This version of the form is not currently in use and is provided for reference only. Download this version of

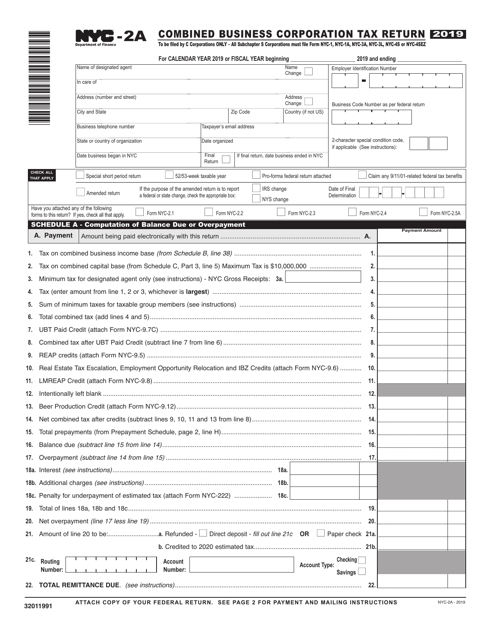

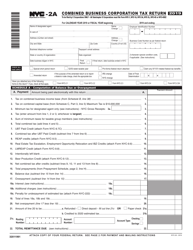

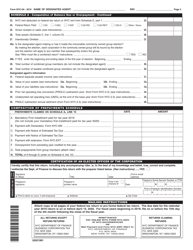

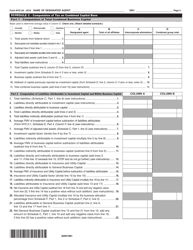

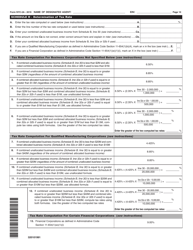

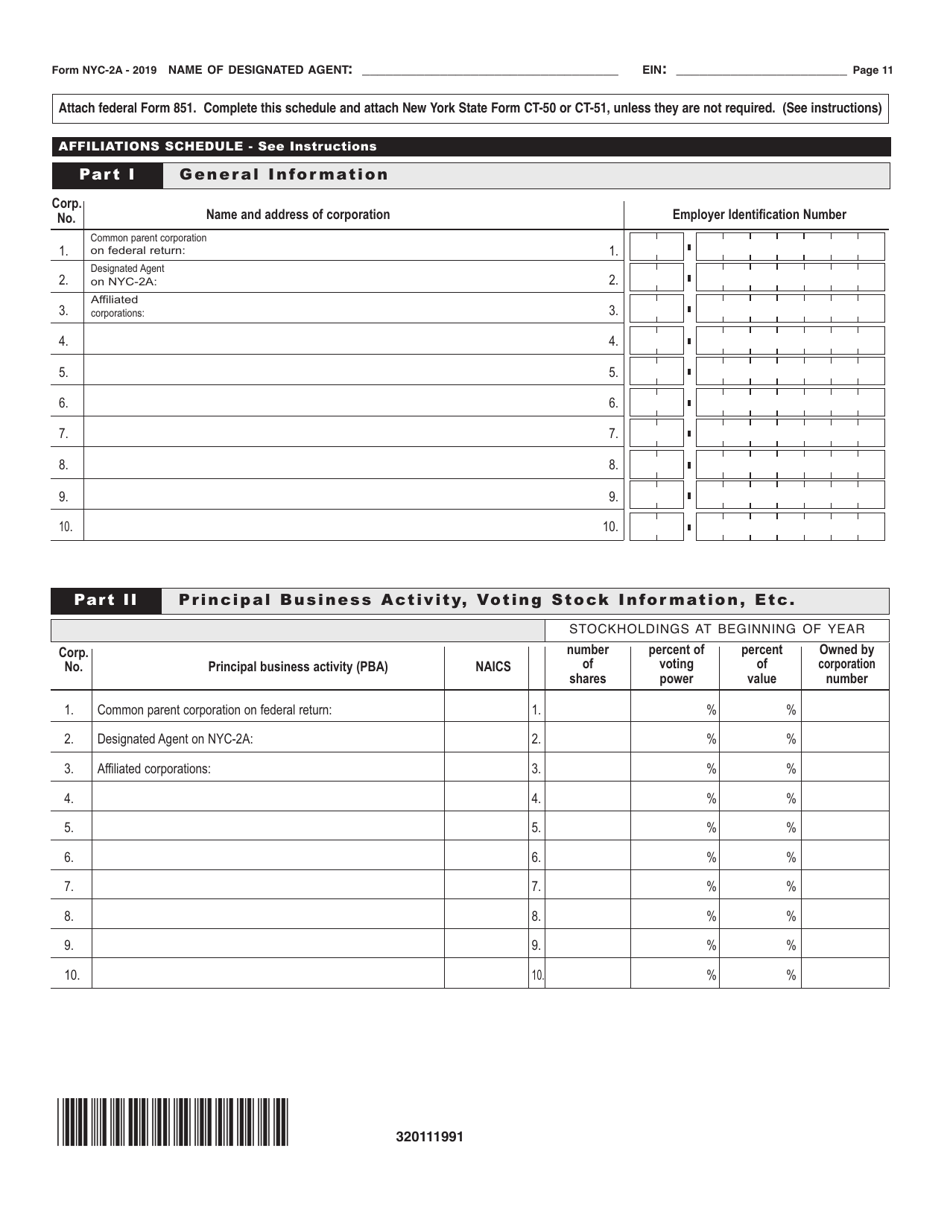

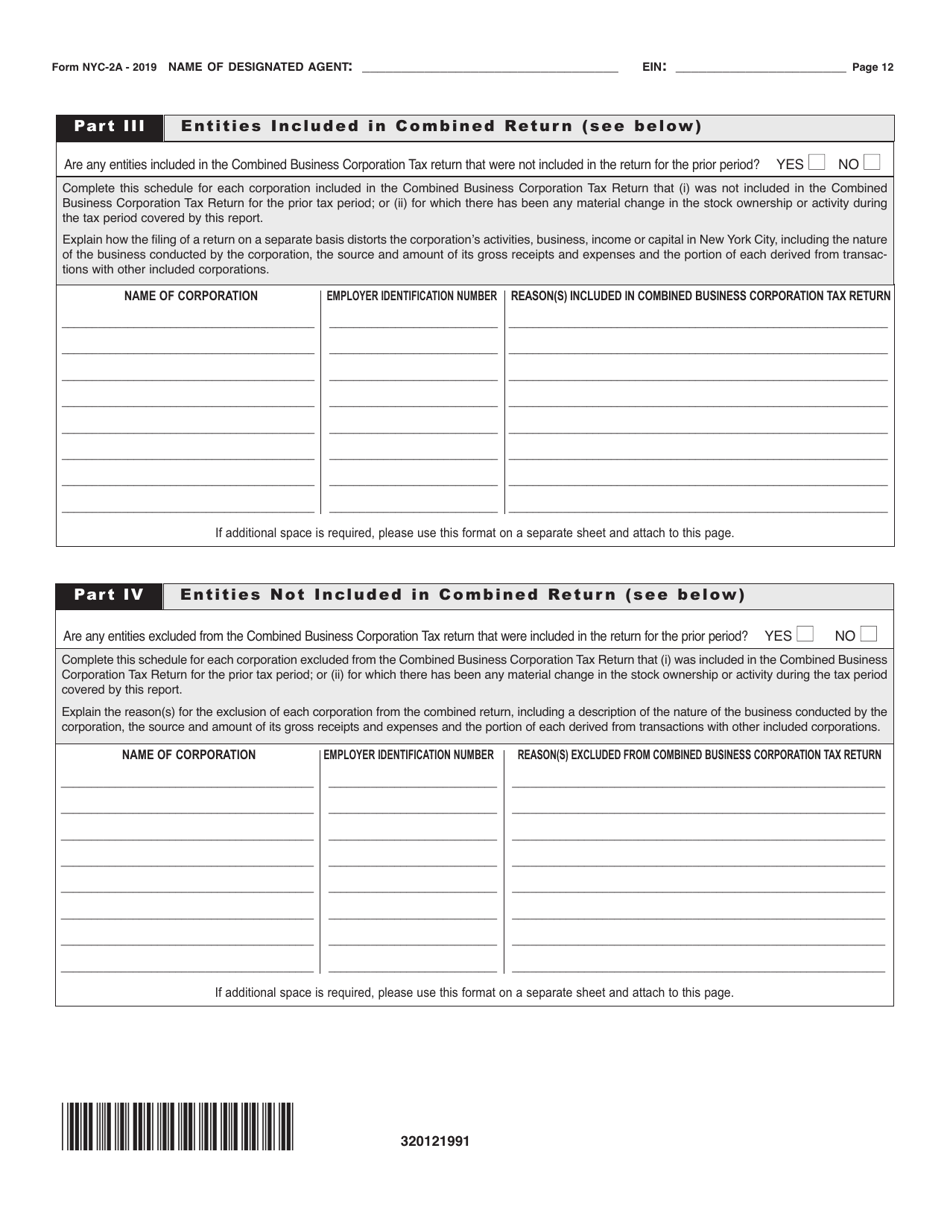

Form NYC-2A

for the current year.

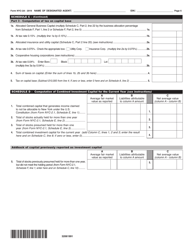

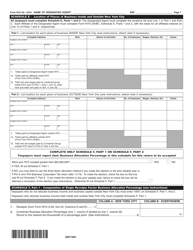

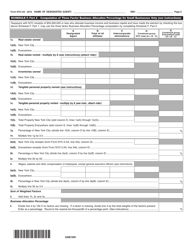

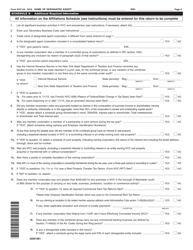

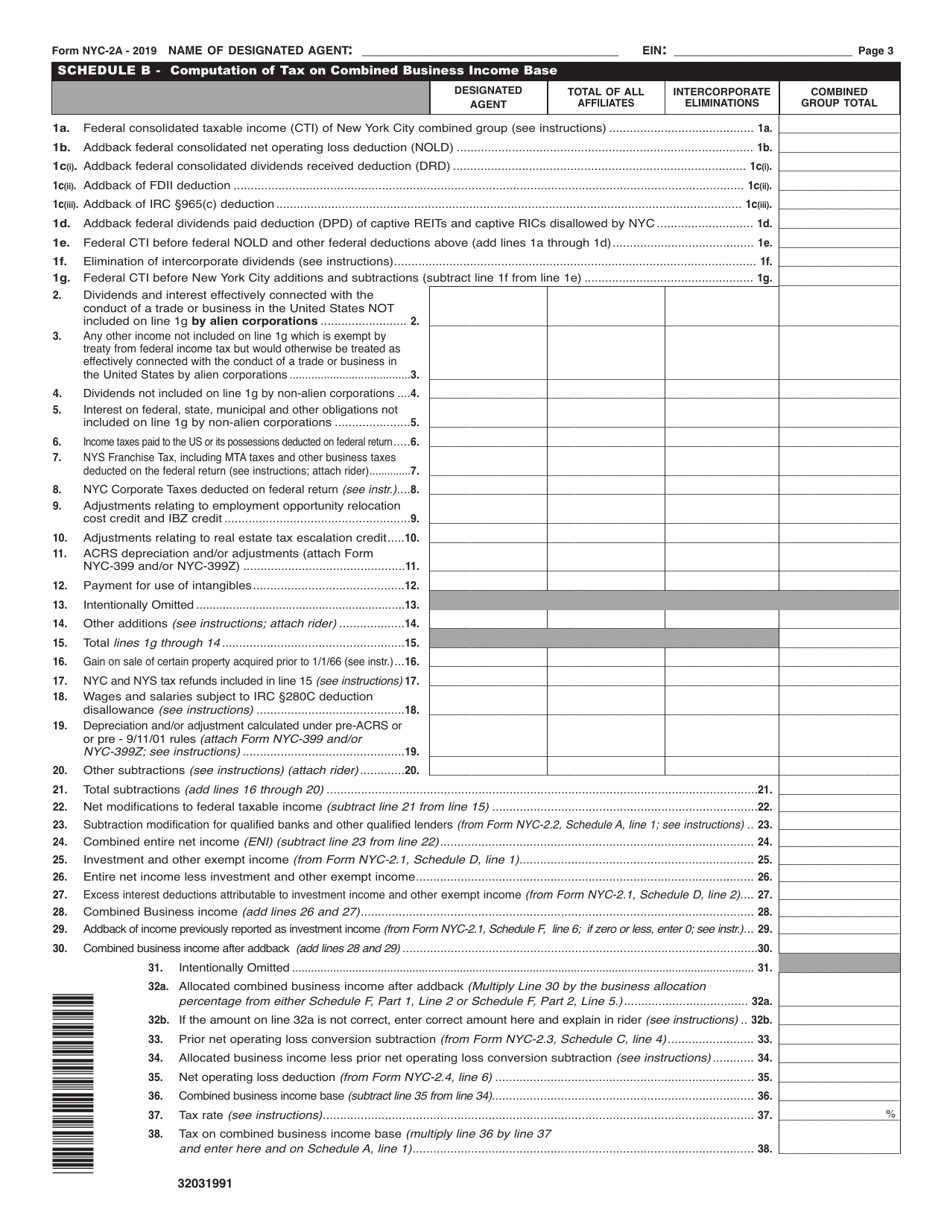

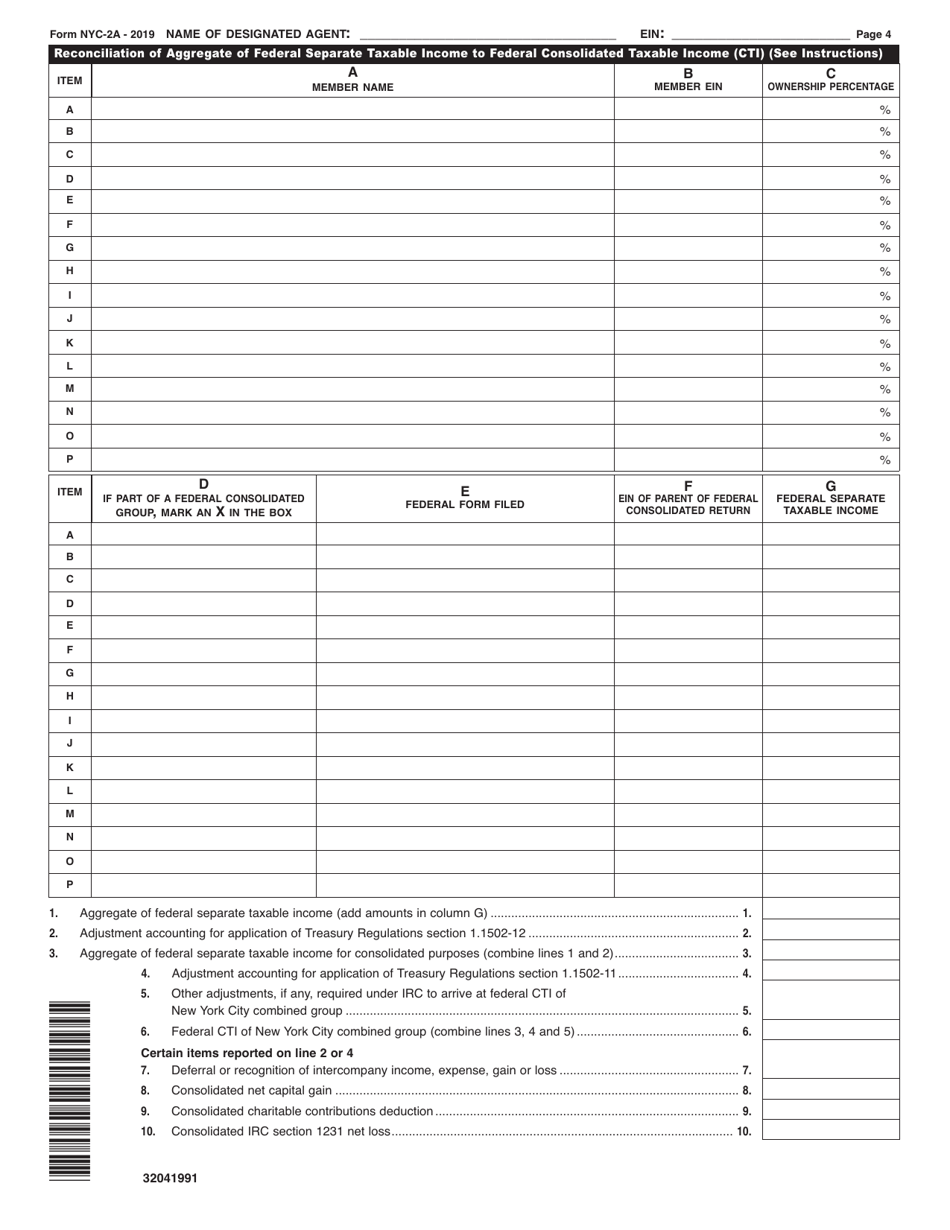

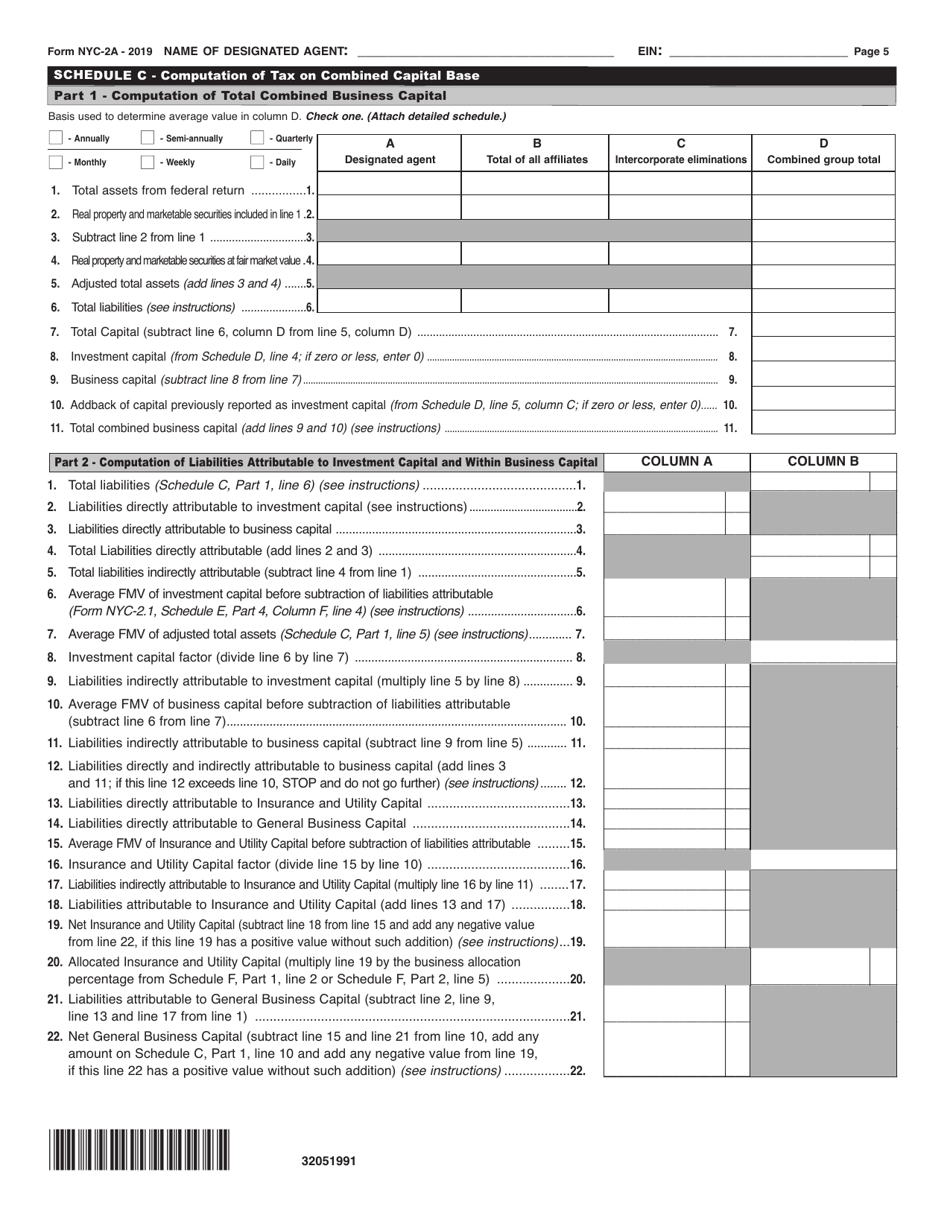

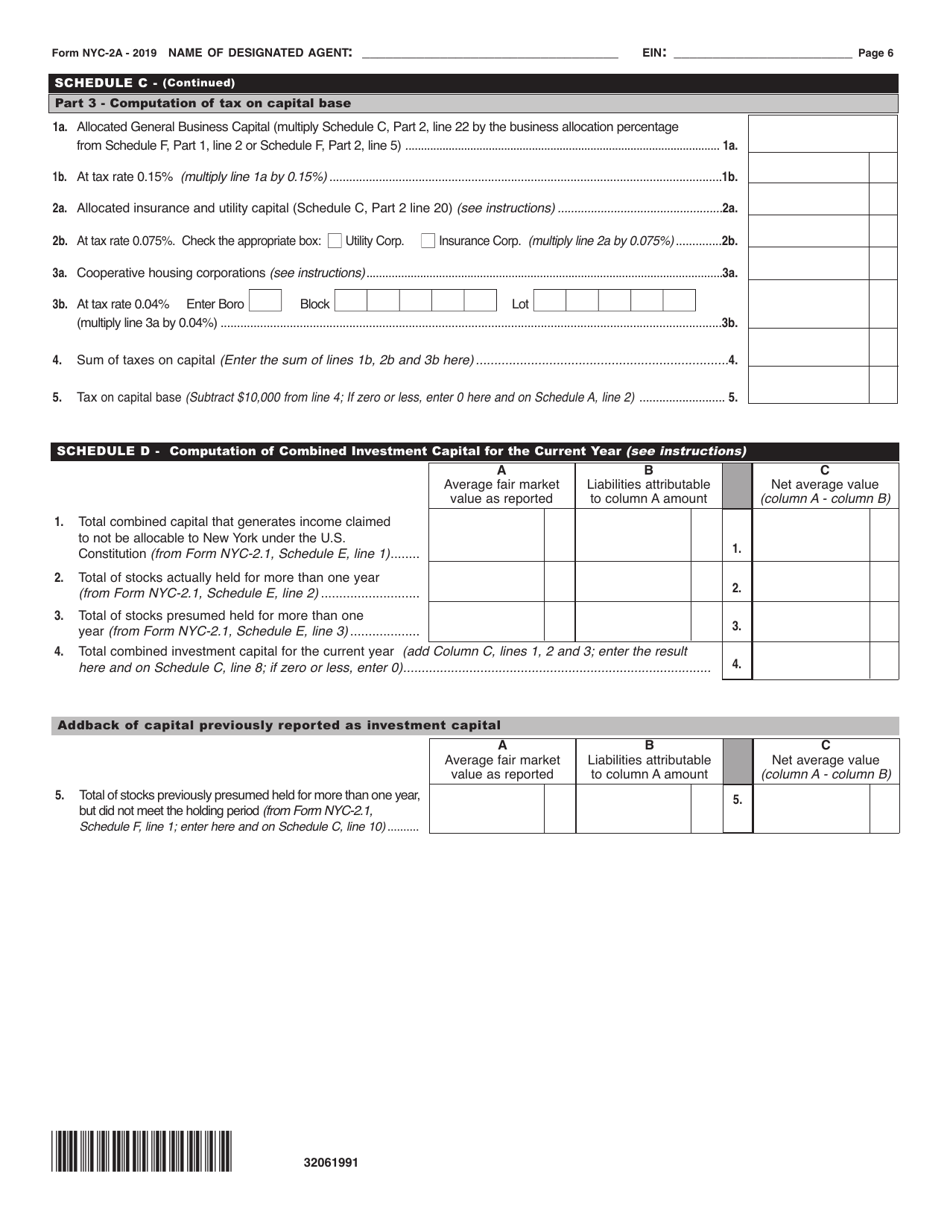

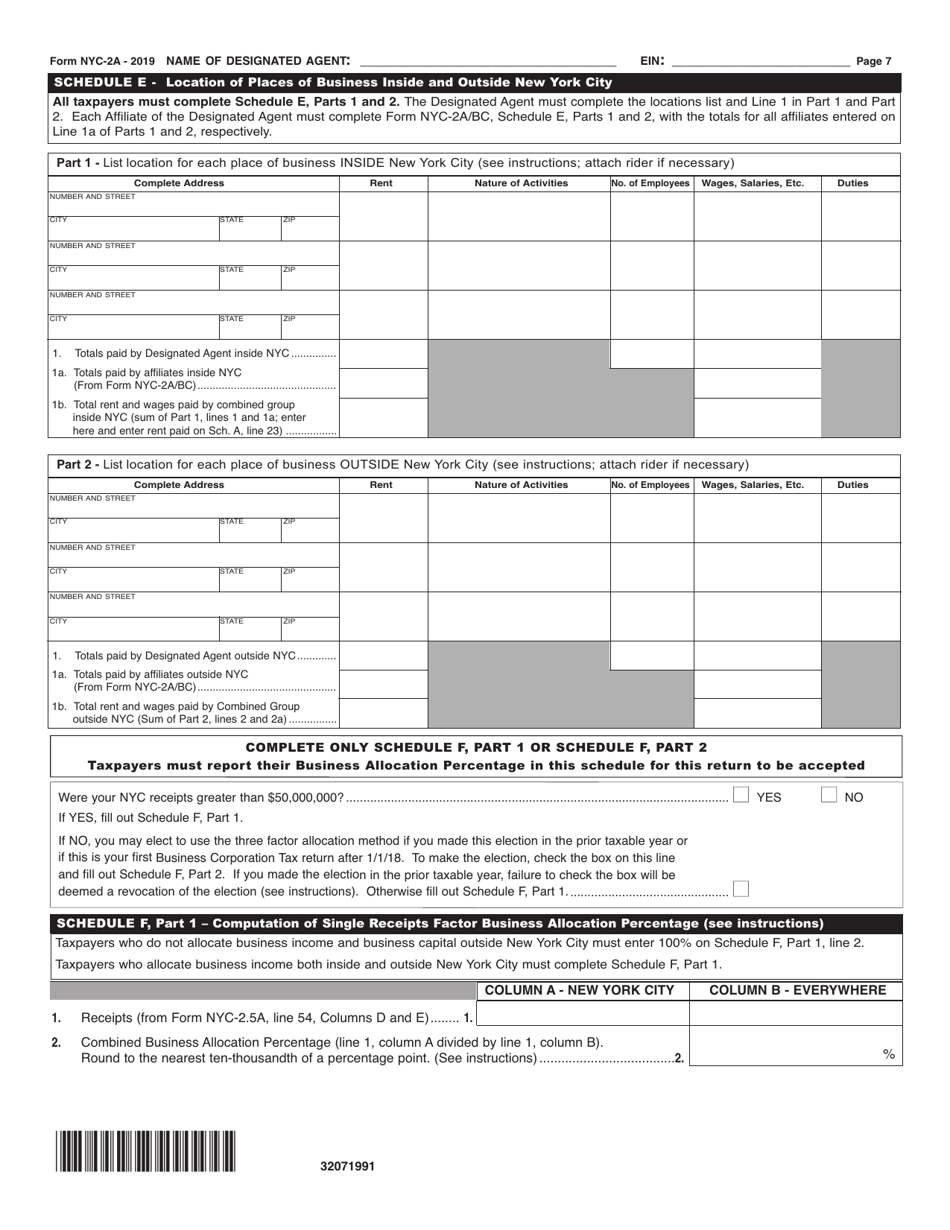

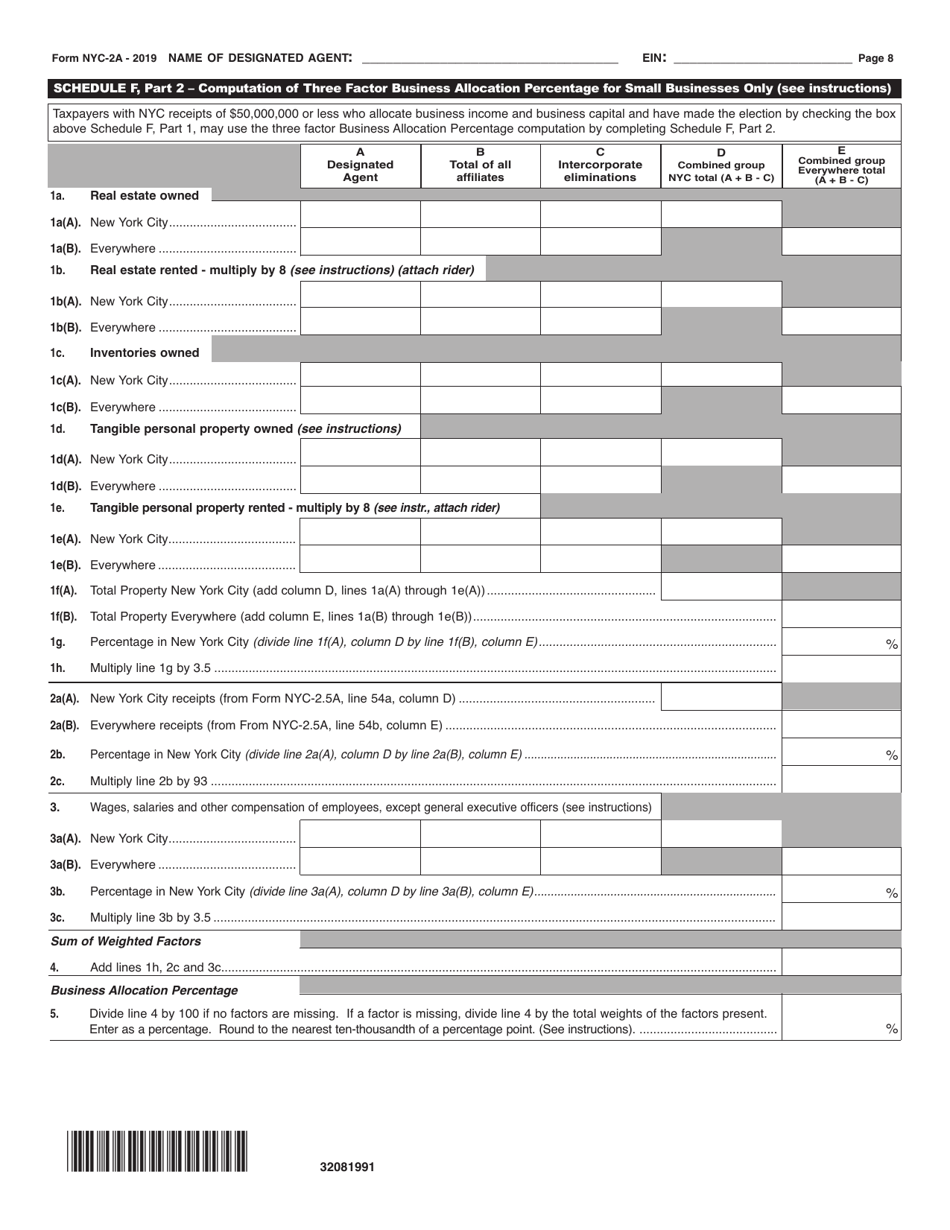

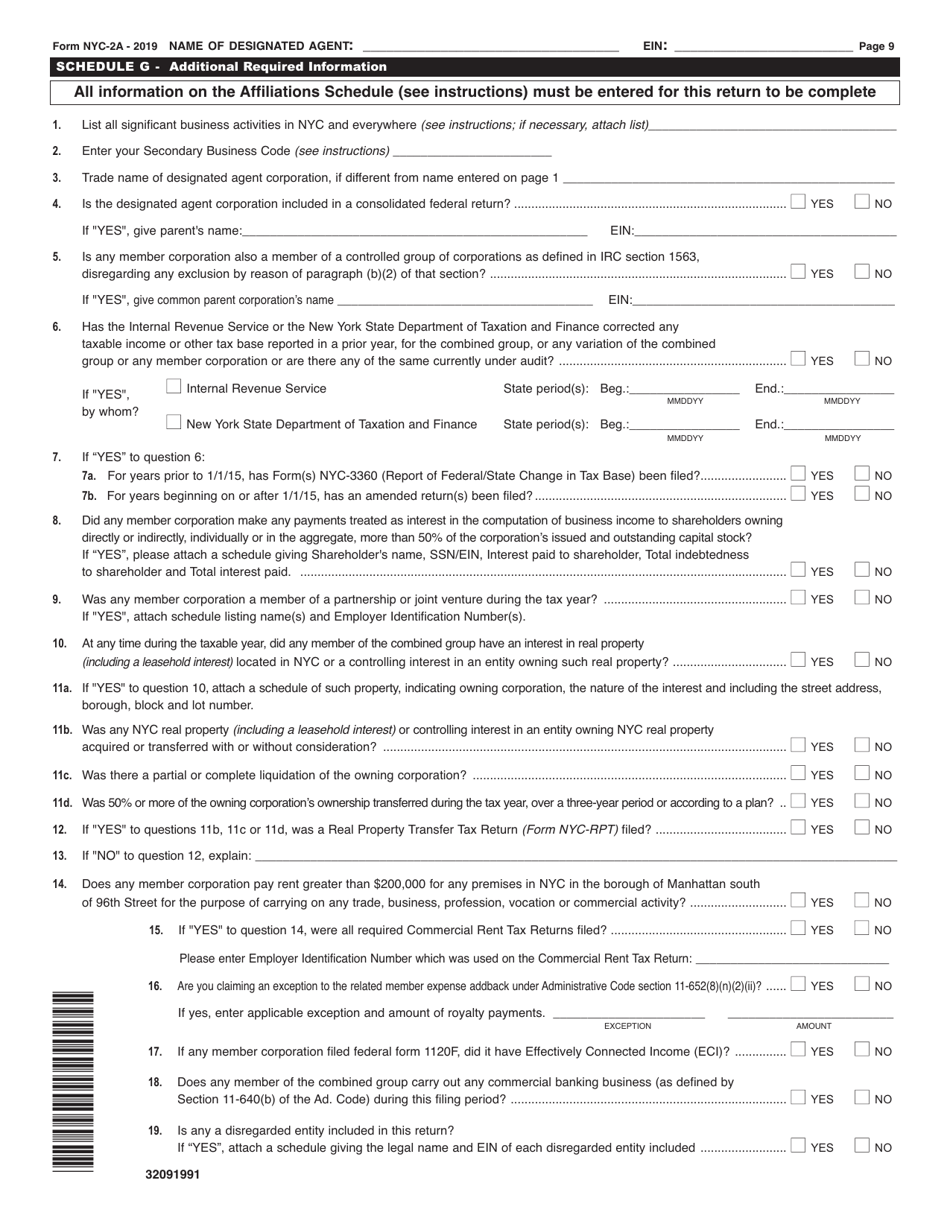

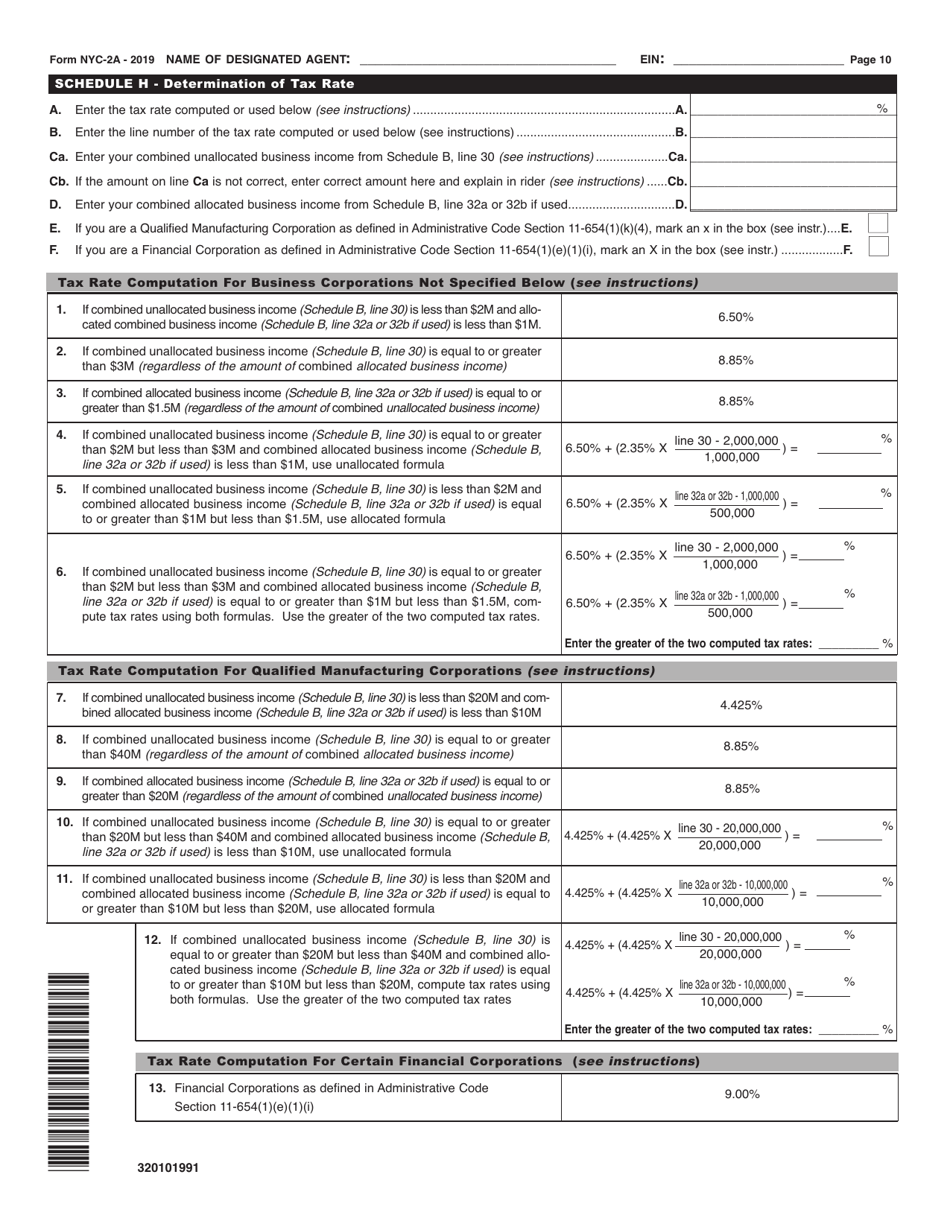

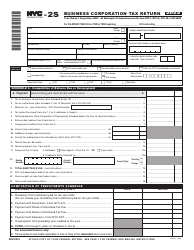

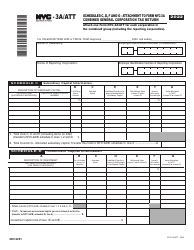

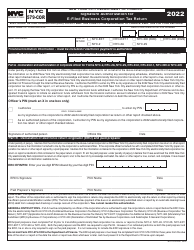

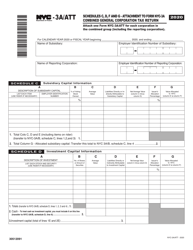

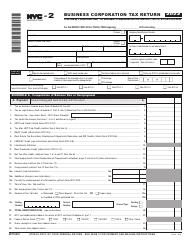

Form NYC-2A Combined Business Corporation Tax Return - New York City

What Is Form NYC-2A?

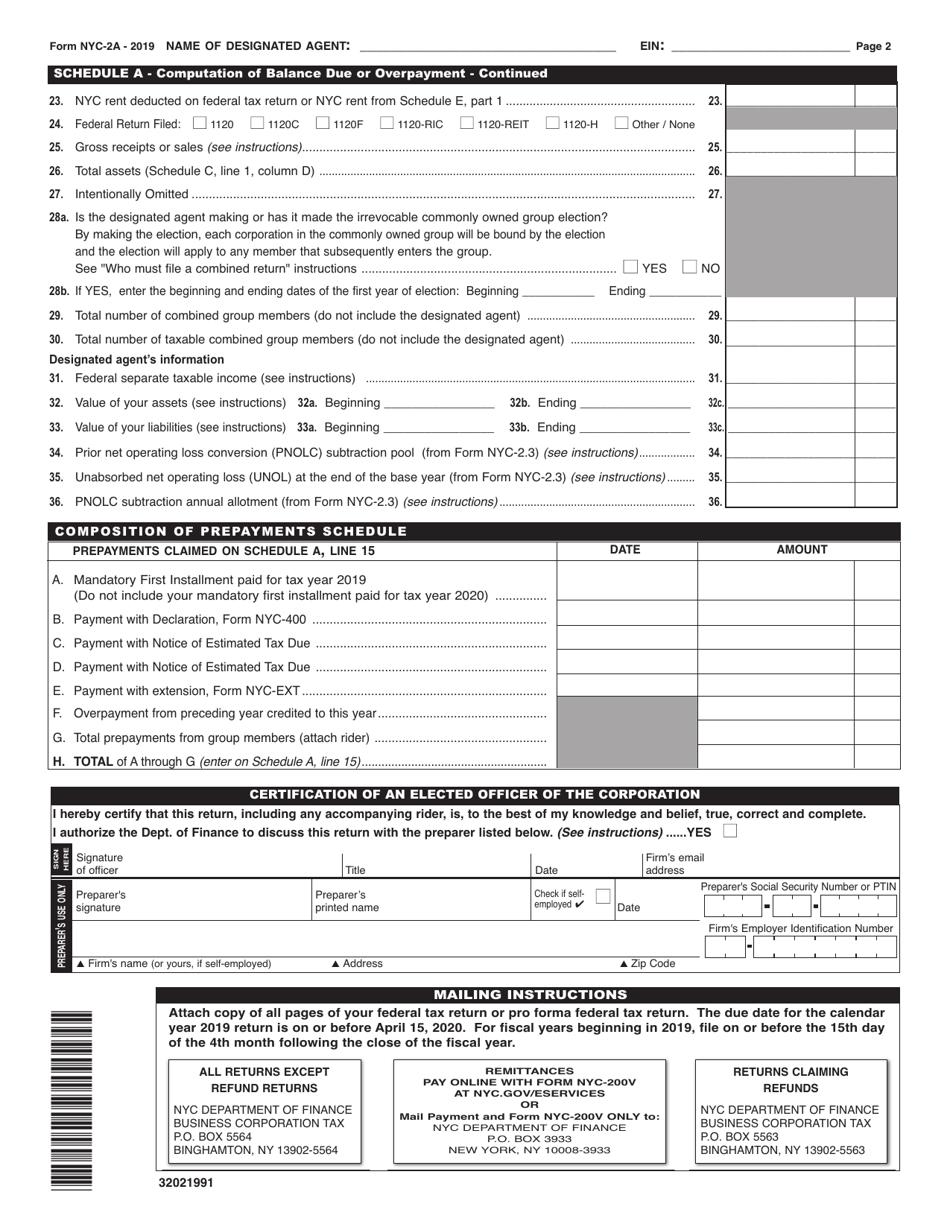

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-2A form?

A: The NYC-2A form is the Combined Business Corporation Tax Return for businesses in New York City.

Q: Who needs to file the NYC-2A form?

A: Businesses that are subject to the New York City Business Corporation Tax need to file the NYC-2A form.

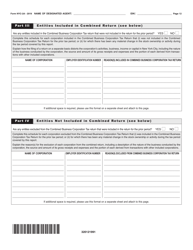

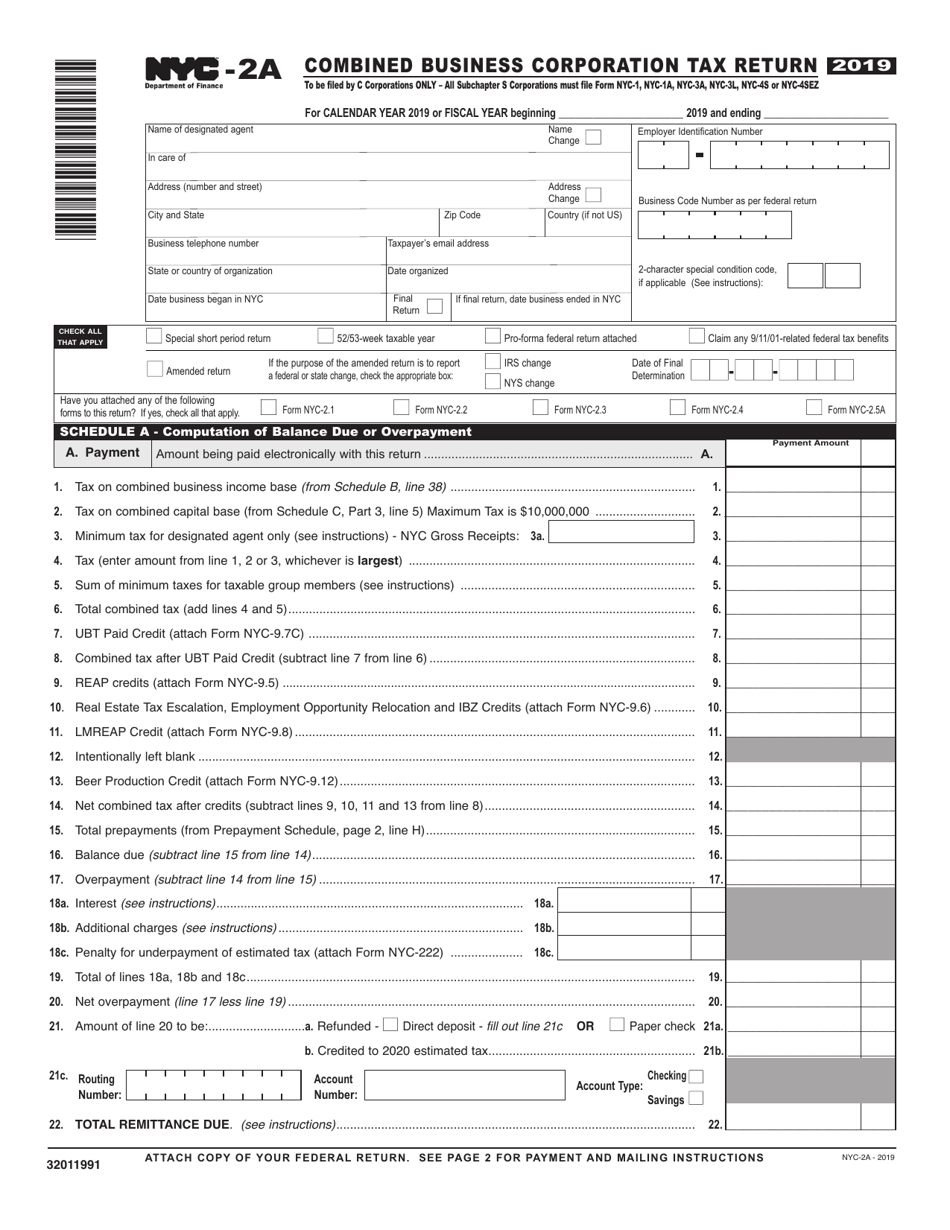

Q: What information is required on the NYC-2A form?

A: The NYC-2A form requires information about the business's income, deductions, and credits, as well as other relevant financial information.

Q: When is the deadline to file the NYC-2A form?

A: The deadline to file the NYC-2A form is generally on or before the 15th day of the fourth month following the end of the tax year.

Q: Are there any penalties for late filing of the NYC-2A form?

A: Yes, there are penalties for late filing of the NYC-2A form. It is important to file the form on time to avoid these penalties.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2A by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.