This version of the form is not currently in use and is provided for reference only. Download this version of

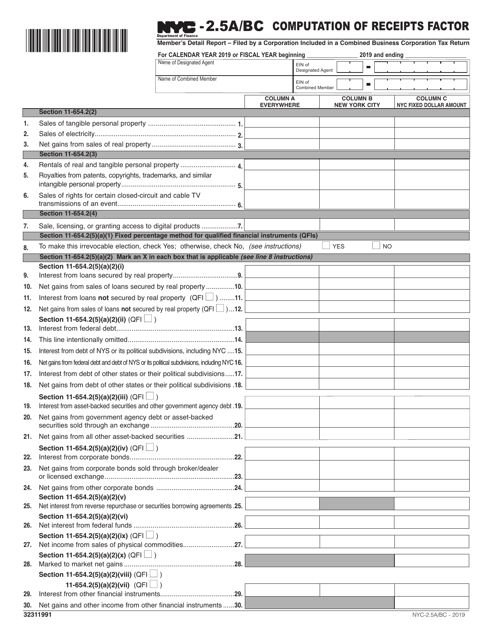

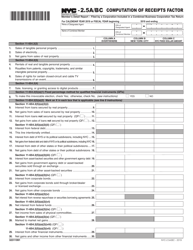

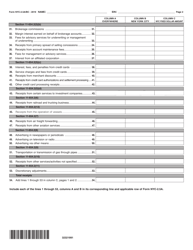

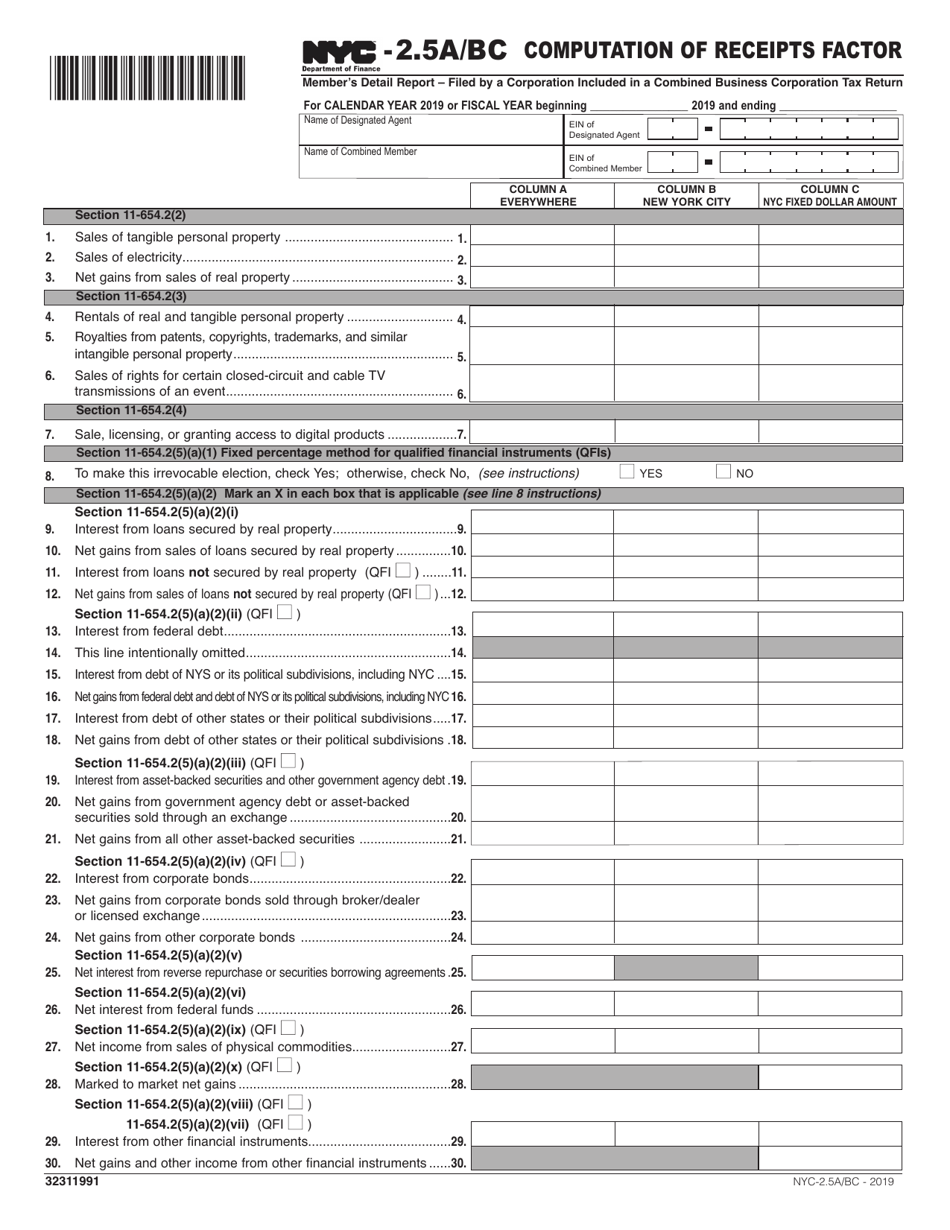

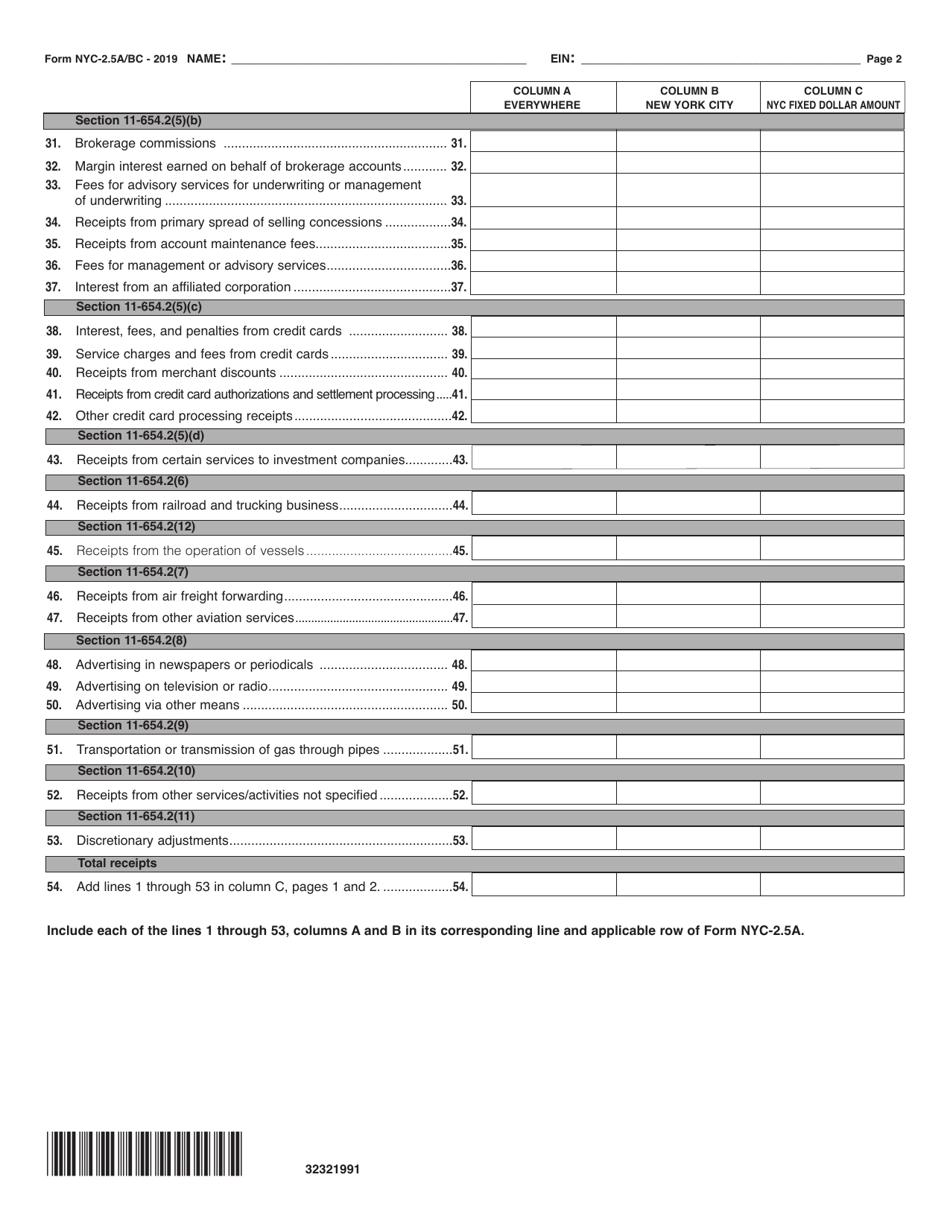

Form NYC-2.5A/BC

for the current year.

Form NYC-2.5A / BC Computation of Receipts Factor - New York City

What Is Form NYC-2.5A/BC?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-2.5A/BC?

A: NYC-2.5A/BC is a computation of the receipts factor for New York City.

Q: What is the receipts factor?

A: The receipts factor is a ratio used to determine the portion of a business's total receipts that should be allocated to New York City.

Q: Why is the receipts factor important?

A: The receipts factor is used to determine the amount of tax a business owes to New York City.

Q: What does NYC-2.5A/BC calculate?

A: NYC-2.5A/BC calculates the receipts factor for New York City.

Q: How is the receipts factor calculated?

A: The receipts factor is calculated by dividing the business's receipts sourced to New York City by its total receipts.

Q: What are sourced receipts?

A: Sourced receipts are the portion of a business's total receipts that can be attributed to New York City.

Q: What are total receipts?

A: Total receipts are the overall revenue earned by a business.

Q: Who needs to file NYC-2.5A/BC?

A: Businesses that have income sourced to New York City need to file NYC-2.5A/BC.

Q: Are there specific requirements or thresholds for filing?

A: Yes, there are specific requirements and thresholds for filing NYC-2.5A/BC. The instructions for the form provide detailed information on who needs to file.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.5A/BC by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.