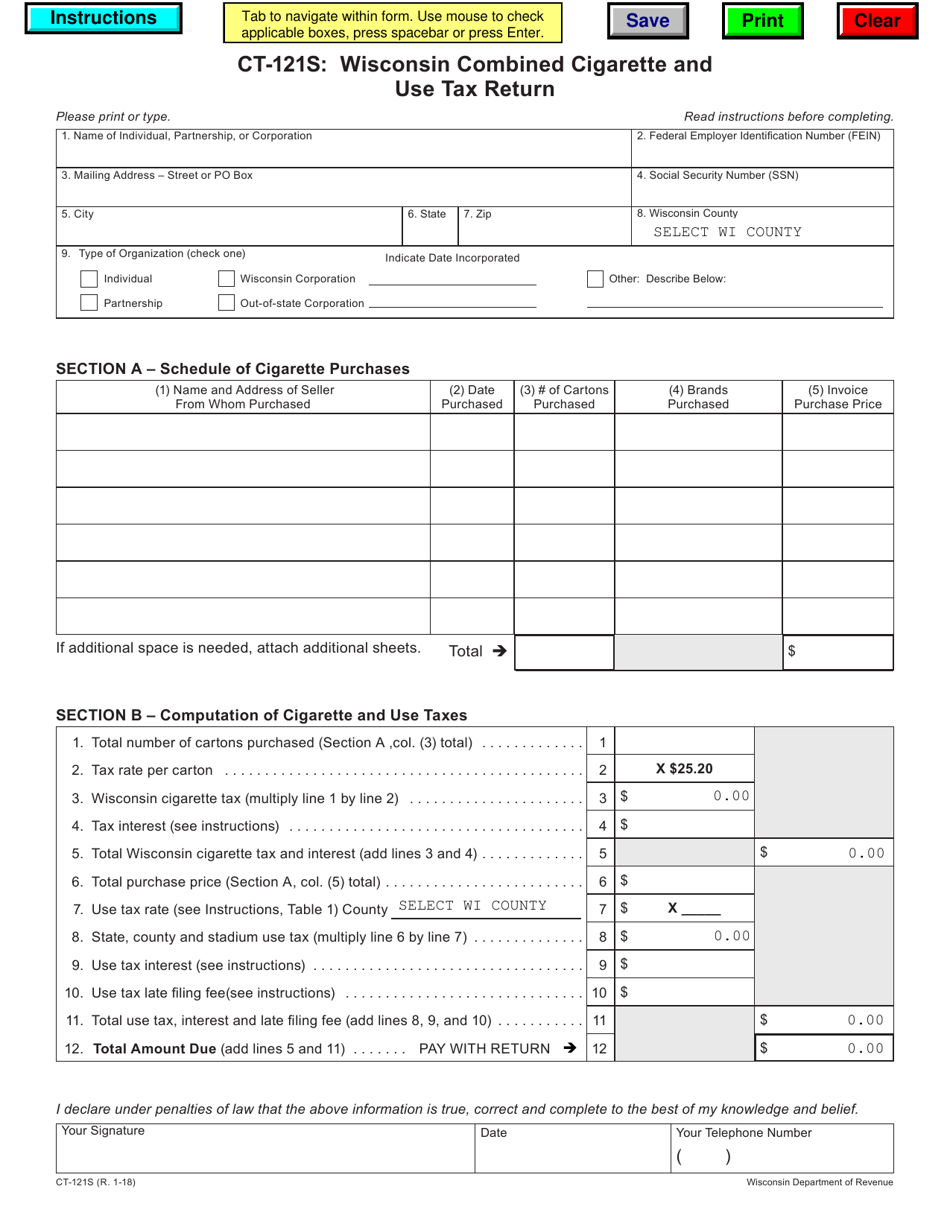

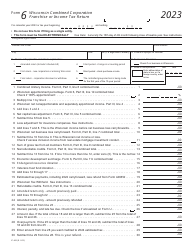

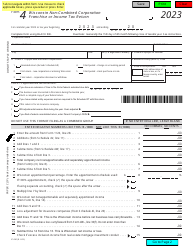

Form CT-121S Wisconsin Combined Cigarette and Use Tax Return - Wisconsin

What Is Form CT-121S?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-121S?

A: Form CT-121S is the Wisconsin Combined Cigarette and Use Tax Return.

Q: What is the purpose of Form CT-121S?

A: The purpose of Form CT-121S is to report and pay the combined cigarette and use tax owed in Wisconsin.

Q: Who needs to file Form CT-121S?

A: Anyone engaged in the sale of cigarettes or subject to the use tax in Wisconsin needs to file Form CT-121S.

Q: How often is Form CT-121S filed?

A: Form CT-121S is filed on a monthly basis.

Q: What information is required on Form CT-121S?

A: Form CT-121S requires information about the number of cigarettes sold and the amount of use tax due.

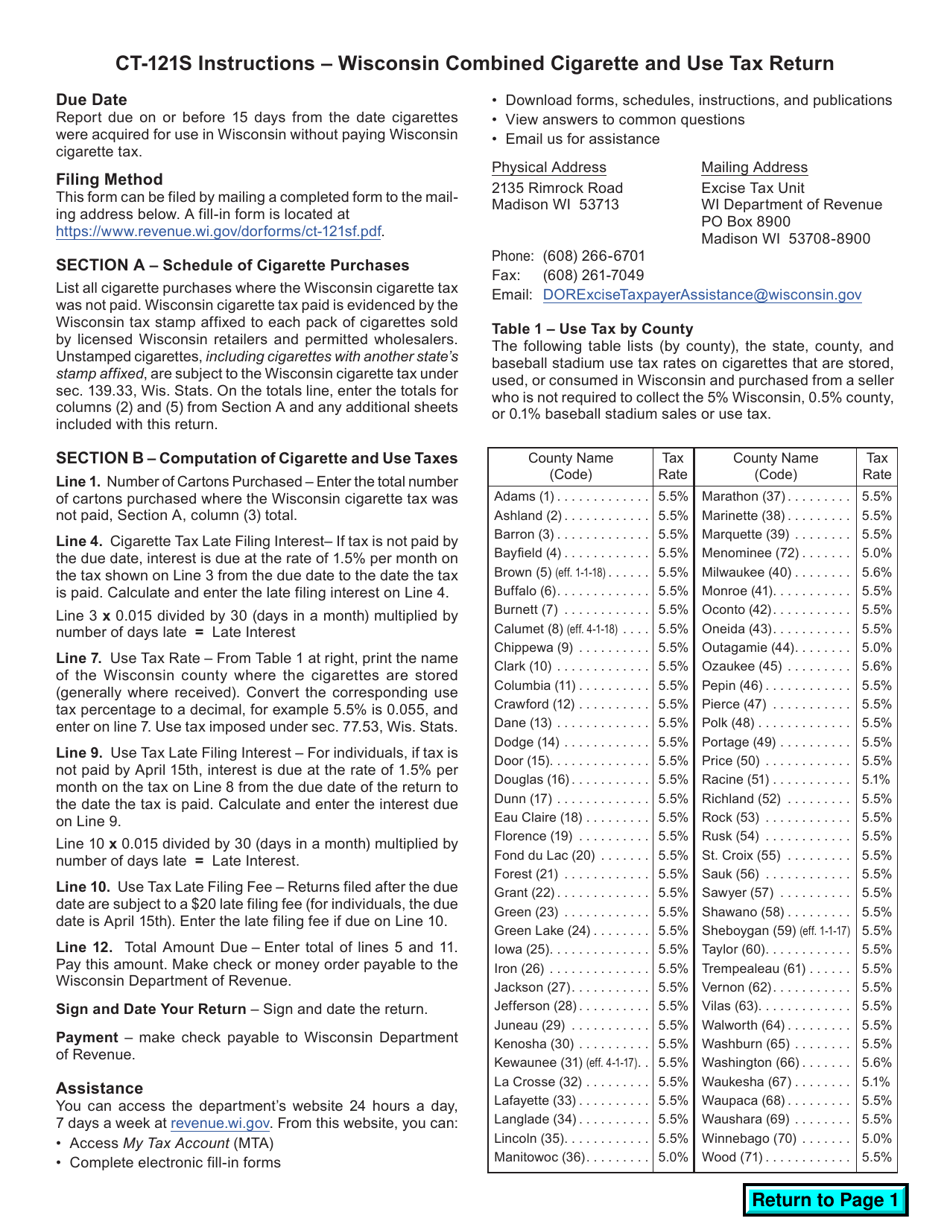

Q: When is Form CT-121S due?

A: Form CT-121S is due by the 25th day of the month following the reporting period.

Q: Is there a penalty for late filing of Form CT-121S?

A: Yes, there is a penalty for late filing of Form CT-121S. The penalty amount varies depending on the number of days late.

Q: Can Form CT-121S be filed electronically?

A: Yes, Form CT-121S can be filed electronically through the Wisconsin Department of Revenue's e-file system.

Q: What should I do if I have questions about Form CT-121S?

A: If you have questions about Form CT-121S, you should contact the Wisconsin Department of Revenue for assistance.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-121S by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.