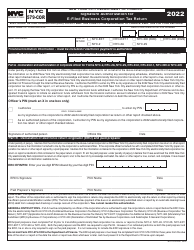

This version of the form is not currently in use and is provided for reference only. Download this version of

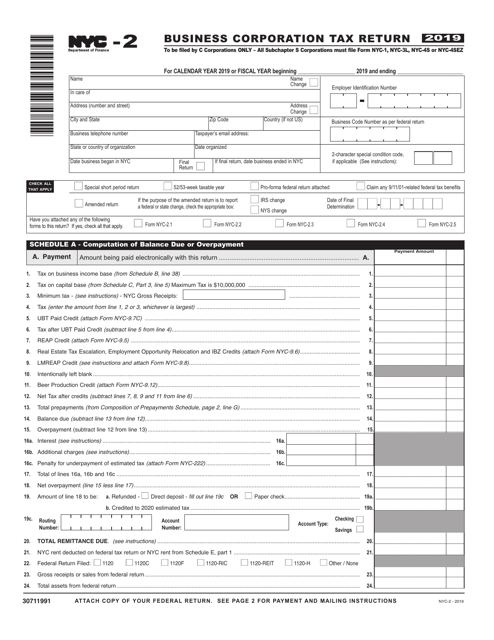

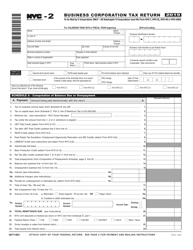

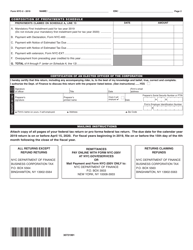

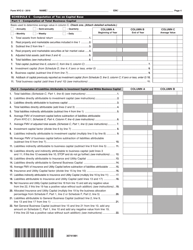

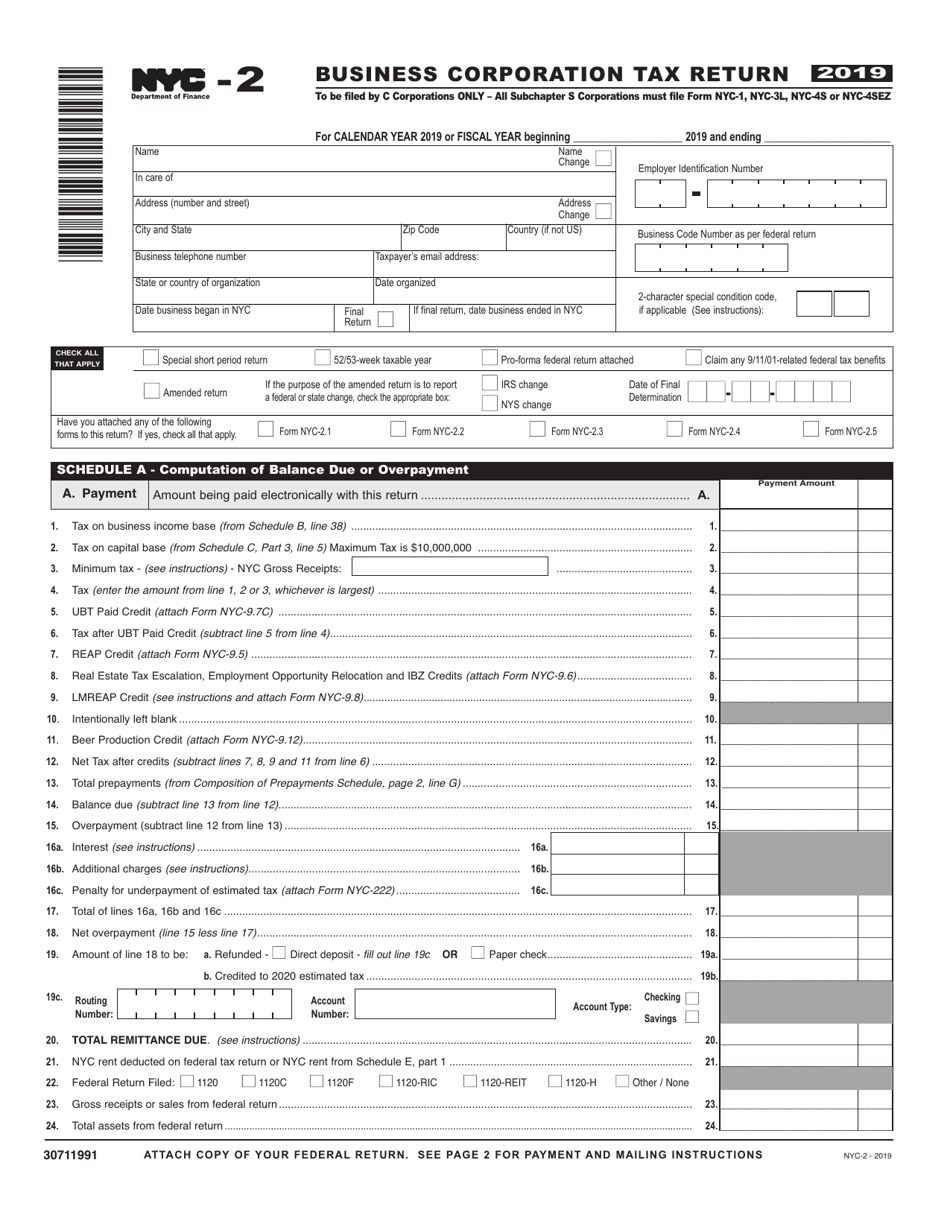

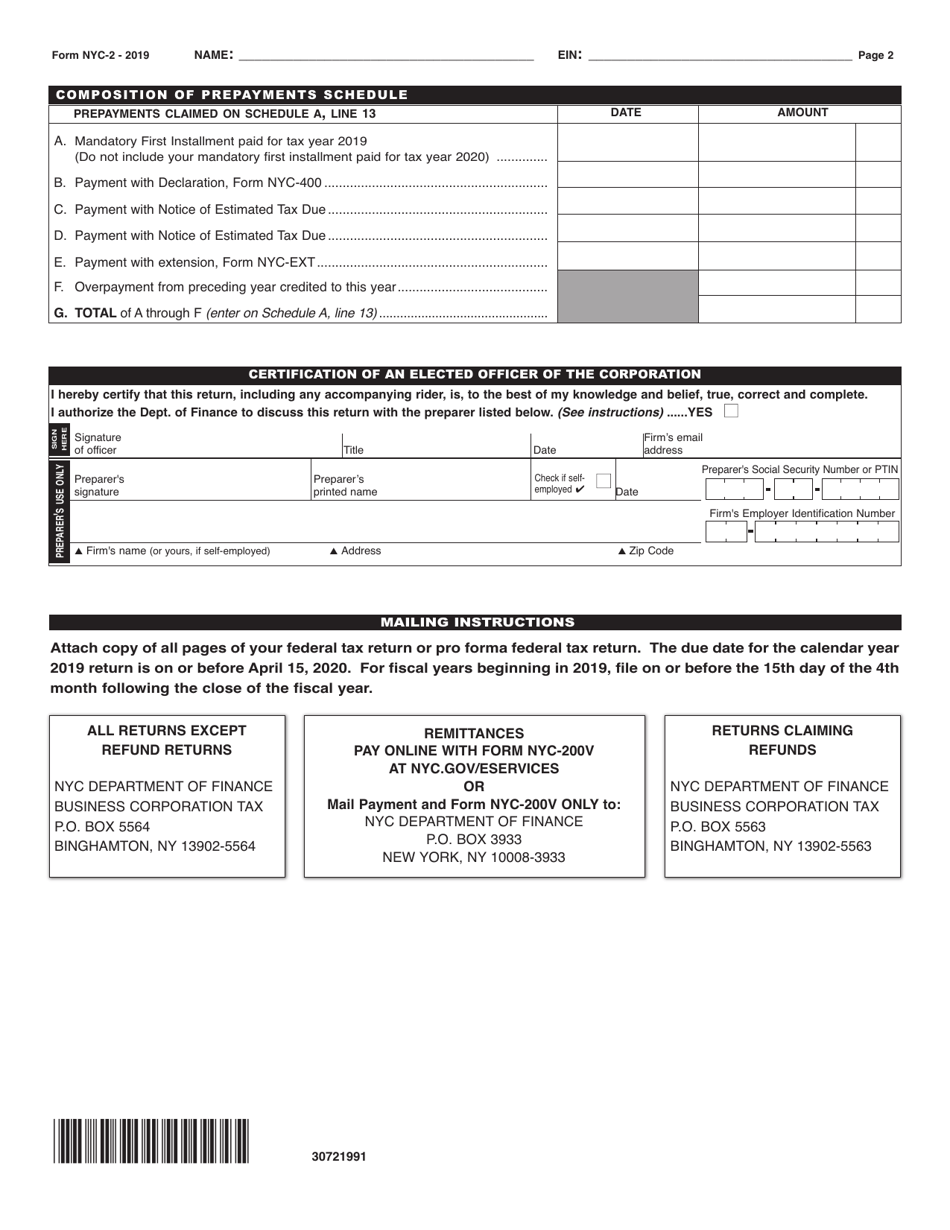

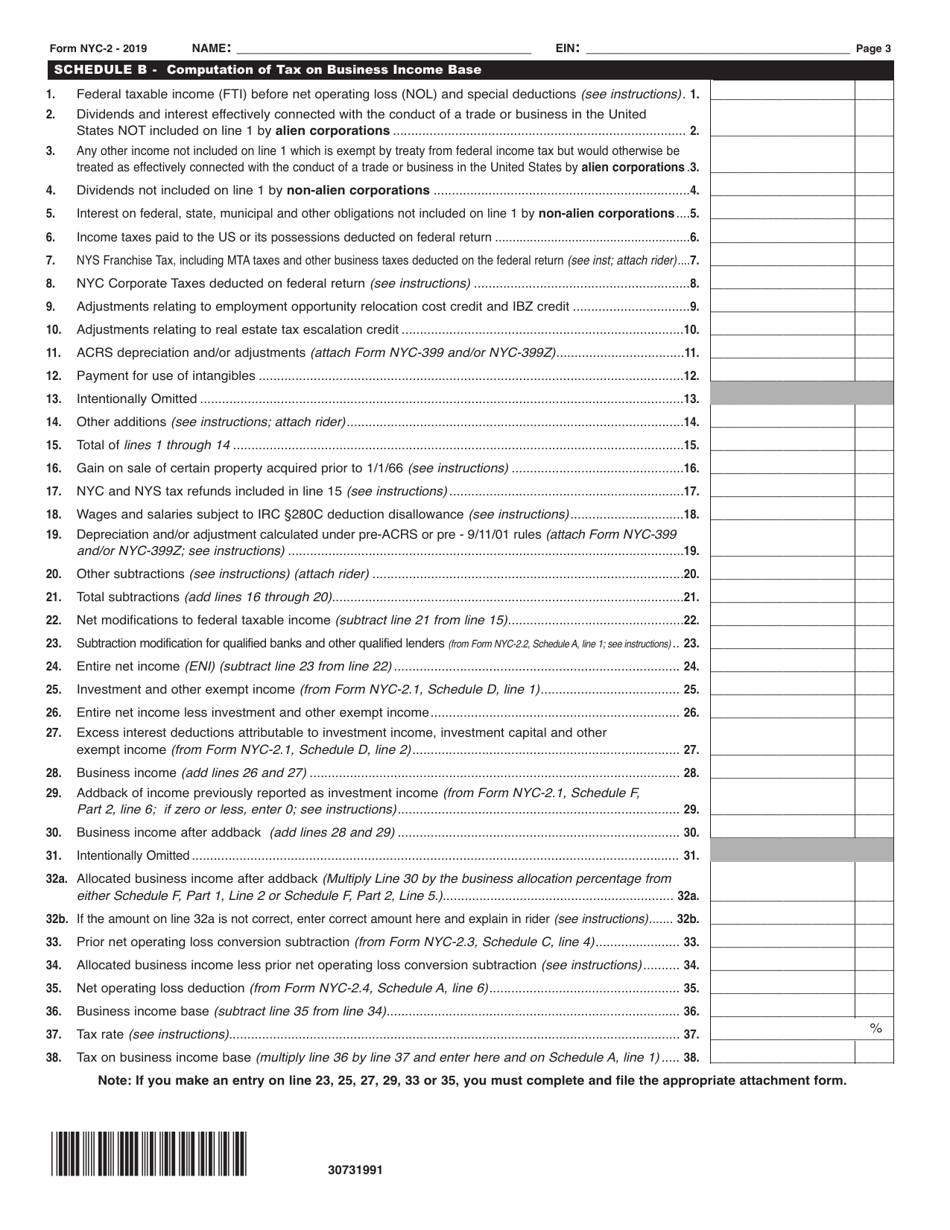

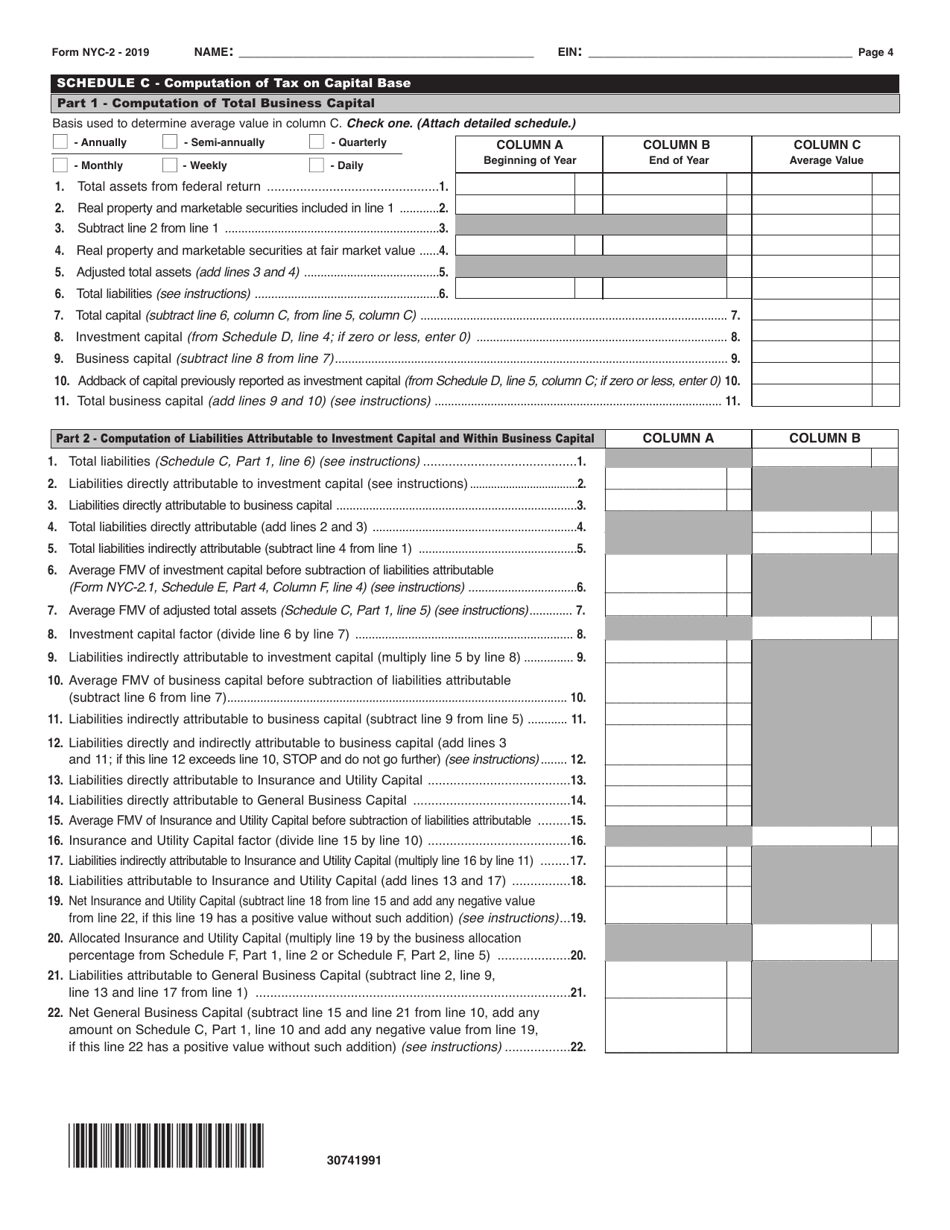

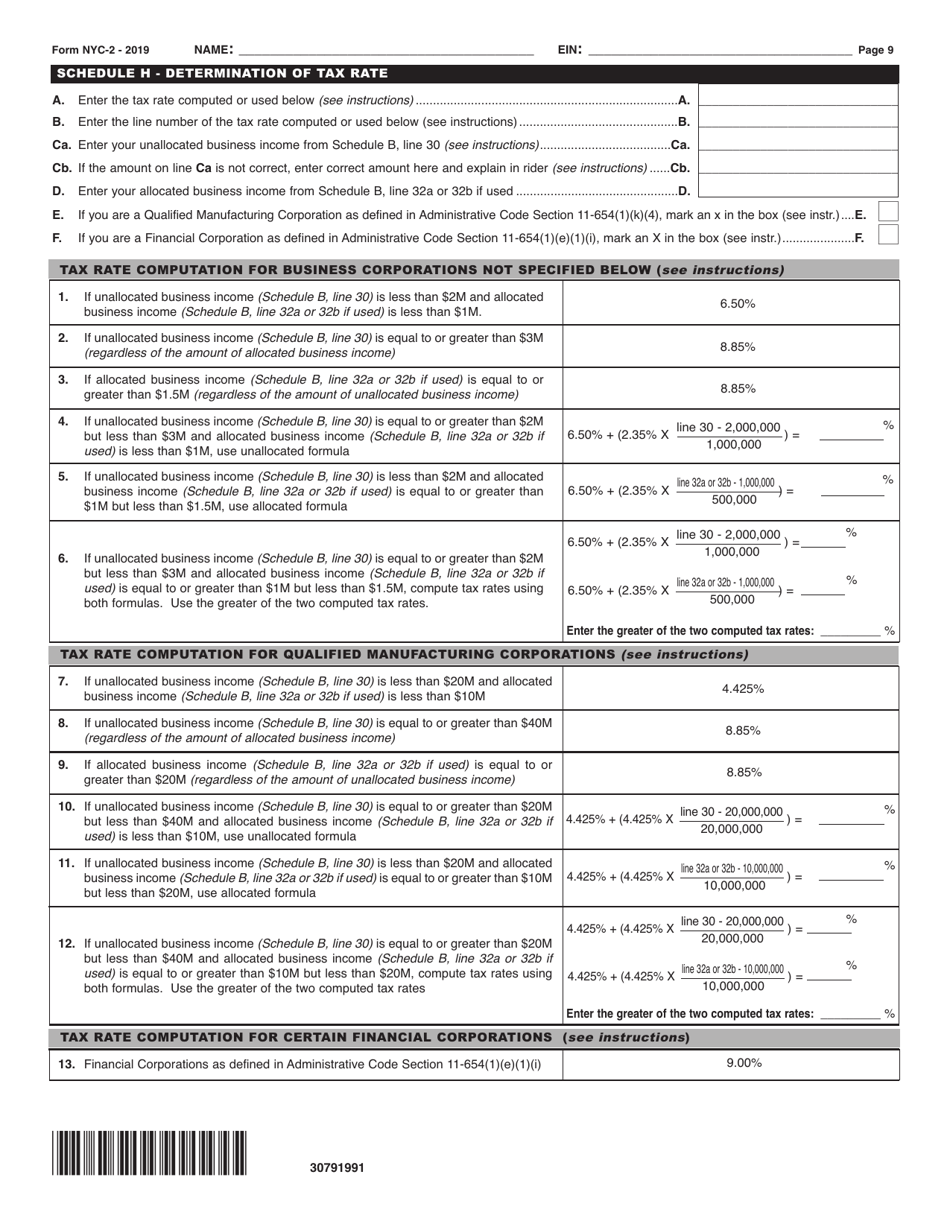

Form NYC-2

for the current year.

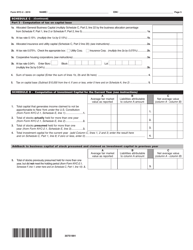

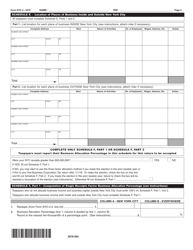

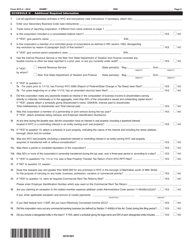

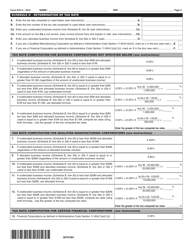

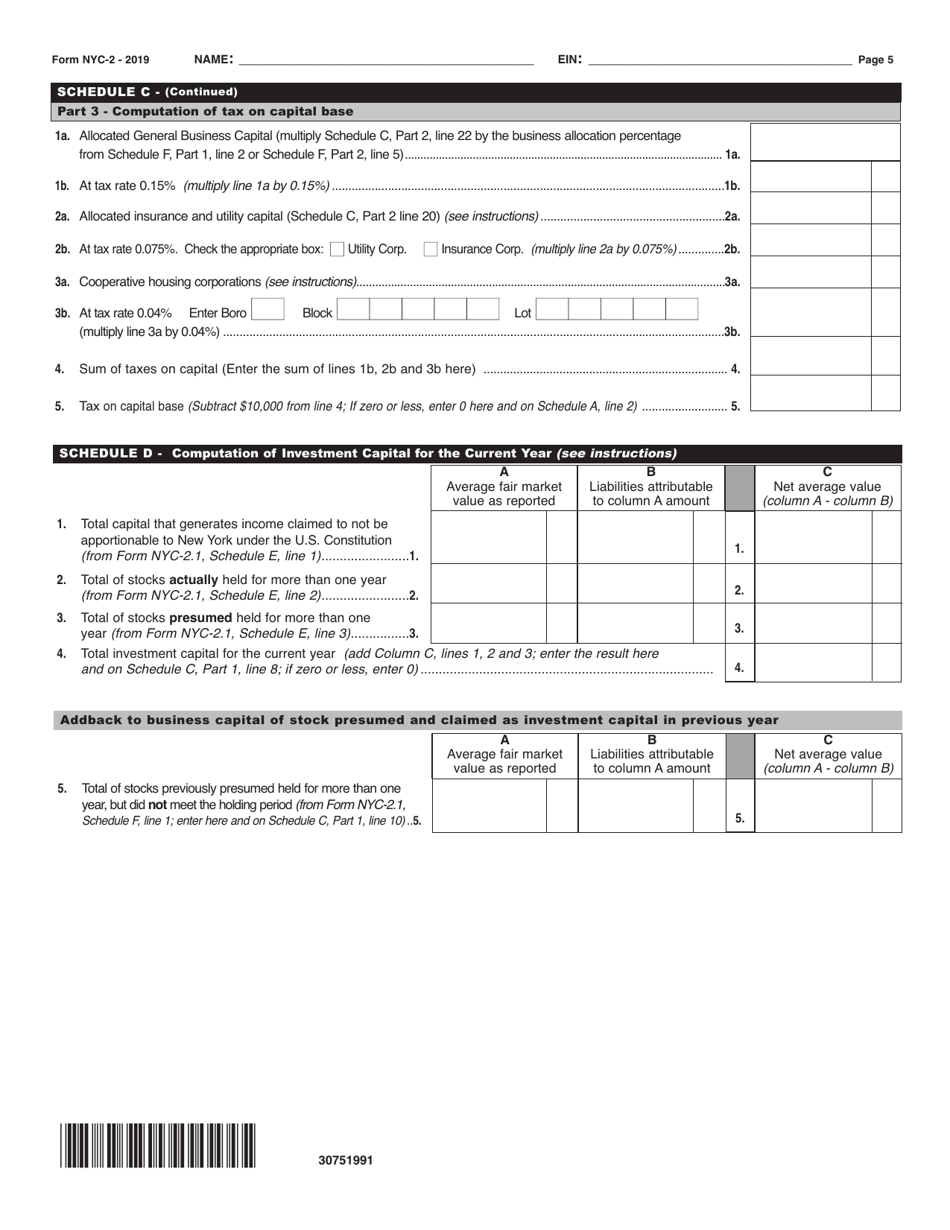

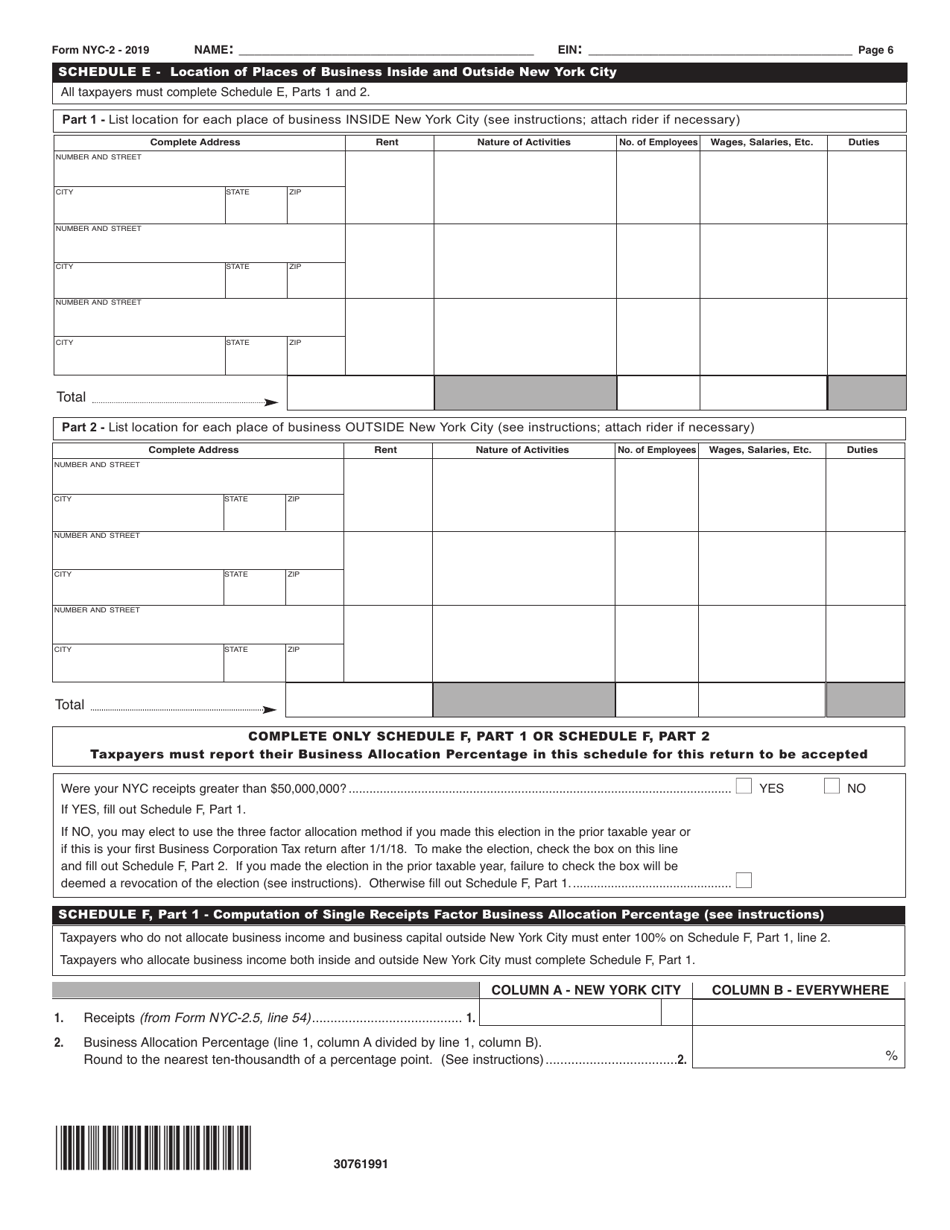

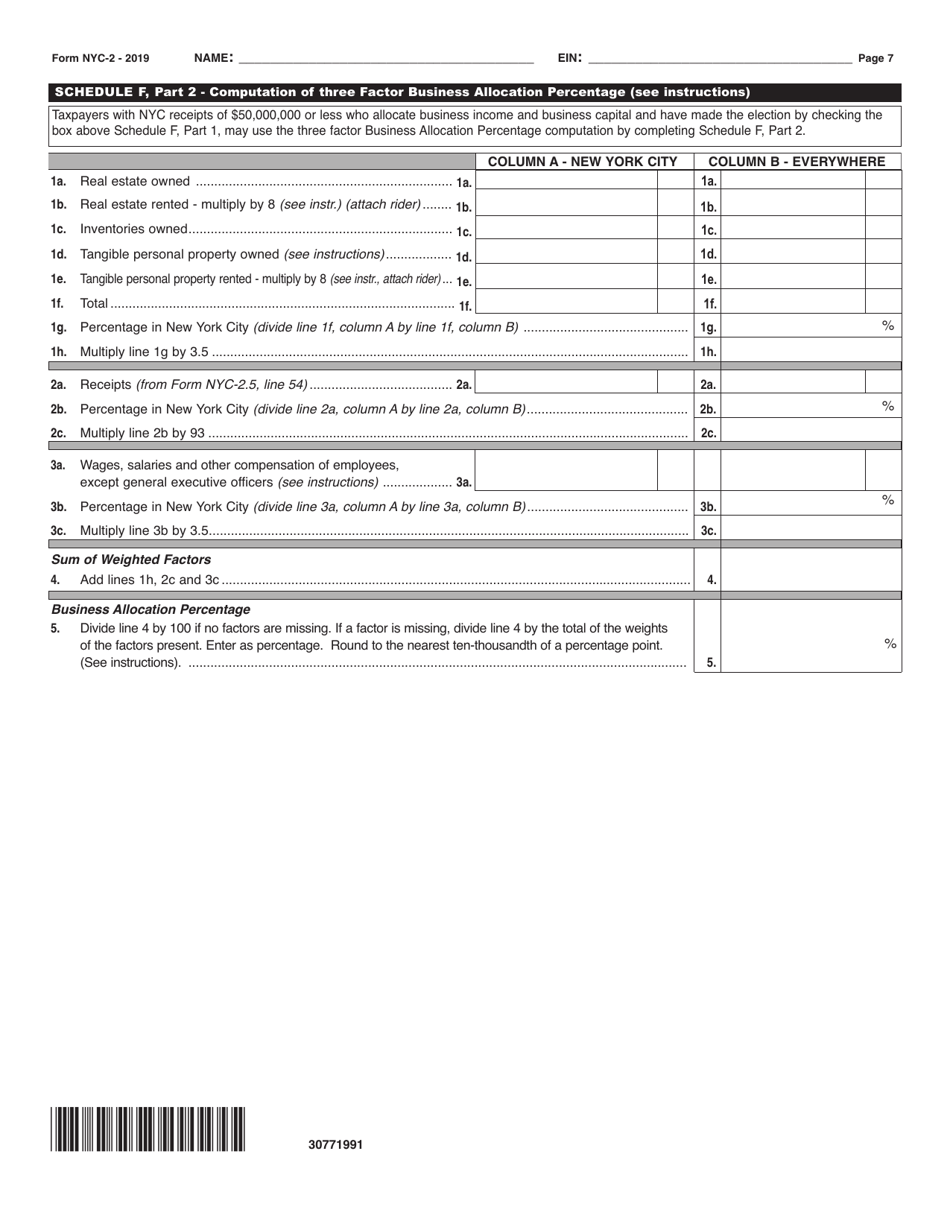

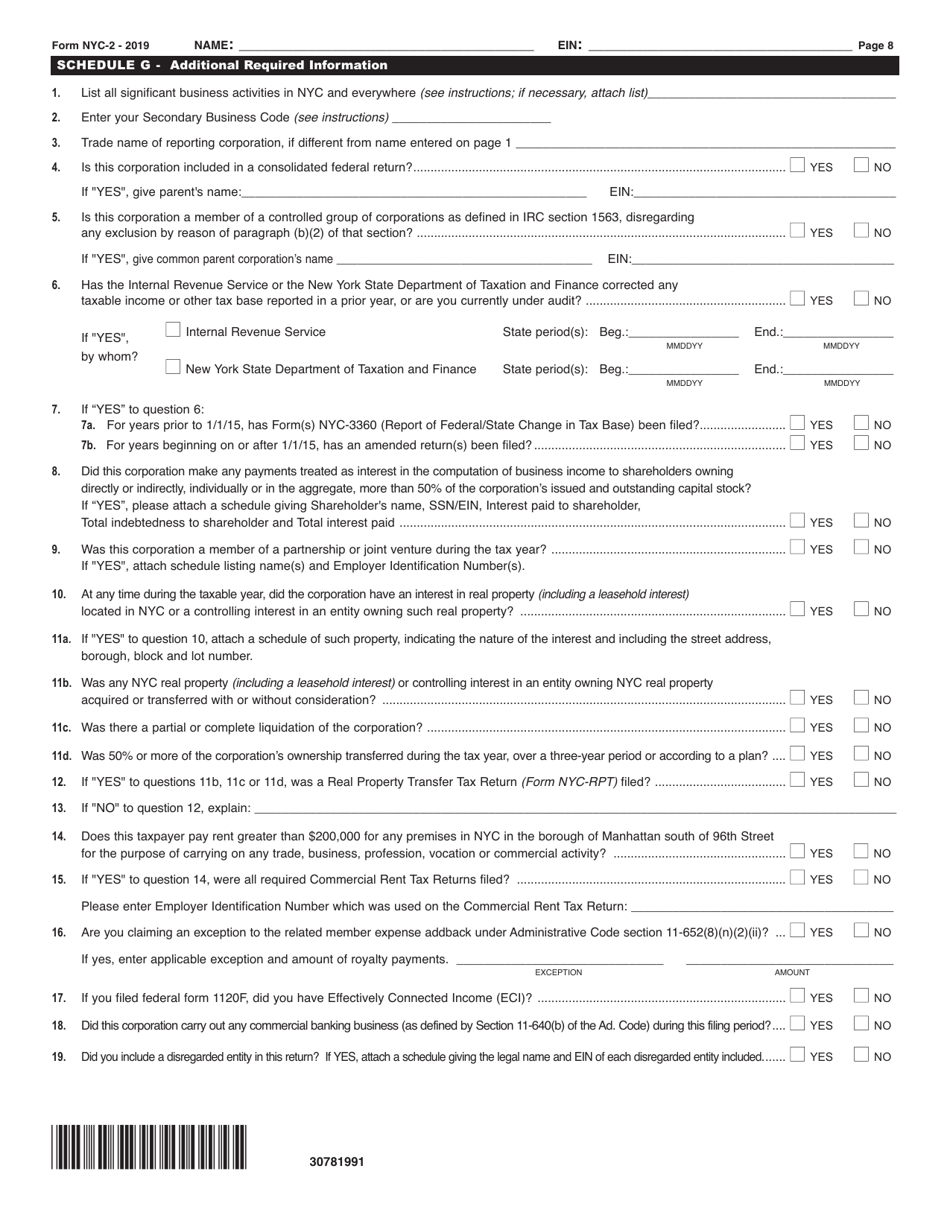

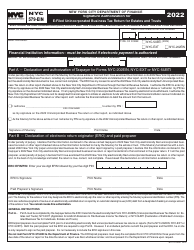

Form NYC-2 Business Corporation Tax Return - New York City

What Is Form NYC-2?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-2 Business Corporation Tax Return?

A: The NYC-2 Business Corporation Tax Return is a form used by businesses in New York City to report their corporate income and pay any taxes owed.

Q: Who needs to file the NYC-2 Business Corporation Tax Return?

A: All businesses that are subject to the New York City Business Corporation Tax must file the NYC-2 Business Corporation Tax Return.

Q: What is the deadline for filing the NYC-2 Business Corporation Tax Return?

A: The deadline for filing the NYC-2 Business Corporation Tax Return is generally April 15th for calendar year filers.

Q: What information do I need to complete the NYC-2 Business Corporation Tax Return?

A: You will need to provide information about your business income, deductions, credits, and other relevant financial details.

Q: Are there any penalties for late filing or non-filing of the NYC-2 Business Corporation Tax Return?

A: Yes, there are penalties for late filing or non-filing of the NYC-2 Business Corporation Tax Return. It is important to file on time to avoid these penalties.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.