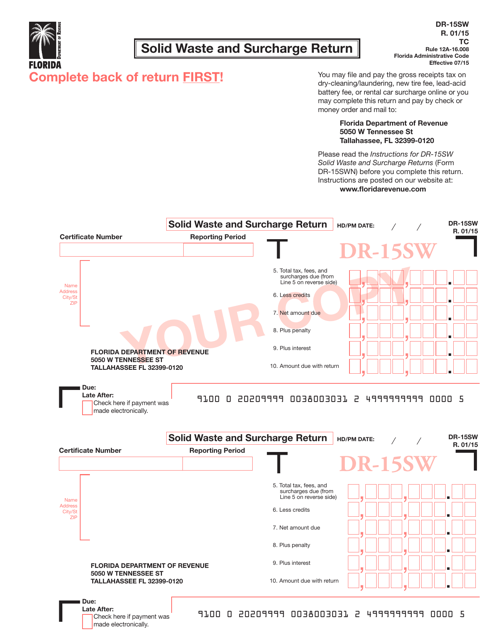

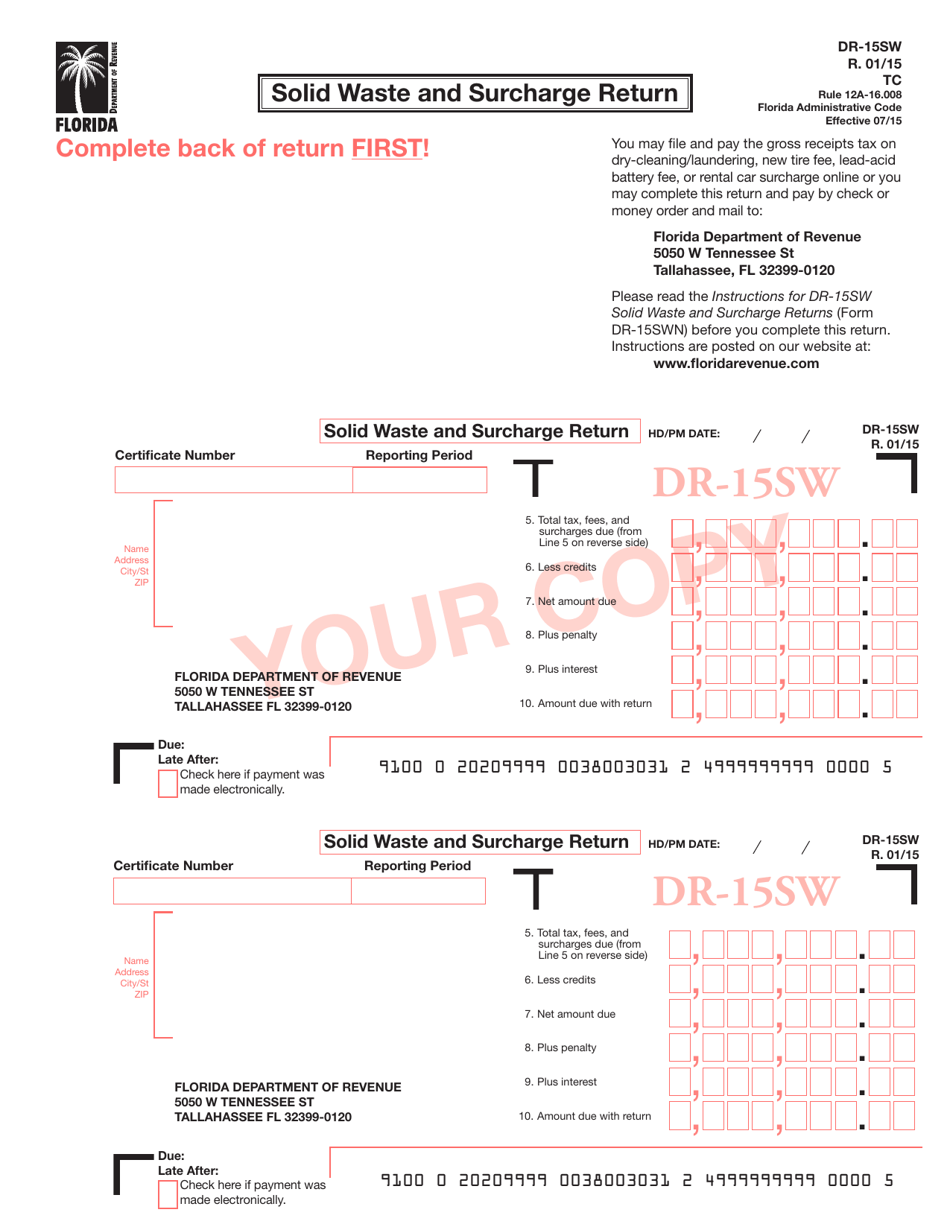

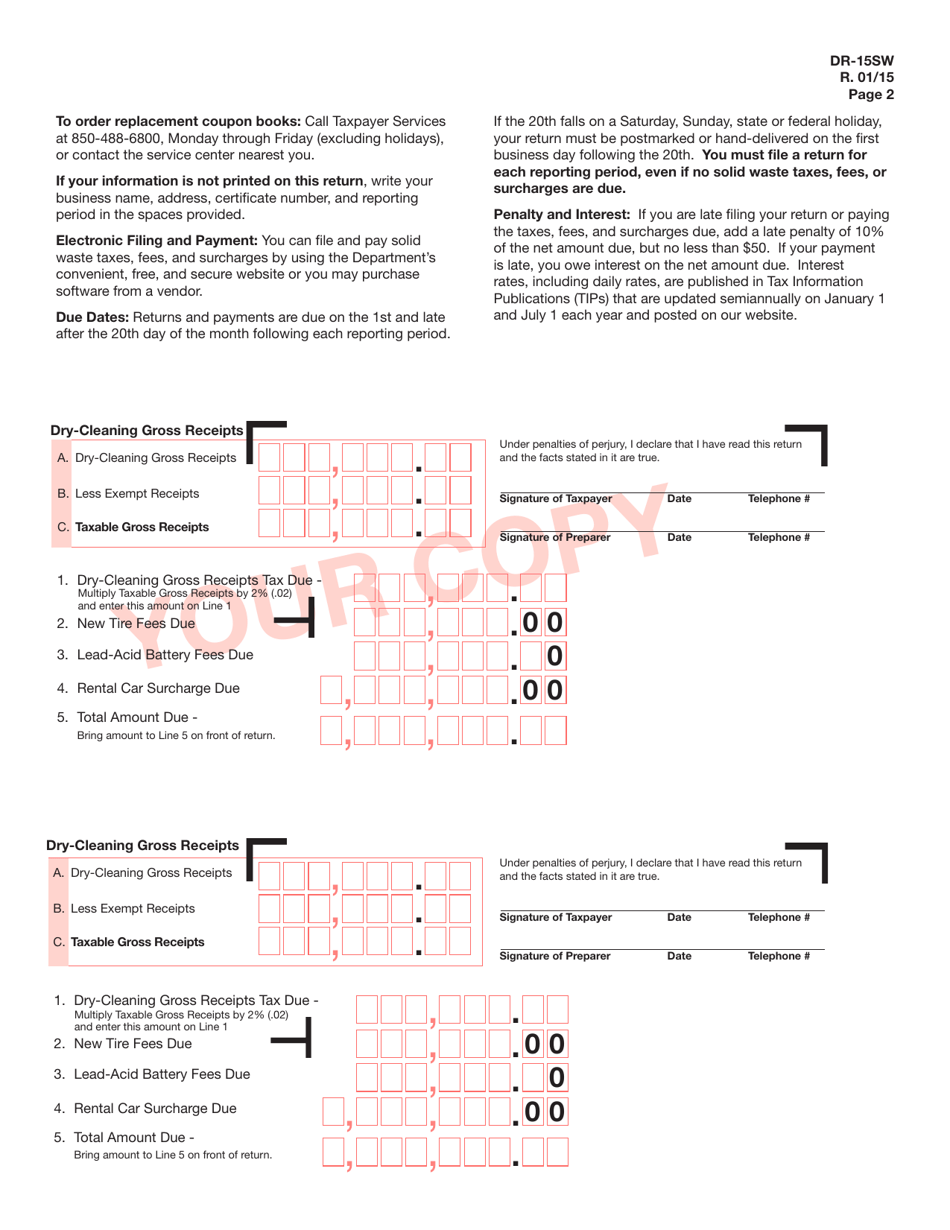

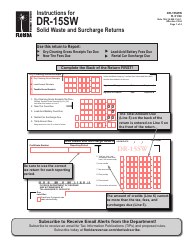

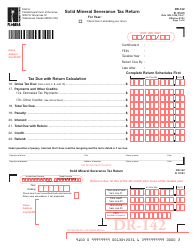

Form DR-15SW Solid Waste and Surcharge Return - Florida

What Is Form DR-15SW?

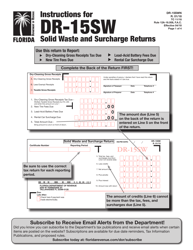

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DR-15SW?

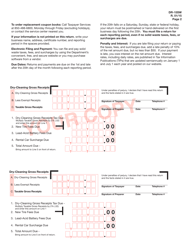

A: Form DR-15SW is the Solid Waste and Surcharge Return form used in the state of Florida.

Q: What is the purpose of Form DR-15SW?

A: Form DR-15SW is used to report and remit the solid waste and surcharge taxes in Florida.

Q: Who needs to file Form DR-15SW?

A: Businesses that are required to collect and remit solid waste and surcharge taxes in Florida need to file Form DR-15SW.

Q: When is Form DR-15SW due?

A: Form DR-15SW is due on a monthly basis and must be filed by the 1st day of the following month.

Q: Is Form DR-15SW mandatory?

A: Yes, businesses that are subject to solid waste and surcharge taxes in Florida are required to file Form DR-15SW.

Q: What are the consequences of not filing Form DR-15SW?

A: Failure to file Form DR-15SW or to remit the required taxes can result in penalties and interest charges.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-15SW by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.