This version of the form is not currently in use and is provided for reference only. Download this version of

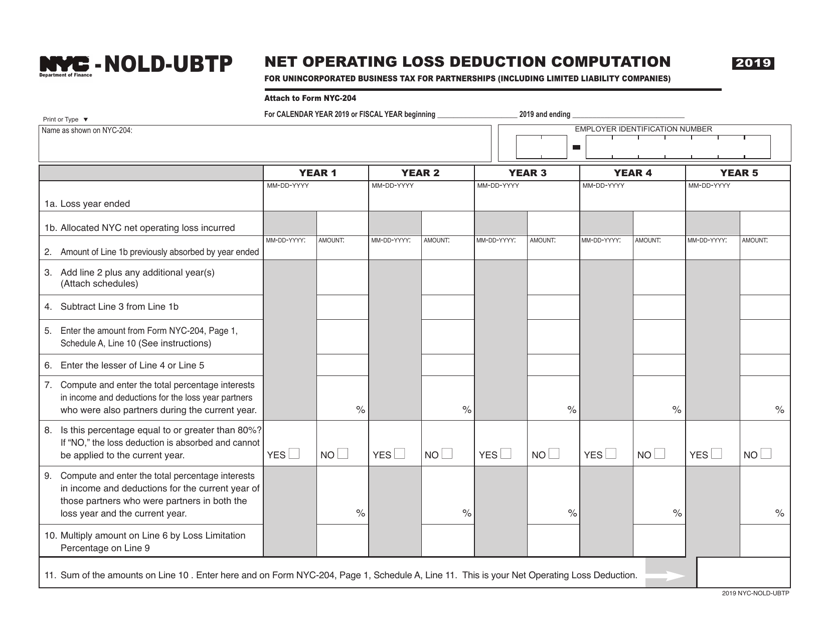

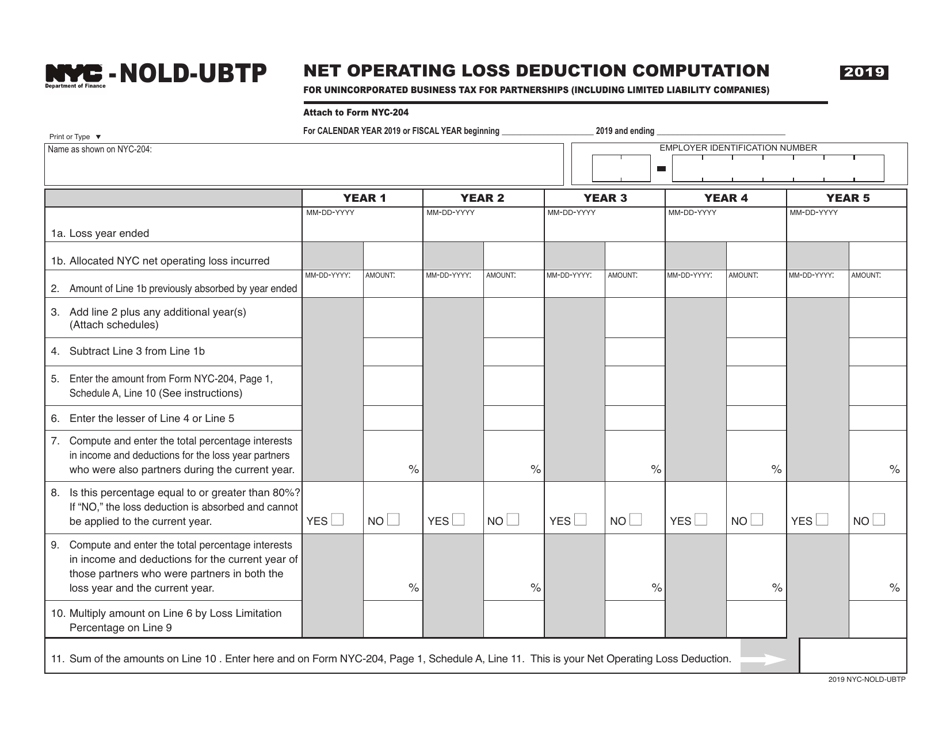

Form NYC-NOLD-UBTP

for the current year.

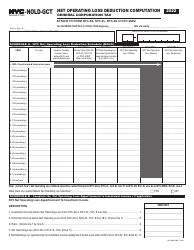

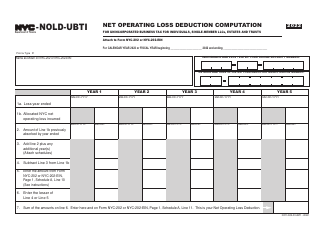

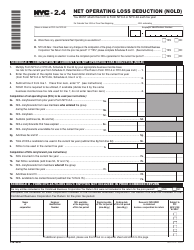

Form NYC-NOLD-UBTP Net Operating Loss Deduction Computation (For Partnerships Including Limited Liability Companies) - New York City

What Is Form NYC-NOLD-UBTP?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-NOLD-UBTP?

A: NYC-NOLD-UBTP refers to the Net Operating Loss Deduction Computation for Partnerships Including Limited Liability Companies in New York City.

Q: Who is eligible for NYC-NOLD-UBTP?

A: Partnerships and Limited Liability Companies (LLCs) operating in New York City are eligible for NYC-NOLD-UBTP.

Q: What is the purpose of NYC-NOLD-UBTP?

A: The purpose of NYC-NOLD-UBTP is to allow eligible partnerships and LLCs to calculate and claim a deduction for their net operating losses.

Q: How does NYC-NOLD-UBTP work?

A: NYC-NOLD-UBTP provides a computation method for partnerships and LLCs to determine the amount of net operating loss deduction they can claim in New York City.

Q: What is a net operating loss?

A: A net operating loss (NOL) occurs when a business's allowable deductions exceed its taxable income in a certain tax year.

Q: How can partnerships and LLCs claim the net operating loss deduction?

A: Partnerships and LLCs can claim the net operating loss deduction by using the NYC-NOLD-UBTP computation method and reporting it on their New York City tax return.

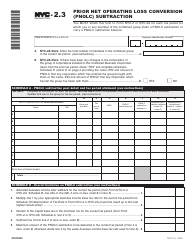

Q: Are there any limitations or restrictions on the net operating loss deduction?

A: Yes, there are limitations and restrictions on the net operating loss deduction, which may vary based on specific circumstances. It is advisable to consult the official guidelines or seek professional tax advice for accurate and up-to-date information.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-NOLD-UBTP by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.