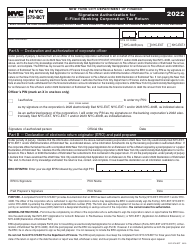

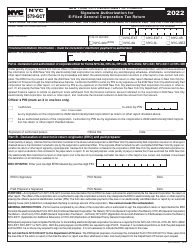

This version of the form is not currently in use and is provided for reference only. Download this version of

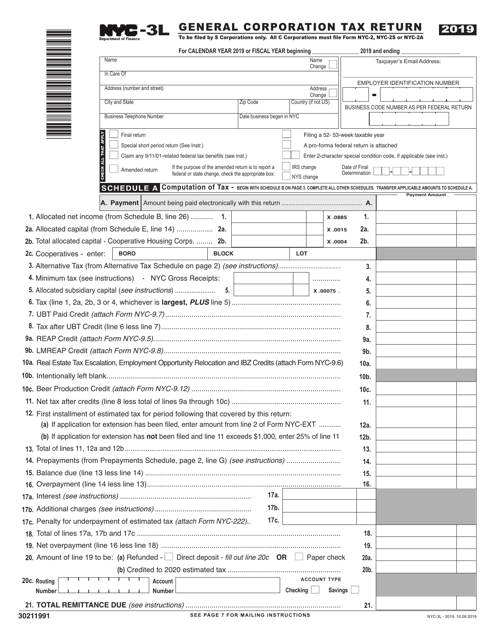

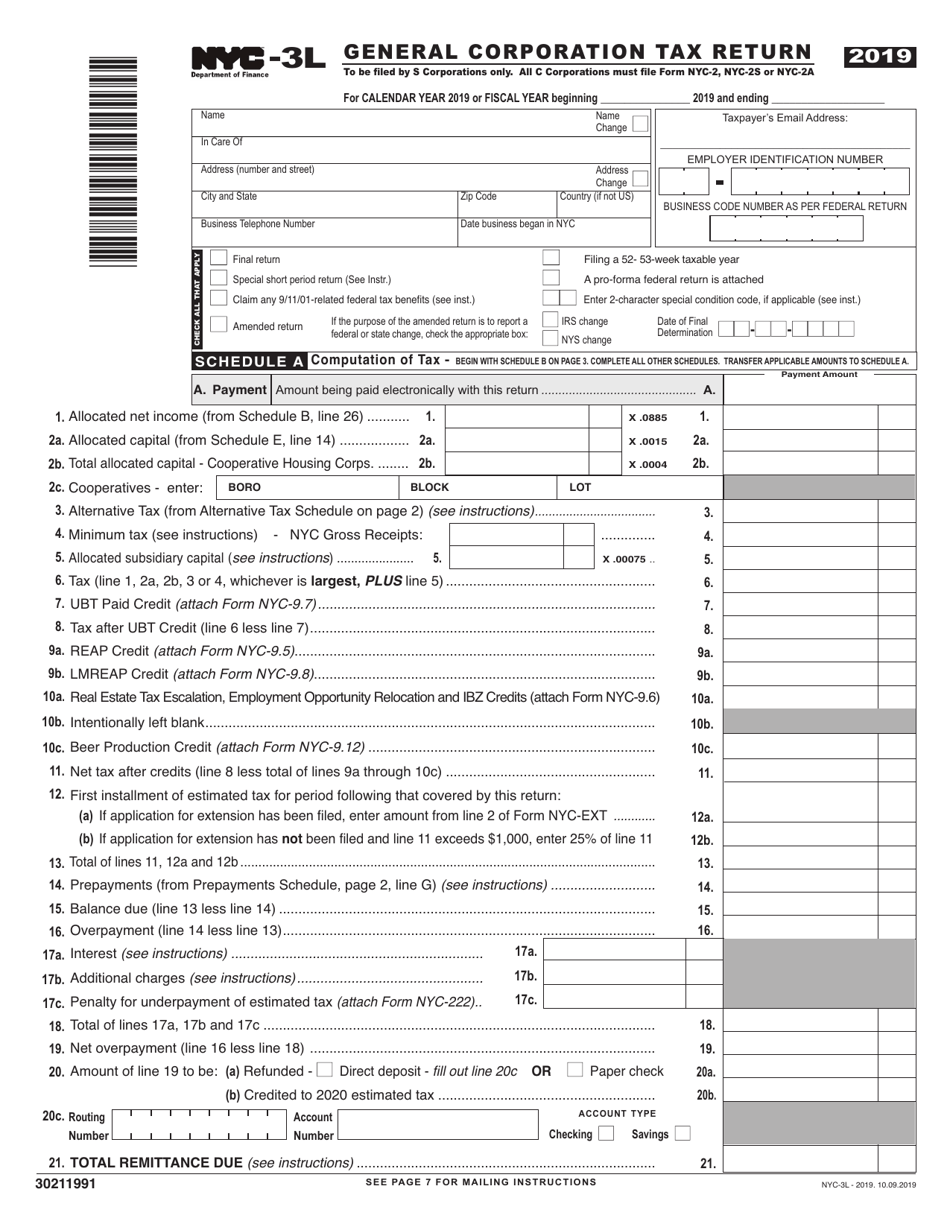

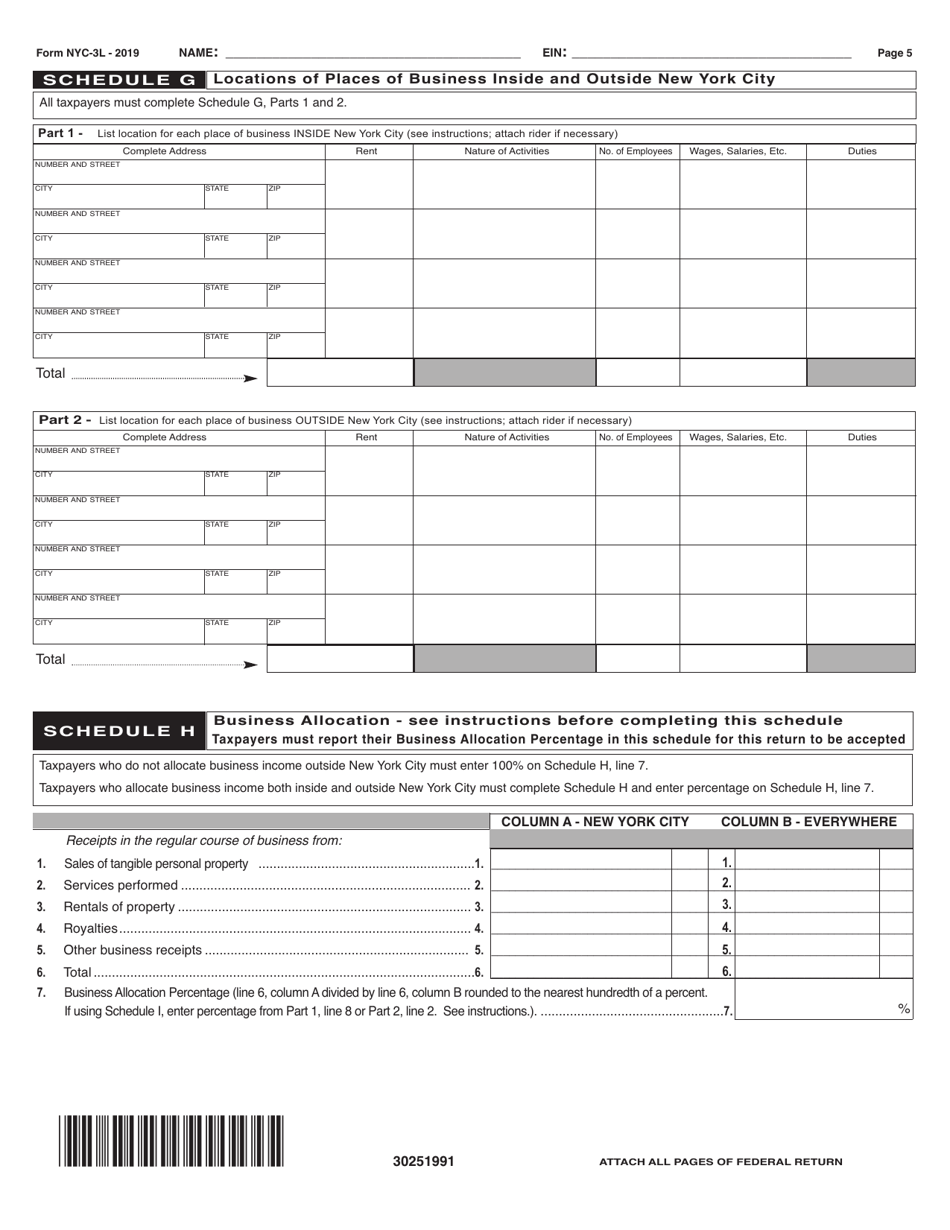

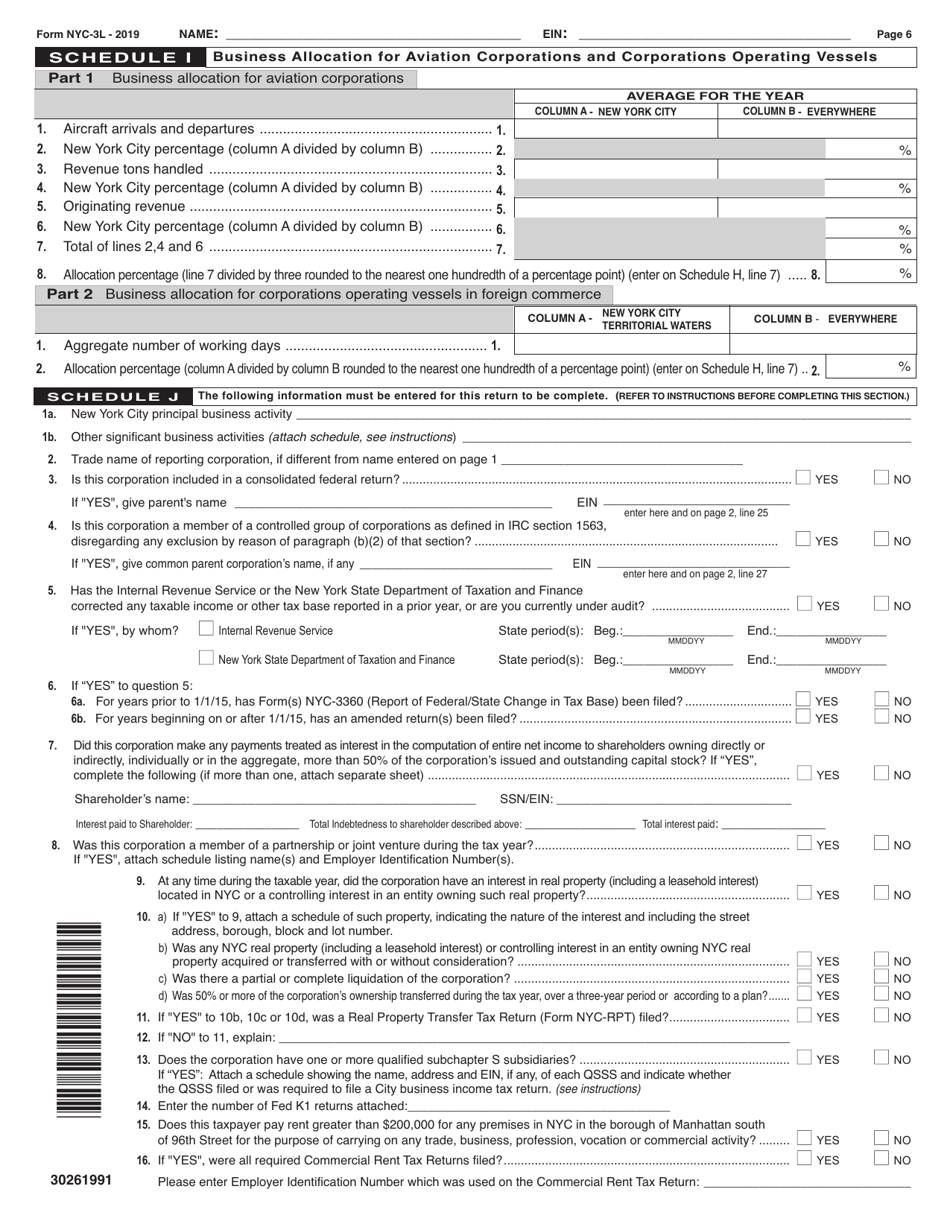

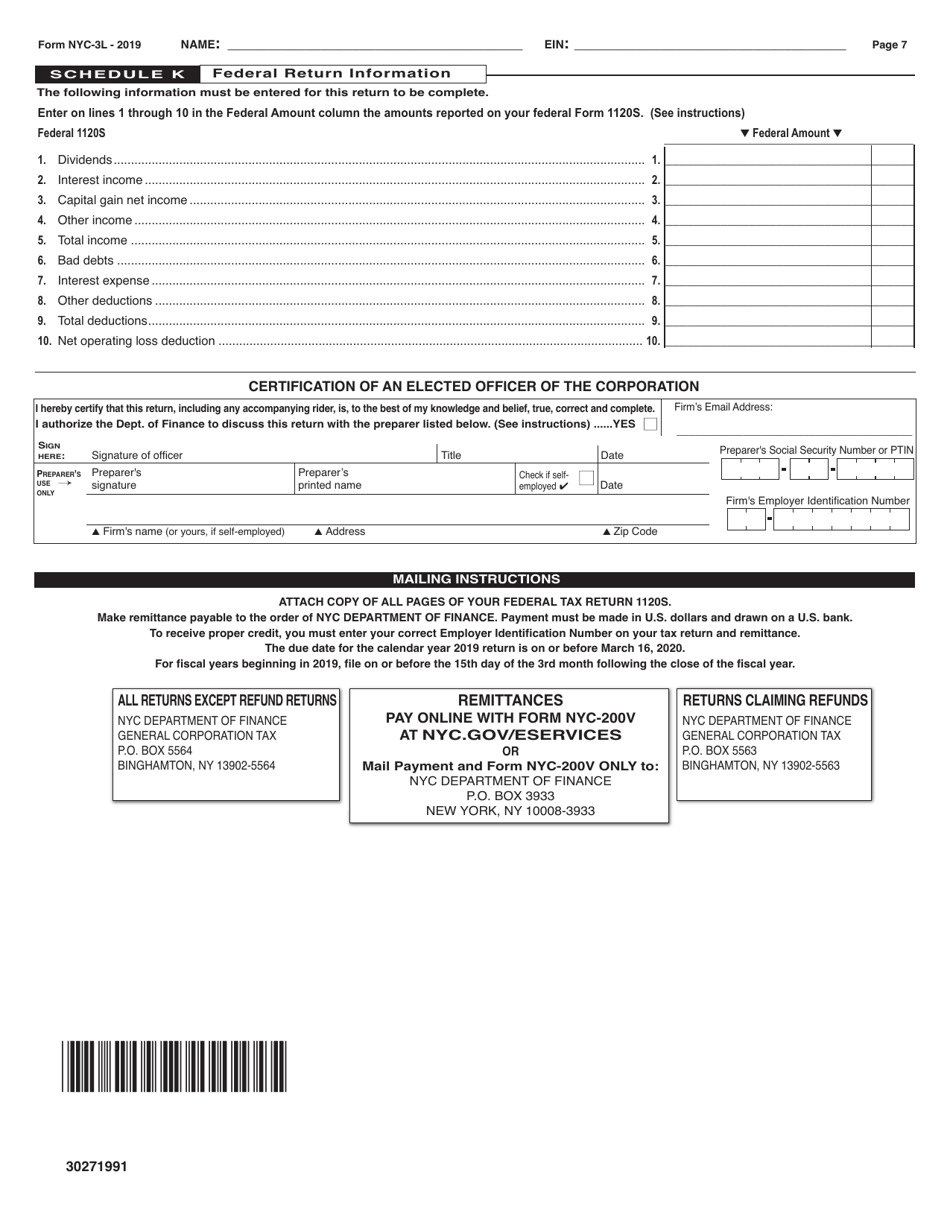

Form NYC-3L

for the current year.

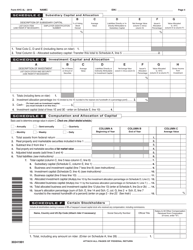

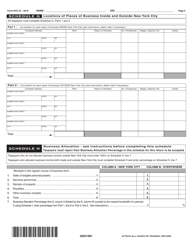

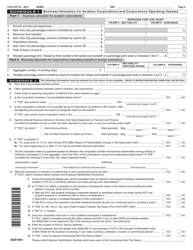

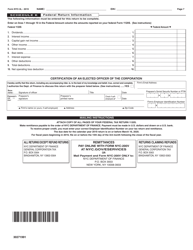

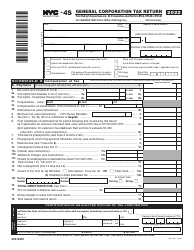

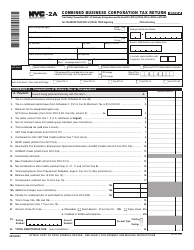

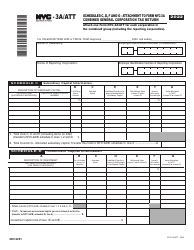

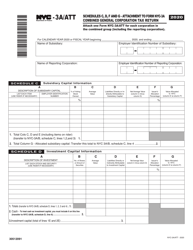

Form NYC-3L General Corporation Tax Return - New York City

What Is Form NYC-3L?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

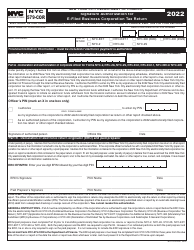

Q: What is the NYC-3L General Corporation Tax Return?

A: The NYC-3L is a tax return form used by general corporations to report and pay their taxes to the City of New York.

Q: Who needs to file the NYC-3L General Corporation Tax Return?

A: General corporations doing business in New York City must file the NYC-3L form.

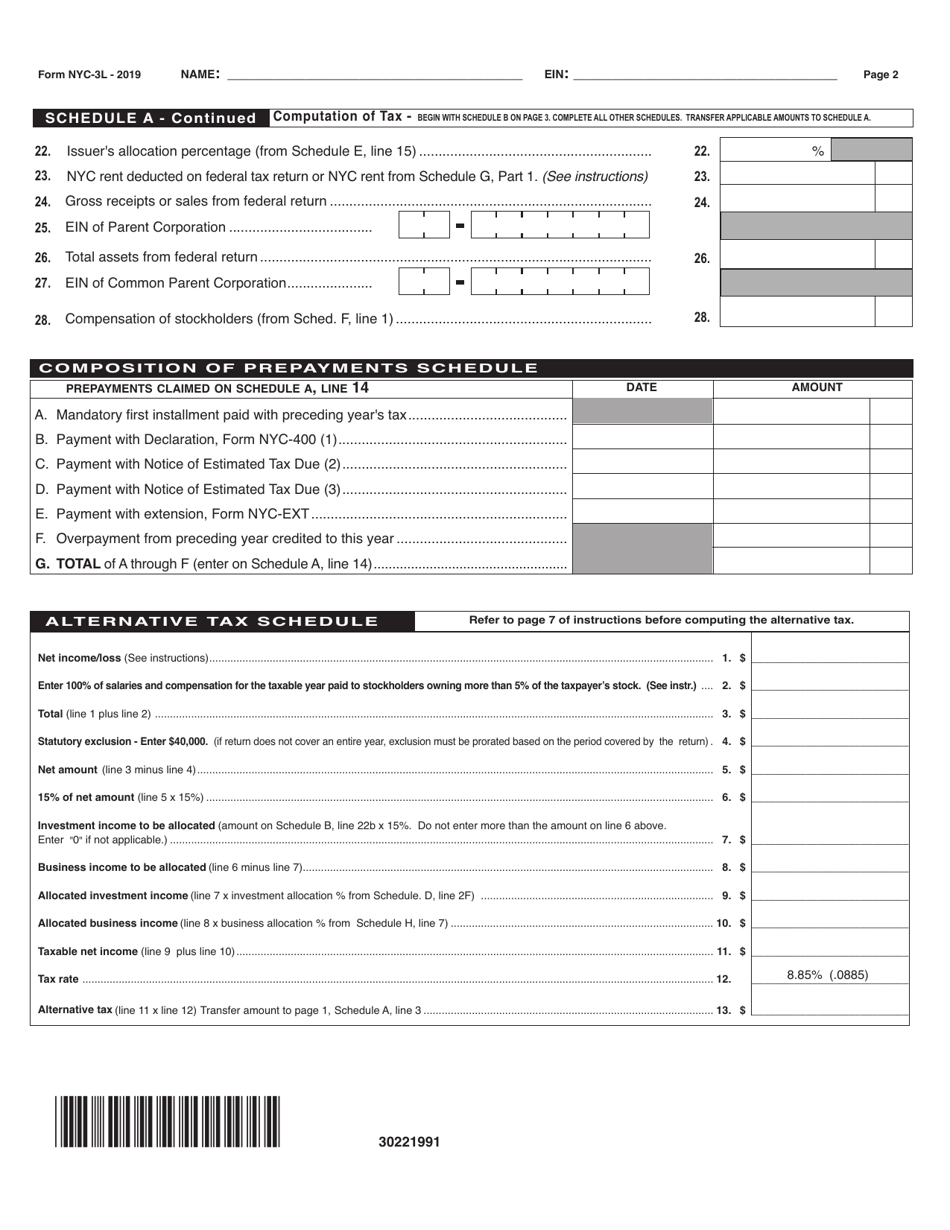

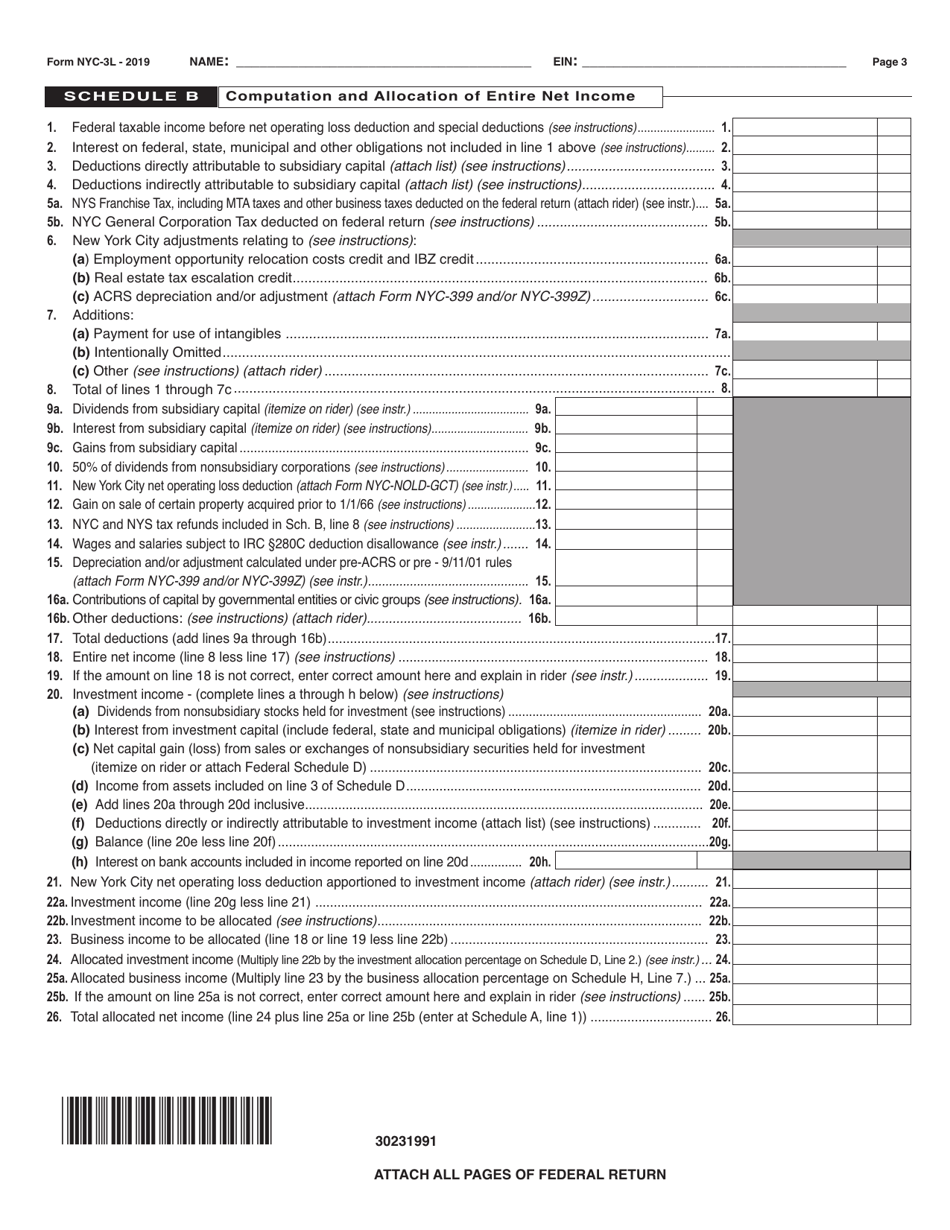

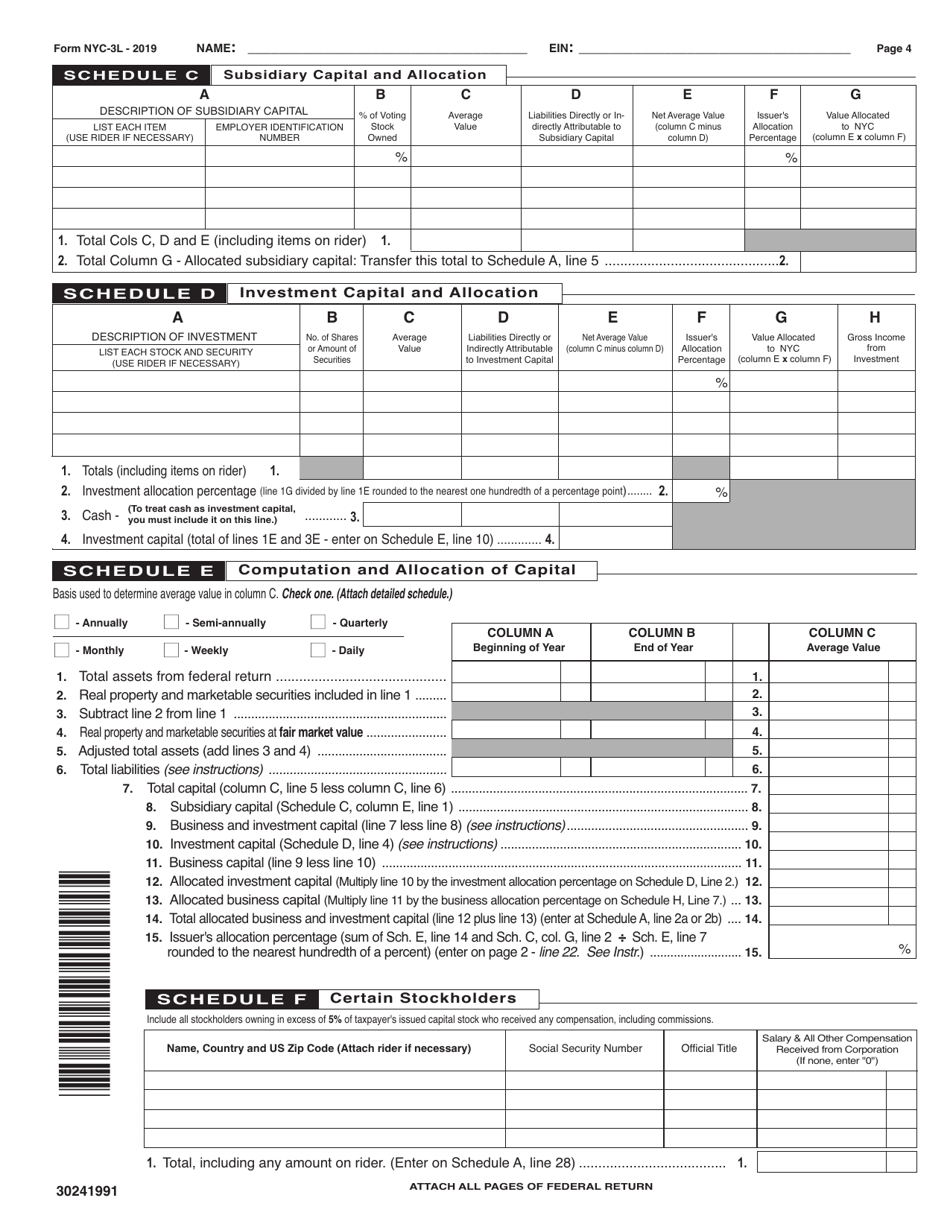

Q: What information is required on the NYC-3L form?

A: The form requires information about the corporation's income, deductions, credits, and other relevant financial details.

Q: When is the deadline to file the NYC-3L General Corporation Tax Return?

A: The deadline to file the NYC-3L form is generally on or before March 15 for calendar year taxpayers.

Form Details:

- Released on October 9, 2019;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-3L by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.