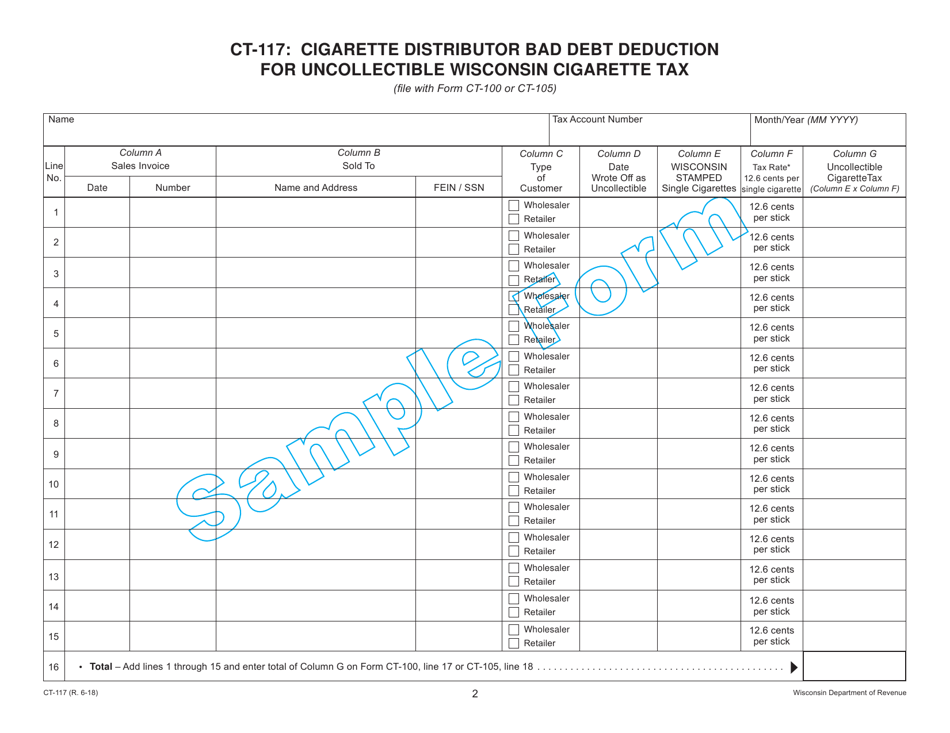

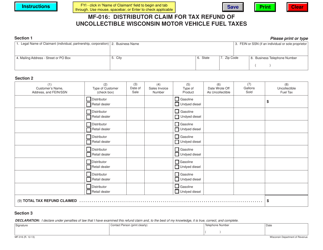

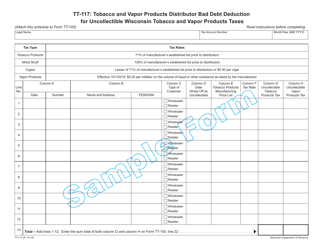

Form CT-117 Cigarette Distributor Bad Debt Deduction for Uncollectible Wisconsin Cigarette Tax - Wisconsin

What Is Form CT-117?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

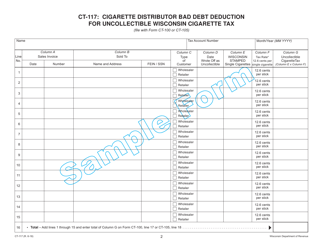

Q: What is Form CT-117?

A: Form CT-117 is a form used by cigarette distributors in Wisconsin for claiming a bad debt deduction for uncollectible Wisconsin cigarette tax.

Q: Who can use Form CT-117?

A: Cigarette distributors in Wisconsin can use Form CT-117.

Q: What is a bad debt deduction?

A: A bad debt deduction is a deduction that allows businesses to write off uncollectible debts.

Q: What is the purpose of Form CT-117?

A: The purpose of Form CT-117 is to claim a bad debt deduction for uncollectible Wisconsin cigarette tax.

Q: When should Form CT-117 be filed?

A: Form CT-117 should be filed on or before the due date of the distributor's Wisconsin cigarette tax return for the applicable quarter.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-117 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.