This version of the form is not currently in use and is provided for reference only. Download this version of

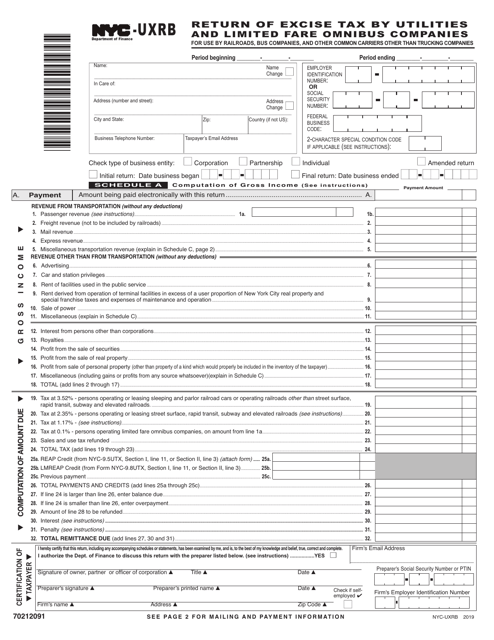

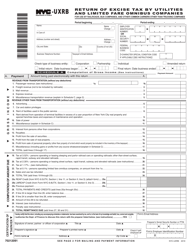

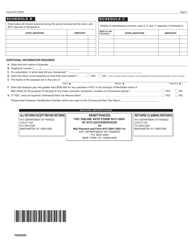

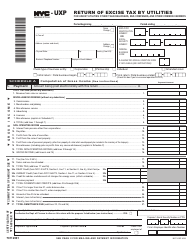

Form NYC-UXRB

for the current year.

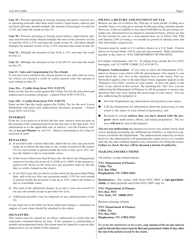

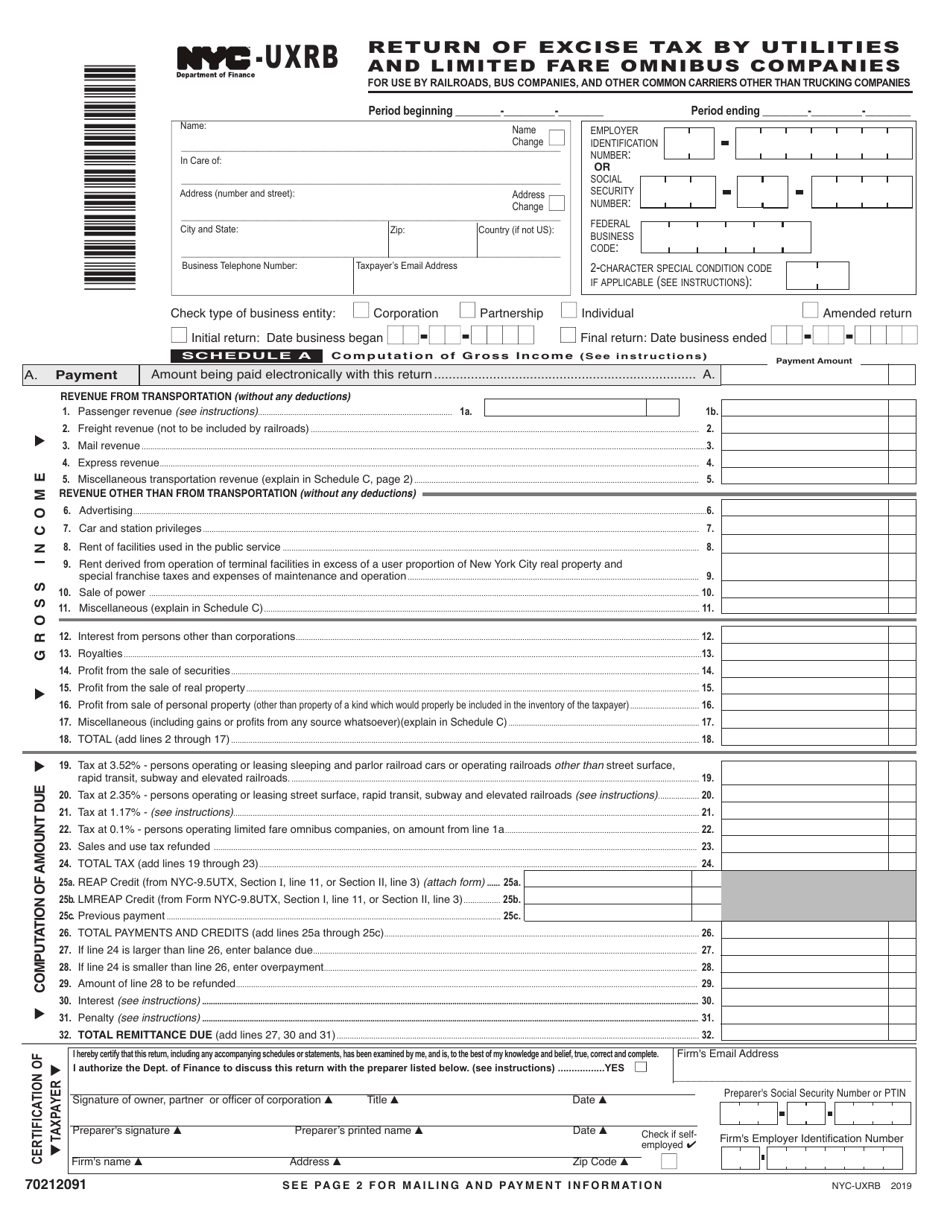

Form NYC-UXRB Return of Excise Tax by Utilities and Limited Fare Omnibus Companies - New York City

What Is Form NYC-UXRB?

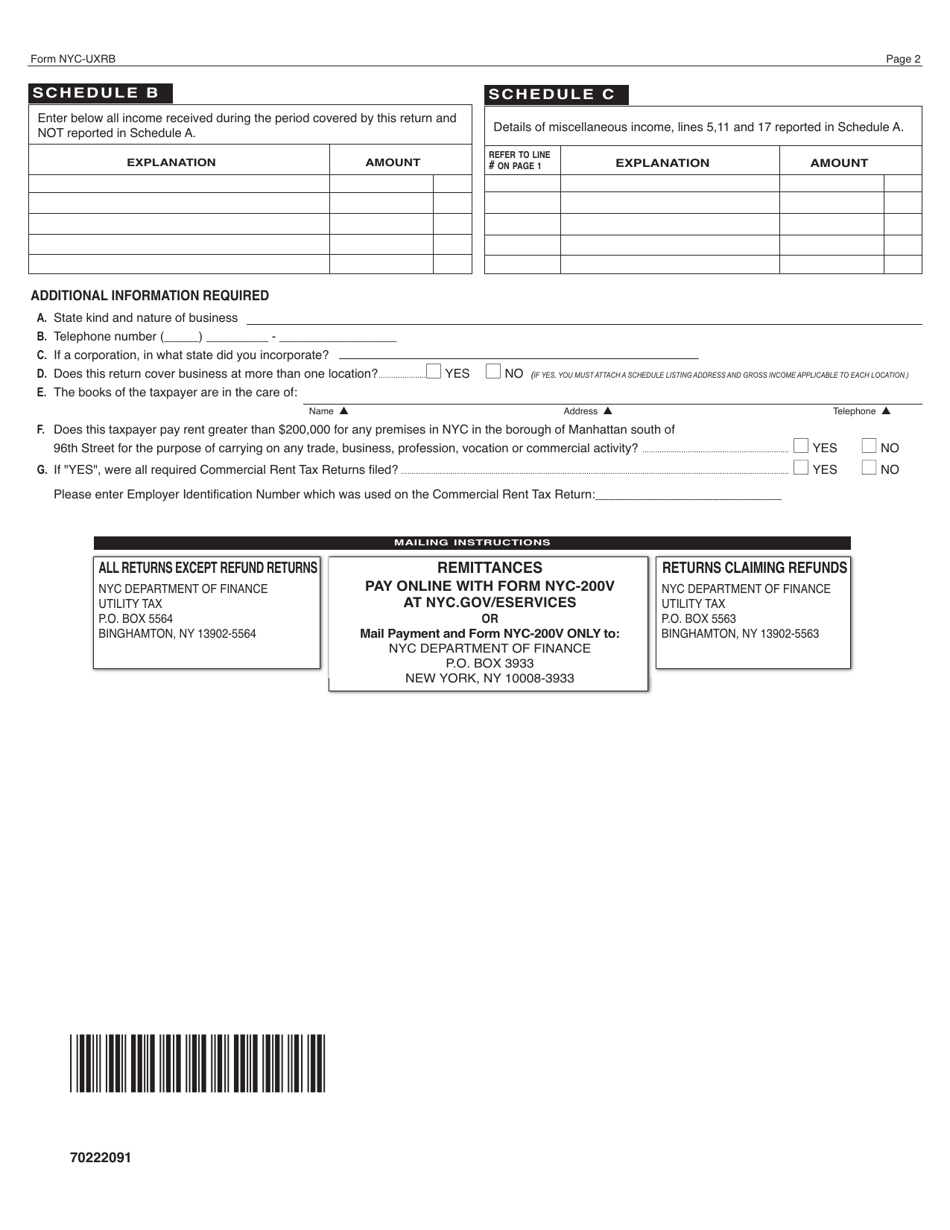

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

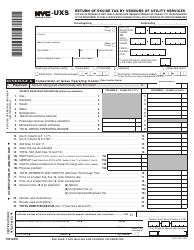

Q: What is the NYC-UXRB form?

A: The NYC-UXRB form is the Return of Excise Tax by Utilities and Limited Fare Omnibus Companies form for New York City.

Q: Who needs to file the NYC-UXRB form?

A: Utilities and limited fare omnibus companies in New York City need to file the NYC-UXRB form.

Q: What is the purpose of the NYC-UXRB form?

A: The purpose of the NYC-UXRB form is to report and pay excise tax for utilities and limited fare omnibus companies in New York City.

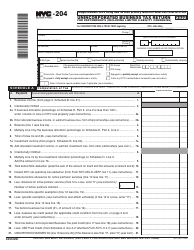

Q: When is the deadline to file the NYC-UXRB form?

A: The deadline to file the NYC-UXRB form is determined by the New York City Department of Finance and may vary.

Q: What happens if I don't file the NYC-UXRB form?

A: If you don't file the NYC-UXRB form, you may be subject to penalties and interest charges by the New York City Department of Finance.

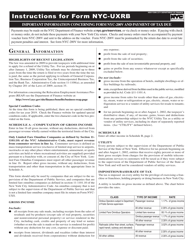

Q: Are there any exemptions or deductions available on the NYC-UXRB form?

A: Specific exemptions and deductions may be available on the NYC-UXRB form, and you should refer to the instructions provided by the New York City Department of Finance.

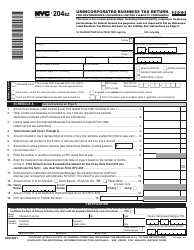

Q: Is the NYC-UXRB form the same as the federal excise tax return?

A: No, the NYC-UXRB form is specific to New York City and is different from the federal excise tax return.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-UXRB by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.