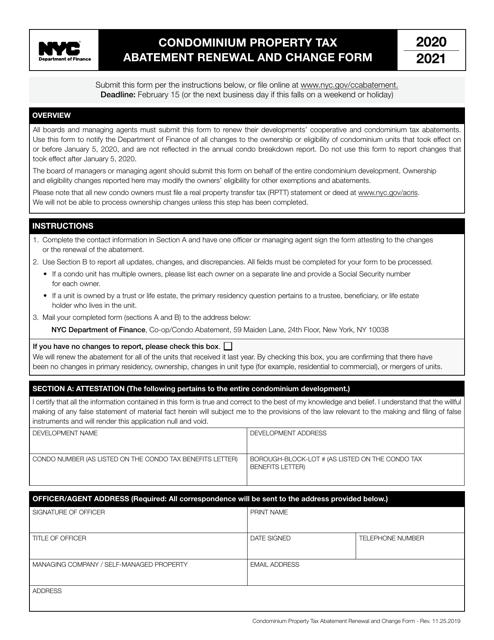

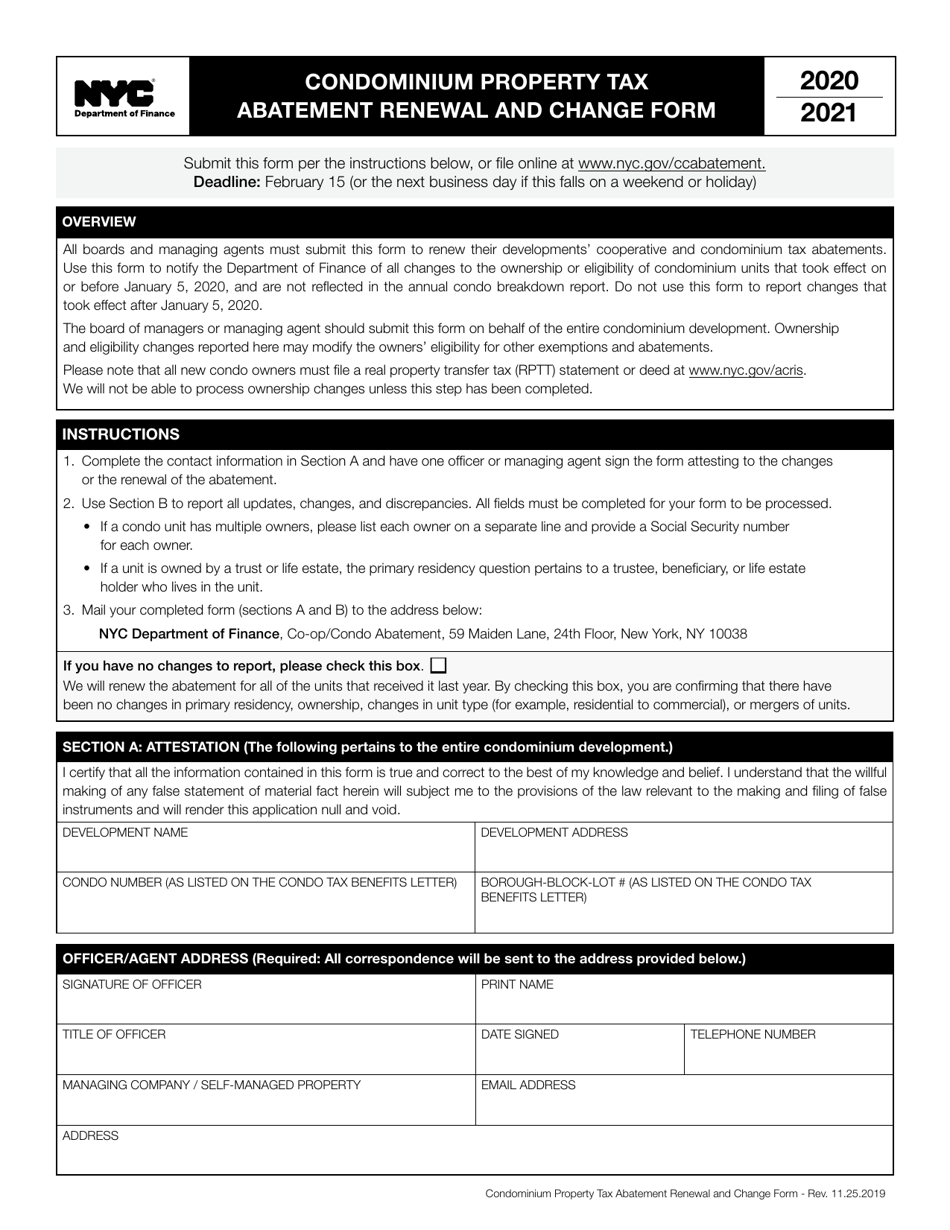

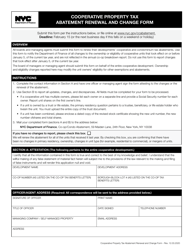

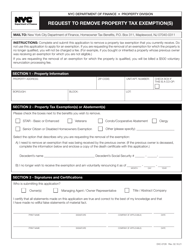

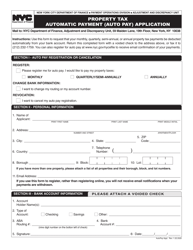

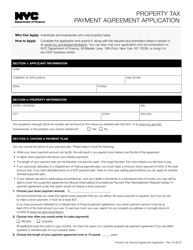

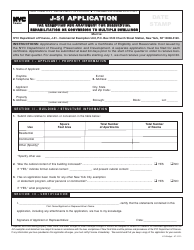

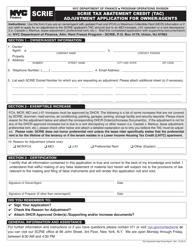

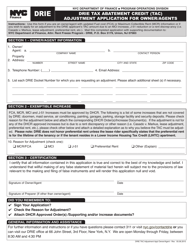

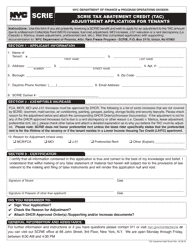

Condominium Property Tax Abatement Renewal and Change Form - New York City

Condominium Property Tax Abatement Renewal and Change Form is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

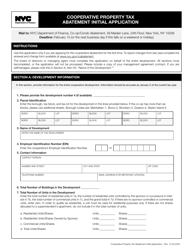

Q: What is the Condominium Property Tax Abatement Renewal and Change Form?

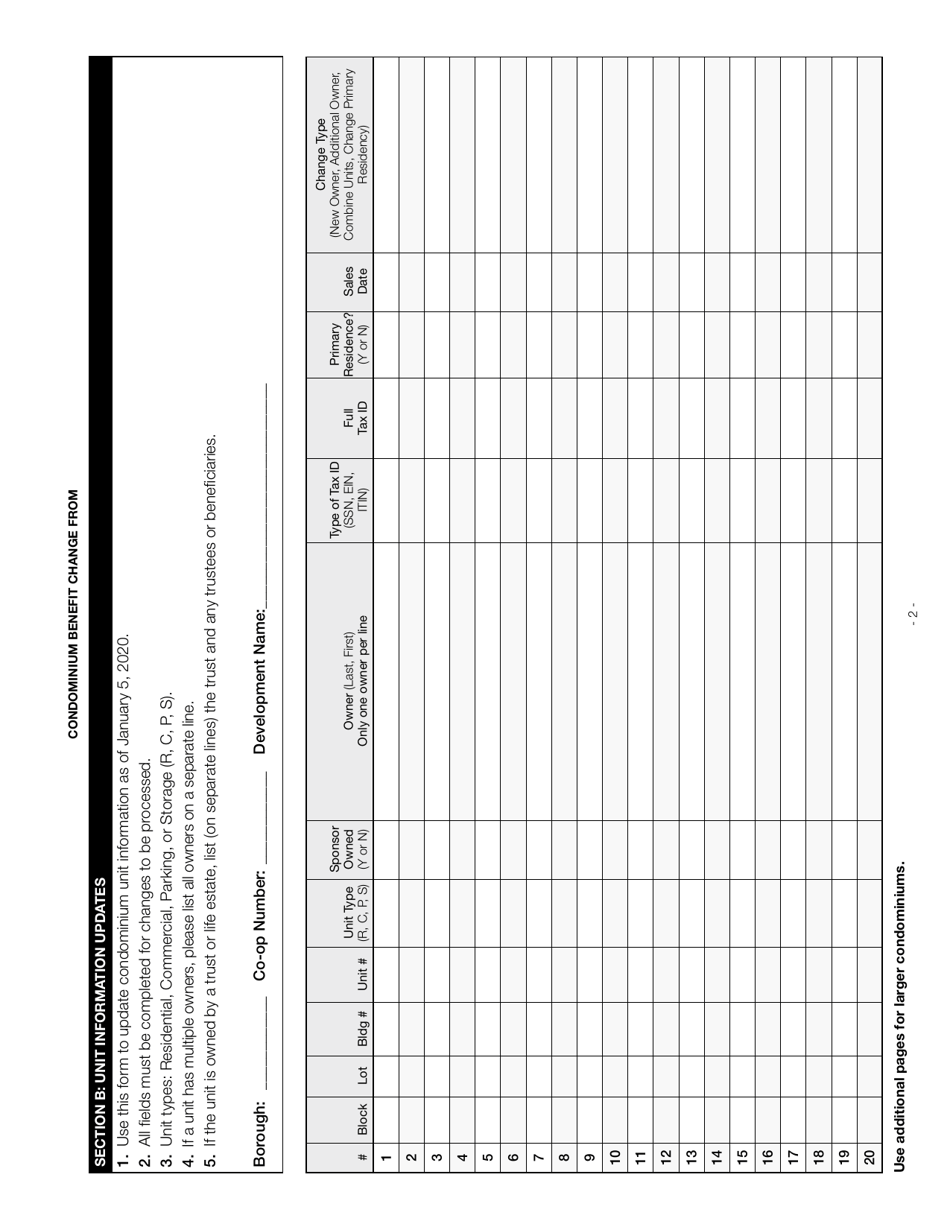

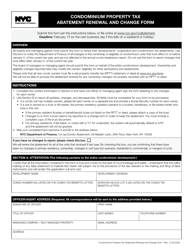

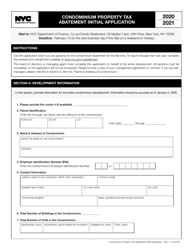

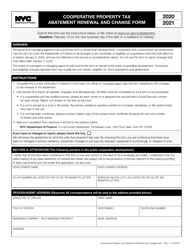

A: The Condominium Property Tax Abatement Renewal and Change Form is a document used in New York City for renewing or making changes to a property tax abatement for condominiums.

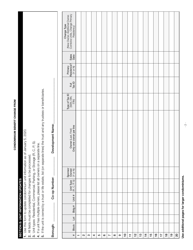

Q: How do I use the Condominium Property Tax Abatement Renewal and Change Form?

A: To use the form, you need to fill in the required information, including your property's identification number, eligibility criteria, and any changes you want to make to the tax abatement.

Q: What is the purpose of the Condominium Property Tax Abatement?

A: The purpose of the Condominium Property Tax Abatement is to provide a reduction in property taxes for eligible condominium properties in New York City.

Q: Who is eligible for the Condominium Property Tax Abatement?

A: To be eligible for the tax abatement, you must meet certain criteria, including using the property as your primary residence and meeting income requirements.

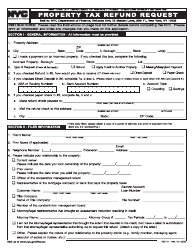

Q: How long does the Condominium Property Tax Abatement last?

A: The tax abatement can last for up to 15 years, depending on the specific program and criteria that apply to your property.

Q: Can I make changes to my Condominium Property Tax Abatement?

A: Yes, you can make changes to your tax abatement by submitting the Condominium Property Tax Abatement Renewal and Change Form to the New York City Department of Finance.

Q: Is there a deadline for renewing the Condominium Property Tax Abatement?

A: Yes, there is a deadline for renewing the tax abatement. You should check with the Department of Finance for the specific deadline that applies to your property.

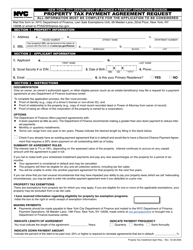

Q: Are there any fees associated with the Condominium Property Tax Abatement?

A: There may be fees associated with the tax abatement, such as application fees or annual recertification fees. You should check with the Department of Finance for the current fee schedule.

Q: What should I do if I have further questions about the Condominium Property Tax Abatement?

A: If you have further questions about the tax abatement, you can contact the New York City Department of Finance for assistance.

Form Details:

- Released on November 25, 2019;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.