This version of the form is not currently in use and is provided for reference only. Download this version of

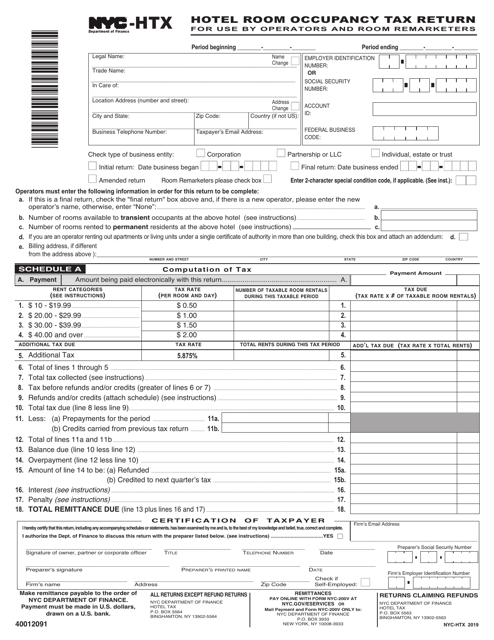

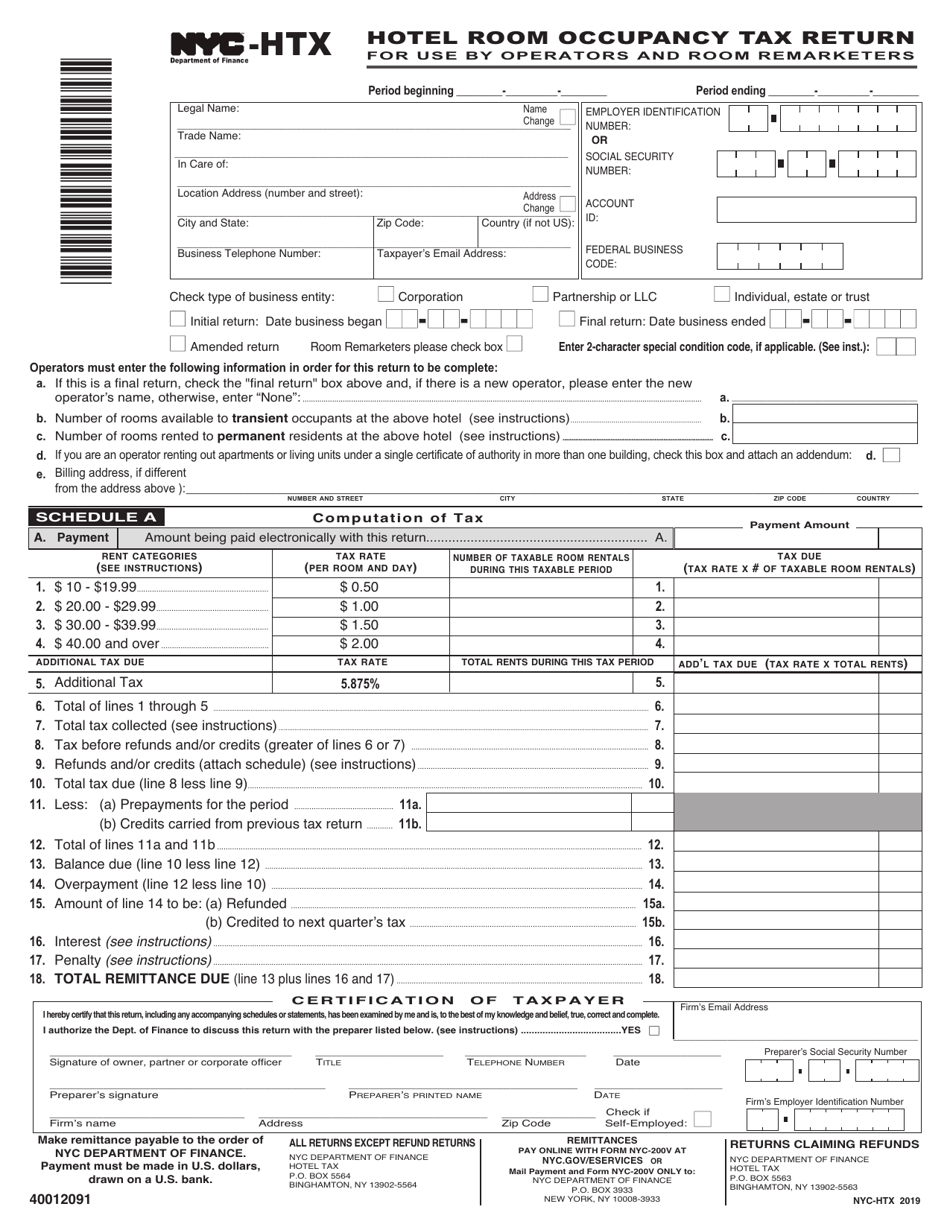

Form NYC-HTX

for the current year.

Form NYC-HTX Hotel Room Occupancy Tax Return for Use by Operators and Room Remarketers - New York City

What Is Form NYC-HTX?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. Check the official instructions before completing and submitting the form.

FAQ

Q: Who needs to file the NYC-HTX Hotel Room Occupancy Tax Return?

A: Operators and room remarketers in New York City.

Q: What is the purpose of the NYC-HTX Hotel Room Occupancy Tax Return?

A: To report and pay the hotel room occupancy tax in New York City.

Q: What is the due date for filing the NYC-HTX Hotel Room Occupancy Tax Return?

A: The NYC-HTX Hotel Room Occupancy Tax Return is due on a monthly basis, on or before the 20th day of the following month.

Q: Are there any penalties for late filing or non-filing of the NYC-HTX Hotel Room Occupancy Tax Return?

A: Yes, there are penalties for late filing or non-filing of the NYC-HTX Hotel Room Occupancy Tax Return. The penalties can range from $250 to $500 for each violation.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-HTX by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.