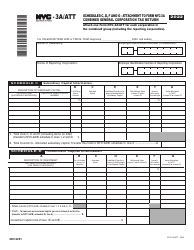

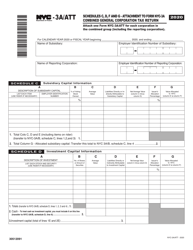

This version of the form is not currently in use and is provided for reference only. Download this version of

Form NYC-ATT-S-CORP

for the current year.

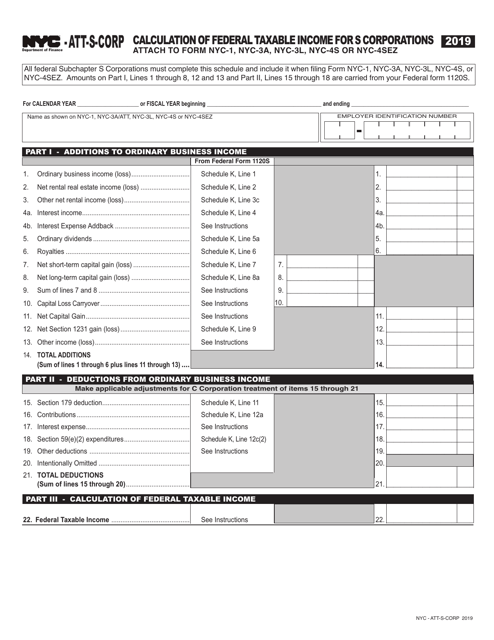

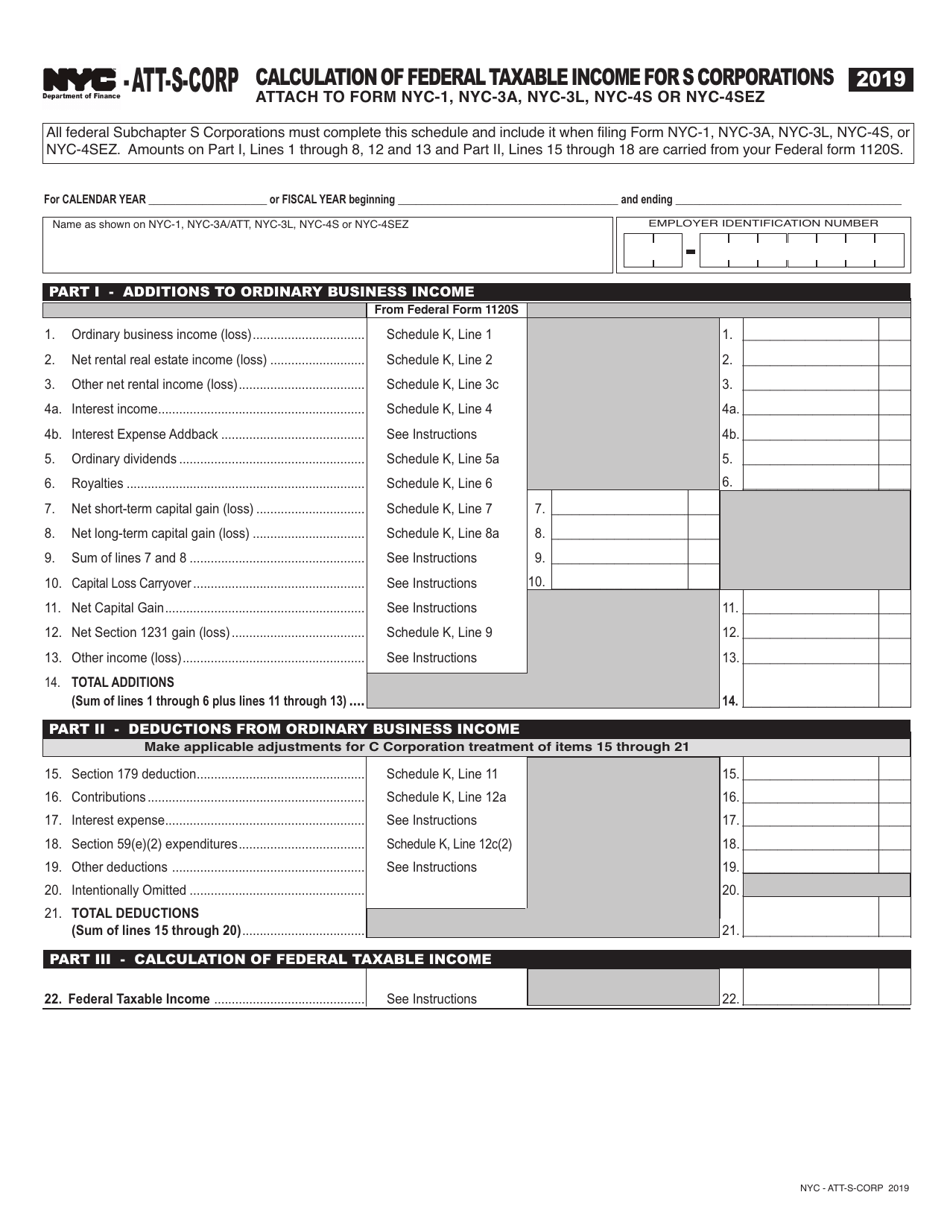

Form NYC-ATT-S-CORP Calculation of Federal Taxable Income for S Corporations - New York City

What Is Form NYC-ATT-S-CORP?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an S Corporation?

A: An S Corporation is a type of business entity that elects to pass corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes.

Q: What is Federal Taxable Income?

A: Federal Taxable Income is the amount of income that a business entity is subject to federal income tax on after deductions, exemptions, and credits.

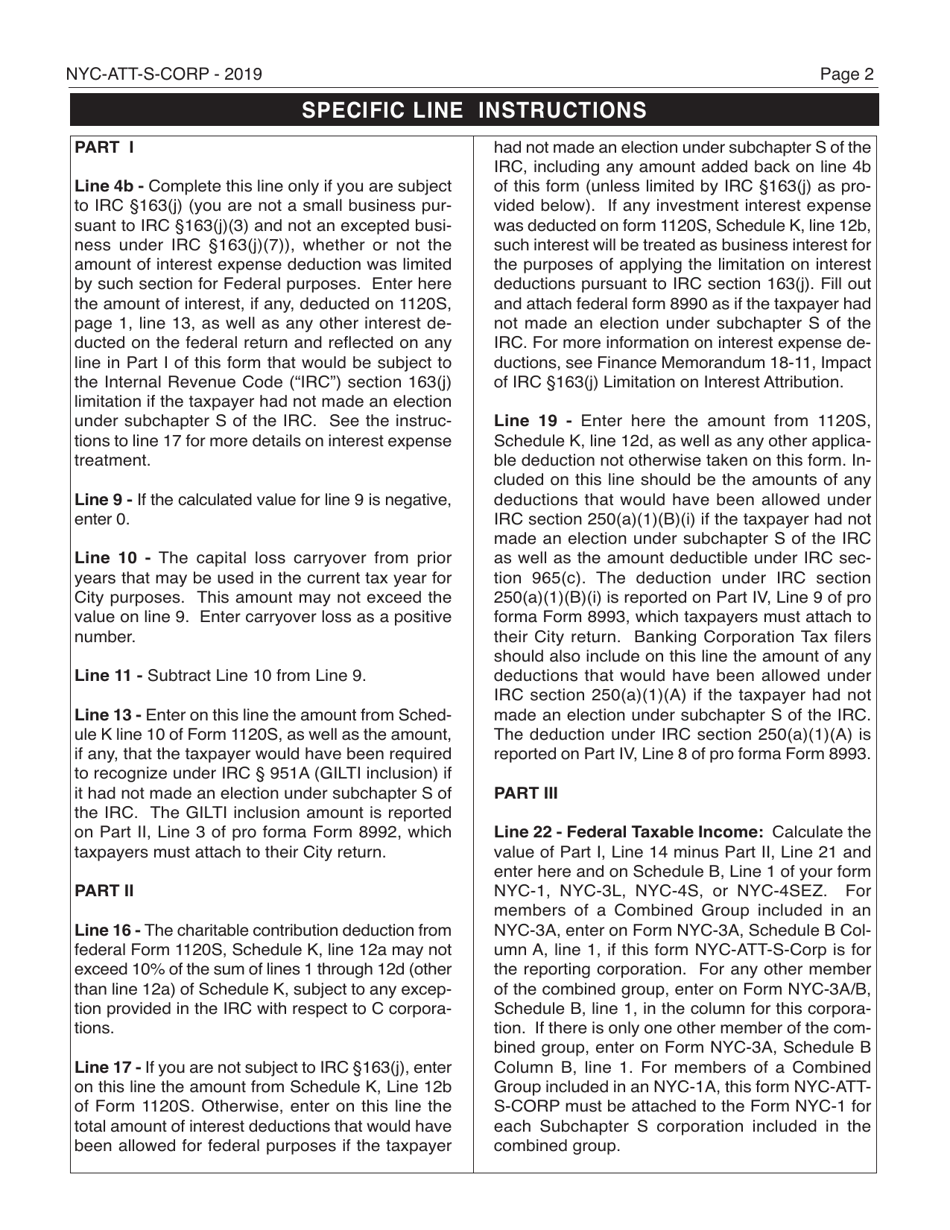

Q: How do you calculate Federal Taxable Income for an S Corporation in New York City?

A: To calculate Federal Taxable Income for an S Corporation in New York City, you would start with the corporation's federal taxable income and then make certain adjustments required by the city.

Q: What are the adjustments required by New York City?

A: The adjustments required by New York City may include items such as city-specific deductions, add-backs, or other modifications to federal taxable income.

Q: Why do S Corporations need to calculate Federal Taxable Income for New York City?

A: S Corporations need to calculate Federal Taxable Income for New York City in order to determine the amount of city income tax they owe to the city.

Q: What is the purpose of the NYC-ATT-S-CORP form?

A: The NYC-ATT-S-CORP form is used by S Corporations in New York City to calculate their Federal Taxable Income and determine their city income tax liability.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-ATT-S-CORP by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.