This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-100

for the current year.

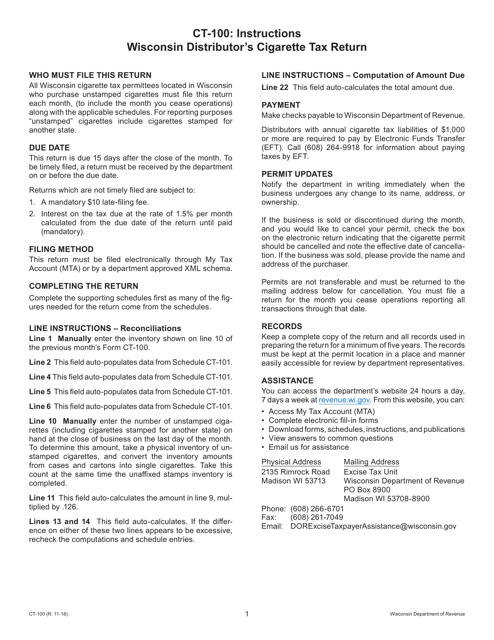

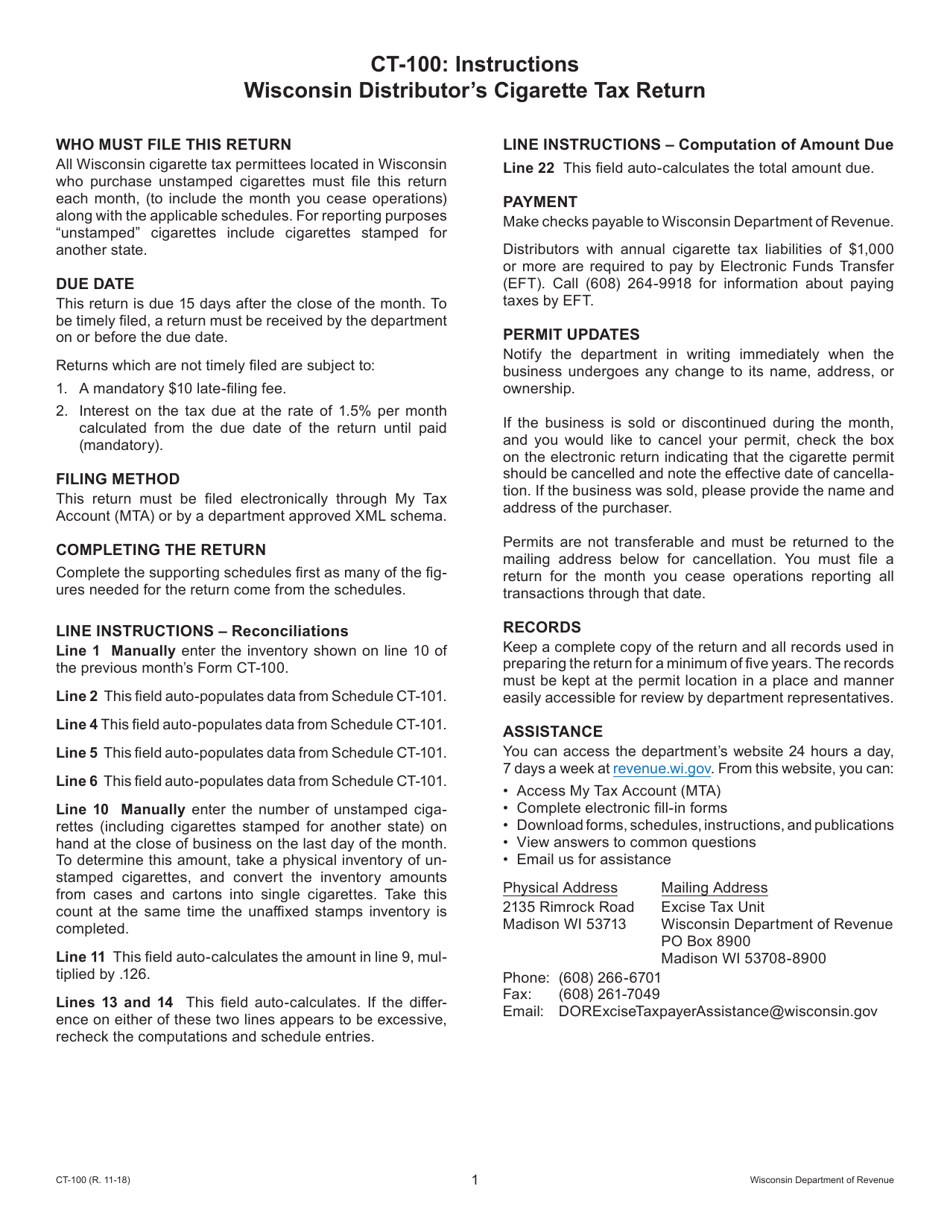

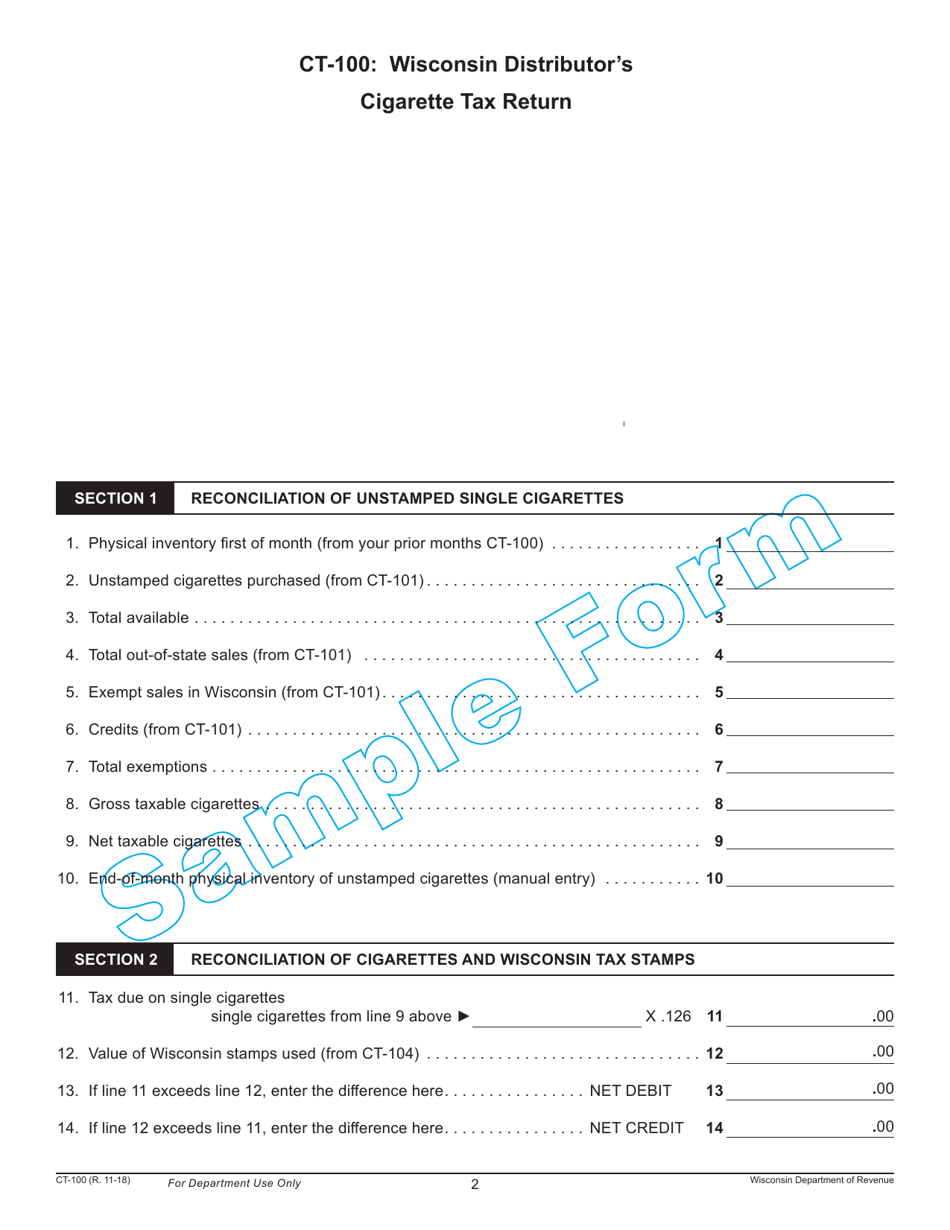

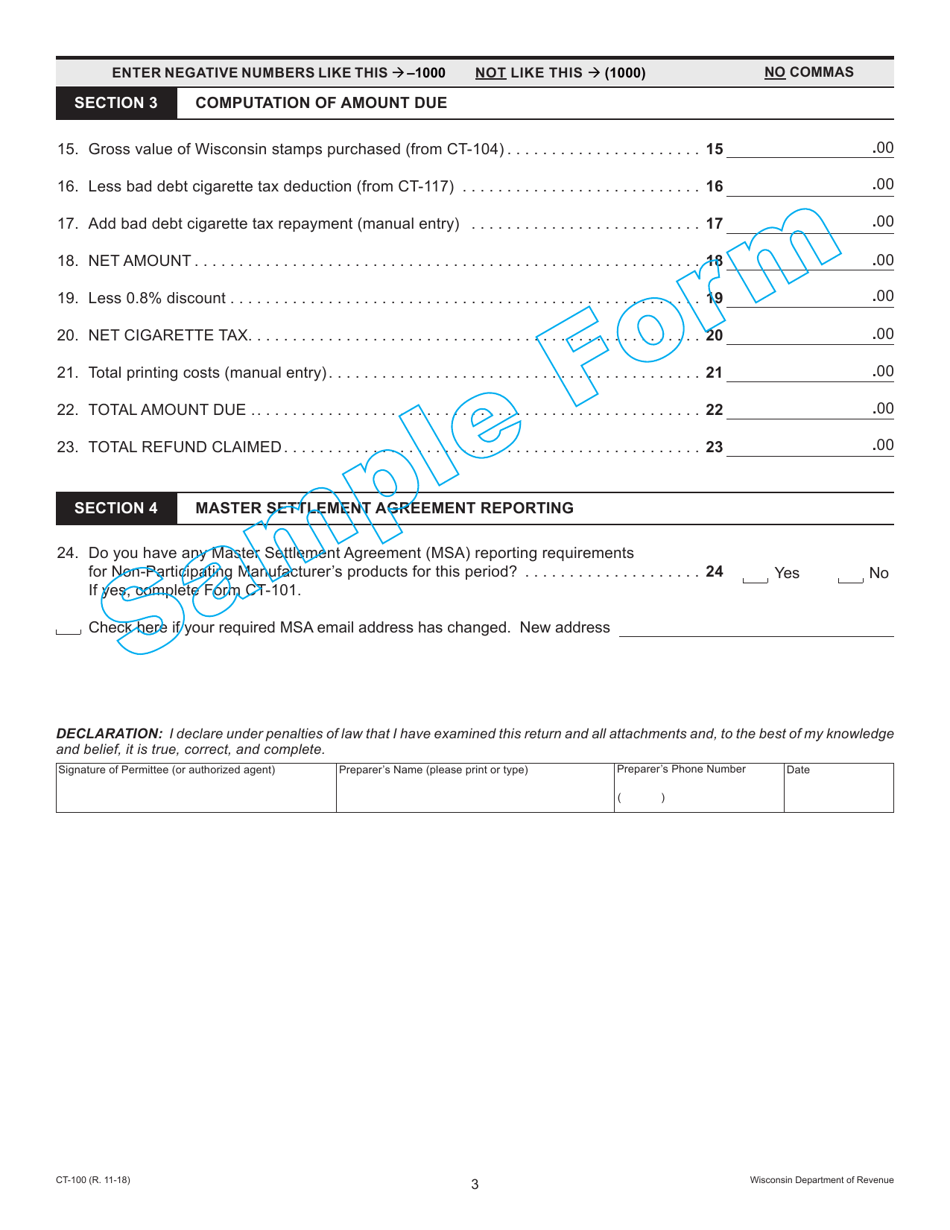

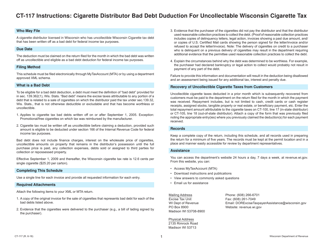

Form CT-100 Wisconsin Distributor's Cigarette Tax Return - Wisconsin

What Is Form CT-100?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-100?

A: Form CT-100 is the Wisconsin Distributor's Cigarette Tax Return.

Q: Who needs to file Form CT-100?

A: Distributors of cigarettes in Wisconsin need to file Form CT-100.

Q: What is the purpose of Form CT-100?

A: The purpose of Form CT-100 is to report and pay the cigarette tax on the distribution of cigarettes in Wisconsin.

Q: When is Form CT-100 due?

A: Form CT-100 is due on a monthly basis, with the deadline falling on the 25th day of the month following the reporting period.

Q: Are there any penalties for late or incorrect filing of Form CT-100?

A: Yes, penalties may be imposed for late or incorrect filing, including interest charges and possible monetary penalties.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-100 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.