This version of the form is not currently in use and is provided for reference only. Download this version of

Form UCP-240

for the current year.

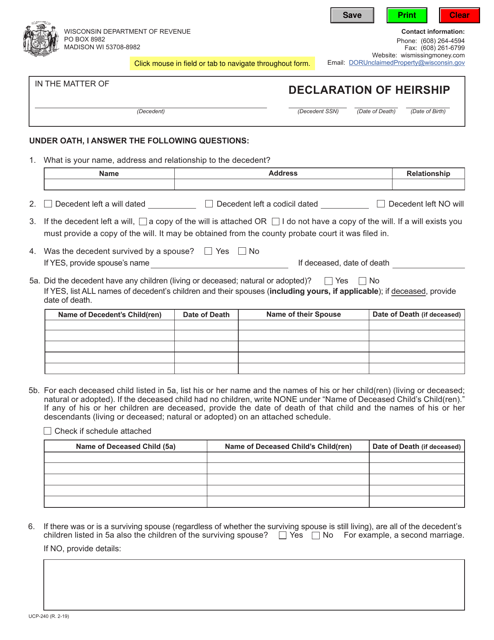

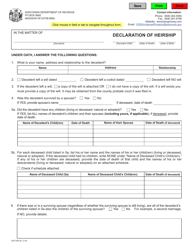

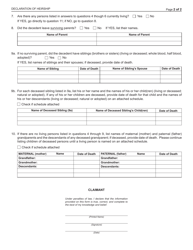

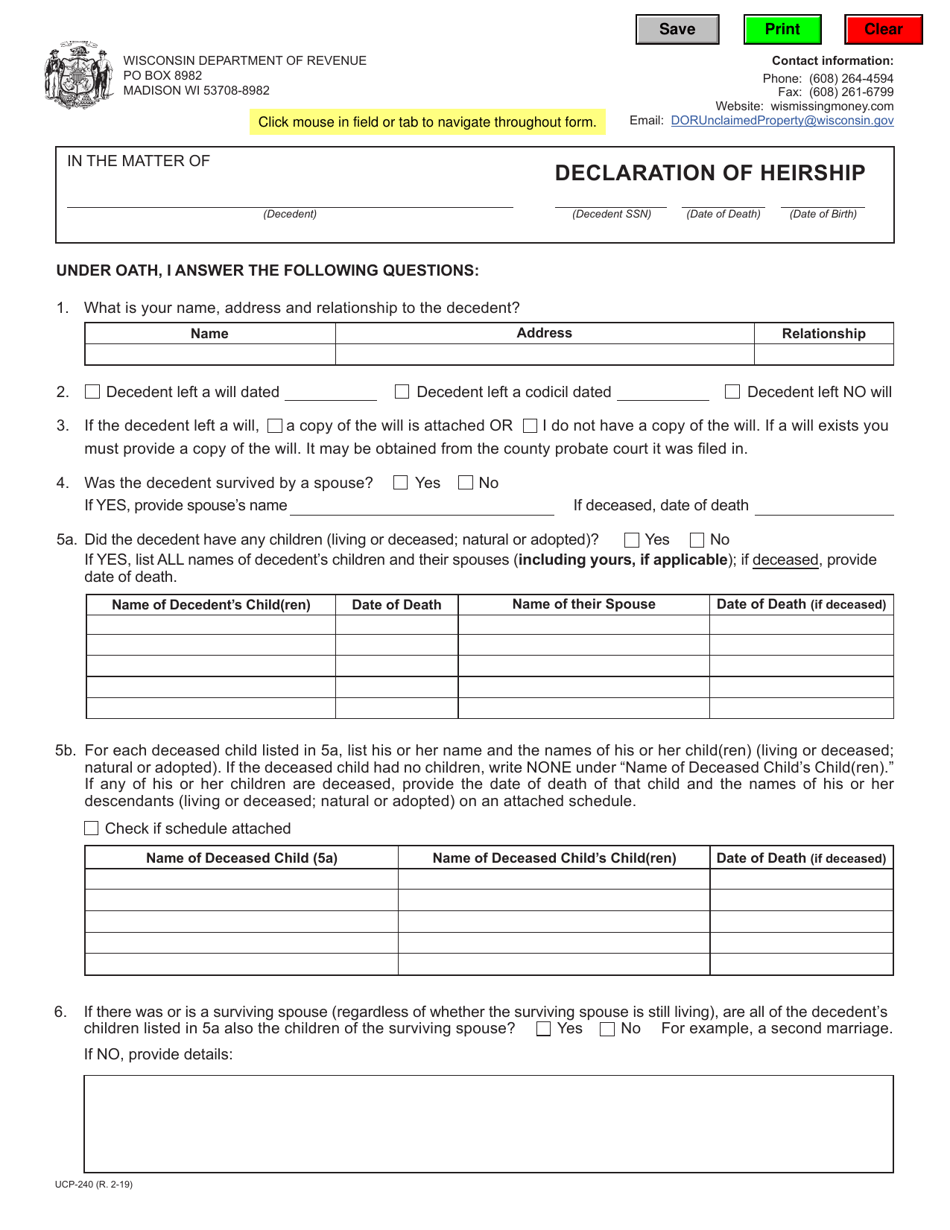

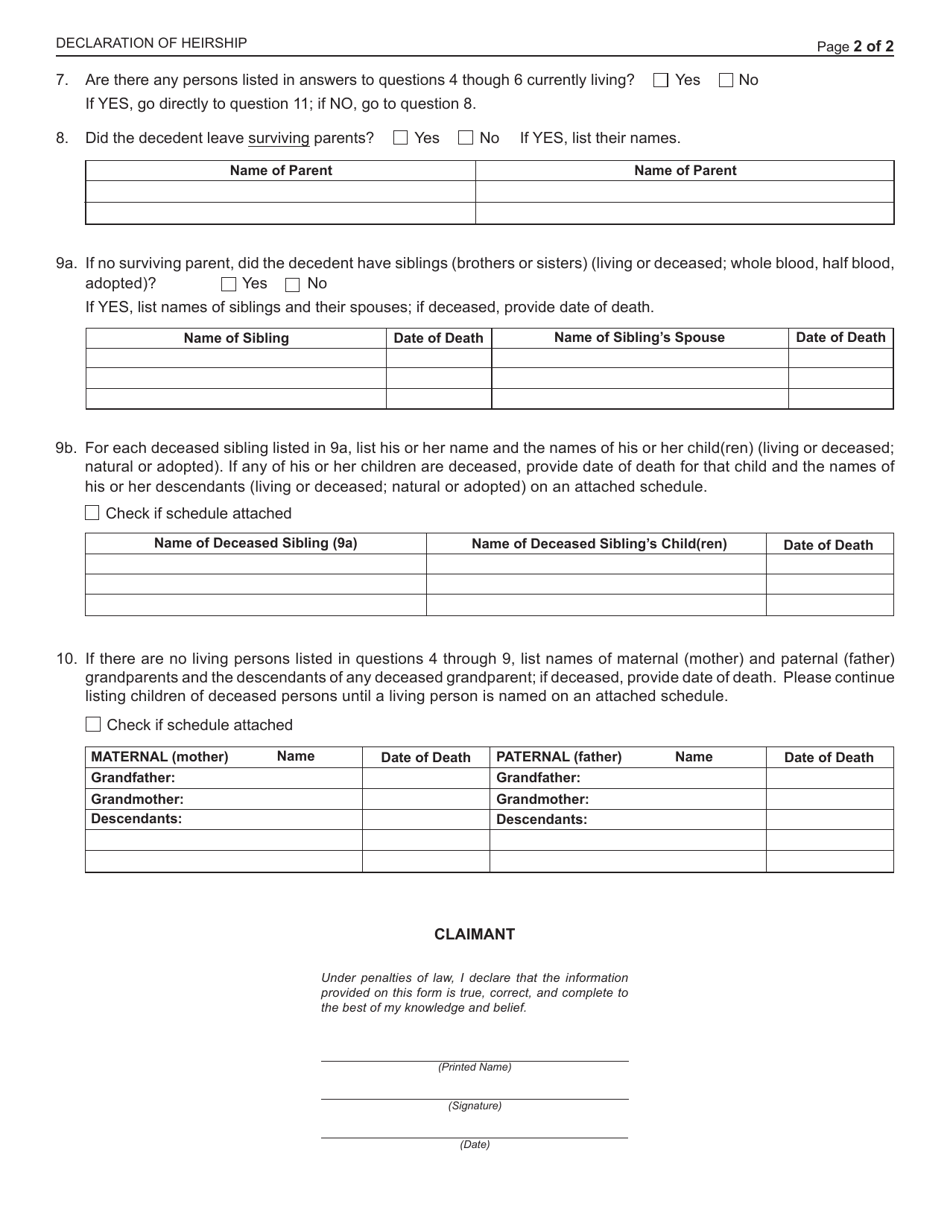

Form UCP-240 Declaration of Heirship - Wisconsin

What Is Form UCP-240?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UCP-240?

A: Form UCP-240 is a Declaration of Heirship.

Q: What is the purpose of Form UCP-240?

A: The purpose of Form UCP-240 is to establish the heirs of a deceased person in Wisconsin.

Q: Who can file Form UCP-240?

A: Any person who has knowledge of the heirs can file Form UCP-240.

Q: Do I need to hire an attorney to file Form UCP-240?

A: It is not required to hire an attorney to file Form UCP-240, but legal advice may be helpful.

Q: What information do I need to provide on Form UCP-240?

A: You will need to provide information about the deceased person, the potential heirs, and their relationship to the deceased.

Q: Is there a fee for filing Form UCP-240?

A: There may be a filing fee associated with submitting Form UCP-240, so it is best to check with the probate court.

Q: What happens after I file Form UCP-240?

A: After filing Form UCP-240, the court will review the information provided and determine the legal heirs of the deceased.

Q: Can I contest the heirs listed on Form UCP-240?

A: Yes, you can contest the heirs listed on Form UCP-240 by filing a formal objection with the court.

Q: How long does it take for the court to make a determination based on Form UCP-240?

A: The length of time for the court to make a determination based on Form UCP-240 can vary depending on the complexity of the case.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCP-240 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.