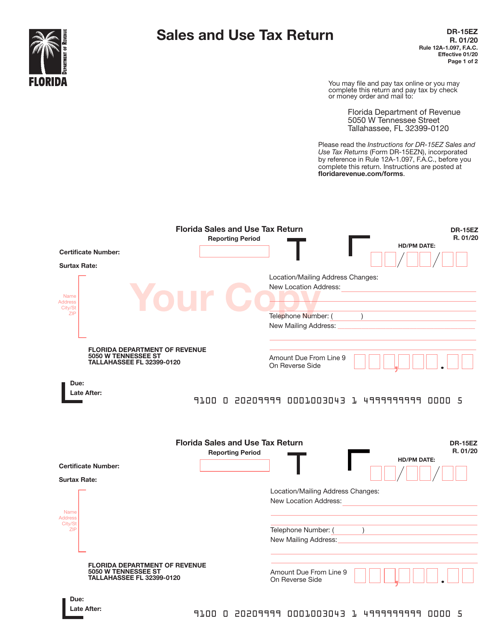

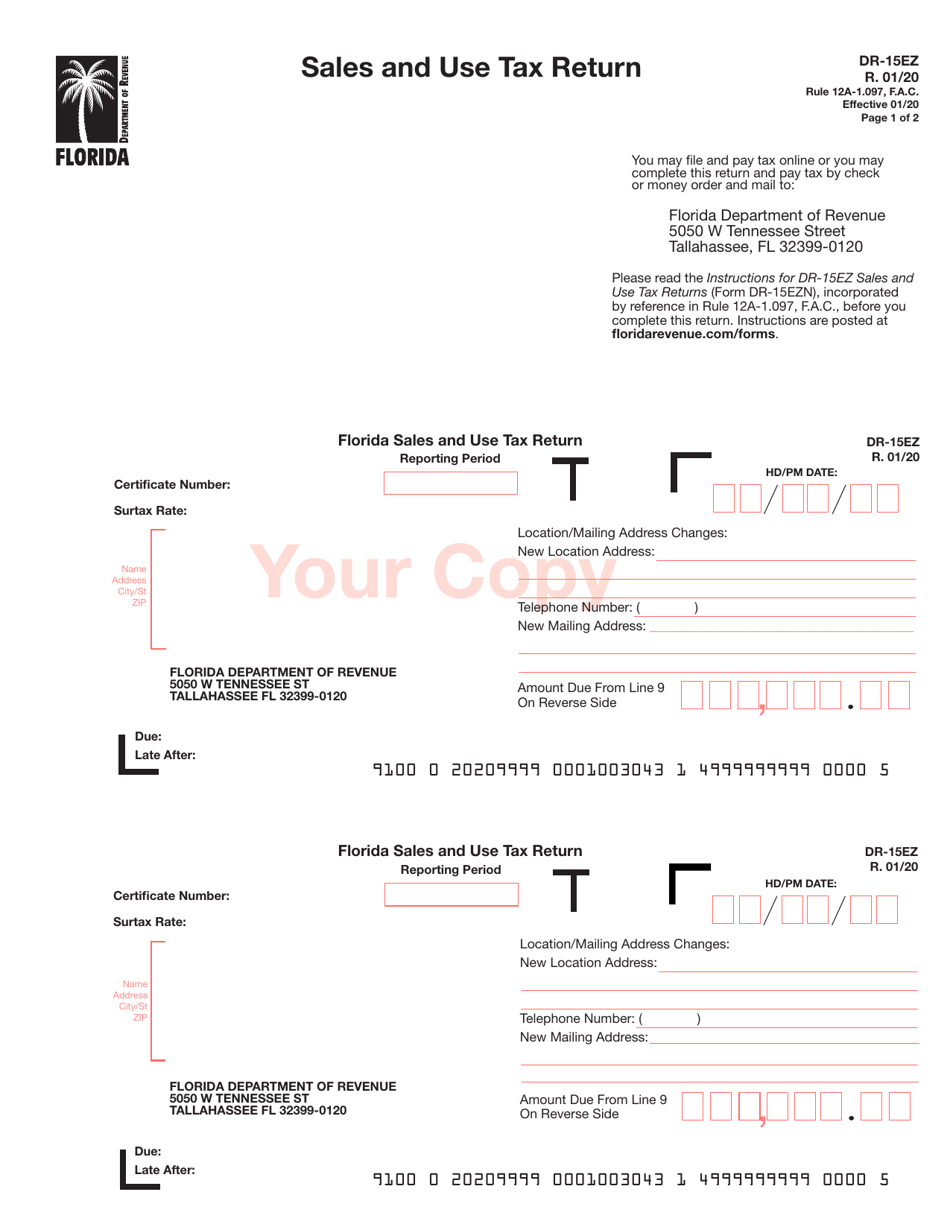

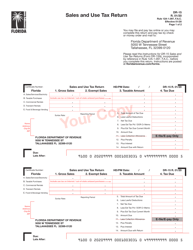

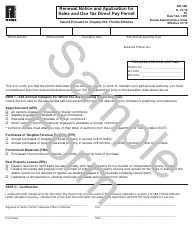

Form DR-15EZ Sales and Use Tax Return - Florida

What Is Form DR-15EZ?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DR-15EZ?

A: Form DR-15EZ is the Sales and Use Tax Return form used in the state of Florida.

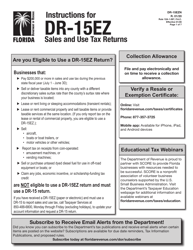

Q: Who should file Form DR-15EZ?

A: Businesses in Florida that are required to collect and remit sales tax should file Form DR-15EZ.

Q: What is the purpose of Form DR-15EZ?

A: Form DR-15EZ is used to report and pay the sales and use tax collected by businesses in Florida.

Q: When is Form DR-15EZ due?

A: Form DR-15EZ is due on the 1st day of the month following the reporting period.

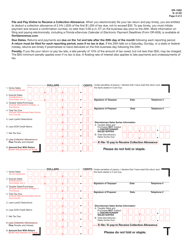

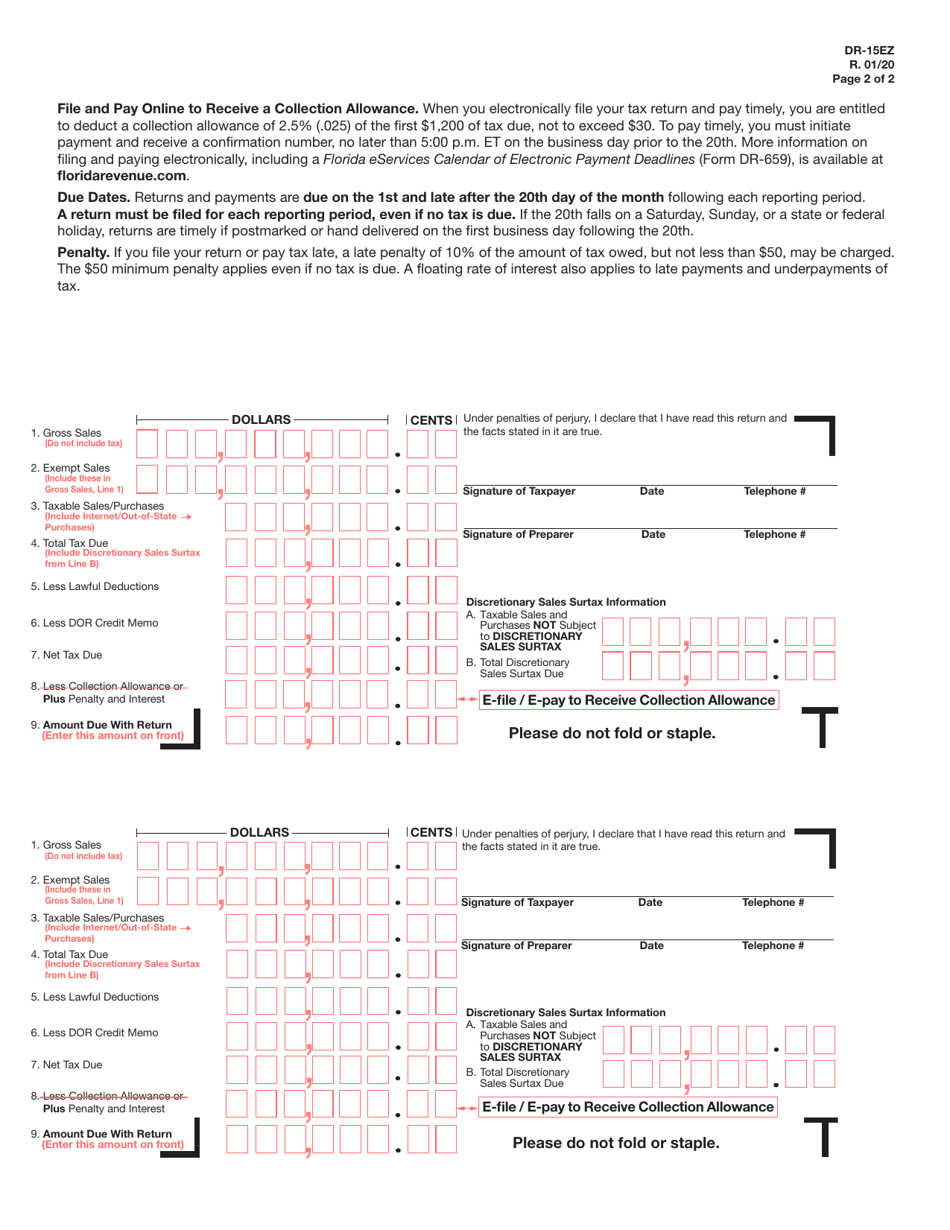

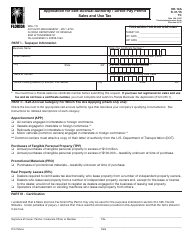

Q: What information is required on Form DR-15EZ?

A: Form DR-15EZ requires information such as gross sales, taxable sales, and sales tax collected.

Q: Are there any penalties for not filing Form DR-15EZ?

A: Yes, failure to file Form DR-15EZ or pay the sales tax on time may result in penalties and interest.

Q: What should I do if I made an error on Form DR-15EZ?

A: If you made an error on Form DR-15EZ, you should file an amended return as soon as possible to correct the mistake.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-15EZ by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.