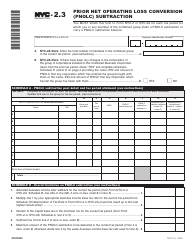

This version of the form is not currently in use and is provided for reference only. Download this version of

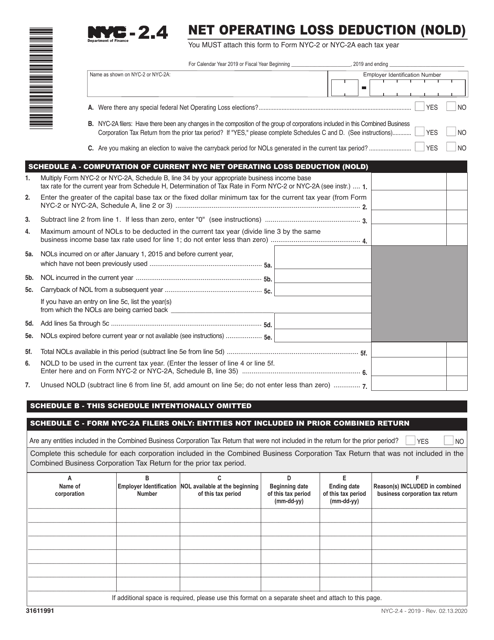

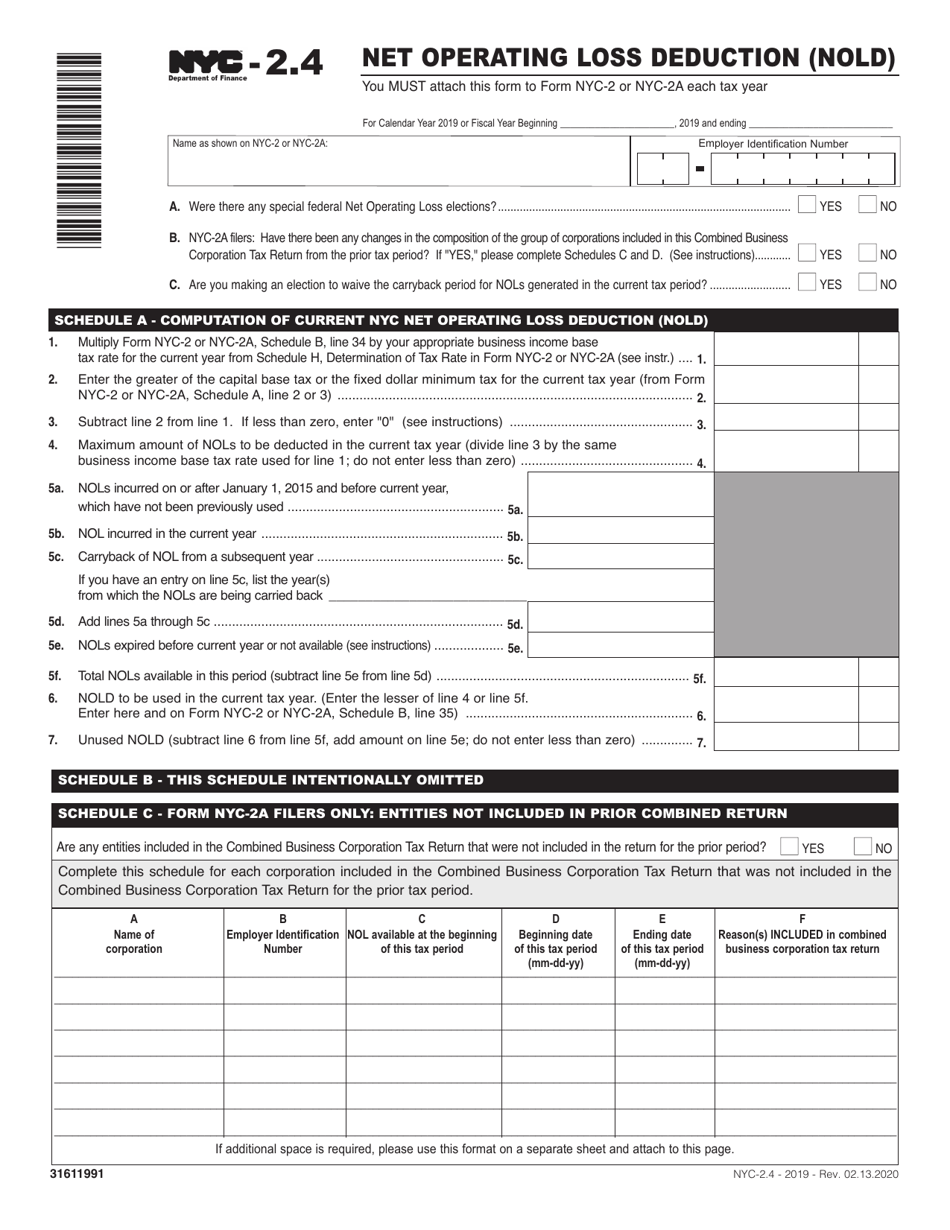

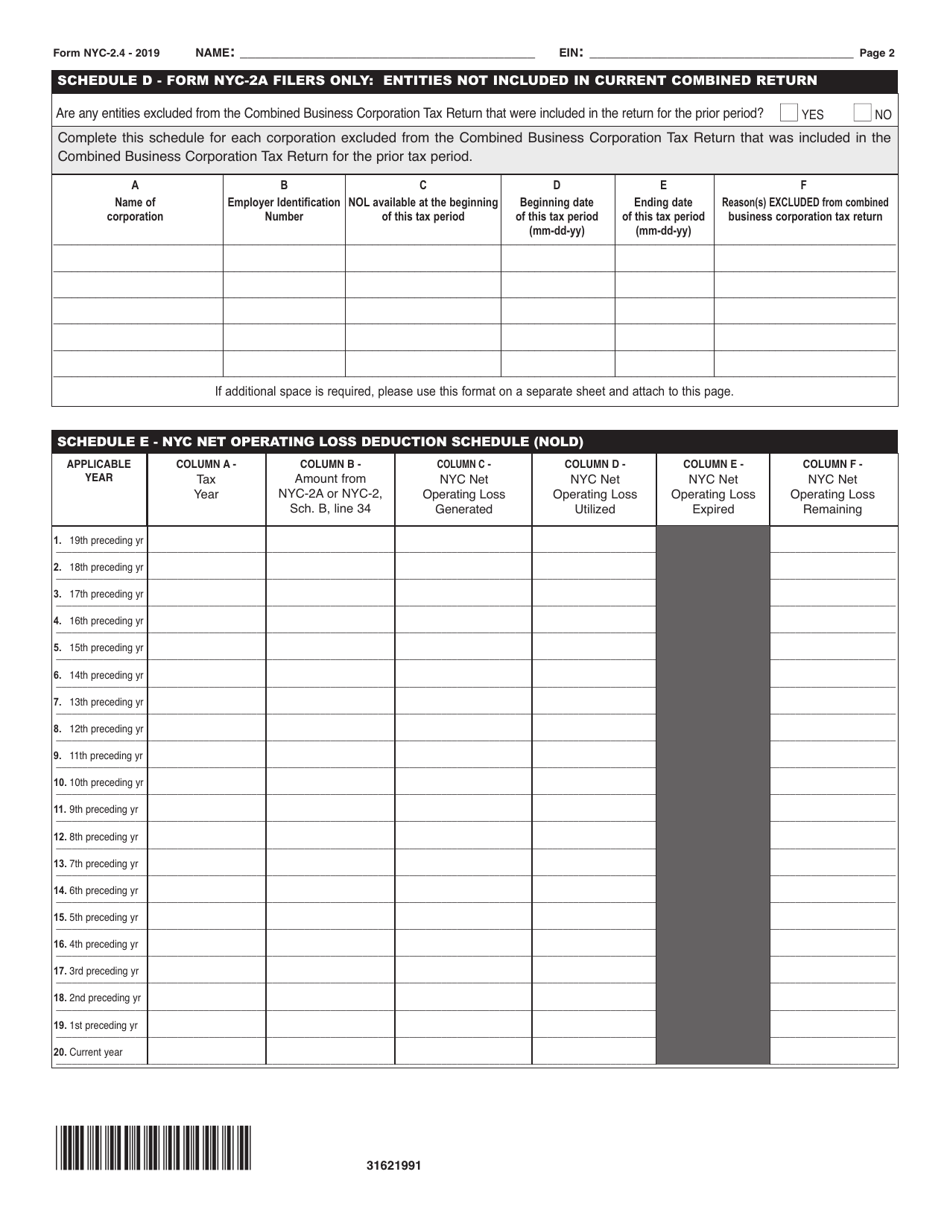

Form NYC-2.4

for the current year.

Form NYC-2.4 Net Operating Loss Deduction (Nold) - New York City

What Is Form NYC-2.4?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-2.4?

A: NYC-2.4 is a form used to claim the Net Operating Loss Deduction (NOLD) in New York City.

Q: What is the Net Operating Loss Deduction?

A: The Net Operating Loss Deduction is a deduction that allows businesses to offset their taxable income with any losses they have incurred.

Q: Who can use the NYC-2.4 form?

A: The NYC-2.4 form is used by businesses operating in New York City to claim the Net Operating Loss Deduction.

Q: How does the Net Operating Loss Deduction work?

A: The Net Operating Loss Deduction allows businesses to carry forward or back any losses they have incurred to offset taxable income in other years.

Form Details:

- Released on February 13, 2020;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.4 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.