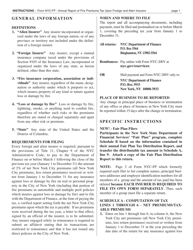

This version of the form is not currently in use and is provided for reference only. Download this version of

Form NYC-FP

for the current year.

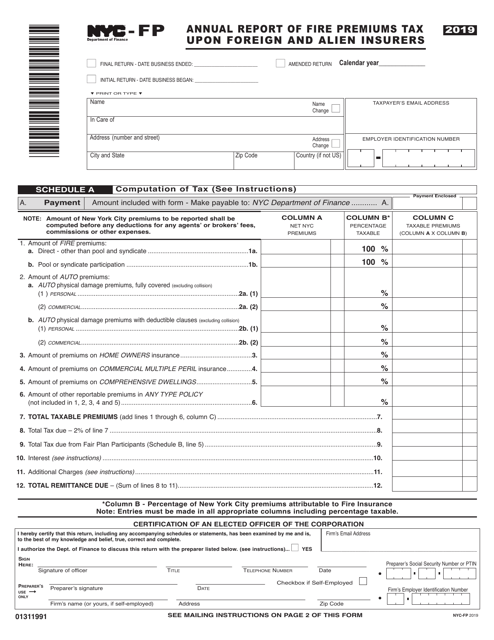

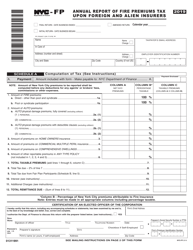

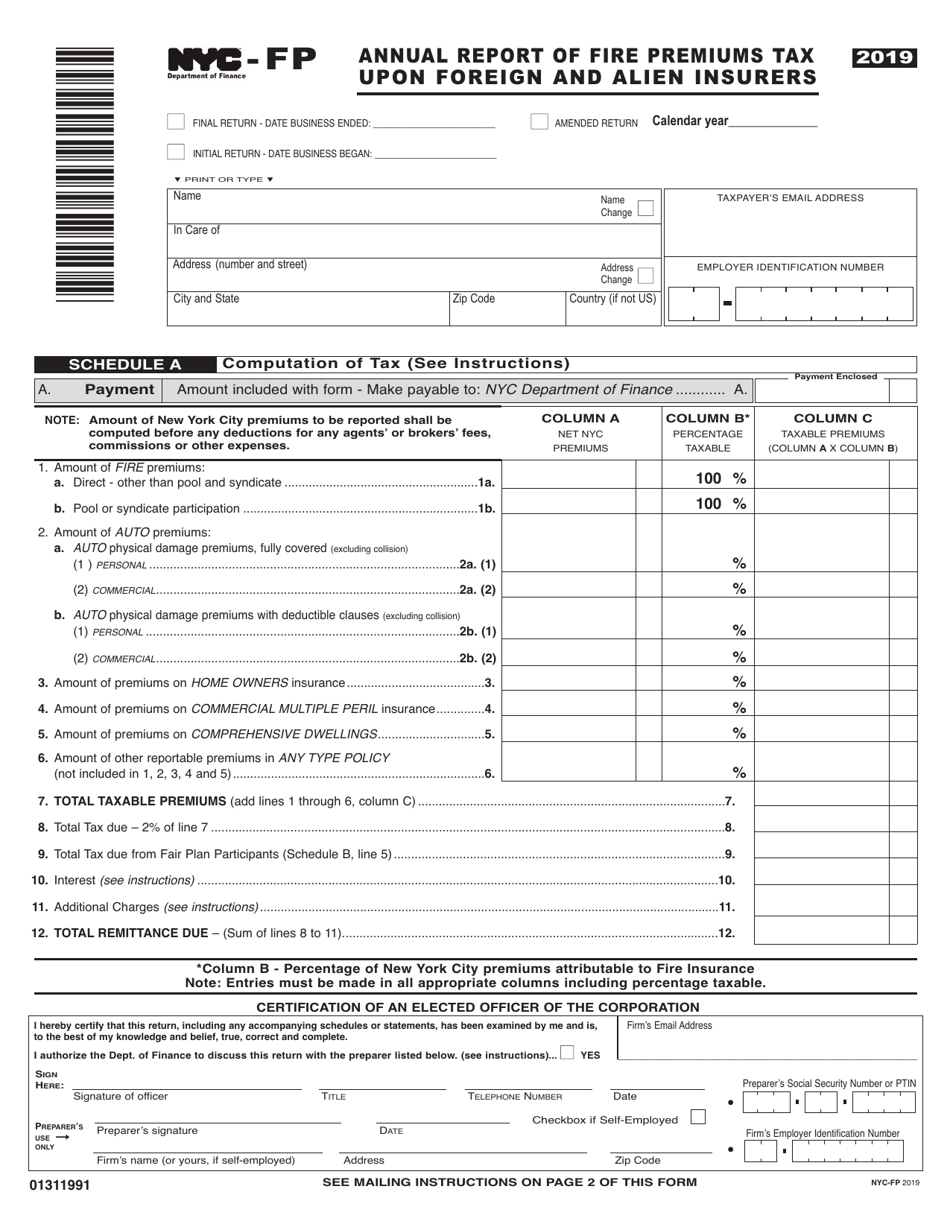

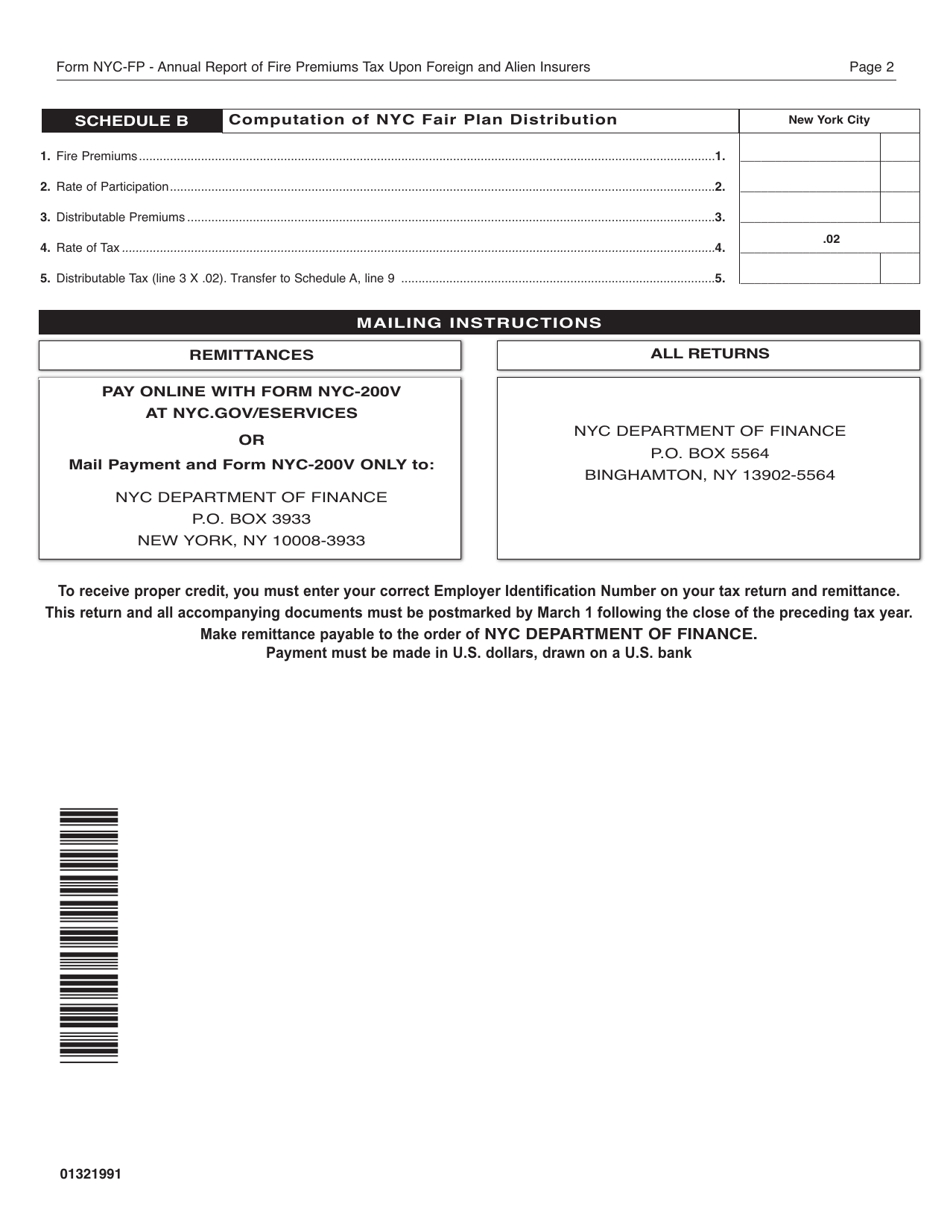

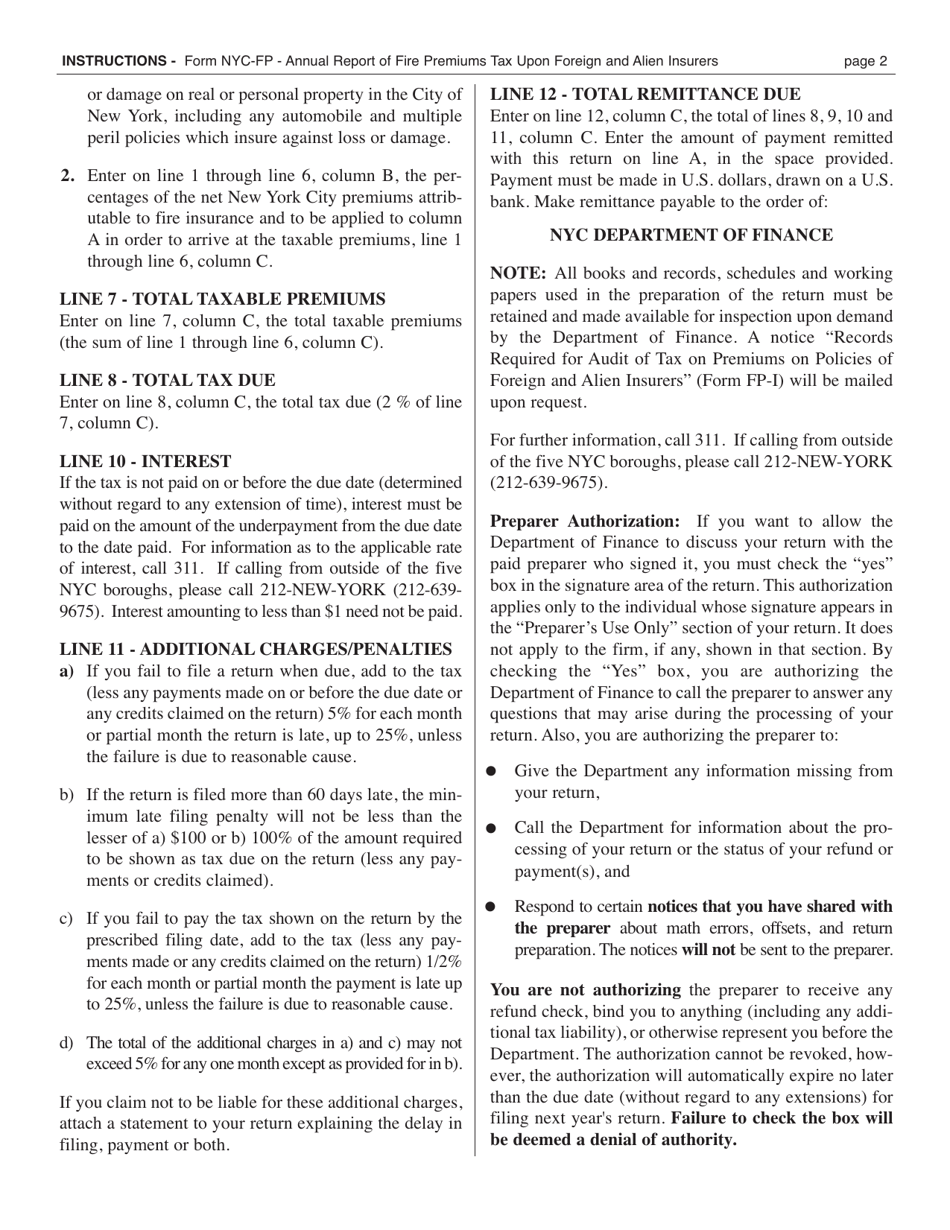

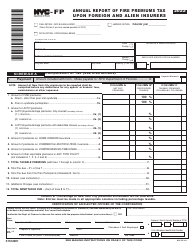

Form NYC-FP Annual Report of Fire Premiums Tax Upon Foreign and Alien Insurers - New York City

What Is Form NYC-FP?

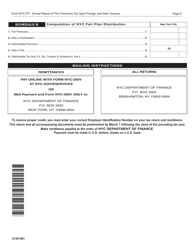

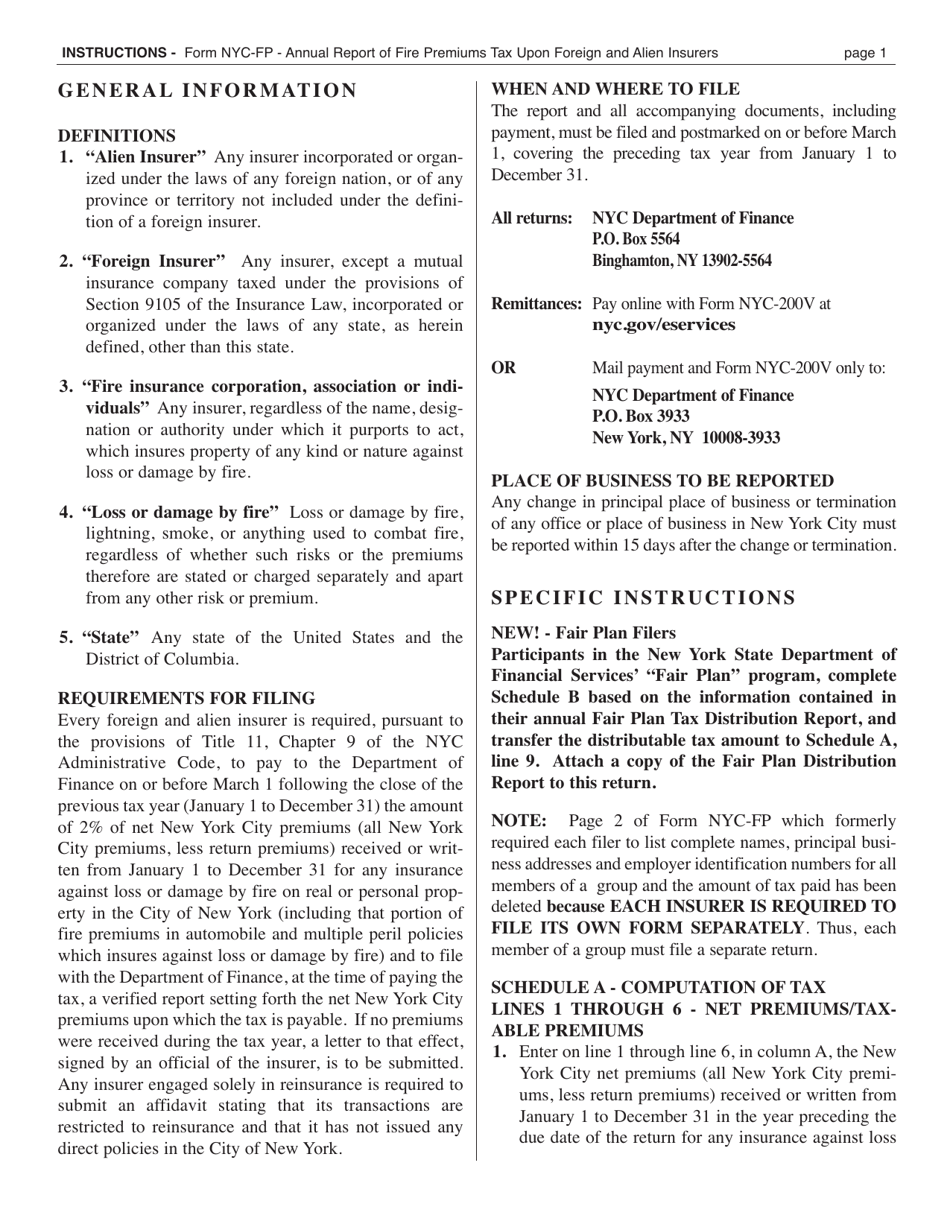

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-FP Annual Report of Fire Premiums Tax?

A: The NYC-FP Annual Report of Fire Premiums Tax is a report that foreign and alien insurance companies operating in New York City need to submit.

Q: Who needs to submit the NYC-FP Annual Report of Fire Premiums Tax?

A: Foreign and alien insurance companies operating in New York City are required to submit the NYC-FP Annual Report of Fire Premiums Tax.

Q: What is the purpose of the NYC-FP Annual Report of Fire Premiums Tax?

A: The purpose of the NYC-FP Annual Report of Fire Premiums Tax is to collect information on fire insurance premiums from foreign and alien insurance companies in order to determine the amount of tax owed.

Q: When is the deadline for submitting the NYC-FP Annual Report of Fire Premiums Tax?

A: The deadline for submitting the NYC-FP Annual Report of Fire Premiums Tax is typically on or before March 1st.

Q: What happens if a foreign or alien insurance company fails to submit the NYC-FP Annual Report of Fire Premiums Tax?

A: Failure to submit the NYC-FP Annual Report of Fire Premiums Tax may result in penalties and fines imposed by the New York City Department of Finance.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-FP by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.