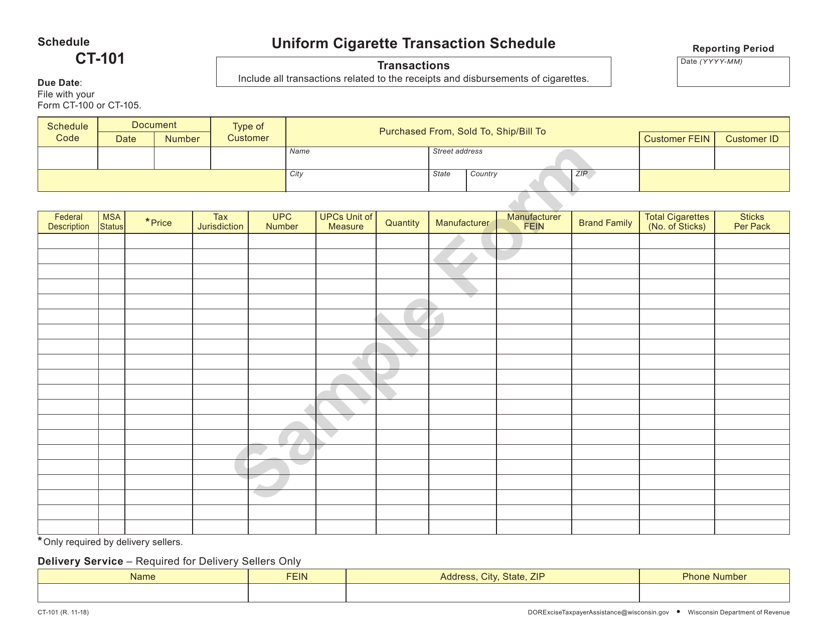

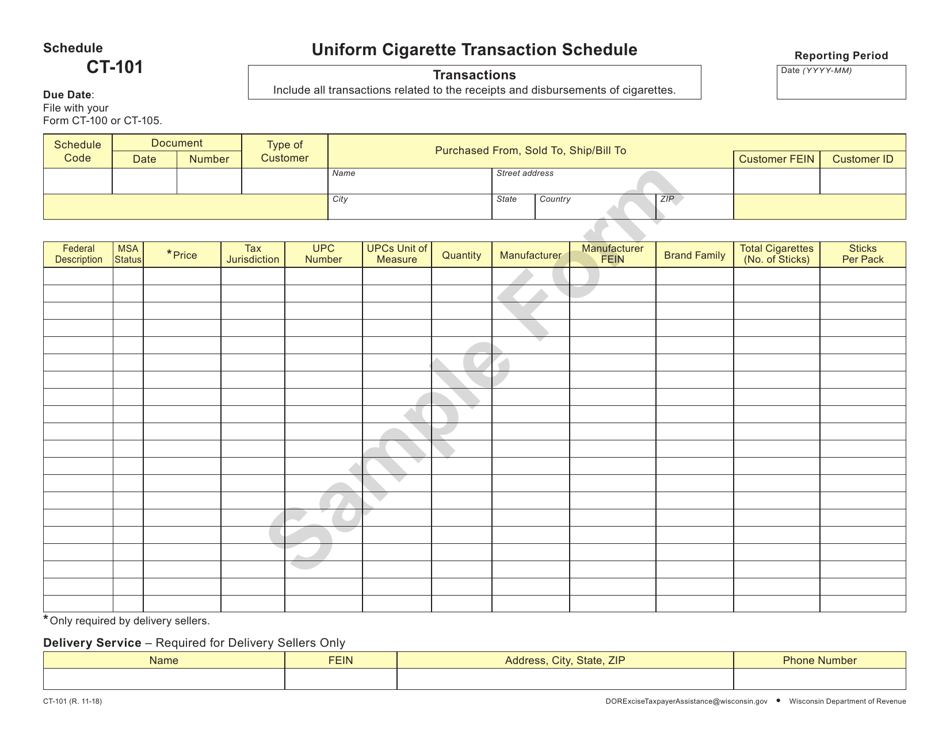

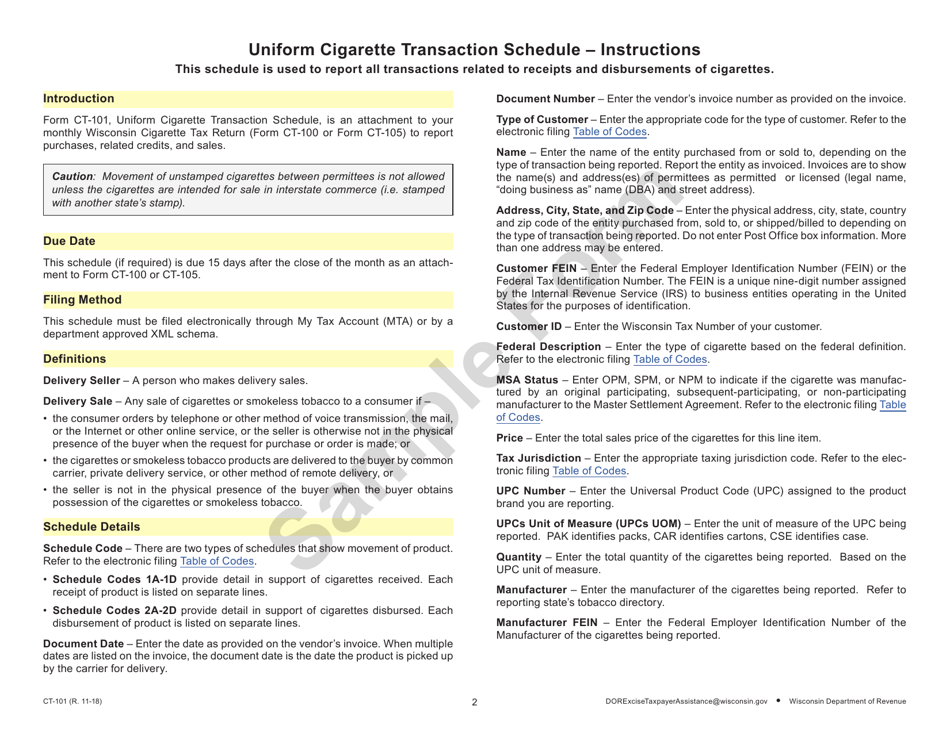

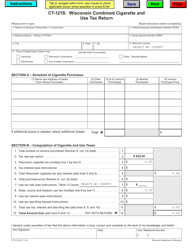

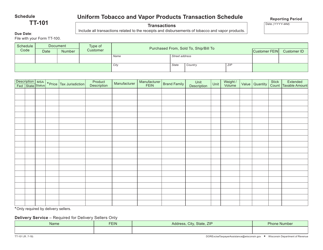

Form CT-101 Uniform Cigarette Transaction Schedule - Wisconsin

What Is Form CT-101?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-101?

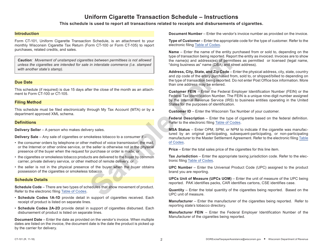

A: Form CT-101 is the Uniform Cigarette Transaction Schedule.

Q: What is the purpose of Form CT-101?

A: The purpose of Form CT-101 is to report the quantity of cigarettes sold or otherwise disposed of in Wisconsin.

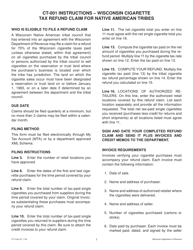

Q: Who needs to file Form CT-101?

A: Any person or entity engaged in the sale or disposition of cigarettes in Wisconsin must file Form CT-101.

Q: When is Form CT-101 due?

A: Form CT-101 is due on or before the 20th day of the month following the end of the reporting period.

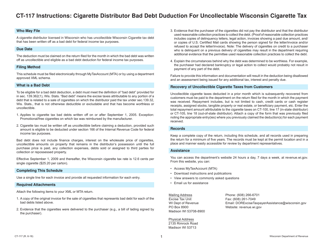

Q: Are there any penalties for late or non-filing of Form CT-101?

A: Yes, there are penalties for late or non-filing of Form CT-101. The penalties range from $10 to $500 per day, depending on the number of cigarettes involved.

Q: Is there a fee for filing Form CT-101?

A: No, there is no fee for filing Form CT-101.

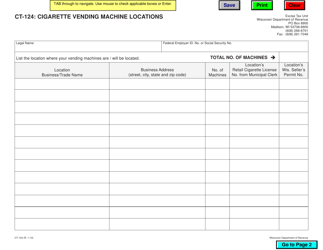

Q: What information is required on Form CT-101?

A: Form CT-101 requires information such as the taxpayer's name, address, number of cigarettes sold, and the total tax liability.

Q: Can I amend a filed Form CT-101?

A: Yes, you can amend a filed Form CT-101 by submitting a corrected form to the Wisconsin Department of Revenue.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-101 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.