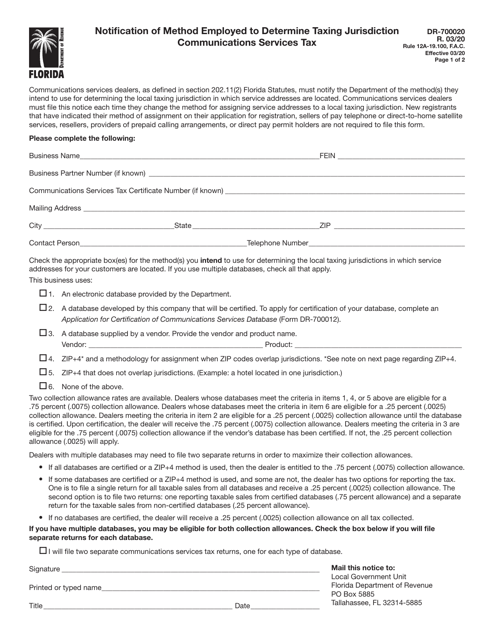

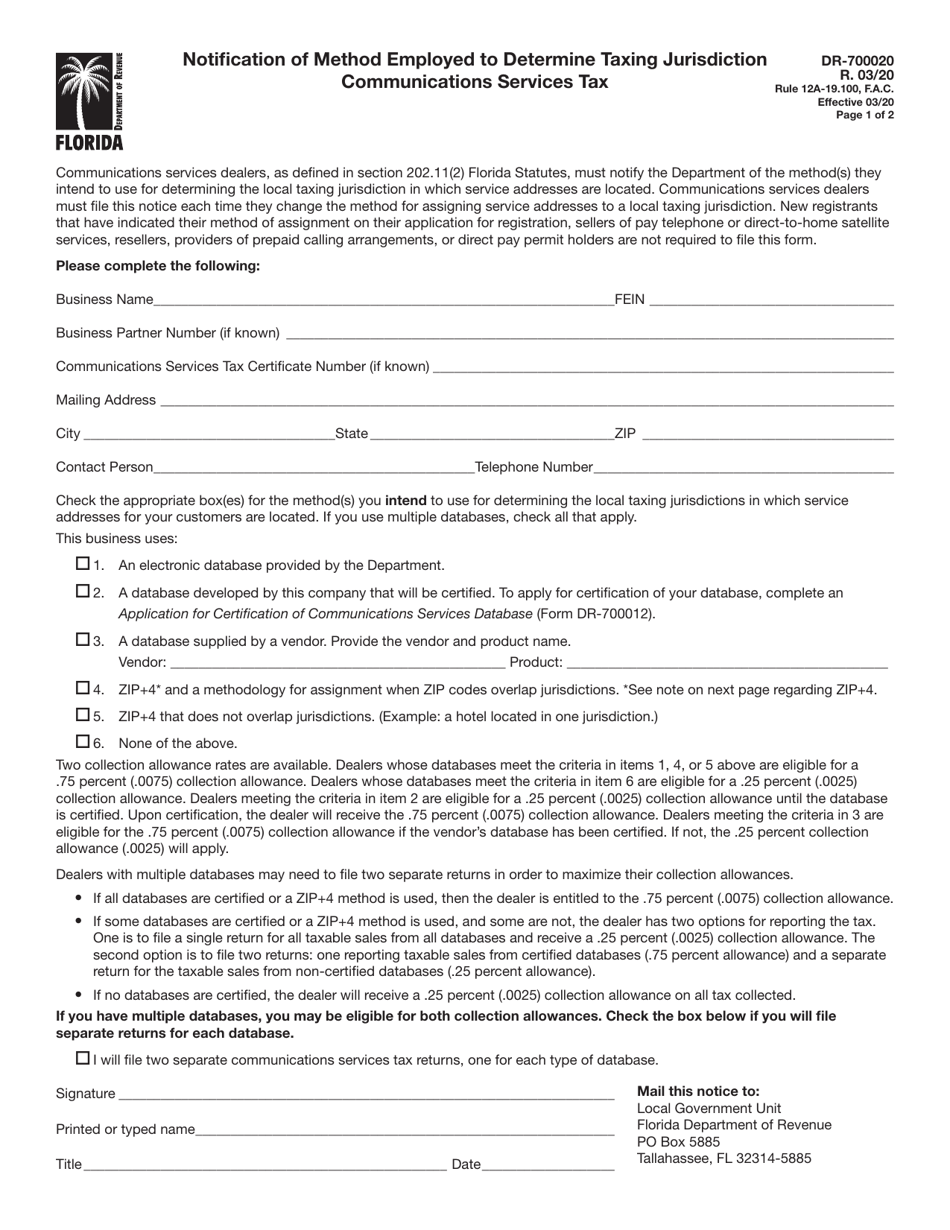

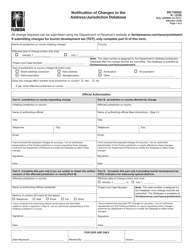

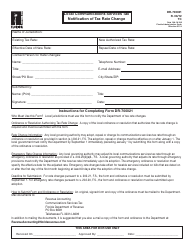

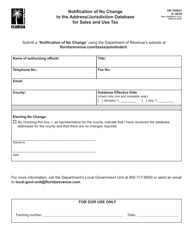

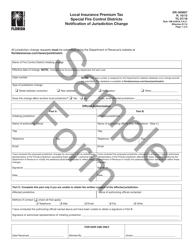

Form DR-700020 Notification of Method Employed to Determine Taxing Jurisdiction - Florida

What Is Form DR-700020?

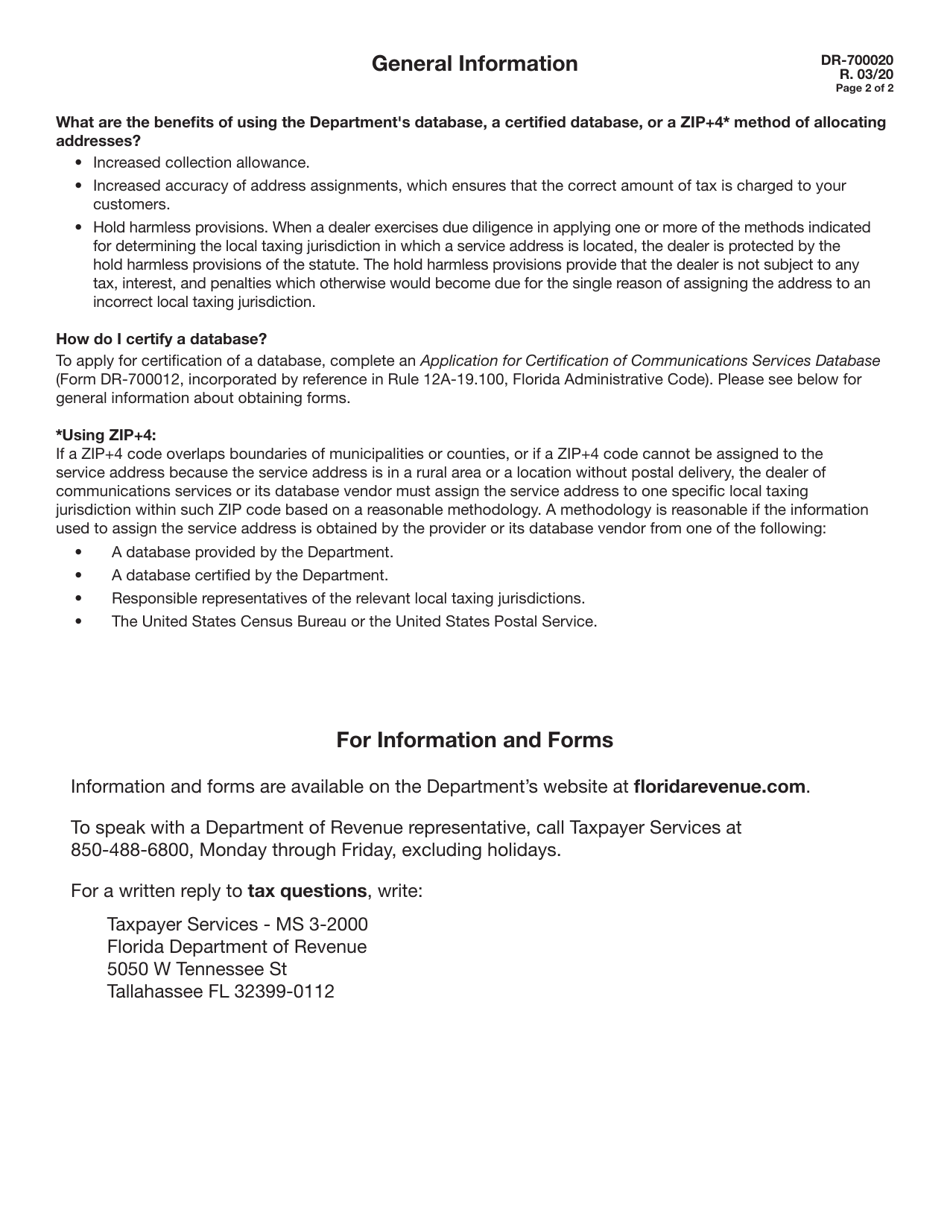

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-700020?

A: Form DR-700020 is a notification form used in Florida to declare the method employed to determine taxing jurisdiction.

Q: When is Form DR-700020 used?

A: Form DR-700020 is used by businesses in Florida to notify the Department of Revenue about the method employed to determine their taxing jurisdiction.

Q: Why is Form DR-700020 important?

A: Form DR-700020 is important as it helps businesses in Florida inform the Department of Revenue regarding their chosen method to determine the taxing jurisdiction. This ensures proper compliance with tax regulations.

Q: Are there any fees associated with Form DR-700020?

A: No, there are no fees associated with Form DR-700020. It is a notification form and does not require any payment.

Q: Is Form DR-700020 specific to businesses?

A: Yes, Form DR-700020 is specific to businesses operating in Florida and it is used to report their chosen method of determining taxing jurisdiction.

Q: What should I do if I make an error on Form DR-700020?

A: If you make an error on Form DR-700020, you should contact the Florida Department of Revenue for guidance on how to correct the mistake.

Q: Is Form DR-700020 required every year?

A: No, Form DR-700020 is only required to be filed when there is a change in the method used to determine taxing jurisdiction or upon initial registration.

Q: Can I submit Form DR-700020 by mail?

A: Yes, you can also submit Form DR-700020 by mail to the address specified by the Florida Department of Revenue.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-700020 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.