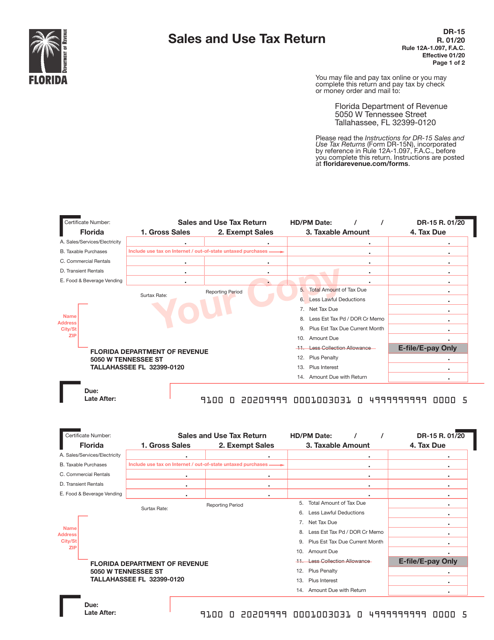

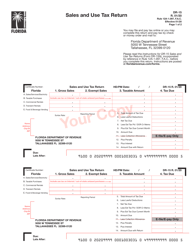

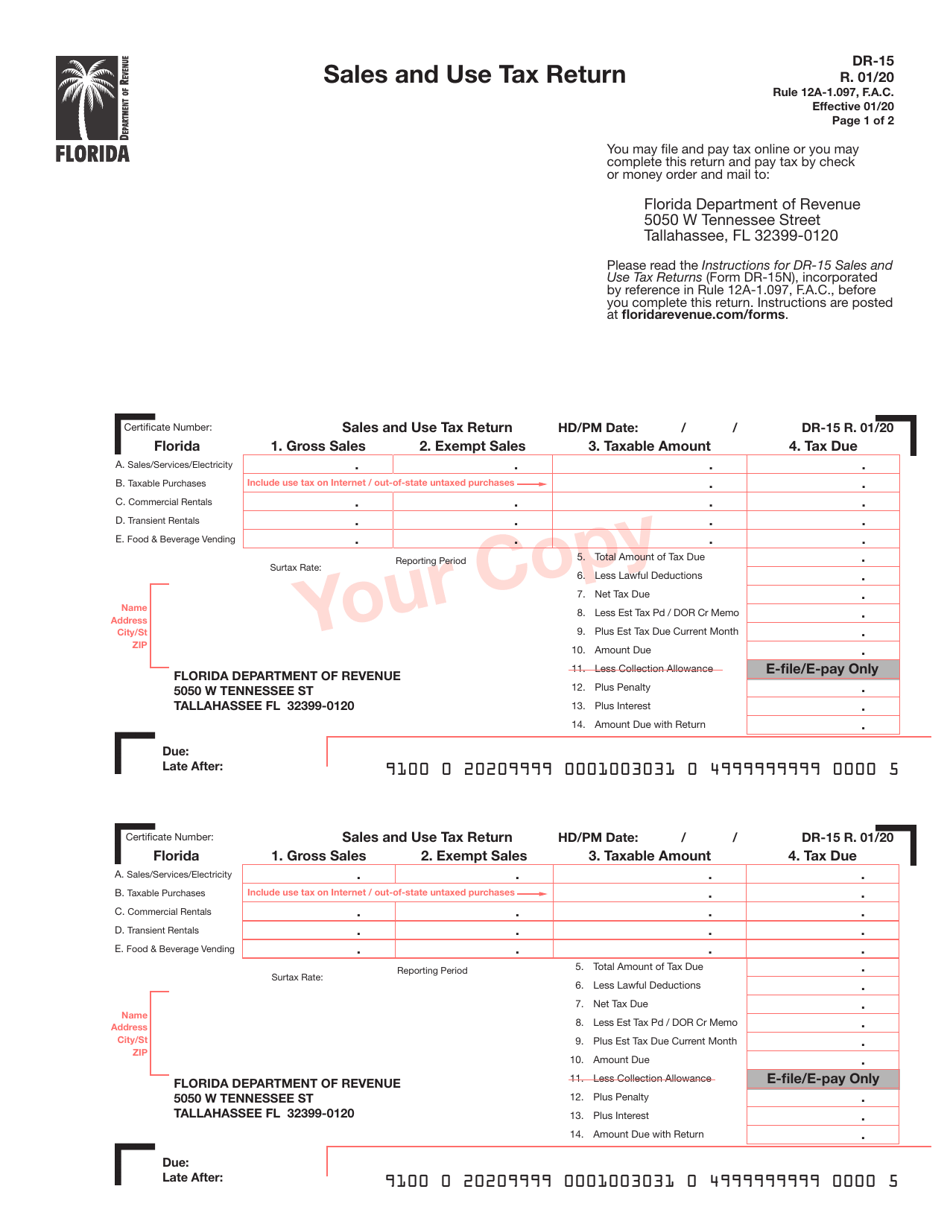

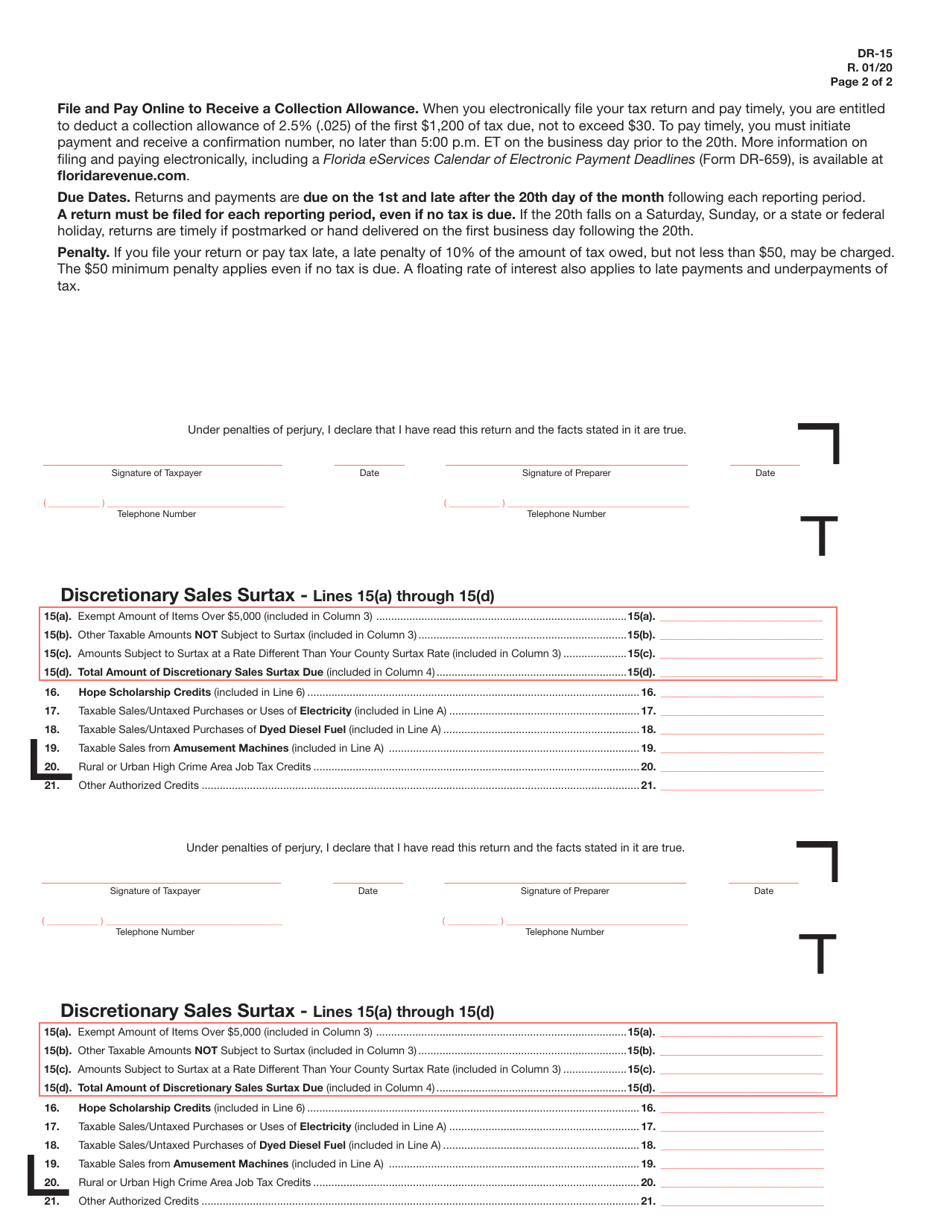

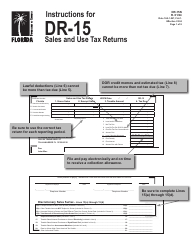

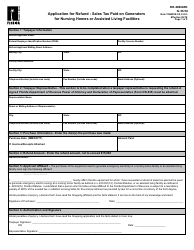

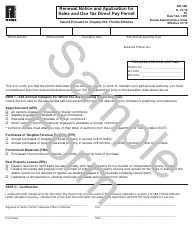

Form DR-15 Sales and Use Tax Return - Florida

What Is Form DR-15?

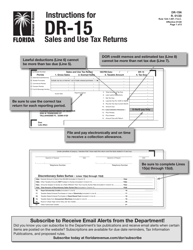

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

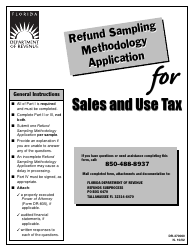

Q: What is Form DR-15?

A: Form DR-15 is the Sales and Use Tax Return for the state of Florida.

Q: Who needs to file Form DR-15?

A: Businesses in Florida that are registered for sales and use tax must file Form DR-15.

Q: What is the purpose of Form DR-15?

A: Form DR-15 is used to report and remit sales and use tax collected by businesses in Florida.

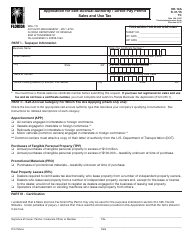

Q: Are there any exemptions or deductions available on Form DR-15?

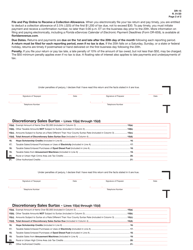

A: Yes, there are certain exemptions and deductions available on Form DR-15. Consult the instructions for more information.

Q: When is the deadline to file Form DR-15?

A: Form DR-15 must be filed monthly or quarterly, depending on the taxpayer's reporting frequency. The due dates can be found on the form or in the instructions.

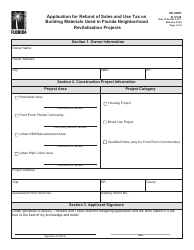

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-15 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.