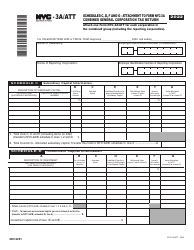

This version of the form is not currently in use and is provided for reference only. Download this version of

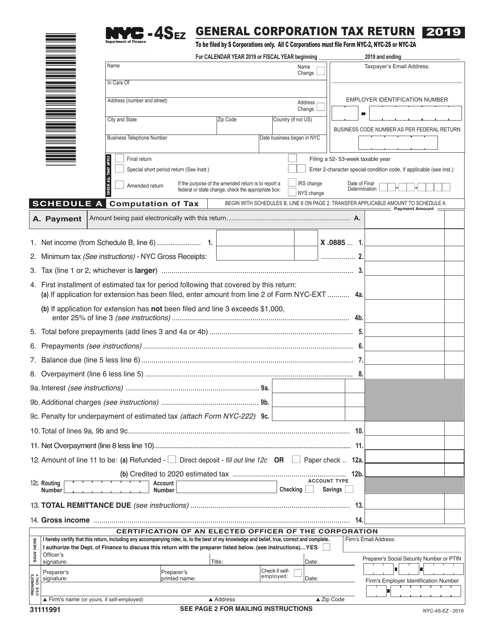

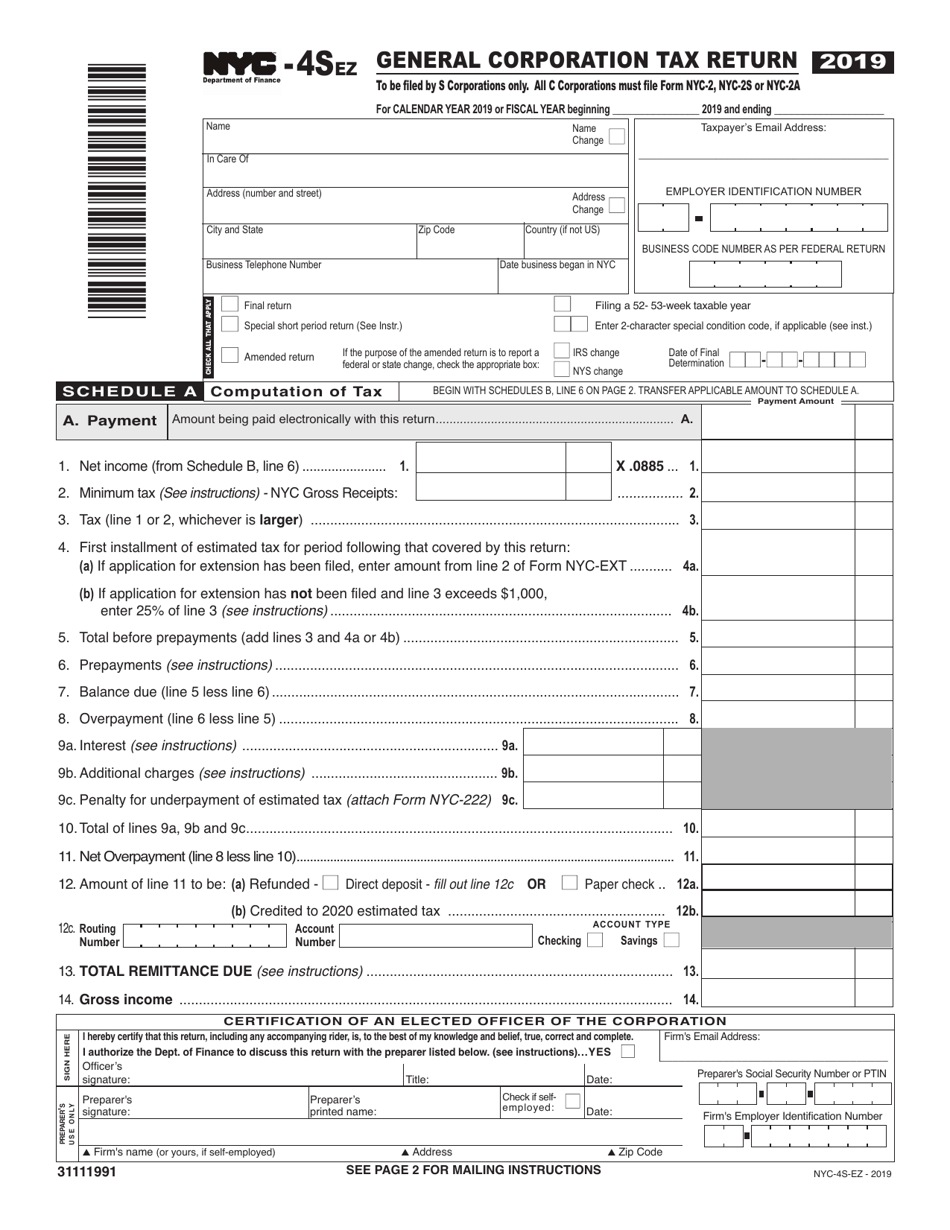

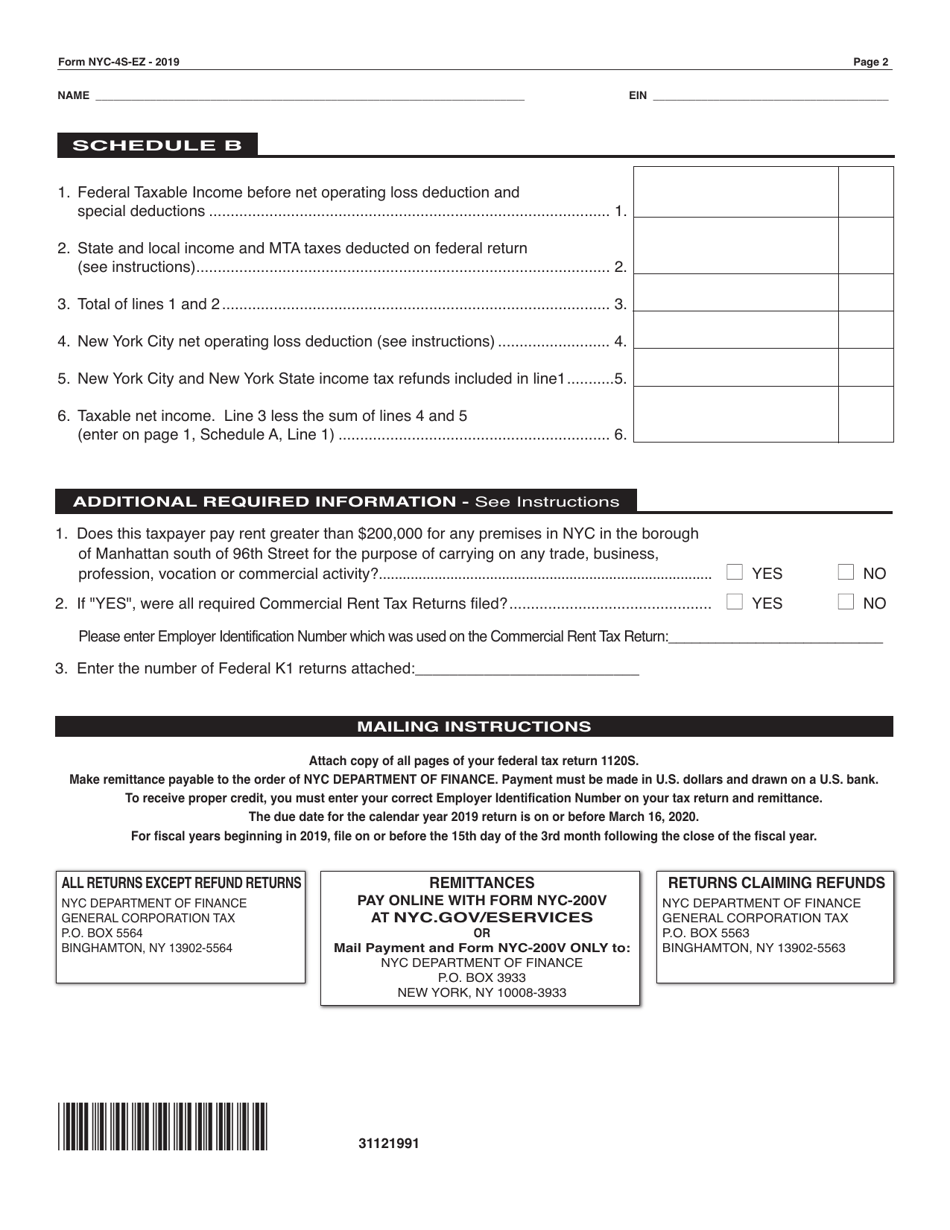

Form NYC-4S-EZ

for the current year.

Form NYC-4S-EZ General Corporation Tax Return - New York City

What Is Form NYC-4S-EZ?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

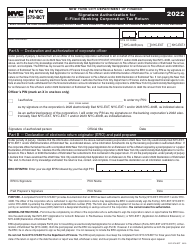

Q: What is the NYC-4S-EZ General Corporation Tax Return?

A: The NYC-4S-EZ General Corporation Tax Return is a tax form used by corporations in New York City to report and pay their general corporation tax.

Q: Who needs to file the NYC-4S-EZ General Corporation Tax Return?

A: Generally, any corporation that is subject to the general corporation tax in New York City needs to file the NYC-4S-EZ.

Q: How often do I need to file the NYC-4S-EZ General Corporation Tax Return?

A: The NYC-4S-EZ must be filed annually.

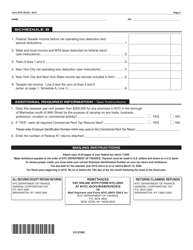

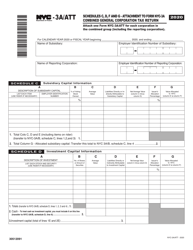

Q: What information is required to complete the NYC-4S-EZ General Corporation Tax Return?

A: The form requires information about the corporation's income, deductions, credits, and other relevant financial information.

Q: When is the deadline to file the NYC-4S-EZ General Corporation Tax Return?

A: The deadline to file the NYC-4S-EZ is generally on or before the 15th day of the fourth month following the close of the corporation's tax year.

Q: Are there any penalties for not filing the NYC-4S-EZ General Corporation Tax Return?

A: Yes, there are penalties for not filing or filing late, including interest charges on any unpaid tax amounts.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-4S-EZ by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.