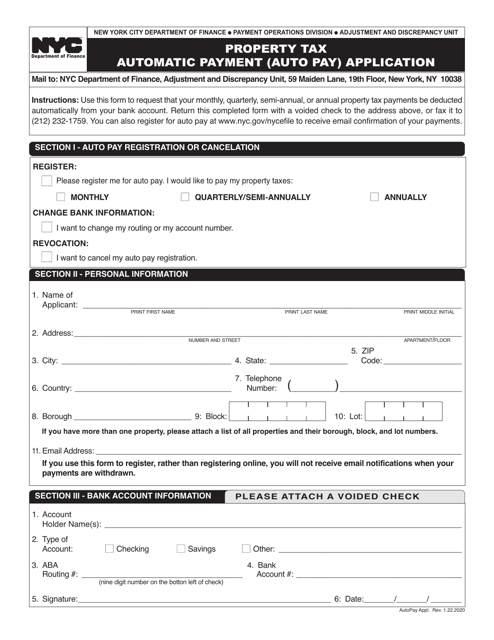

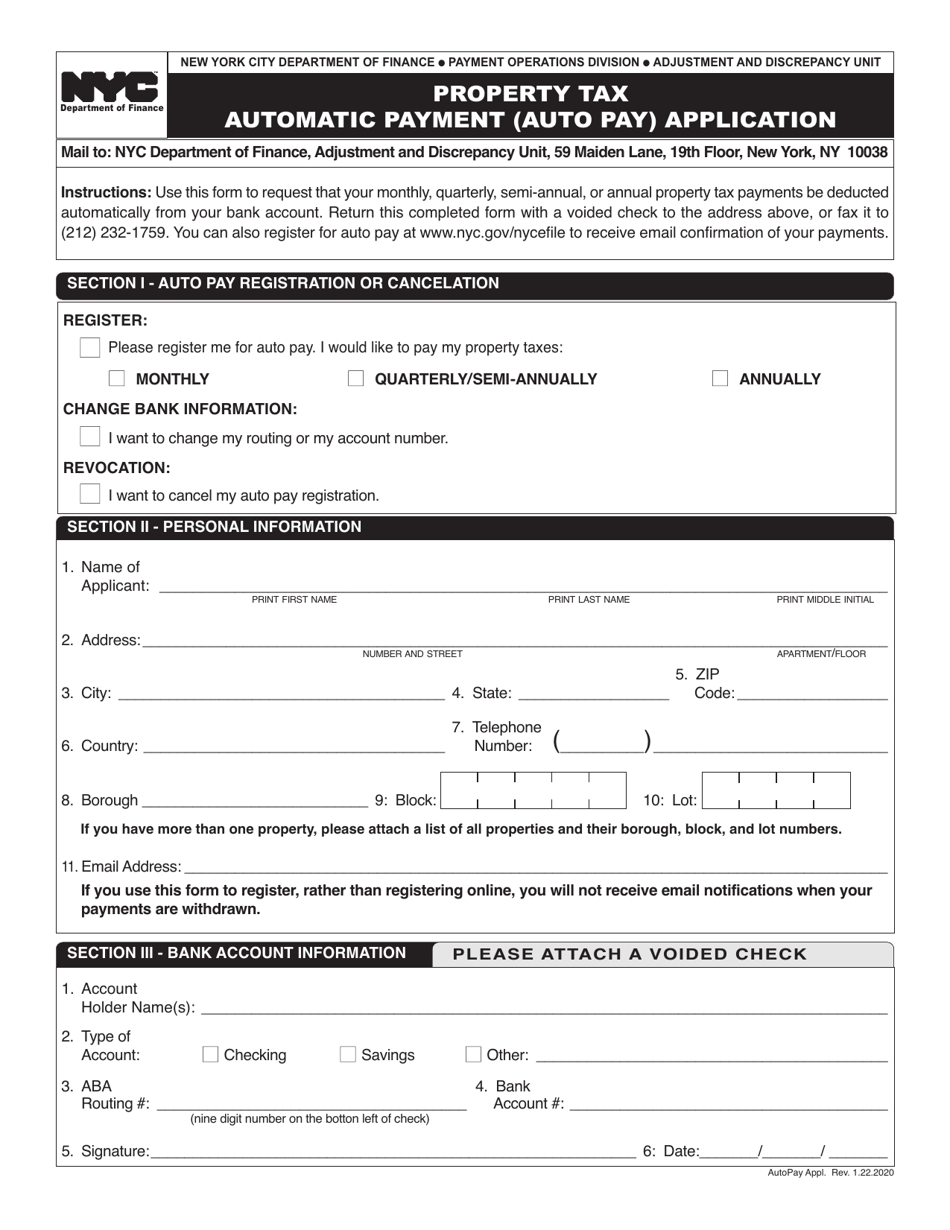

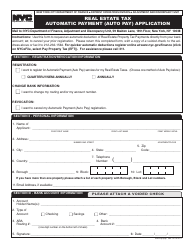

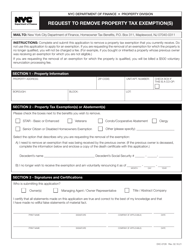

Property Tax Automatic Payment (Auto Pay) Application - New York City

Property Tax Automatic Payment (Auto Pay) Application is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is the property tax automatic payment application?

A: The property tax automatic payment application is a system in New York City that allows residents to set up automatic payments for their property taxes.

Q: How does the property tax automatic payment application work?

A: Once you fill out the application, your property taxes will be automatically deducted from your bank account on the due date each year.

Q: Who is eligible to use the property tax automatic payment application?

A: All property owners in New York City are eligible to use the application.

Q: What are the benefits of using the property tax automatic payment application?

A: Using the application can help ensure that your property taxes are paid on time and eliminate the need for manual payments each year.

Q: Can I cancel the property tax automatic payment?

A: Yes, you can cancel the automatic payment at any time by contacting the Department of Finance in New York City.

Q: Is there a fee for using the property tax automatic payment application?

A: No, there is no fee for using the application.

Q: What if there are changes to my property tax amount?

A: If there are changes to your property tax amount, the automatic payment will be adjusted accordingly.

Q: Can I still pay my property taxes manually if I use the automatic payment application?

A: Yes, you can still make manual payments if you prefer, but using the automatic payment option is convenient and hassle-free.

Q: Is the property tax automatic payment application available in other cities in the US?

A: The property tax automatic payment application is specific to New York City and may not be available in other cities.

Form Details:

- Released on January 22, 2020;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.