This version of the form is not currently in use and is provided for reference only. Download this version of

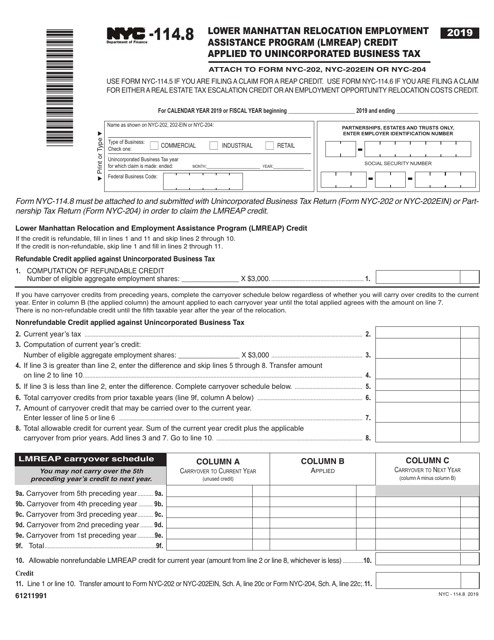

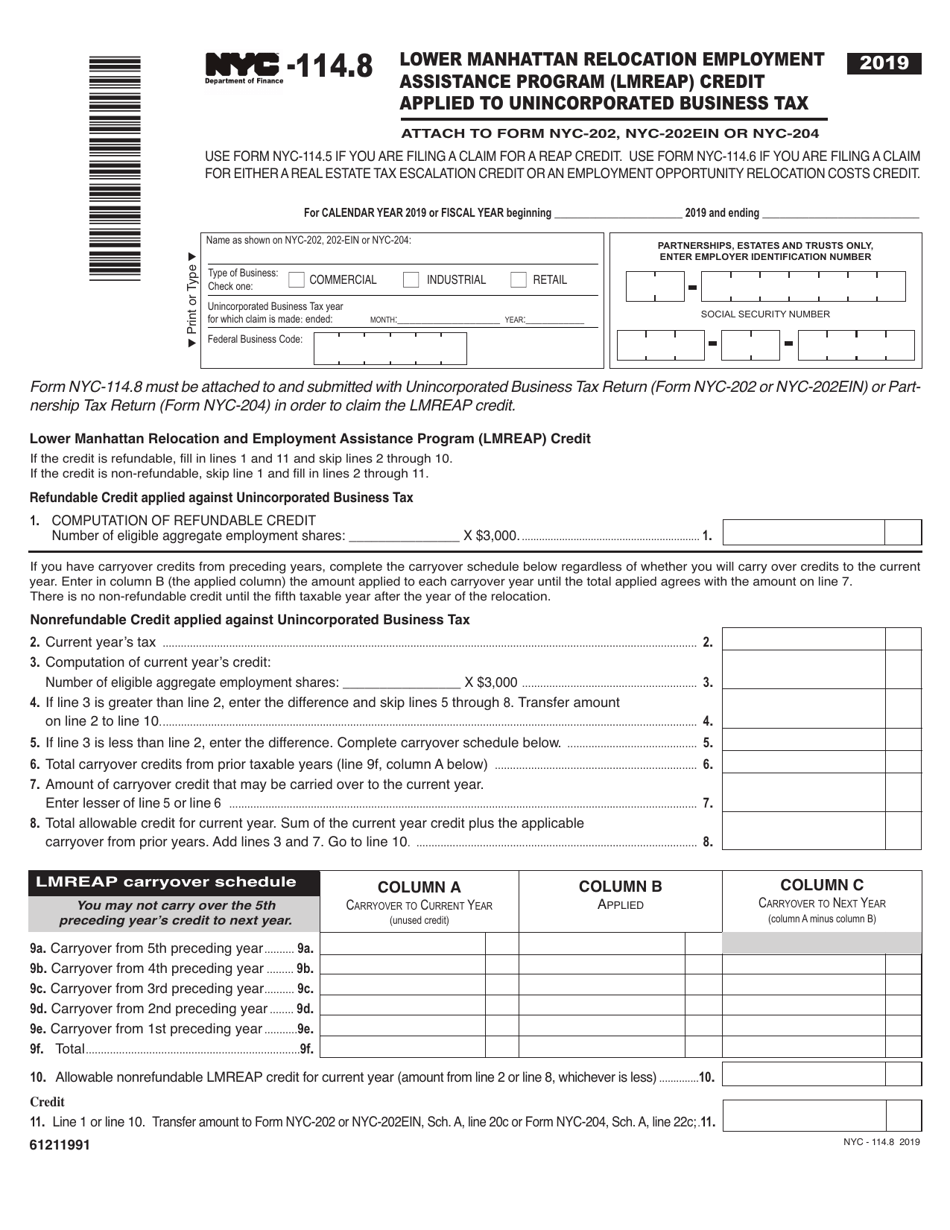

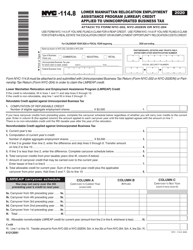

Form NYC-114.8

for the current year.

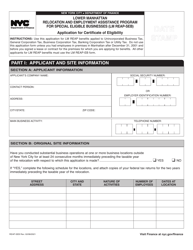

Form NYC-114.8 Lower Manhattan Relocation Employment Assistance Program (Lmreap) Credit Applied to Unincorporated Business Tax - New York City

What Is Form NYC-114.8?

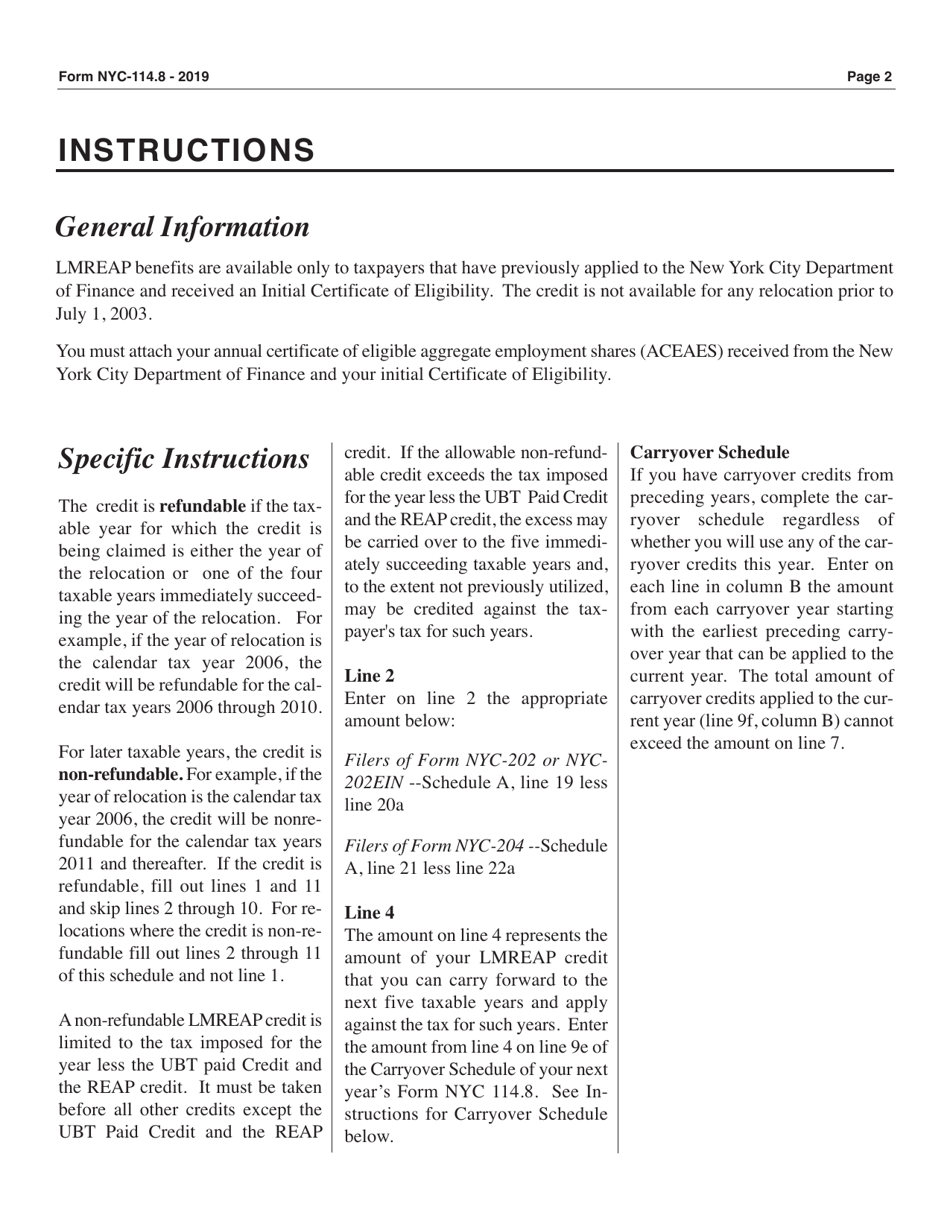

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-114.8 form?

A: The NYC-114.8 form is the form used for the Lower Manhattan Relocation Employment Assistance Program (LMREAP) Credit applied to Unincorporated Business Tax in New York City.

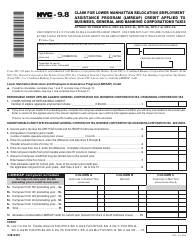

Q: What is the purpose of the LMREAP program?

A: The LMREAP program is designed to provide tax credits to businesses that relocated to Lower Manhattan after the September 11 attacks.

Q: Who is eligible for the LMREAP program?

A: Businesses that relocated to Lower Manhattan after the September 11 attacks and meet certain criteria are eligible for the LMREAP program.

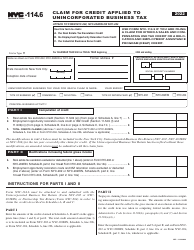

Q: What is the Unincorporated Business Tax?

A: The Unincorporated Business Tax is a tax imposed on self-employed individuals or partnerships that conduct business in New York City.

Q: How does the LMREAP credit work?

A: The LMREAP credit is applied to the Unincorporated Business Tax. It provides a tax credit to eligible businesses based on the amount of qualified expenses incurred in relocating to Lower Manhattan.

Q: What are qualified expenses under the LMREAP program?

A: Qualified expenses under the LMREAP program include costs related to acquiring, renovating, or improving commercial or residential property in Lower Manhattan.

Form Details:

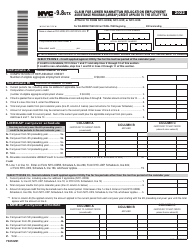

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-114.8 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.