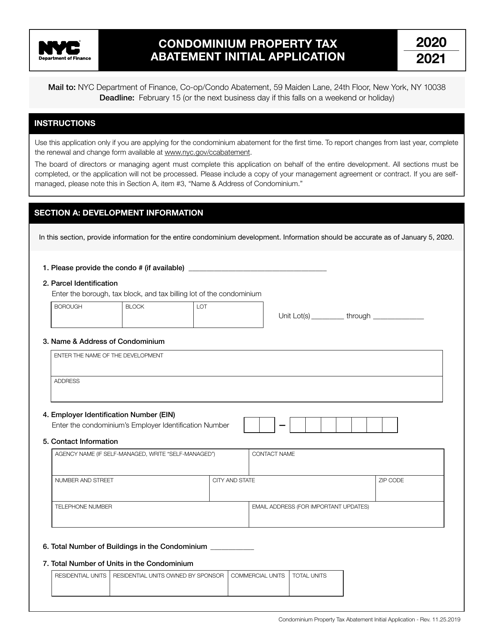

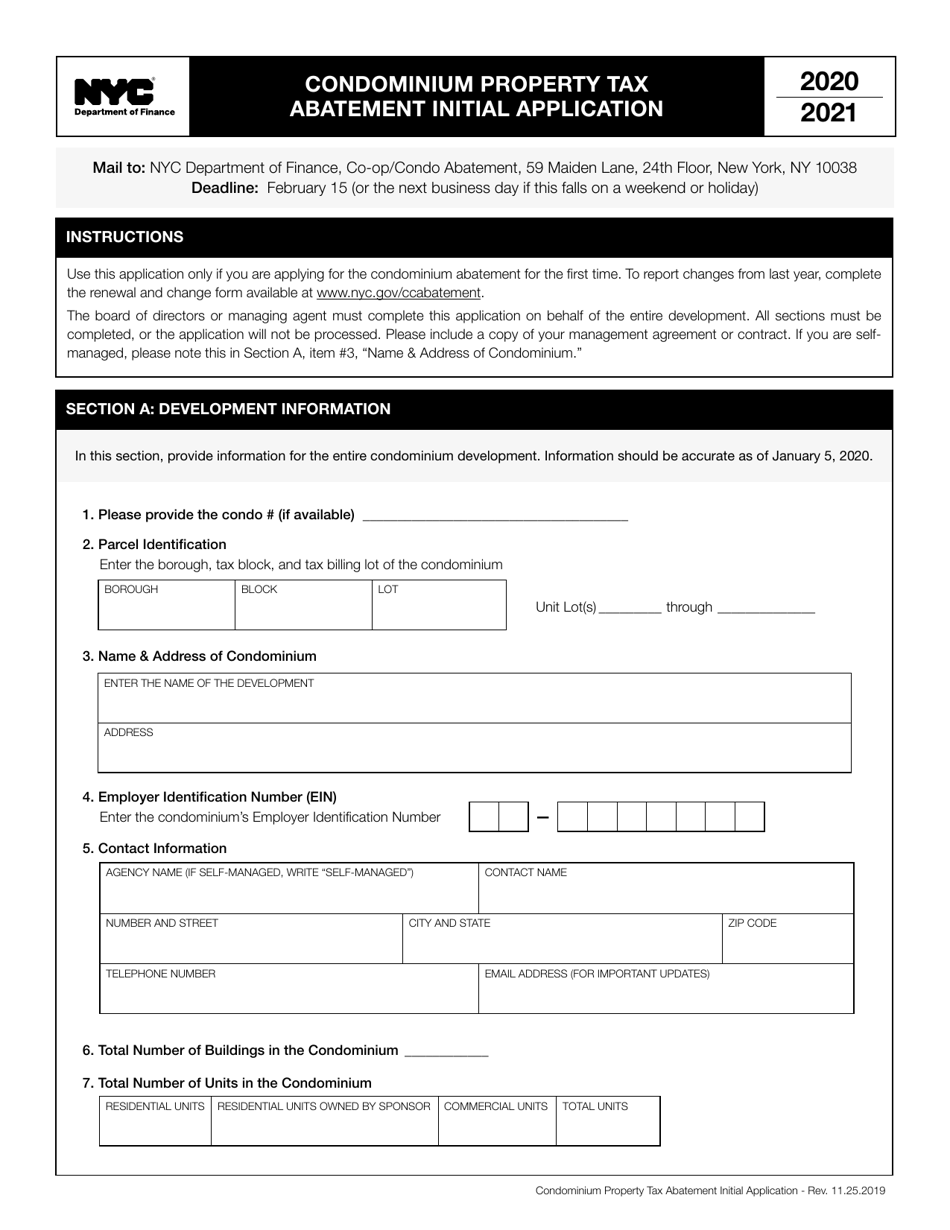

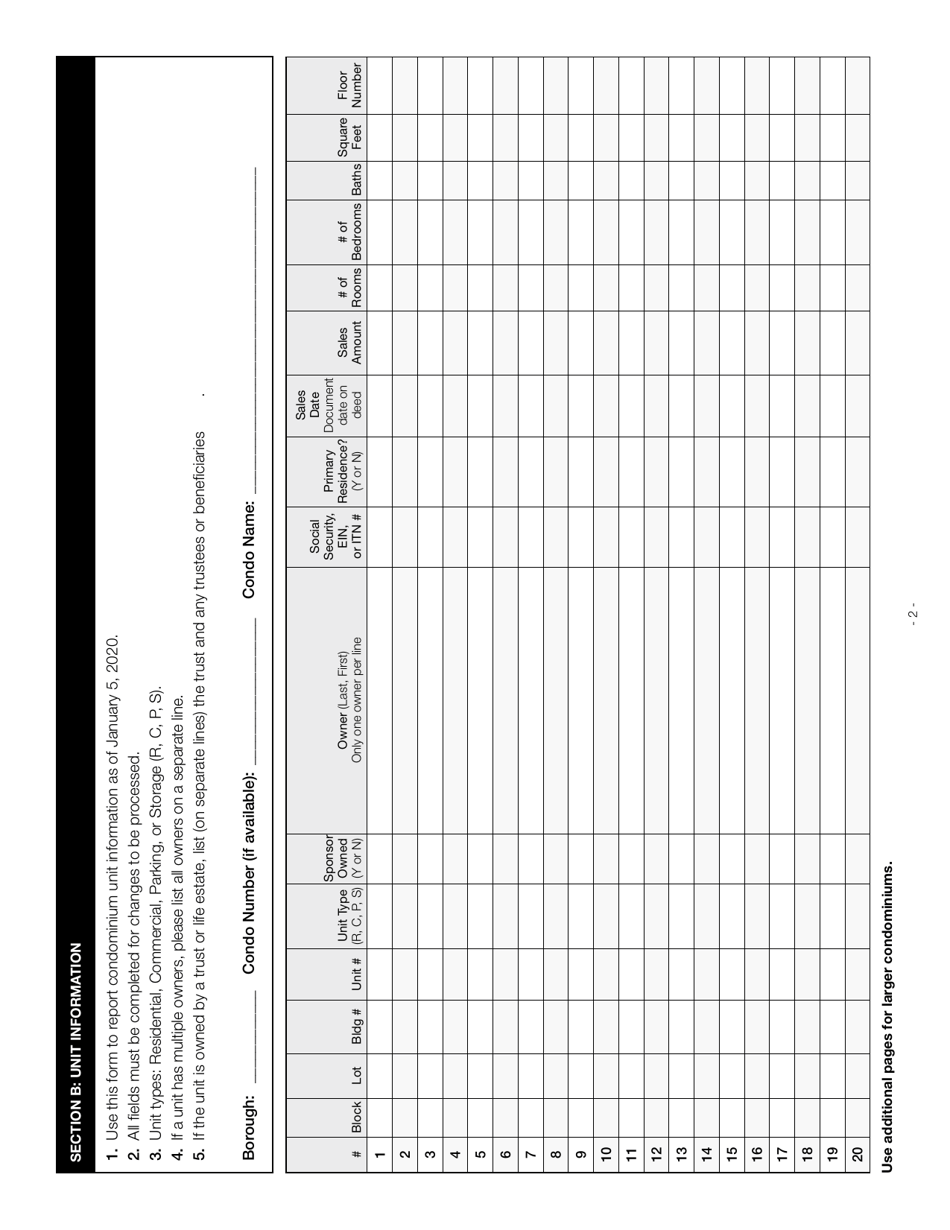

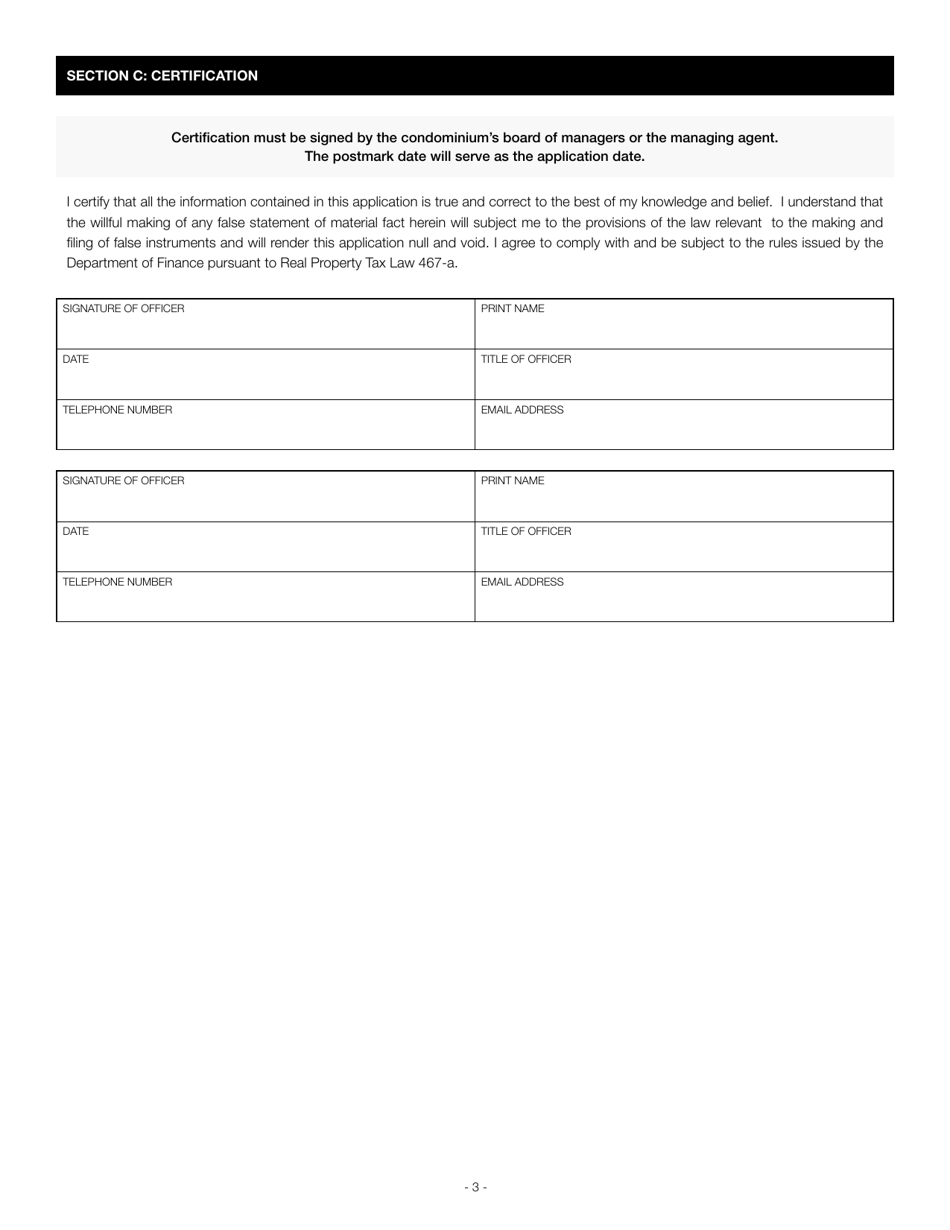

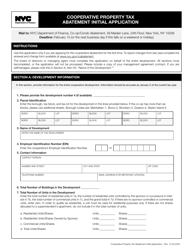

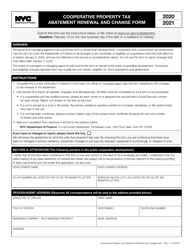

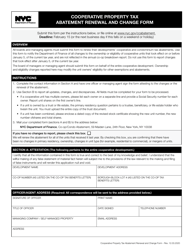

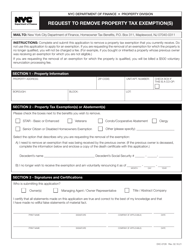

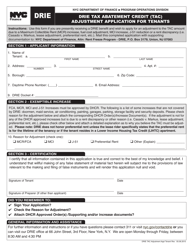

Condominium Property Tax Abatement Initial Application - New York City

Condominium Property Tax Abatement Initial Application is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

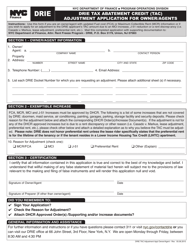

Q: What is a condominium property tax abatement?

A: A condominium property tax abatement is a program in New York City that provides eligible condominium owners with a reduction in their property taxes.

Q: Who is eligible for the condominium property tax abatement?

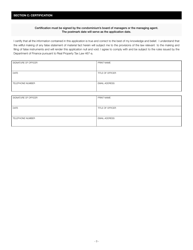

A: To be eligible for the condominium property tax abatement, you must meet certain requirements, such as being the owner of a condominium unit and using it as your primary residence.

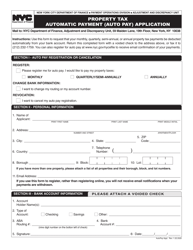

Q: How do I apply for the condominium property tax abatement?

A: To apply for the condominium property tax abatement in New York City, you will need to complete and submit the Initial Application to the Department of Finance.

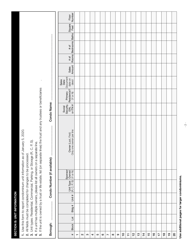

Q: What documents are required for the application?

A: The Initial Application for the condominium property tax abatement typically requires documents such as proof of ownership, proof of primary residence, and income documentation.

Q: When is the deadline to submit the application?

A: The deadline to submit the Initial Application for the condominium property tax abatement varies each year, so it is important to check with the Department of Finance for the current deadline.

Q: What are the benefits of the condominium property tax abatement?

A: The condominium property tax abatement can provide eligible owners with significant savings on their property taxes, helping to make homeownership more affordable in New York City.

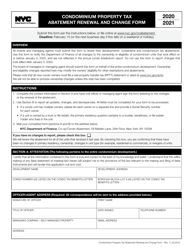

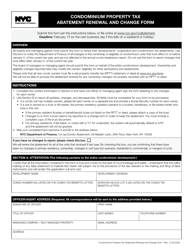

Q: Is the condominium property tax abatement renewable?

A: Yes, the condominium property tax abatement must be renewed annually. This requires submitting a renewal application and meeting all the eligibility requirements each year.

Q: Are there any income limitations for the condominium property tax abatement?

A: Yes, there are income limitations for the condominium property tax abatement. The exact income limits vary each year and depend on factors such as household size and location.

Q: Can I still receive the abatement if I rent out my condominium?

A: No, the condominium property tax abatement is only available to owners who use their unit as their primary residence. Renting out the unit would disqualify you from receiving the abatement.

Form Details:

- Released on November 25, 2019;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.