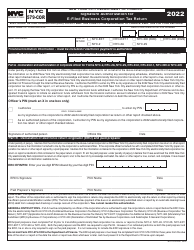

This version of the form is not currently in use and is provided for reference only. Download this version of

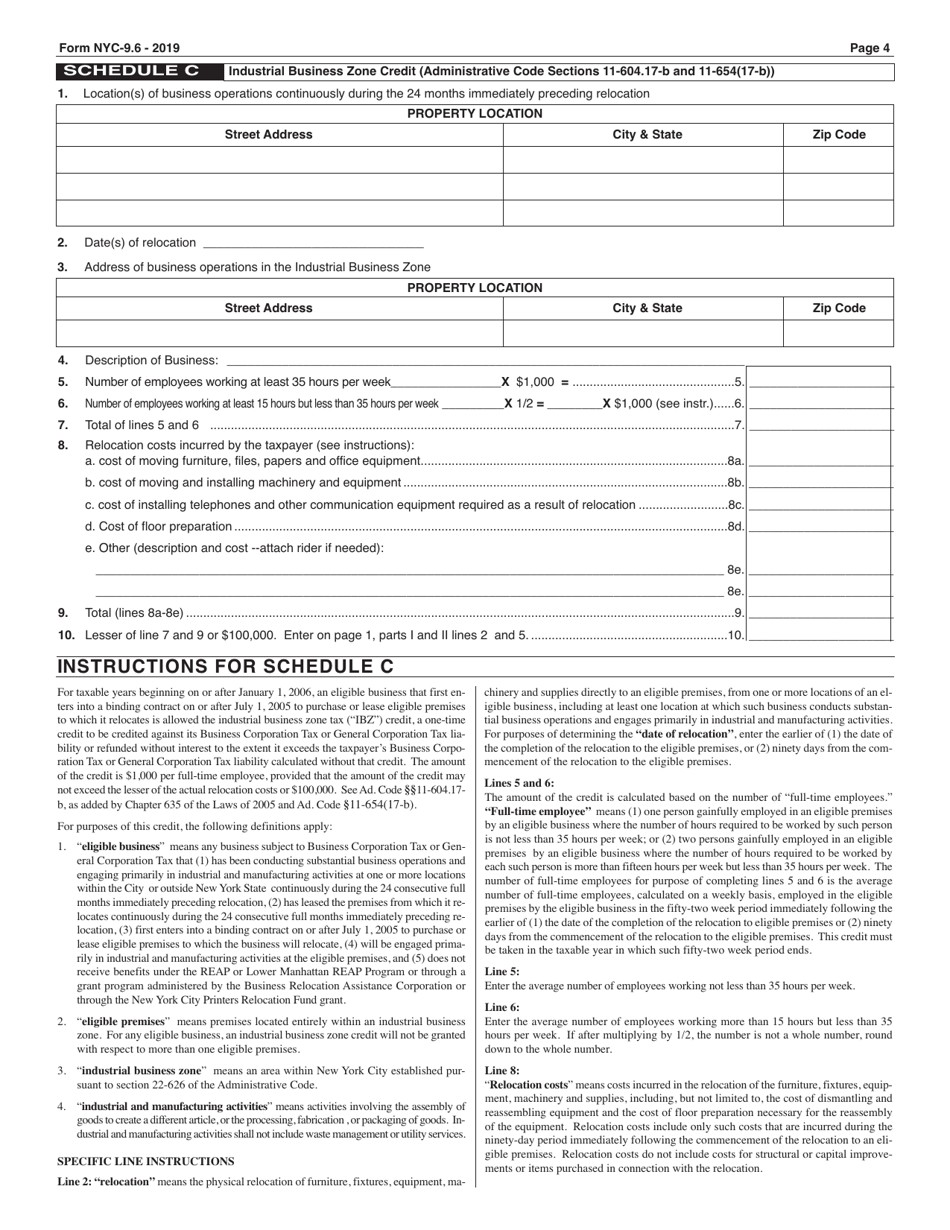

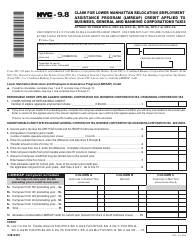

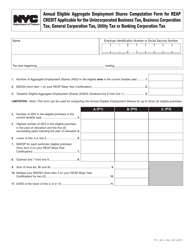

Form NYC-9.6

for the current year.

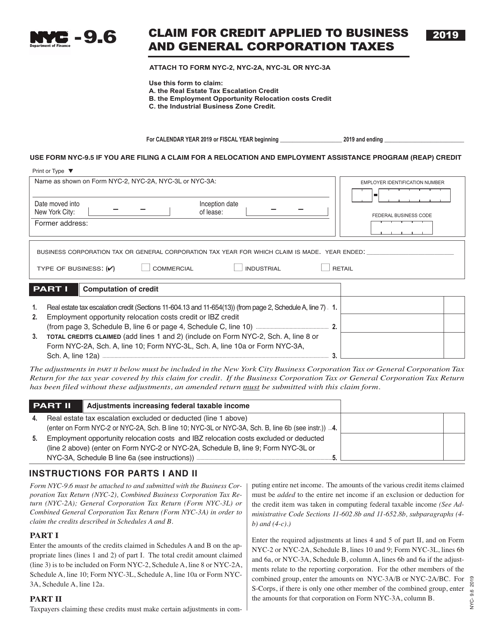

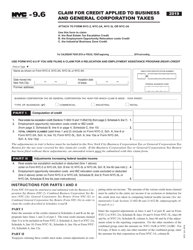

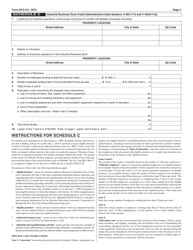

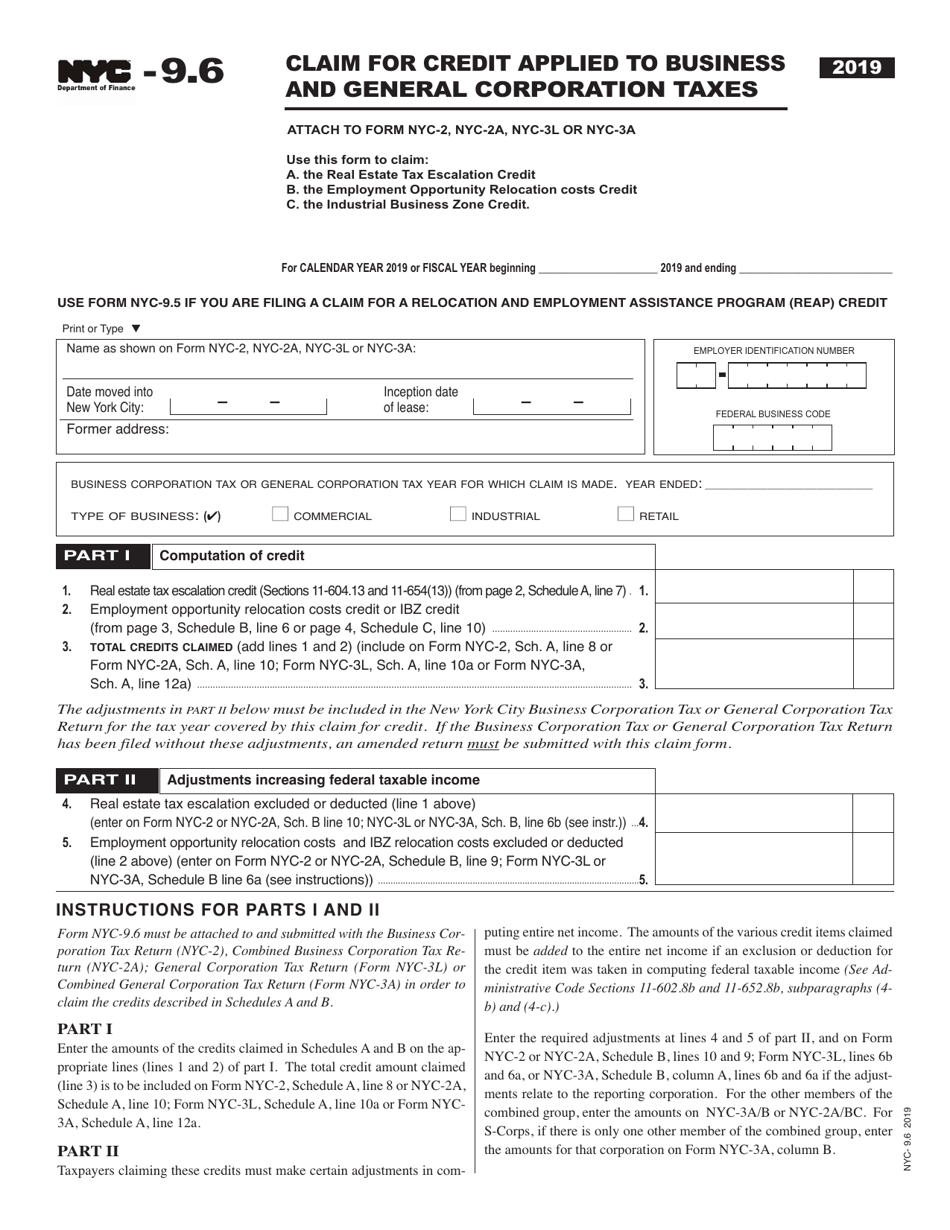

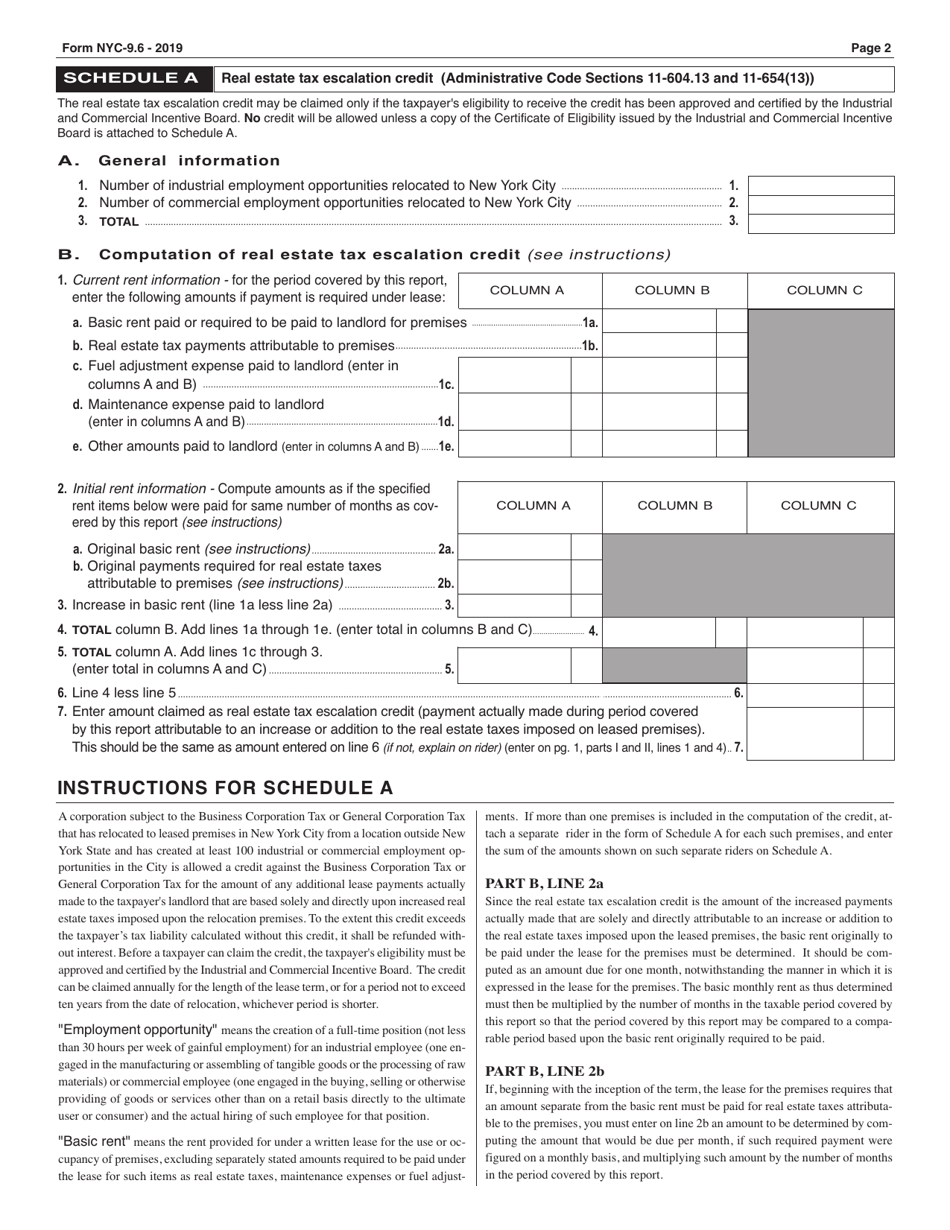

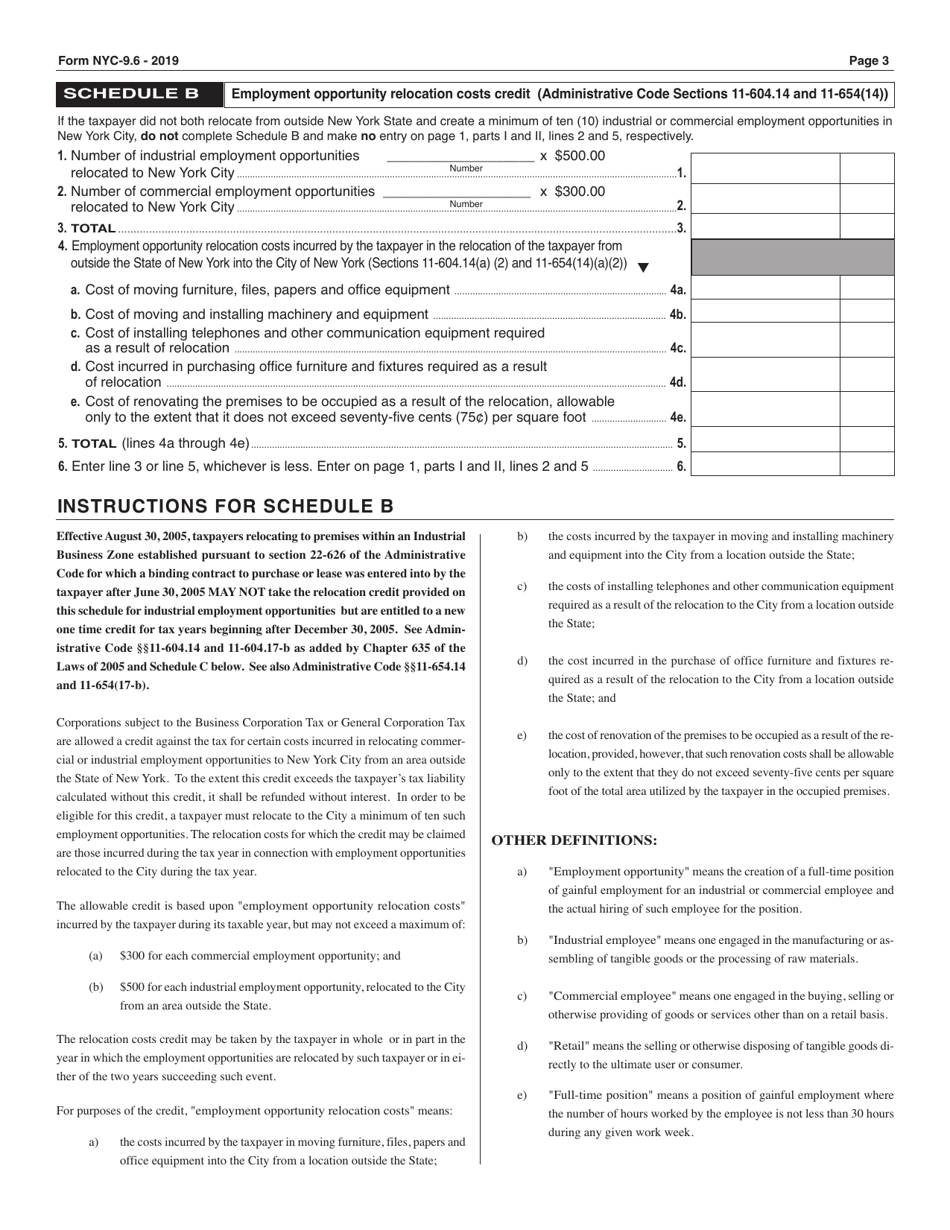

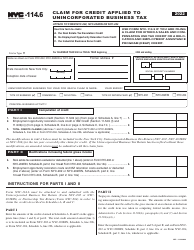

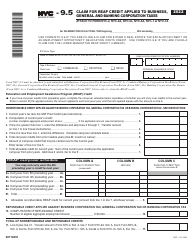

Form NYC-9.6 Claim for Credit Applied to Business and General Corporation Taxes - New York City

What Is Form NYC-9.6?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-9.6?

A: NYC-9.6 is a form used to claim credits applied to Business and General Corporation Taxes in New York City.

Q: Who can use the NYC-9.6 form?

A: The NYC-9.6 form can be used by businesses and corporations that are liable for taxes in New York City.

Q: What is the purpose of the NYC-9.6 form?

A: The purpose of the NYC-9.6 form is to claim credits that can be applied to Business and General Corporation Taxes in New York City.

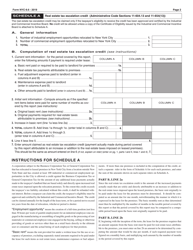

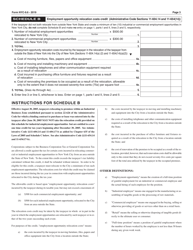

Q: What types of credits can be claimed using the NYC-9.6 form?

A: The NYC-9.6 form allows businesses and corporations to claim various tax credits, such as investment credits, startup investment credits, empire zone investment credits, and energy investment credits.

Q: Is there a deadline for submitting the NYC-9.6 form?

A: Yes, the deadline for submitting the NYC-9.6 form generally coincides with the deadline for filing the Business and General Corporation Tax return in New York City.

Q: Are there any specific instructions for completing the NYC-9.6 form?

A: Yes, the NYC-9.6 form comes with detailed instructions that provide guidance on how to complete the form accurately.

Q: Can I file the NYC-9.6 form electronically?

A: Yes, businesses and corporations can file the NYC-9.6 form electronically using the New York State Department of Taxation and Finance's e-file system.

Q: What should I do if I need assistance with the NYC-9.6 form?

A: If you need assistance with the NYC-9.6 form, you can contact the New York City Department of Finance or consult a tax professional for guidance.

Q: Can the NYC-9.6 form be used for personal income tax purposes?

A: No, the NYC-9.6 form is specifically for claiming credits applied to Business and General Corporation Taxes in New York City and cannot be used for personal income tax purposes.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-9.6 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.