This version of the form is not currently in use and is provided for reference only. Download this version of

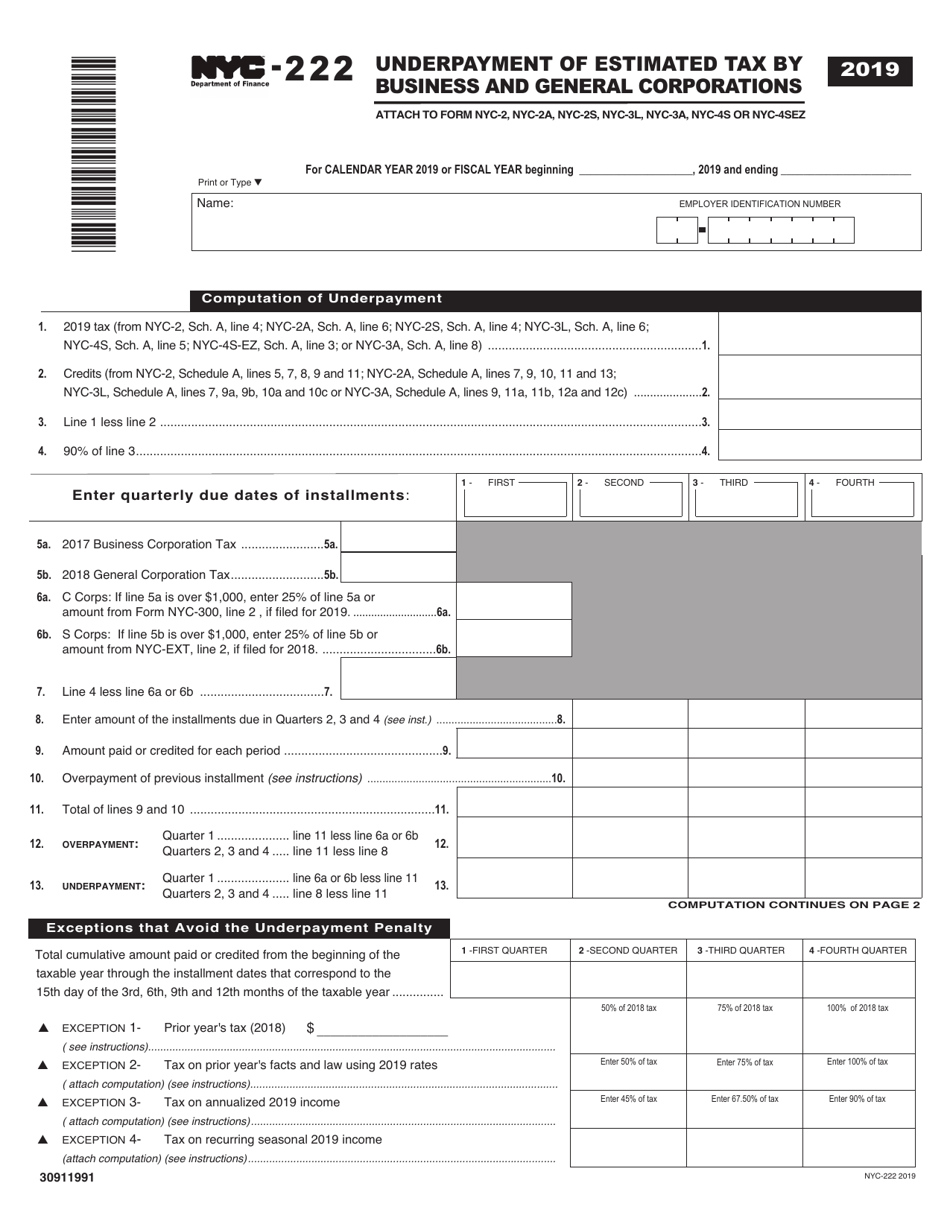

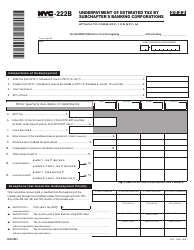

Form NYC-222

for the current year.

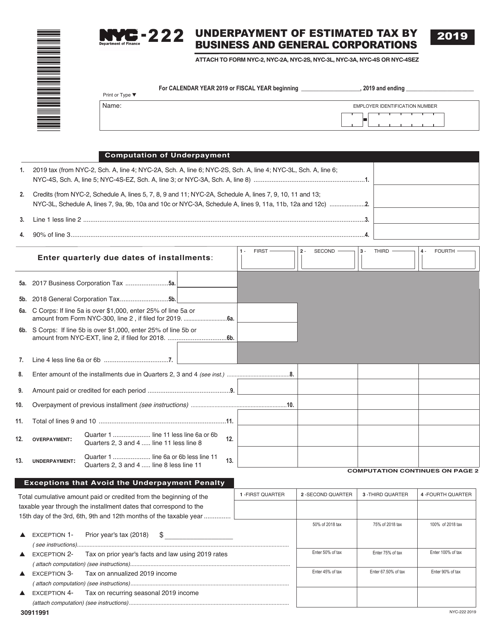

Form NYC-222 Underpayment of Estimated Tax by Business and General Corporations - New York City

What Is Form NYC-222?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

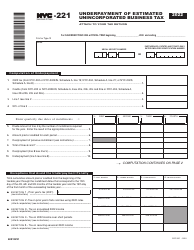

Q: What is the NYC-222 form?

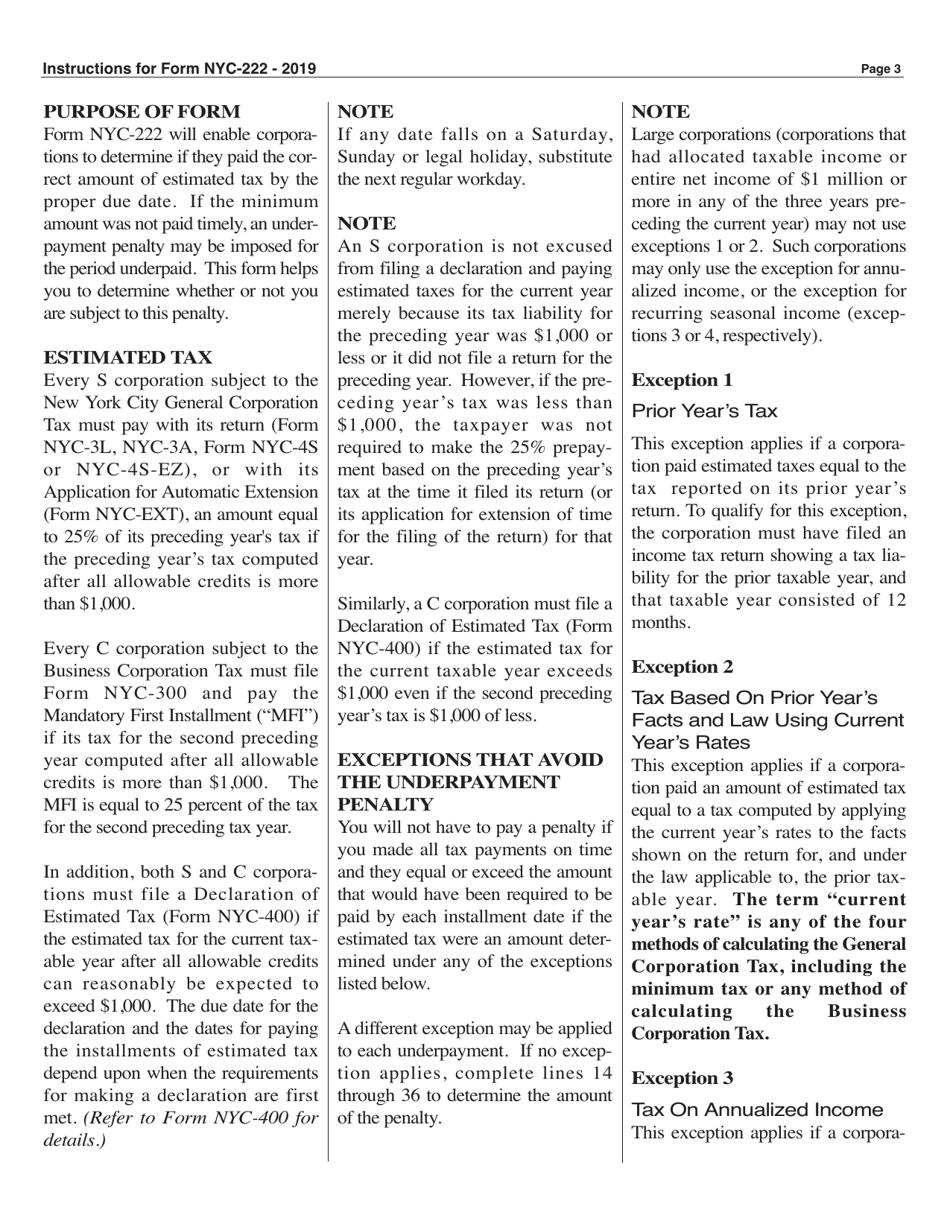

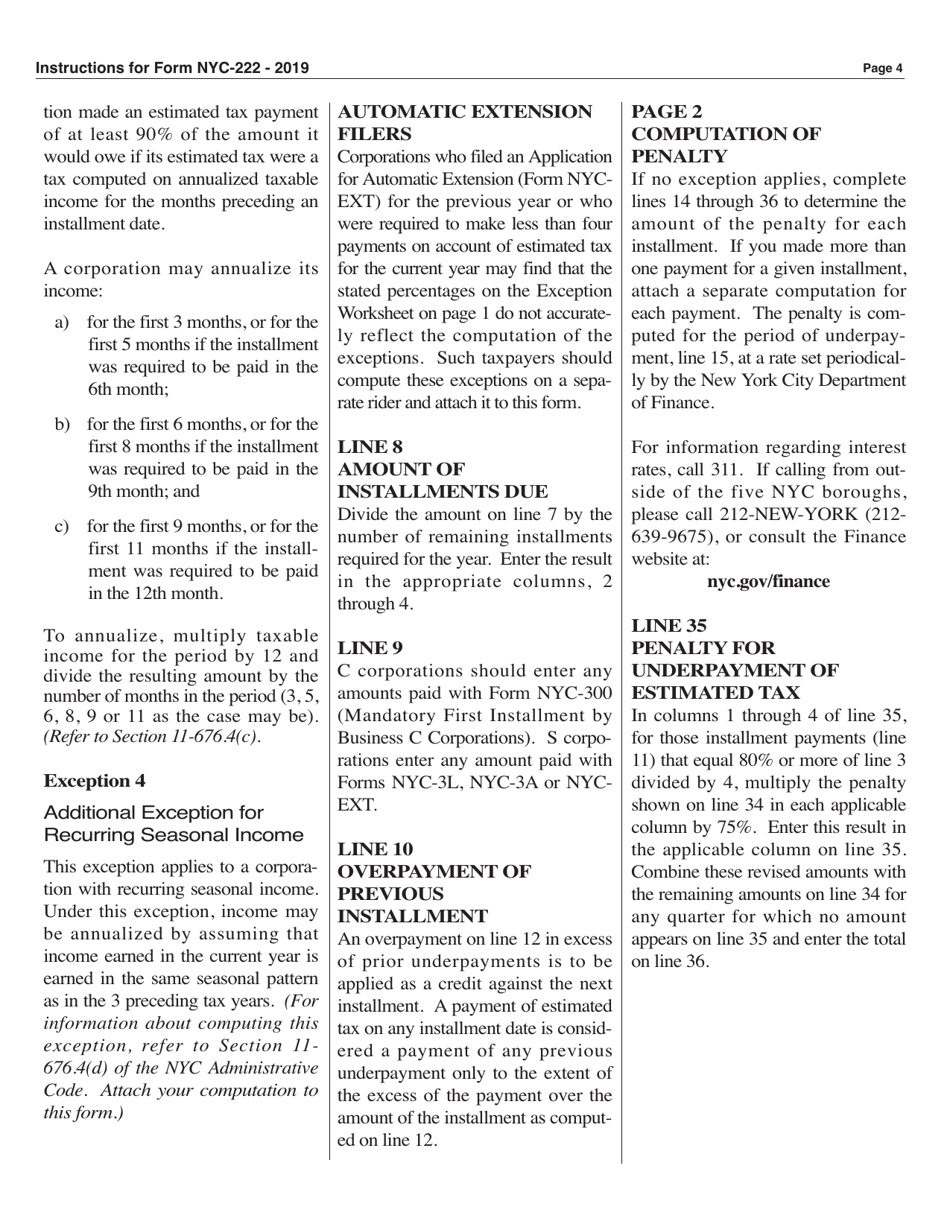

A: The NYC-222 form is a form used by business and general corporations in New York City to report underpayment of estimated taxes.

Q: Who is required to file the NYC-222 form?

A: Business and general corporations in New York City that have underpaid their estimated taxes are required to file the NYC-222 form.

Q: What is underpayment of estimated tax?

A: Underpayment of estimated tax occurs when a business or general corporation pays less than the required amount of estimated tax throughout the year.

Q: When is the NYC-222 form due?

A: The NYC-222 form is due on or before the 15th day of the third month following the end of the tax year.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-222 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.