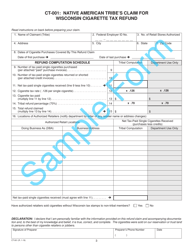

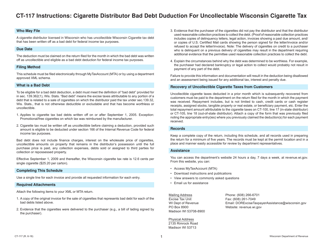

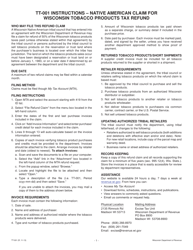

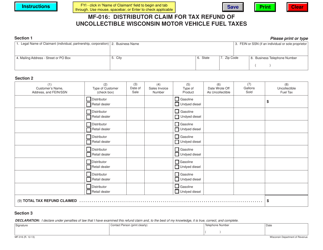

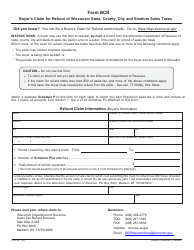

Form CT-001 Native American Tribe's Claim for Wisconsin Cigarette Tax Refund - Wisconsin

What Is Form CT-001?

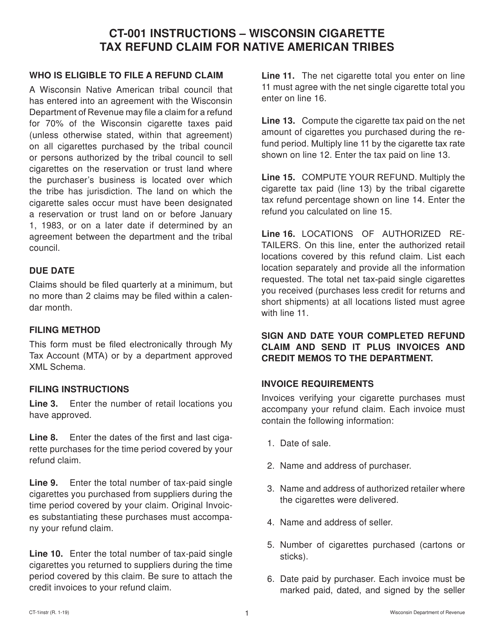

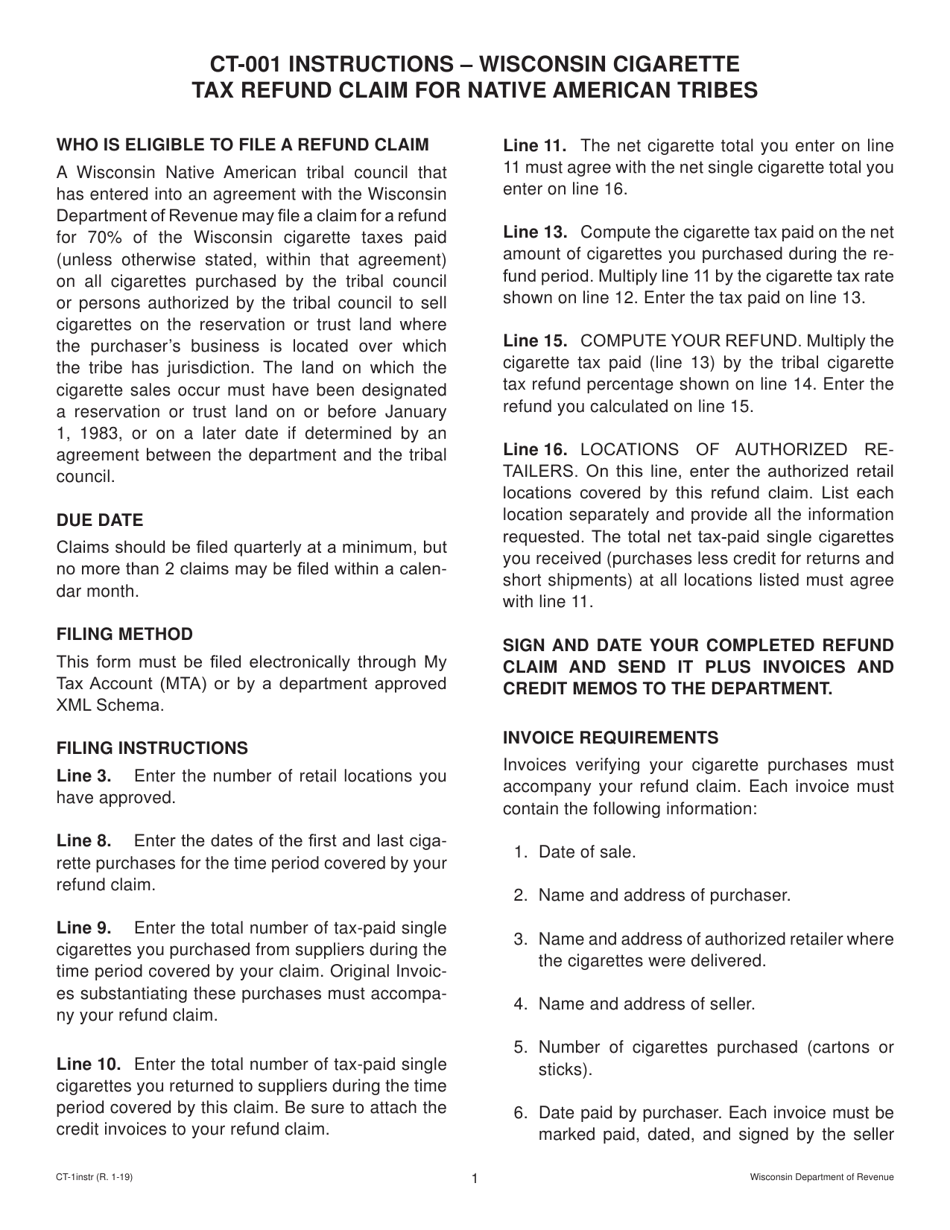

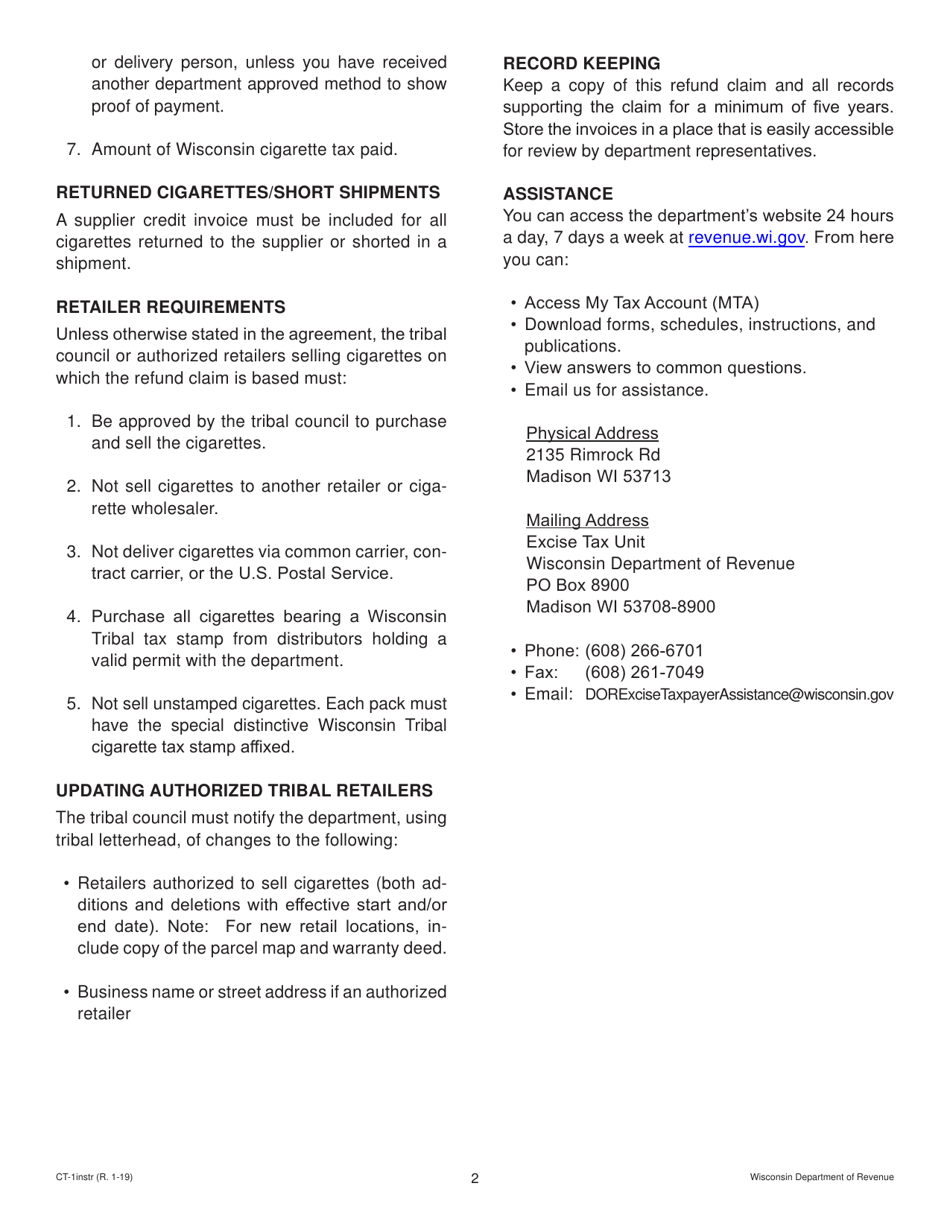

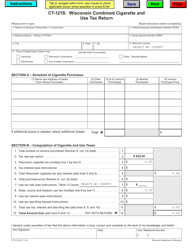

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-001?

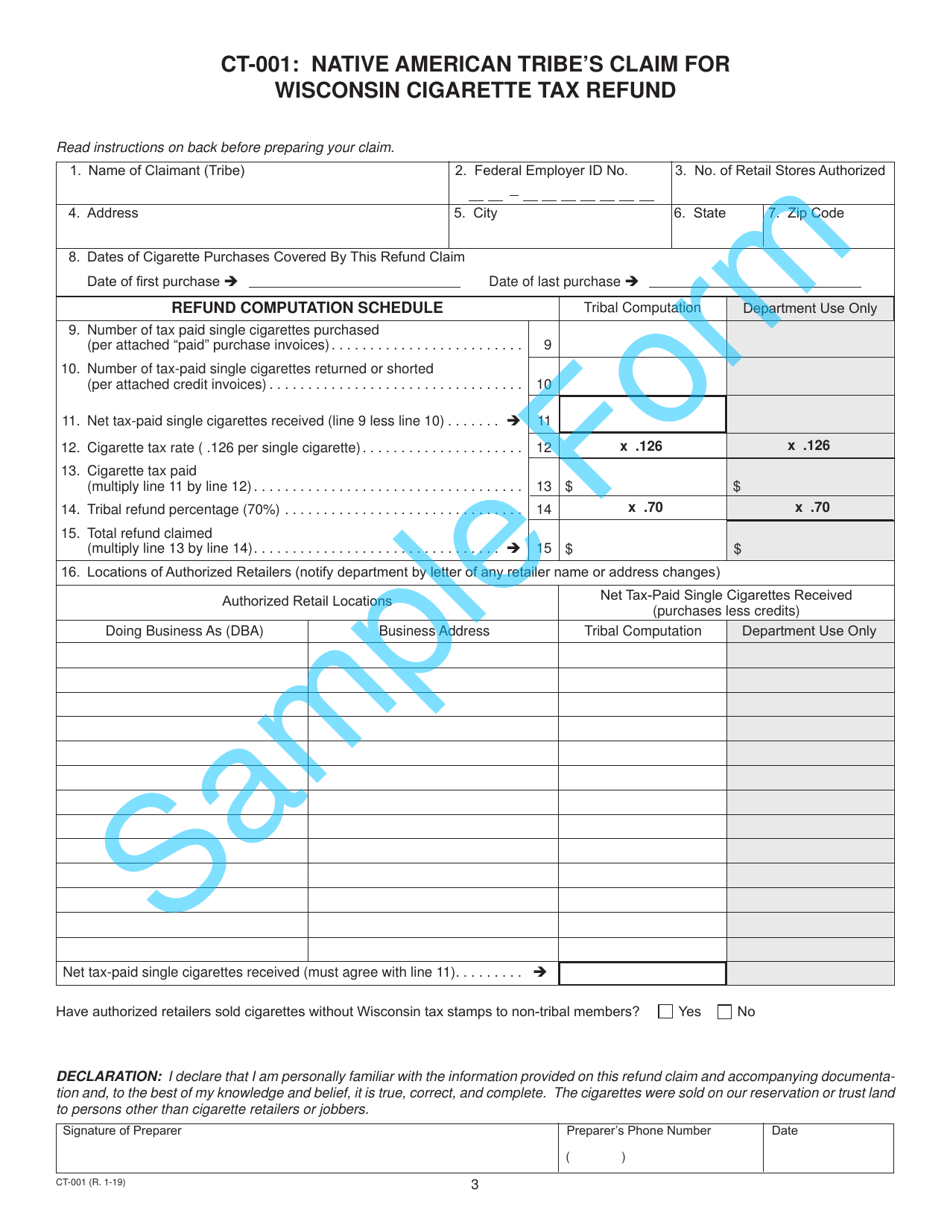

A: Form CT-001 is the Native American Tribe's Claim for Wisconsin Cigarette Tax Refund.

Q: Who can use Form CT-001?

A: Native American tribes can use Form CT-001 to claim a refund of Wisconsin cigarette tax.

Q: What is the purpose of Form CT-001?

A: The purpose of Form CT-001 is to request a refund of the cigarette tax paid by Native American tribes in Wisconsin.

Q: Is Form CT-001 specific to Wisconsin?

A: Yes, Form CT-001 is specifically for claiming a cigarette tax refund in Wisconsin.

Q: Can individuals use Form CT-001?

A: No, Form CT-001 is only for use by Native American tribes.

Q: Are there any special requirements for using Form CT-001?

A: Yes, Native American tribes must meet certain criteria and provide supporting documentation to use Form CT-001.

Q: How long does it take to process a Form CT-001?

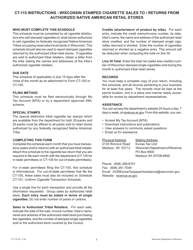

A: The processing time for Form CT-001 can vary, so it is best to contact the Wisconsin Department of Revenue for more information.

Q: Can Form CT-001 be filed electronically?

A: No, Form CT-001 cannot be filed electronically and must be submitted by mail.

Q: What should I do if I have questions about Form CT-001?

A: If you have questions about Form CT-001, you should contact the Wisconsin Department of Revenue for assistance.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-001 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.