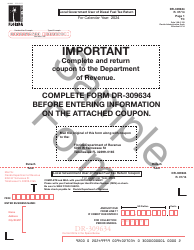

Form DR-15TDT Local Option Transient Rental Tax Rates (Tourist Development Tax Rates) - Florida

What Is Form DR-15TDT?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-15TDT?

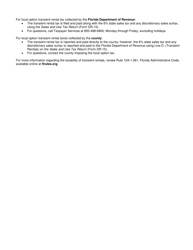

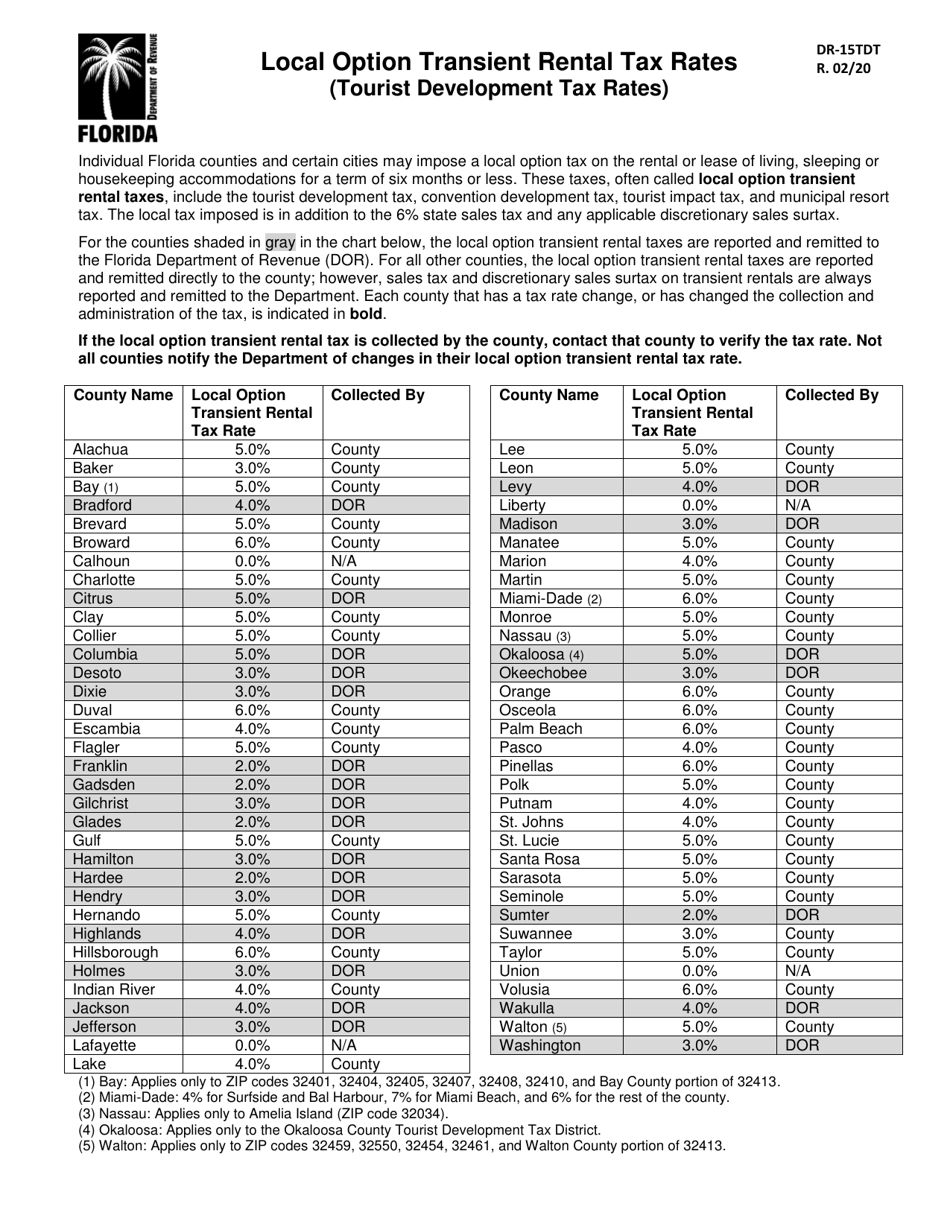

A: Form DR-15TDT is a tax form used to report and remit local option transient rental tax rates, also known as tourist development tax rates, in Florida.

Q: What are local option transient rental tax rates?

A: Local option transient rental tax rates, or tourist development tax rates, are taxes imposed on transient rentals such as hotel rooms or vacation rentals in certain areas of Florida.

Q: Who is required to file Form DR-15TDT?

A: Businesses or individuals who rent out accommodations for short-term stays in areas of Florida where local option transient rental taxes apply are required to file Form DR-15TDT.

Q: Why do I need to report and remit local option transient rental tax?

A: Reporting and remitting local option transient rental tax is required by law and helps fund tourism promotion, development, and other initiatives in the respective areas of Florida.

Q: When is Form DR-15TDT due?

A: Form DR-15TDT is due on the 1st day of the month following the end of the reporting period.

Q: How do I calculate the local option transient rental tax?

A: The local option transient rental tax rate can vary depending on the specific area in Florida. The rate is applied to the total rental amount charged for the short-term accommodation.

Q: What should I do if I have questions or need assistance with Form DR-15TDT?

A: If you have questions or need assistance with Form DR-15TDT, you can contact the Florida Department of Revenue for guidance and support.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-15TDT by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.