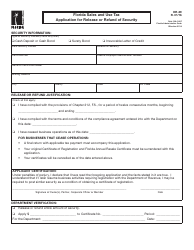

This version of the form is not currently in use and is provided for reference only. Download this version of

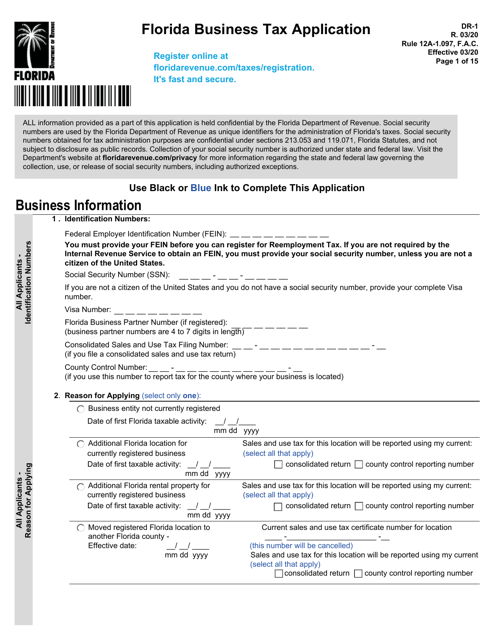

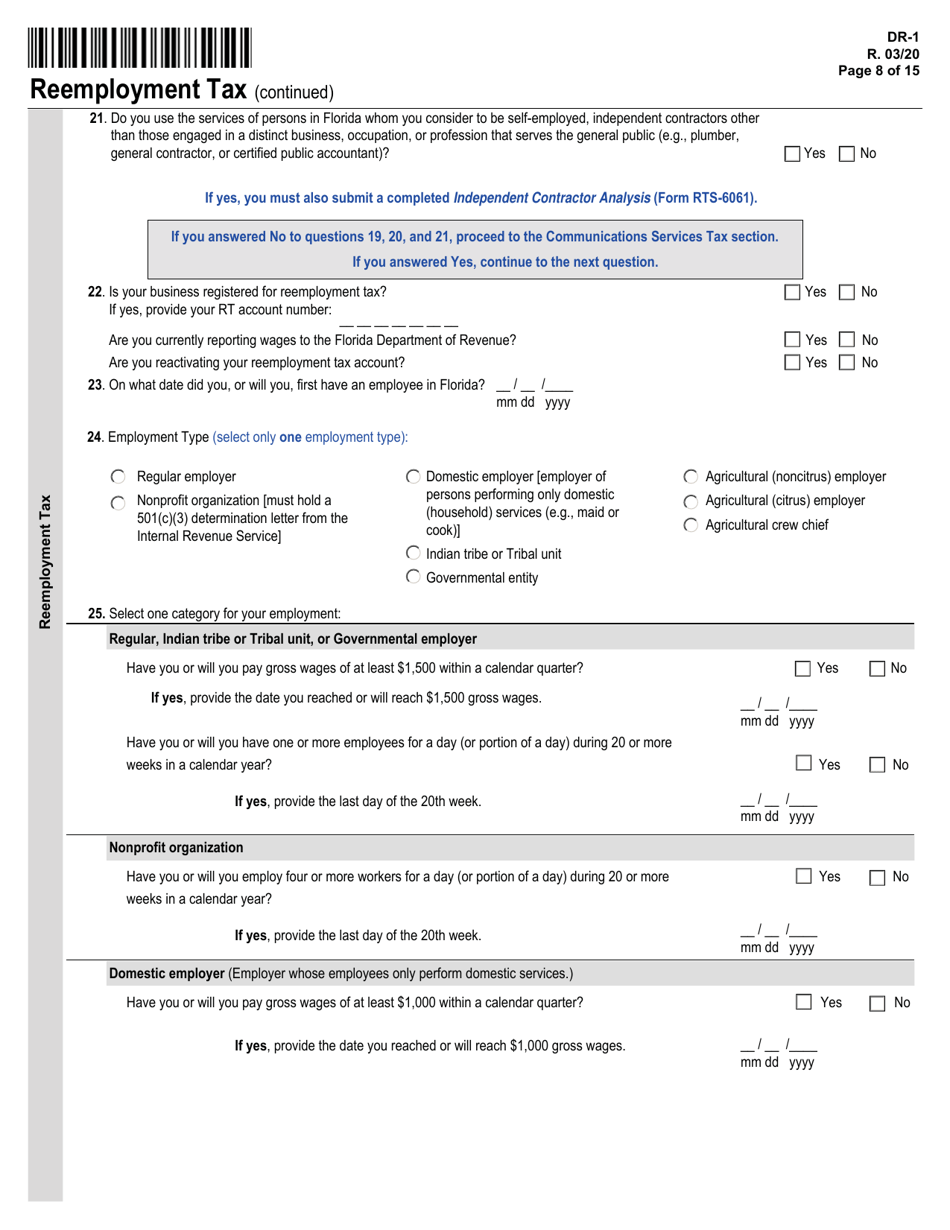

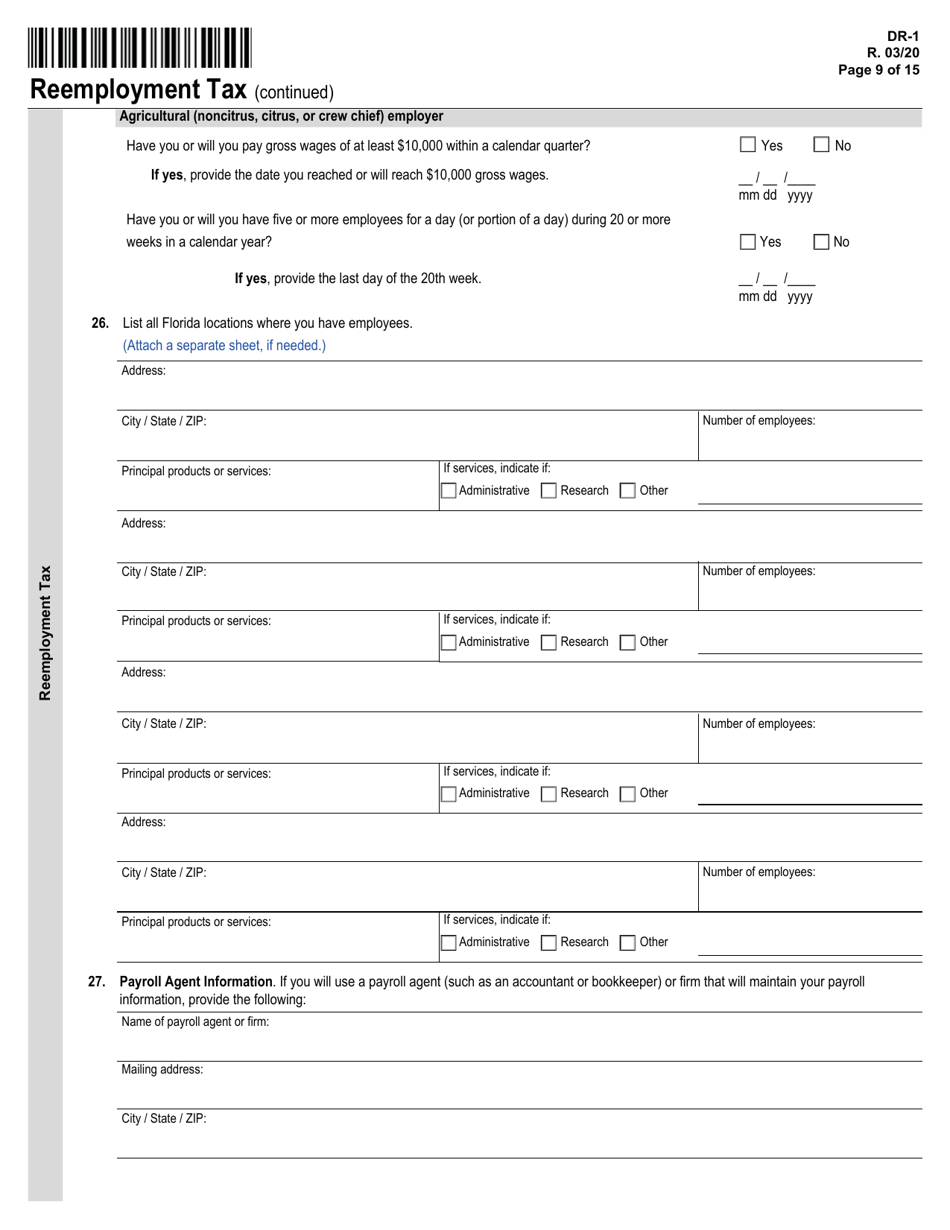

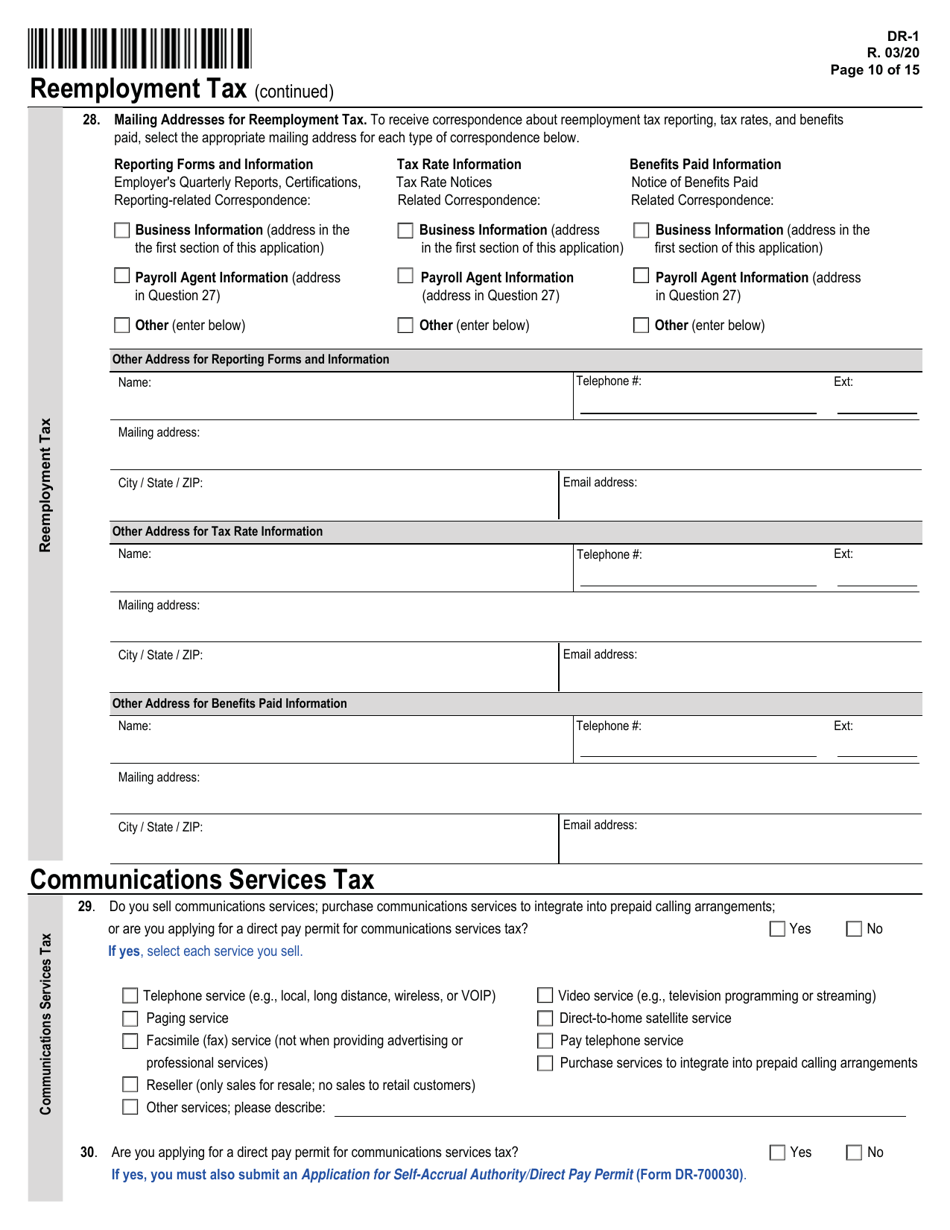

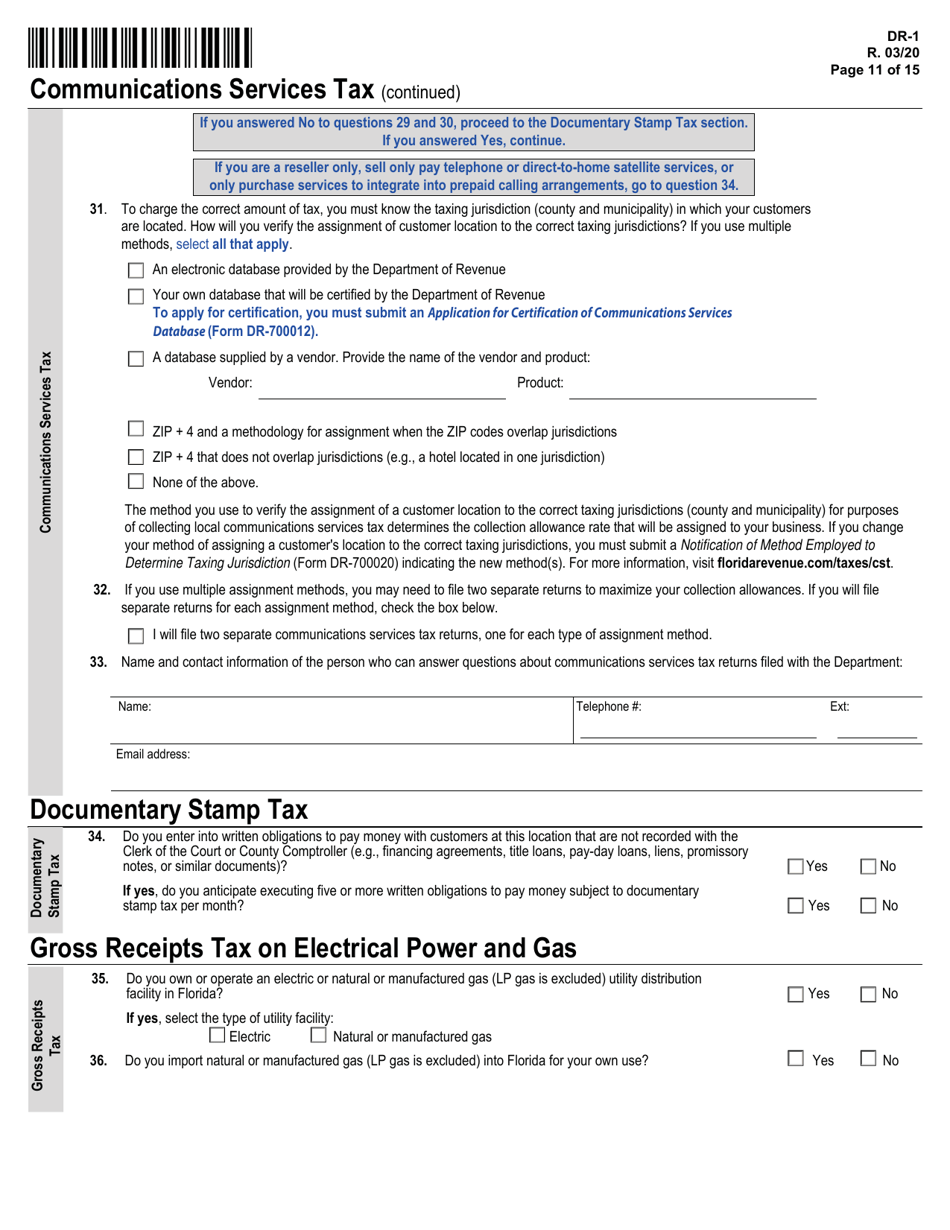

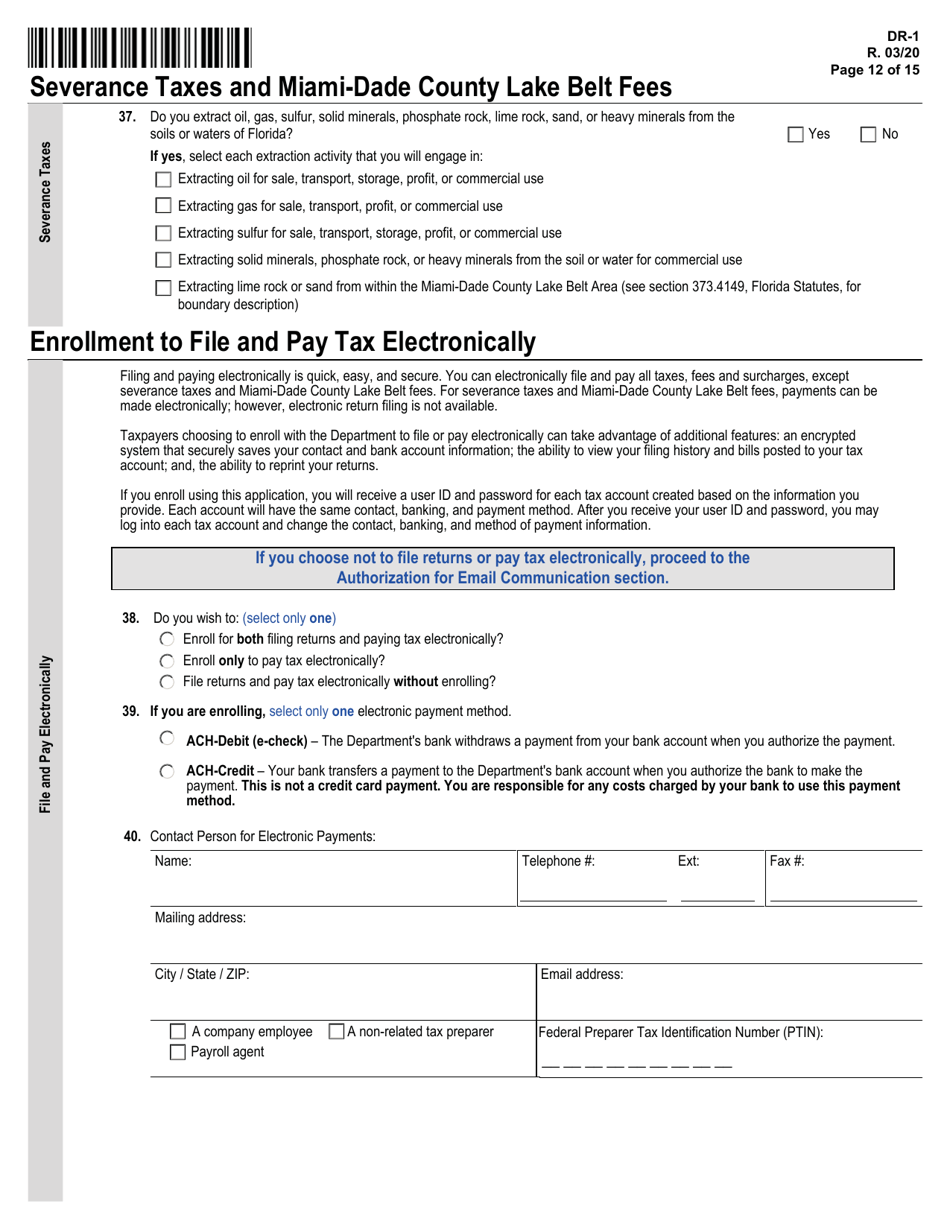

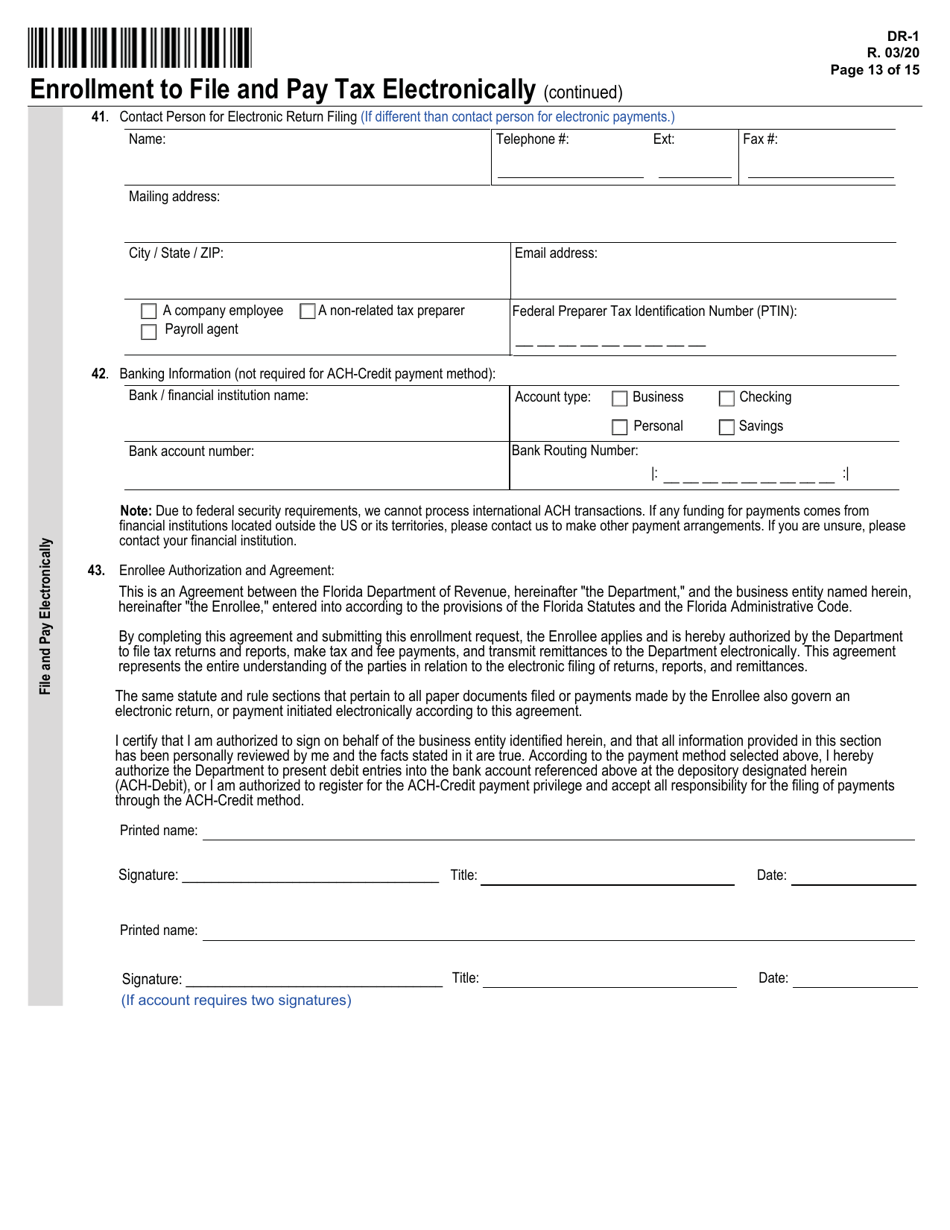

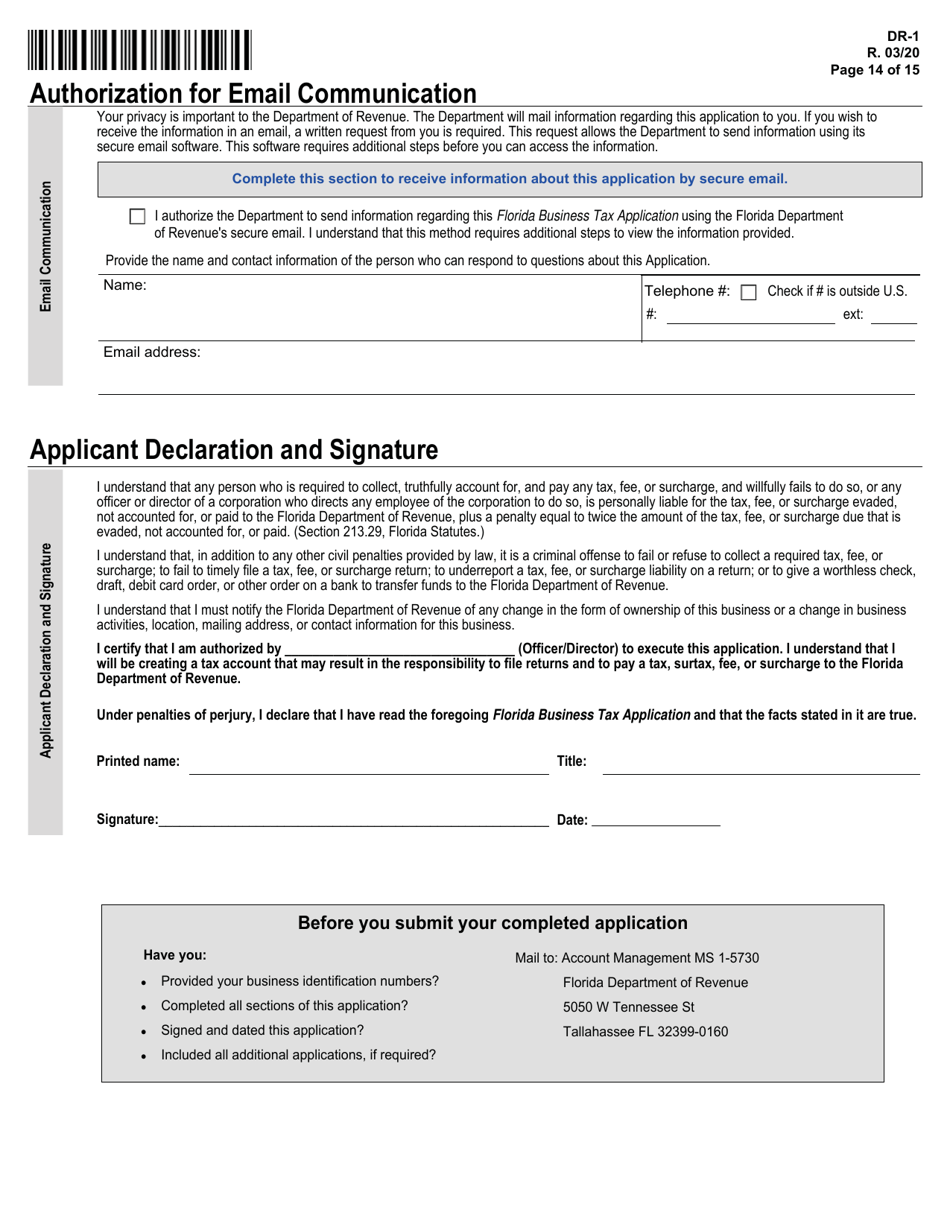

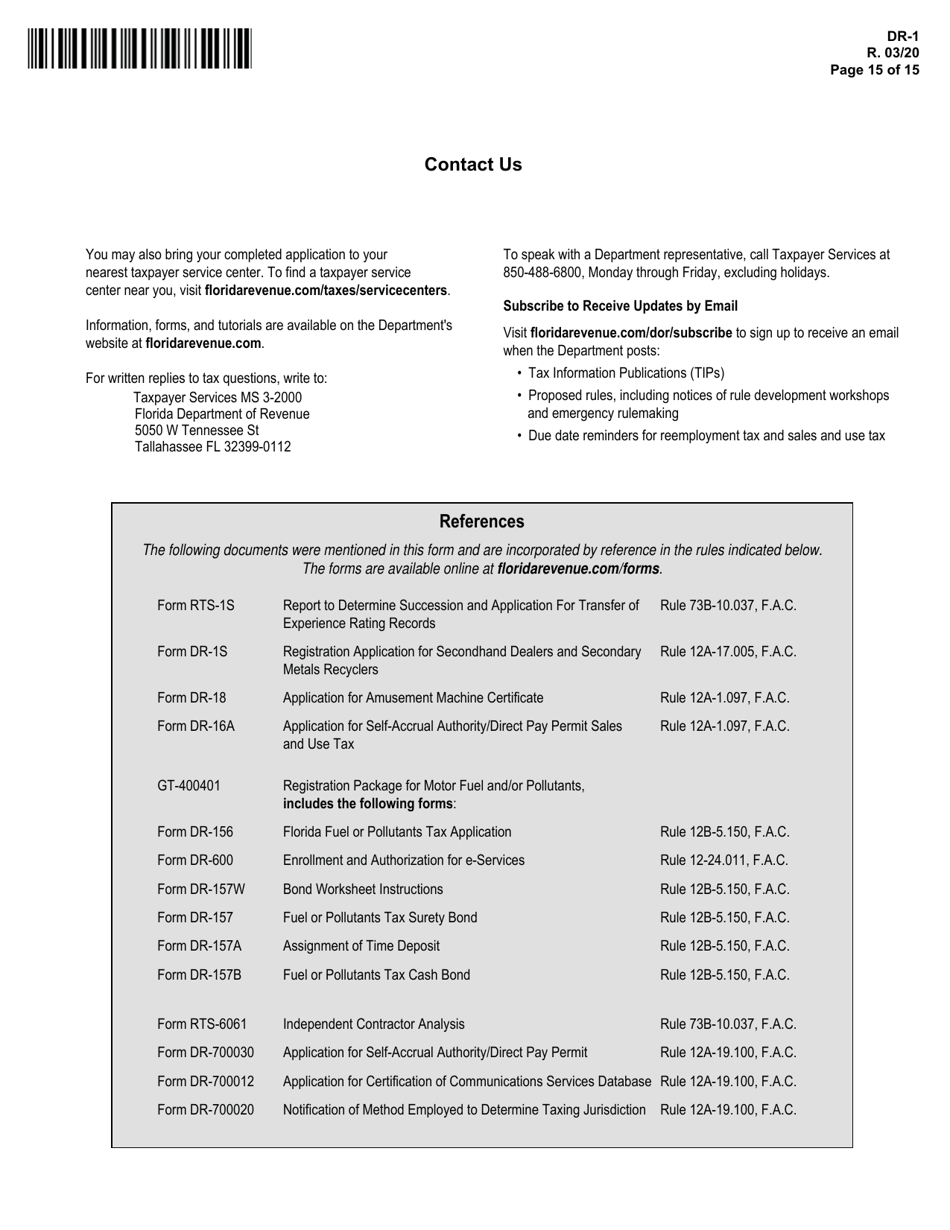

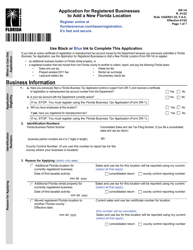

Form DR-1

for the current year.

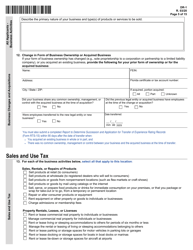

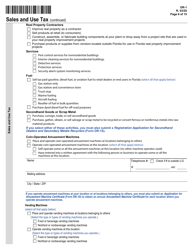

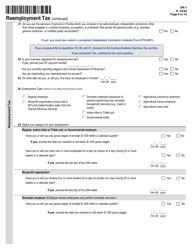

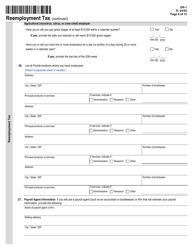

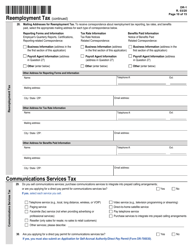

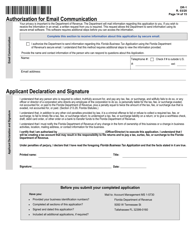

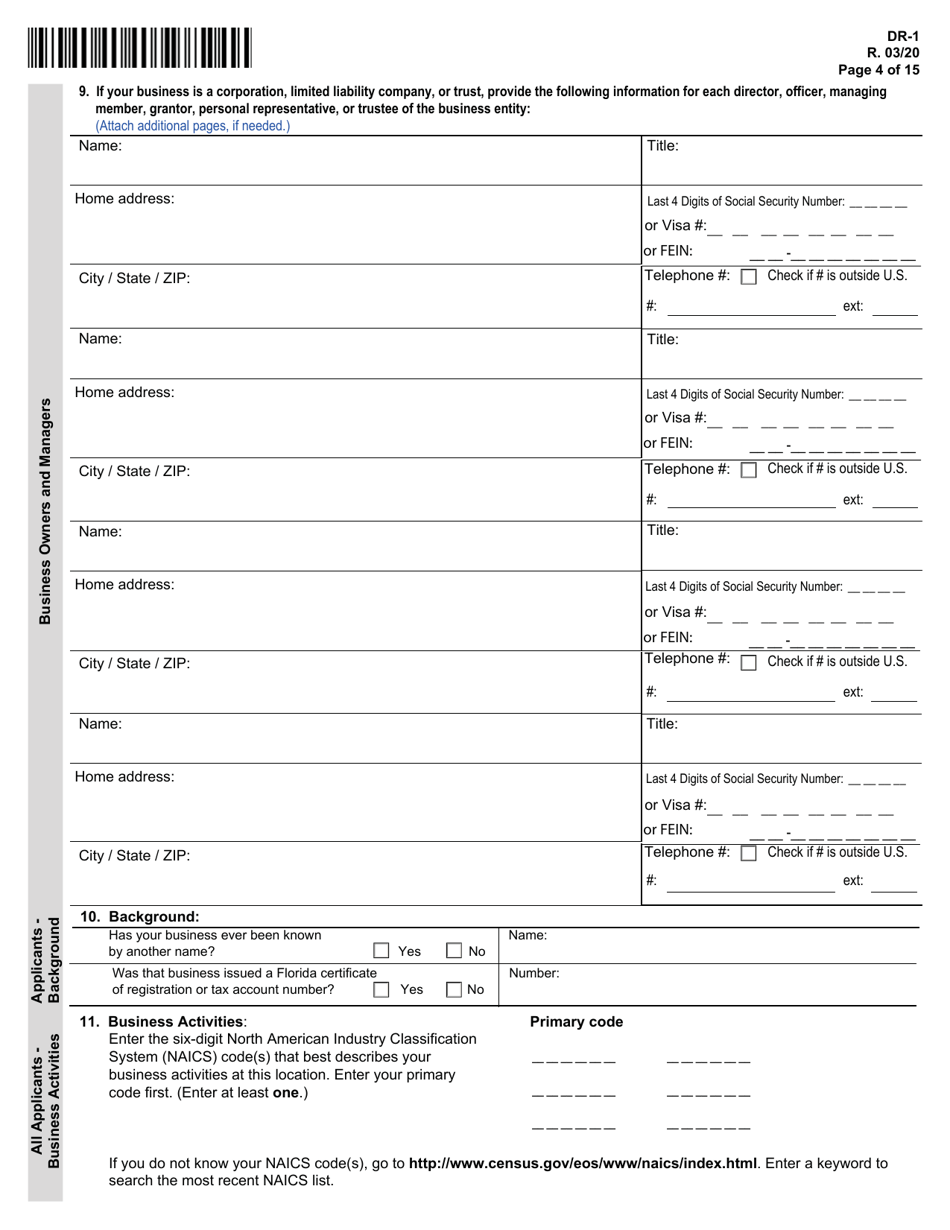

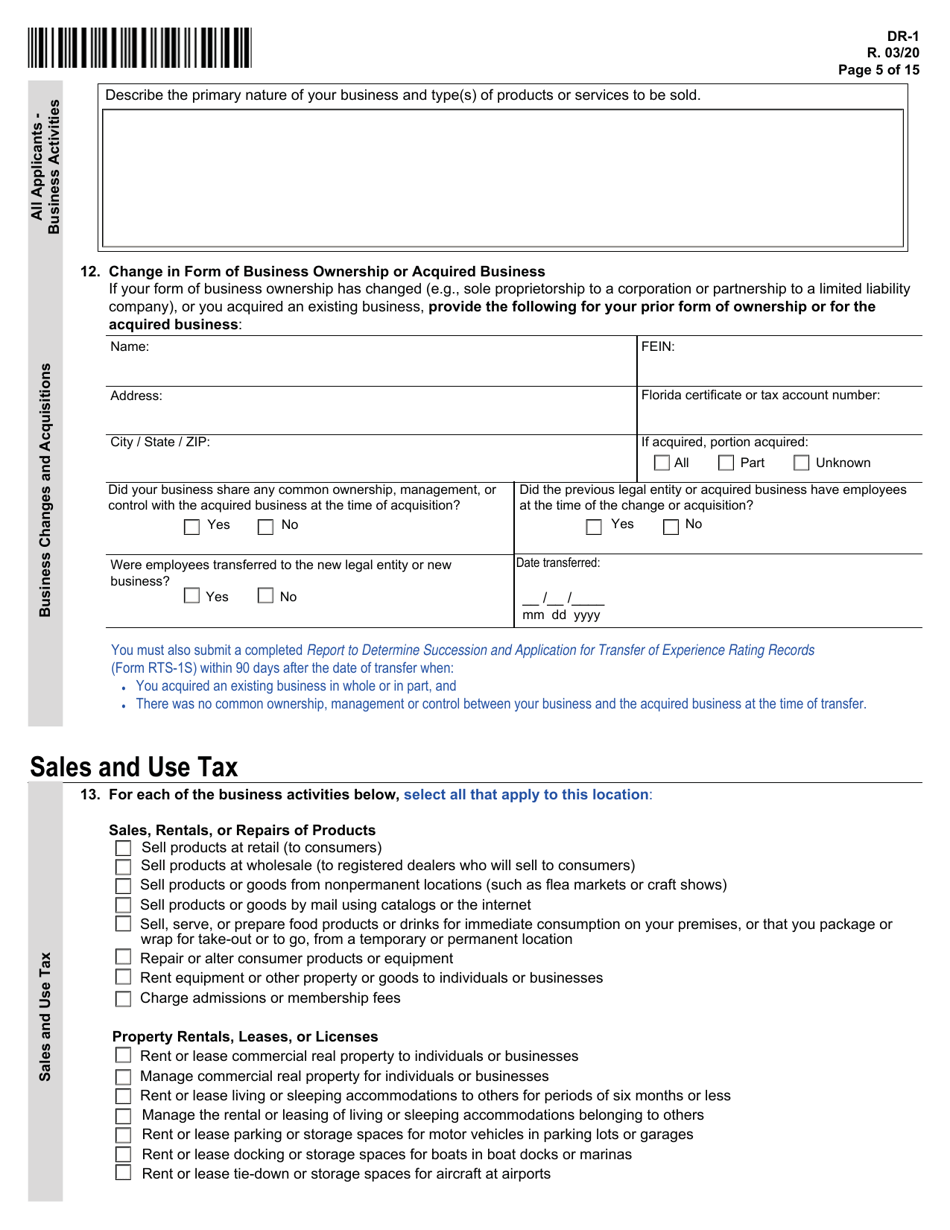

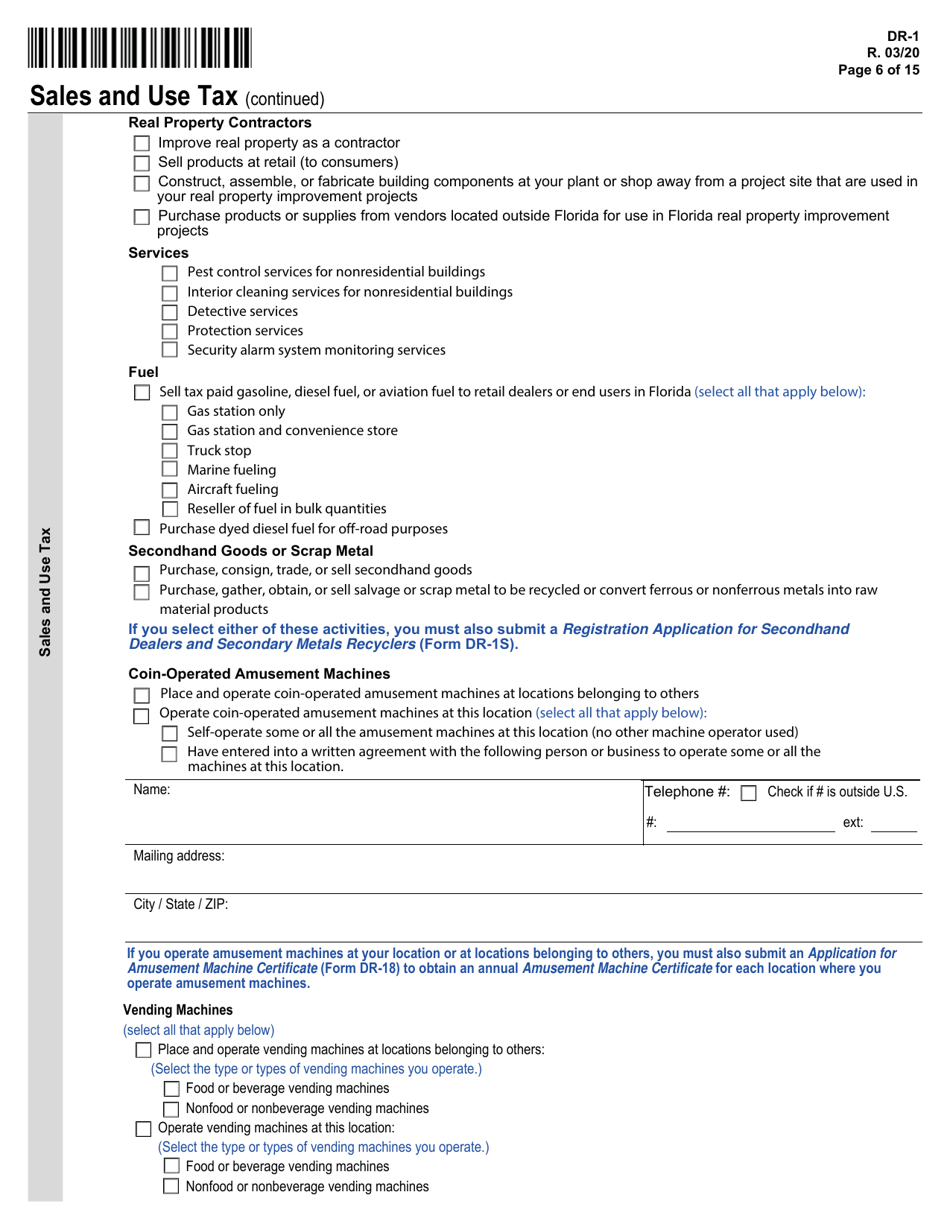

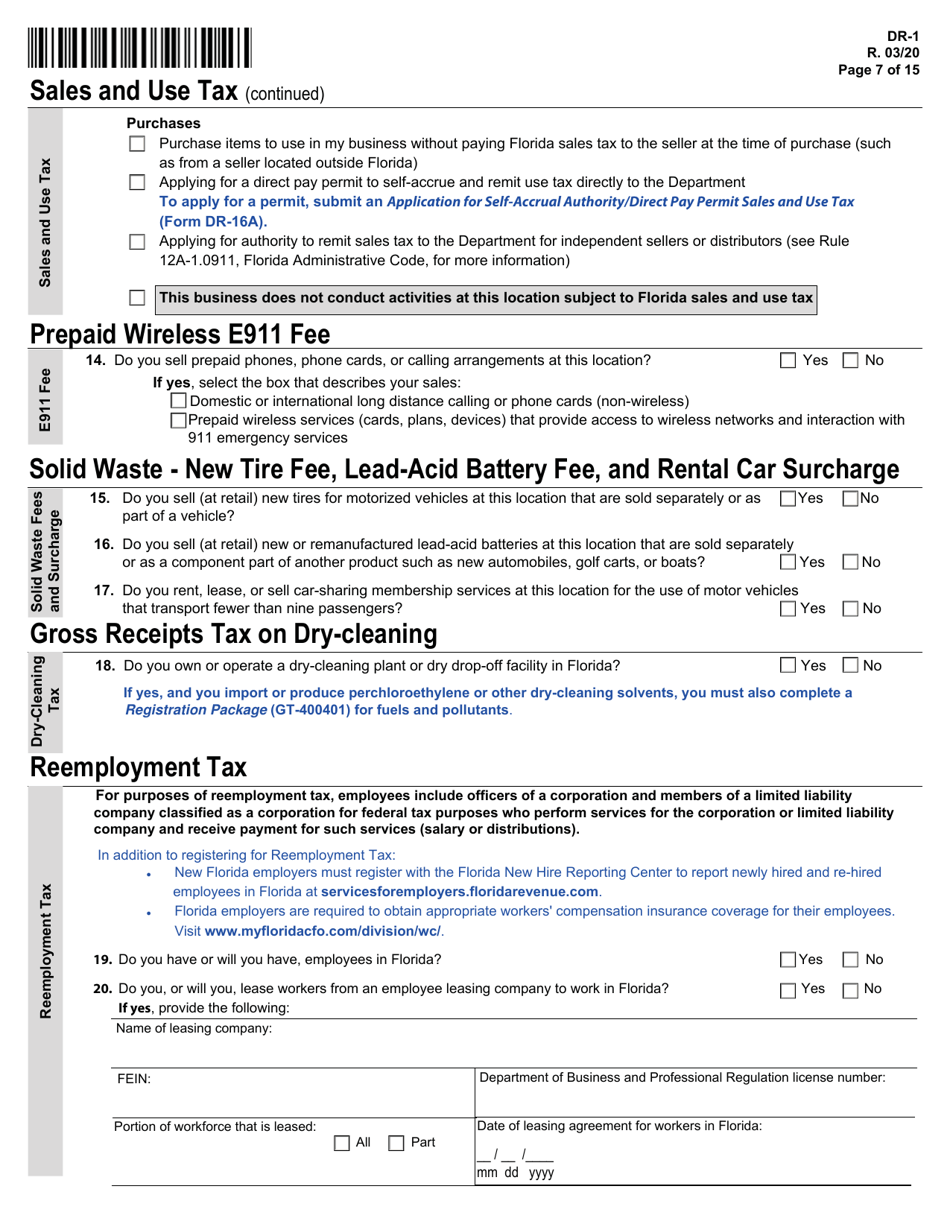

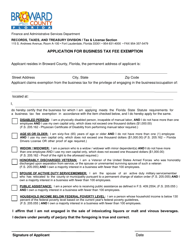

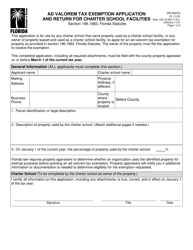

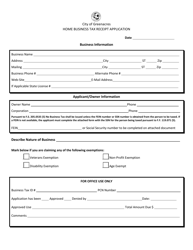

Form DR-1 Florida Business Tax Application - Florida

What Is Form DR-1?

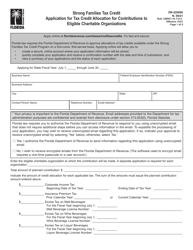

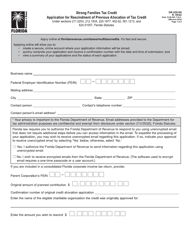

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

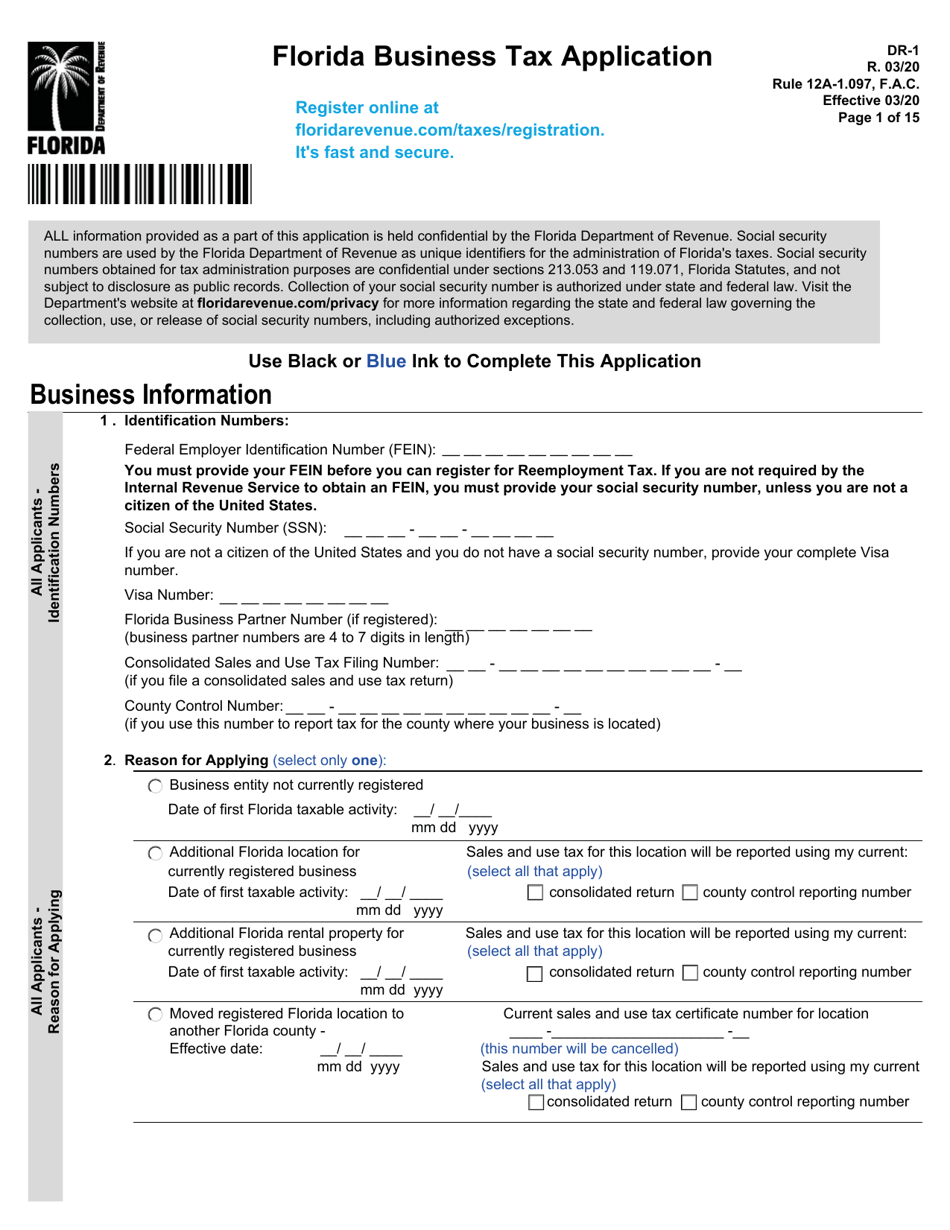

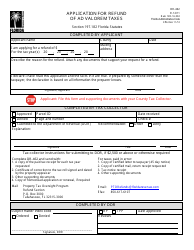

Q: What is the Form DR-1?

A: Form DR-1 is the Florida Business Tax Application.

Q: Who needs to file Form DR-1?

A: Any business entity that wants to operate in Florida and engage in taxable transactions needs to file Form DR-1.

Q: What is the purpose of Form DR-1?

A: The purpose of Form DR-1 is to apply for a Florida Business Tax number and register the business with the Department of Revenue.

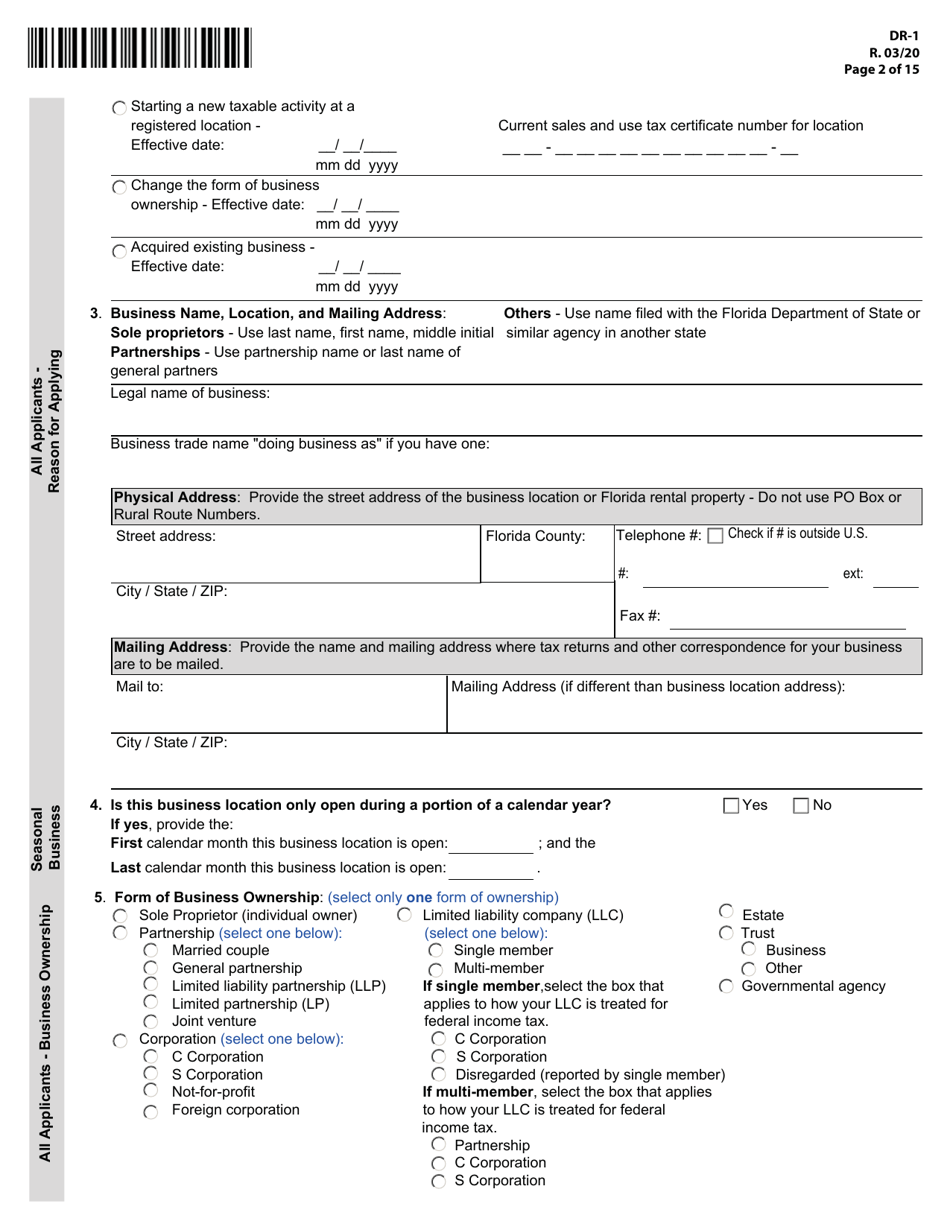

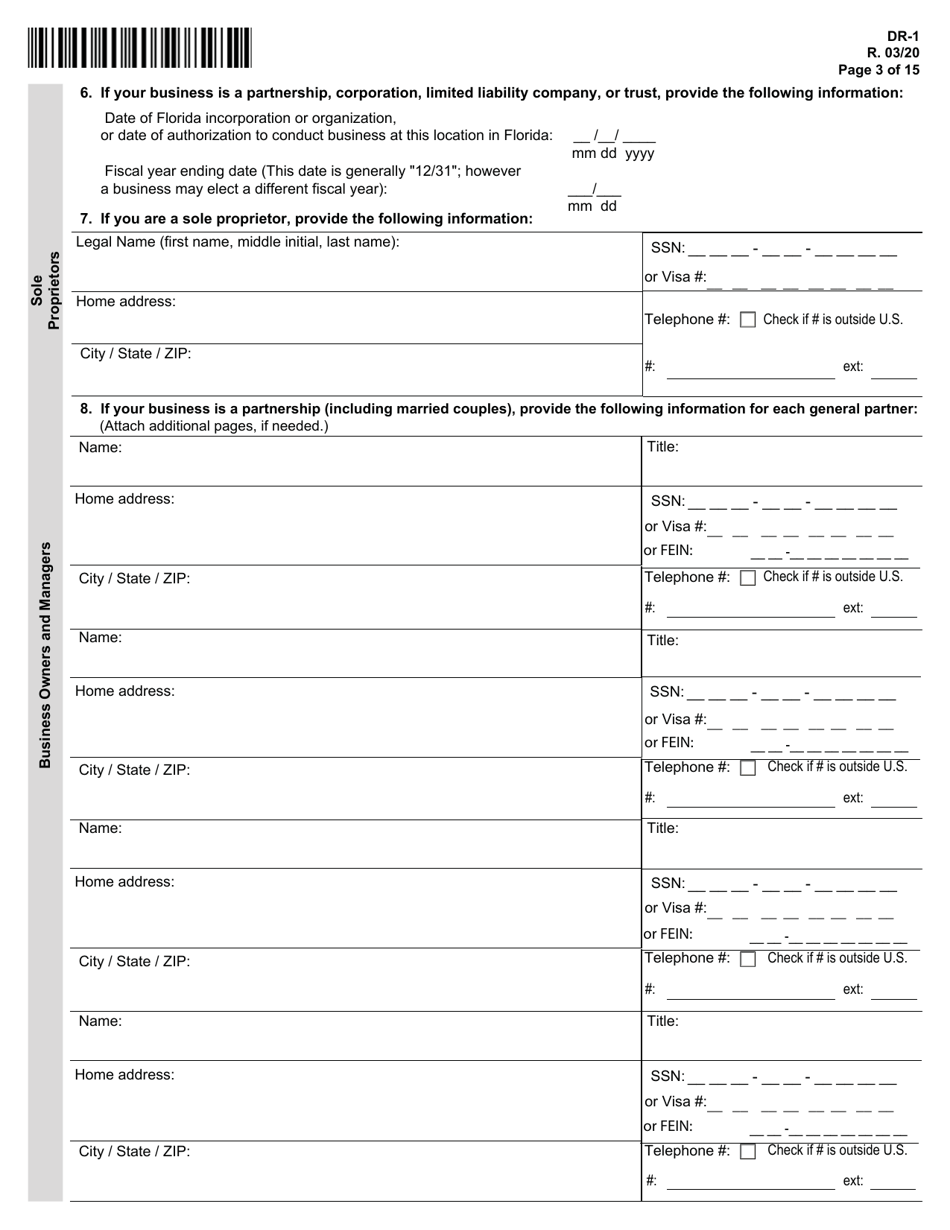

Q: What information do I need to provide on Form DR-1?

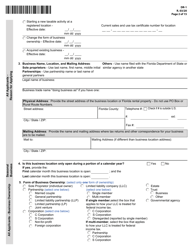

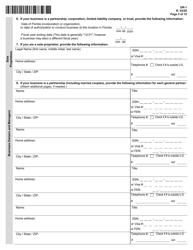

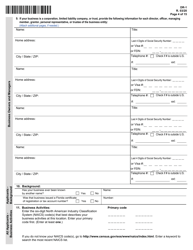

A: You need to provide information about your business, such as its legal name, address, federal employer identification number (EIN), and the type of business you operate.

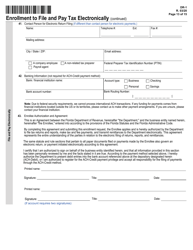

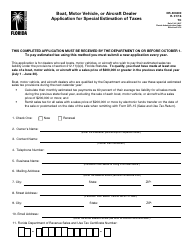

Q: Are there any fees associated with filing Form DR-1?

A: No, there are no fees associated with filing Form DR-1 itself, but certain businesses may have to pay annual renewal fees or other taxes.

Q: When should I file Form DR-1?

A: You should file Form DR-1 before the start of any taxable transactions or within 30 days of starting your business.

Q: Do I need to file Form DR-1 every year?

A: No, once you have obtained a Florida Business Tax number, you do not need to file Form DR-1 again unless there are changes to your business information.

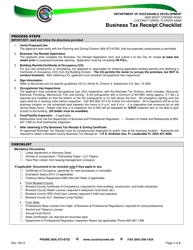

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-1 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.