This version of the form is not currently in use and is provided for reference only. Download this version of

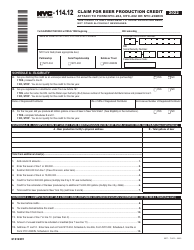

Form NYC-9.12

for the current year.

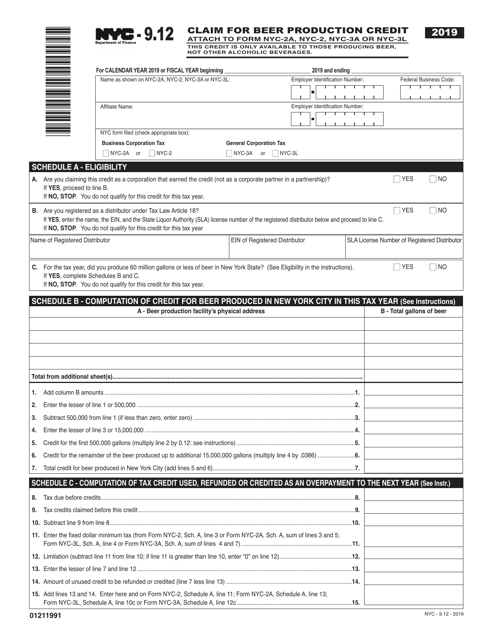

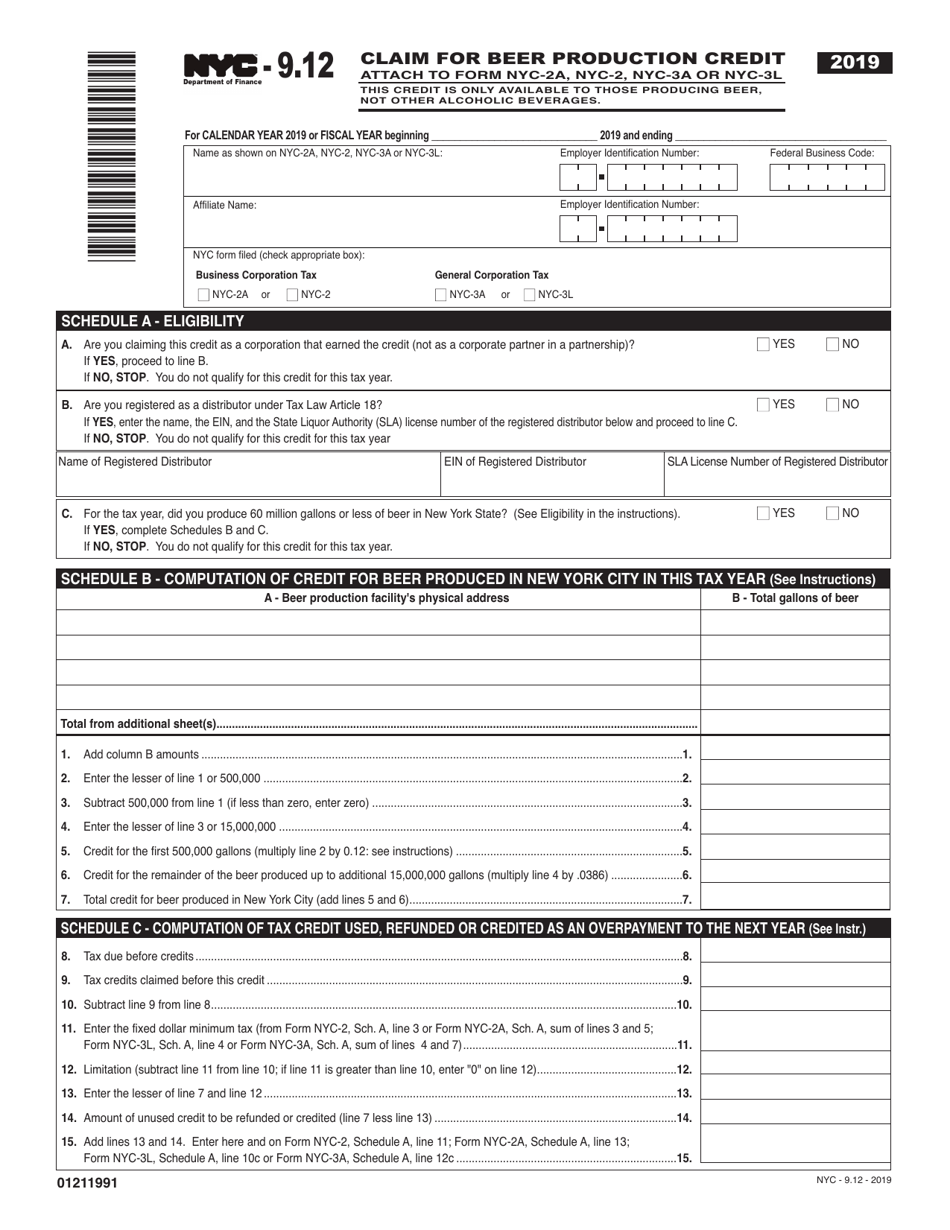

Form NYC-9.12 Claim for Beer Production Credit - New York City

What Is Form NYC-9.12?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-9.12?

A: NYC-9.12 is a claim form for Beer Production Credit in New York City.

Q: What is the purpose of NYC-9.12?

A: The purpose of NYC-9.12 is to claim the Beer Production Credit in New York City.

Q: Who can use NYC-9.12?

A: This form can be used by individuals or businesses engaged in beer production in New York City.

Q: What is the Beer Production Credit?

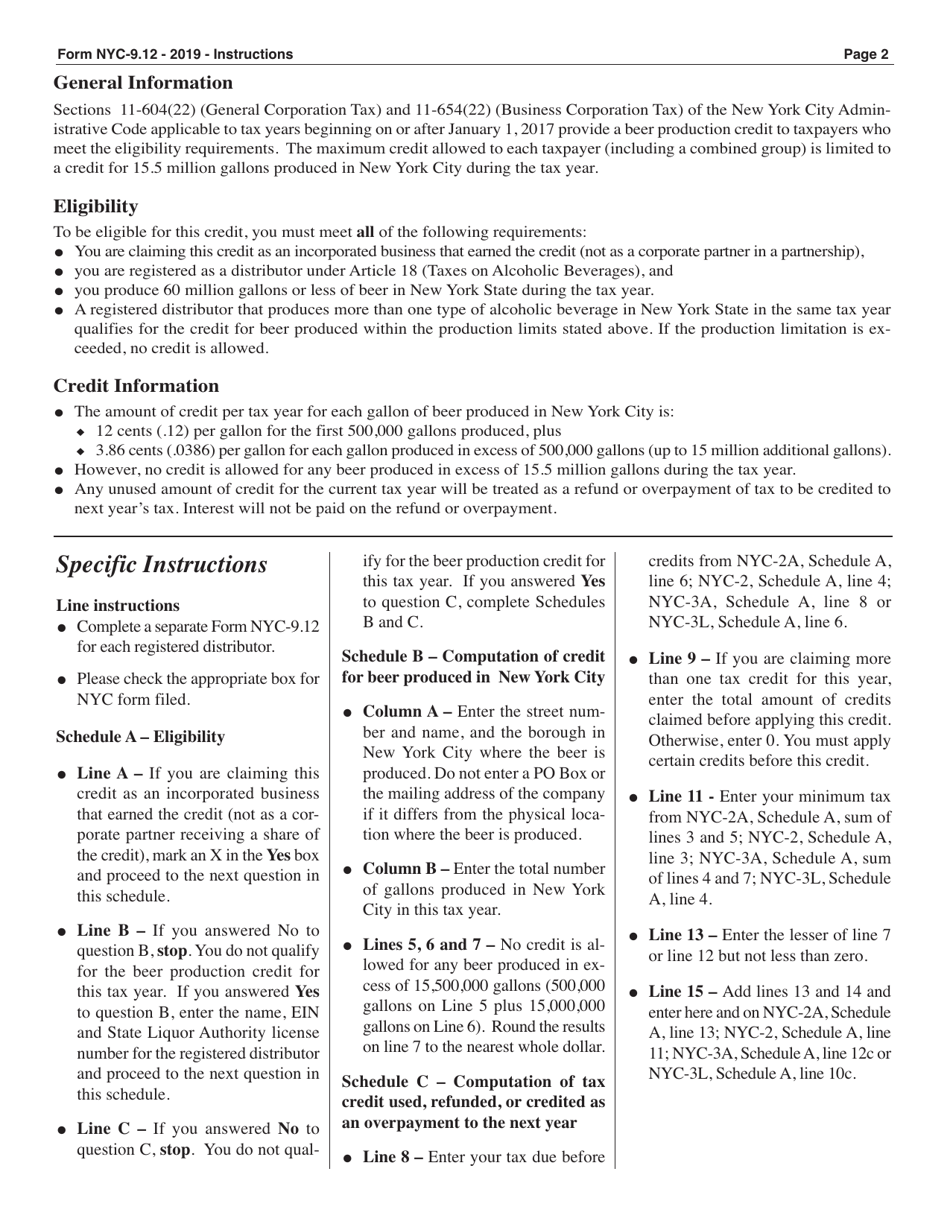

A: The Beer Production Credit is a tax credit available to beer producers in New York City.

Q: How can I qualify for the Beer Production Credit?

A: To qualify for the Beer Production Credit, you must meet certain criteria, such as producing beer in New York City and meeting production volume requirements.

Q: Is there a deadline to submit the NYC-9.12 form?

A: Yes, the NYC-9.12 form must be filed by the due date specified by the New York City Department of Finance.

Q: Are there any supporting documents required with the NYC-9.12 form?

A: Yes, you may need to attach supporting documents such as production records and sales invoices.

Q: What happens after I submit the NYC-9.12 form?

A: After you submit the NYC-9.12 form, it will be reviewed by the New York City Department of Finance, and if approved, you may receive the Beer Production Credit.

Q: Can I claim the Beer Production Credit for previous years?

A: No, the Beer Production Credit can only be claimed for the current tax year.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-9.12 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.