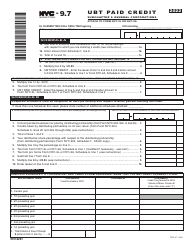

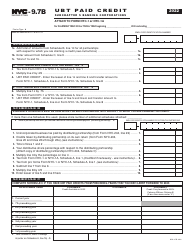

This version of the form is not currently in use and is provided for reference only. Download this version of

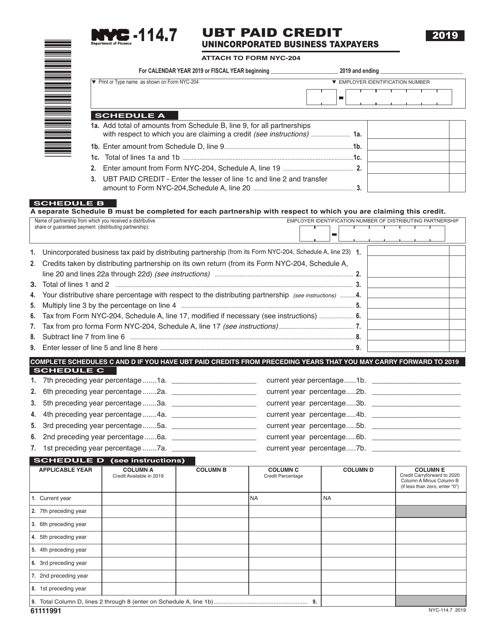

Form NYC-114.7

for the current year.

Form NYC-114.7 Ubt Paid Credit - New York City

What Is Form NYC-114.7?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-114.7?

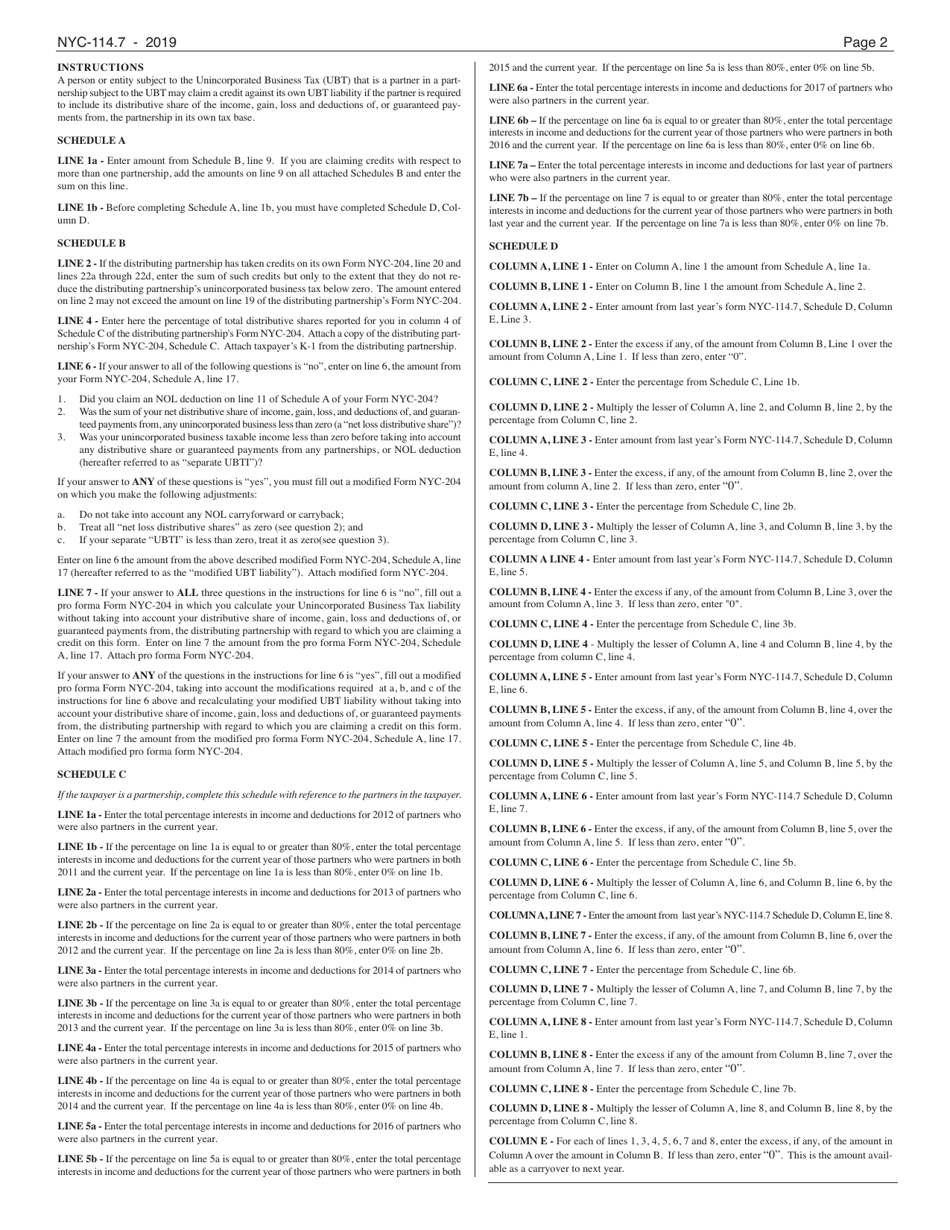

A: NYC-114.7 is a tax form used for reporting the UBT (Unincorporated Business Tax) Paid Credit in New York City.

Q: What is UBT?

A: UBT stands for Unincorporated Business Tax, which is a tax imposed on businesses in New York City that are not incorporated.

Q: What is the UBT Paid Credit?

A: The UBT Paid Credit is a credit that can be claimed on the NYC-114.7 form, which allows taxpayers to reduce their UBT liability based on taxes paid to other cities or states.

Q: Who needs to file the NYC-114.7 form?

A: Individuals and entities that are subject to the UBT in New York City and are eligible for the UBT Paid Credit need to file the NYC-114.7 form.

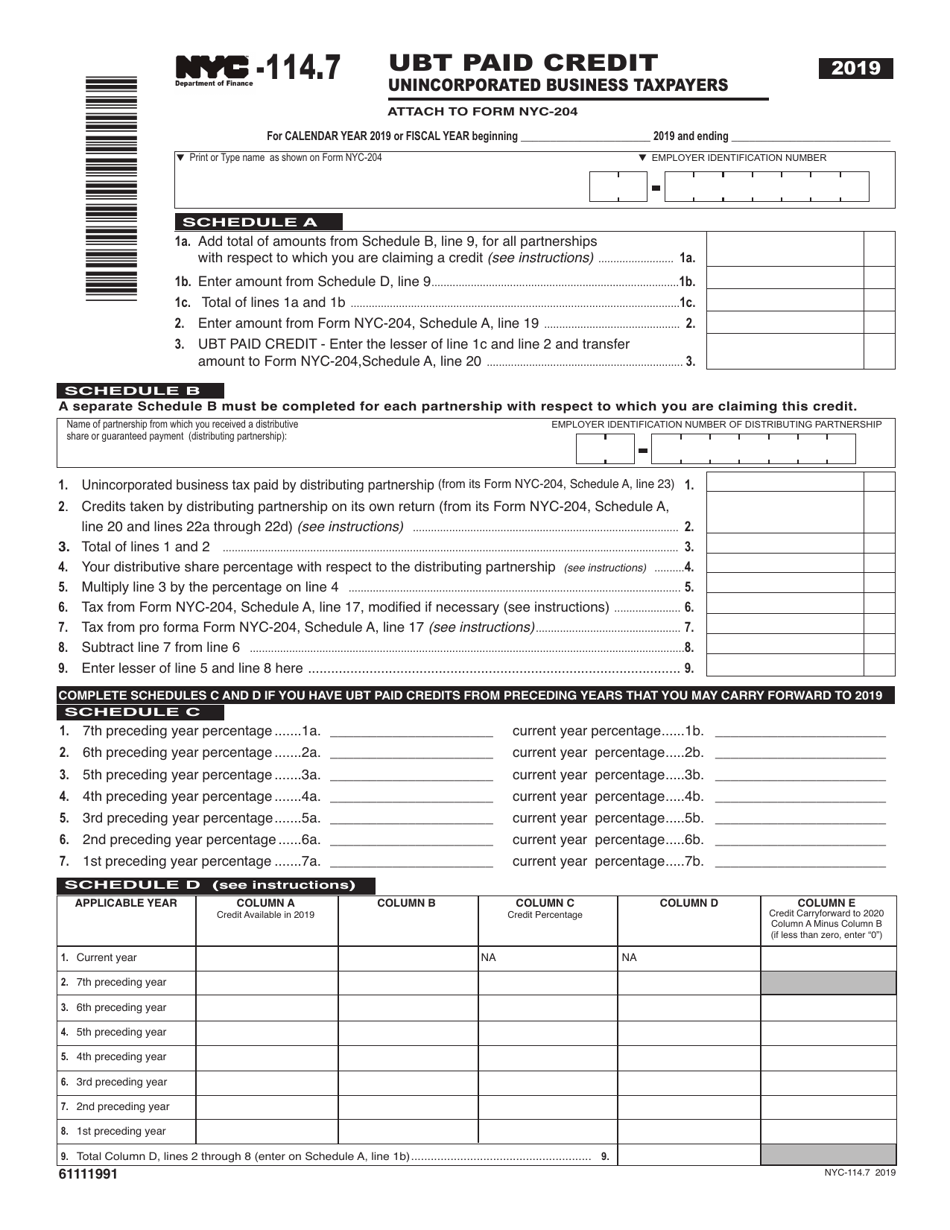

Q: How can I claim the UBT Paid Credit?

A: To claim the UBT Paid Credit, you need to complete and file the NYC-114.7 form, providing the necessary information about your UBT liability and the taxes paid in other jurisdictions.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-114.7 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.