This version of the form is not currently in use and is provided for reference only. Download this version of

Form UCP-281

for the current year.

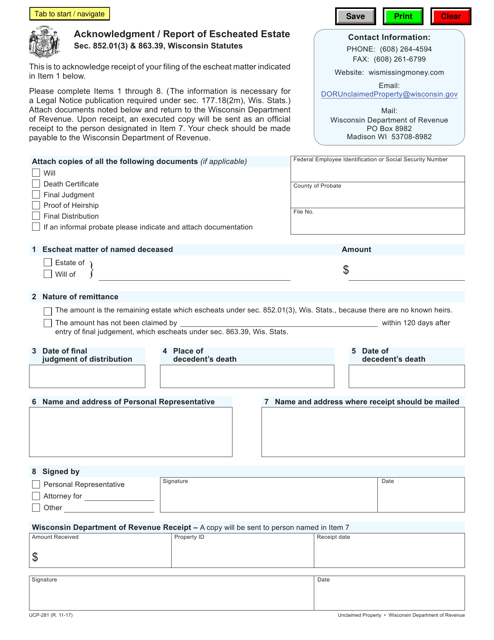

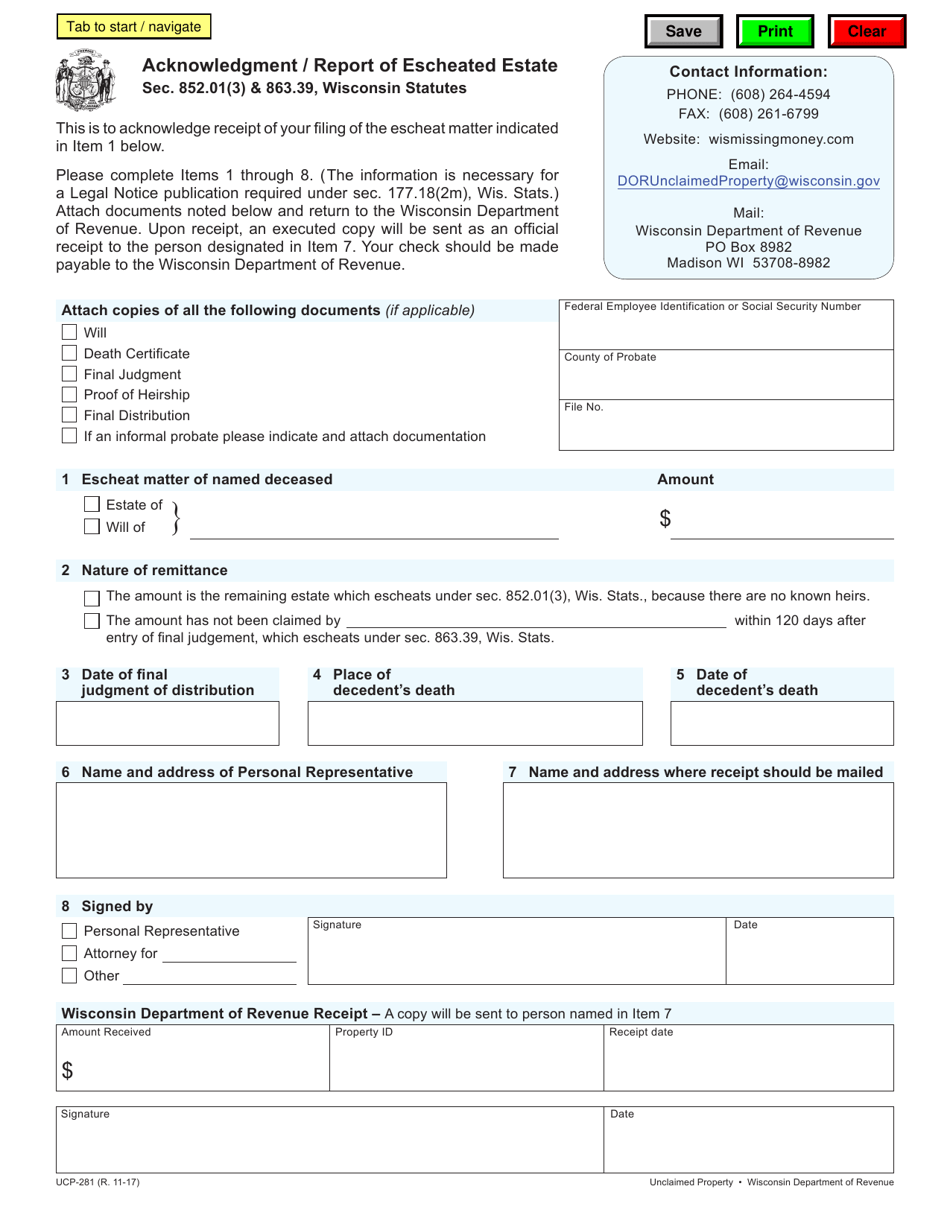

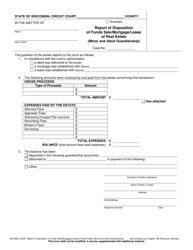

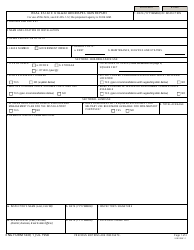

Form UCP-281 Acknowledgment / Report of Escheated Estate - Wisconsin

What Is Form UCP-281?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UCP-281?

A: Form UCP-281 is the Acknowledgment / Report of Escheated Estate form used in Wisconsin.

Q: What is an escheated estate?

A: An escheated estate refers to assets or property that have been turned over to the state government because the owner or rightful heir cannot be located or identified.

Q: Who needs to file Form UCP-281?

A: Form UCP-281 needs to be filed by the holder of the escheated estate, which is typically a financial institution or company that is holding the assets.

Q: What information is required on Form UCP-281?

A: Form UCP-281 requires information about the escheated estate, such as the owner's name, last known address, and details about the assets being reported.

Q: When is Form UCP-281 due?

A: Form UCP-281 is typically due by November 1st of each year for the reporting period ending on the preceding June 30th.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCP-281 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.