This version of the form is not currently in use and is provided for reference only. Download this version of

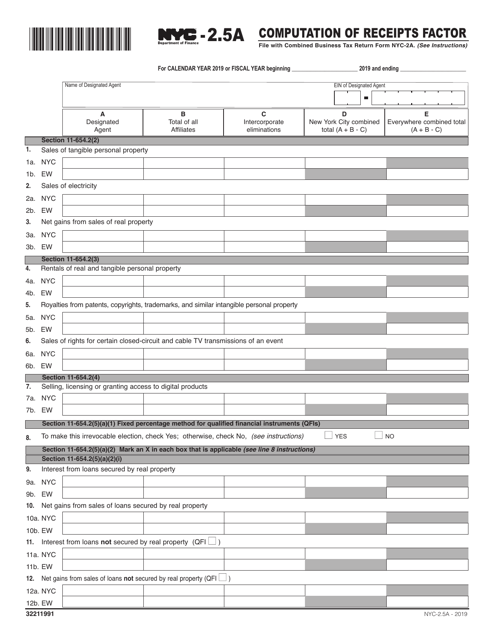

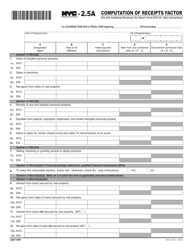

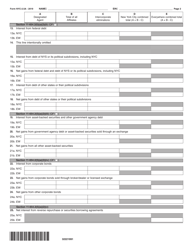

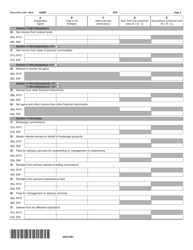

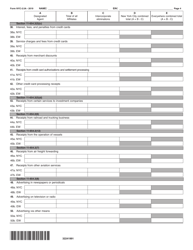

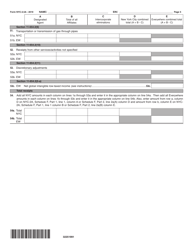

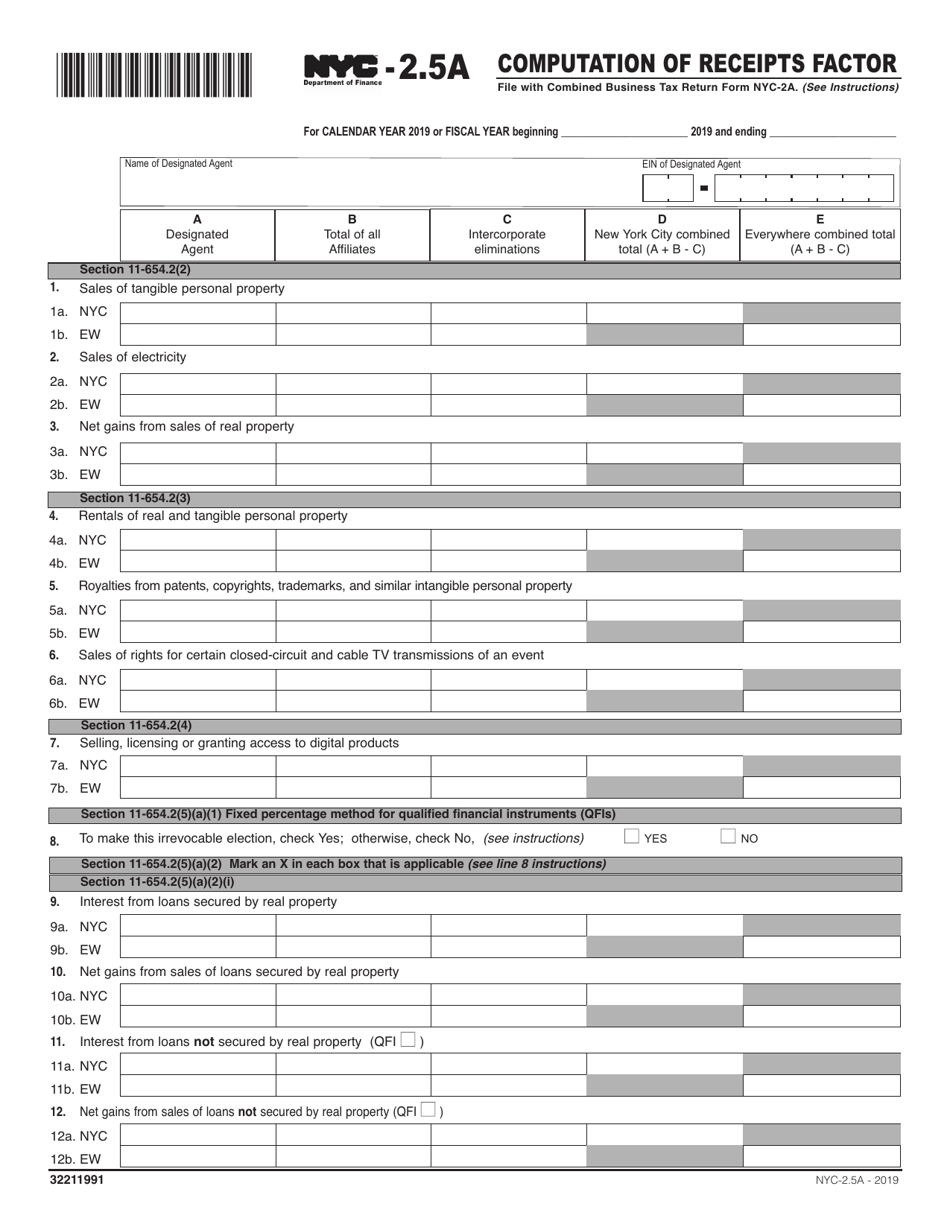

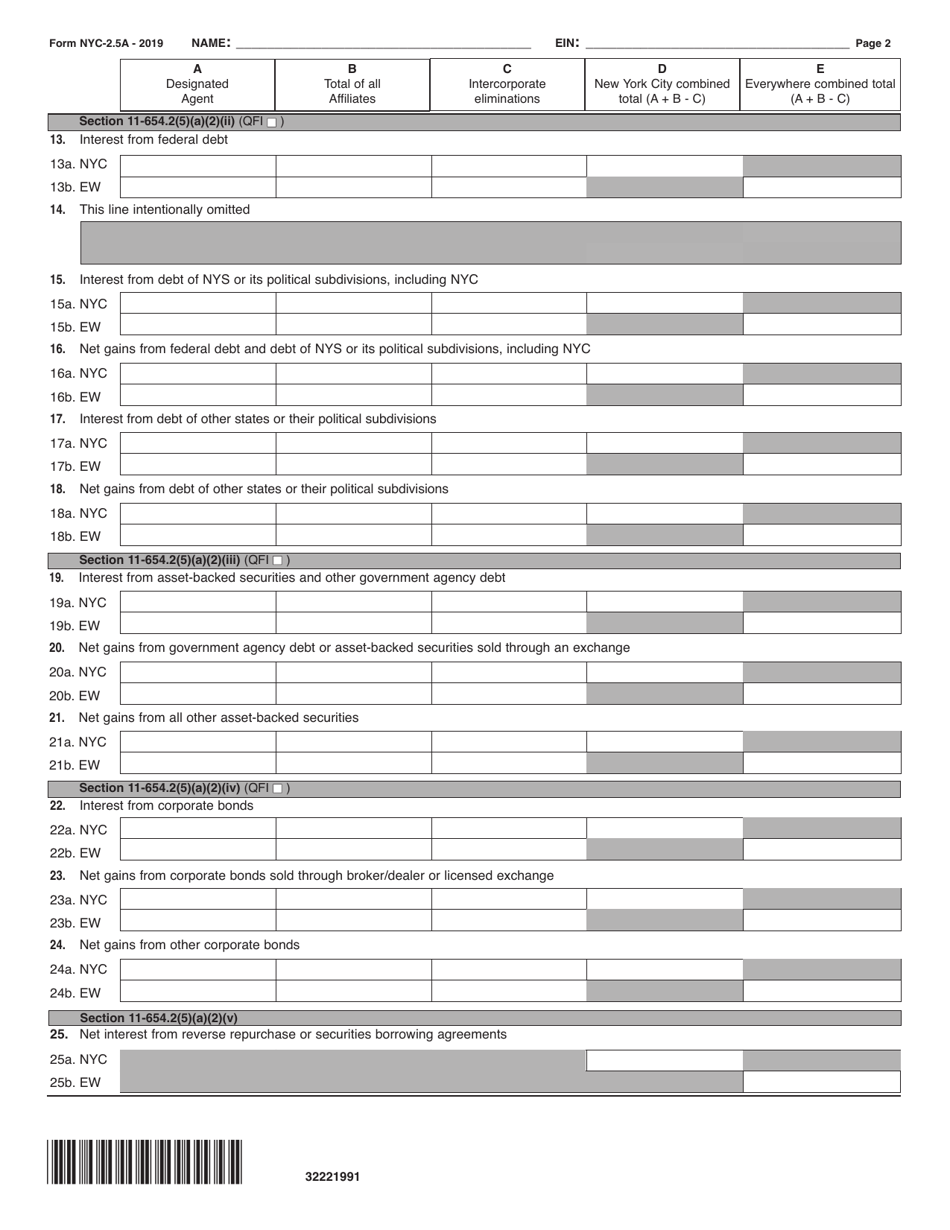

Form NYC-2.5A

for the current year.

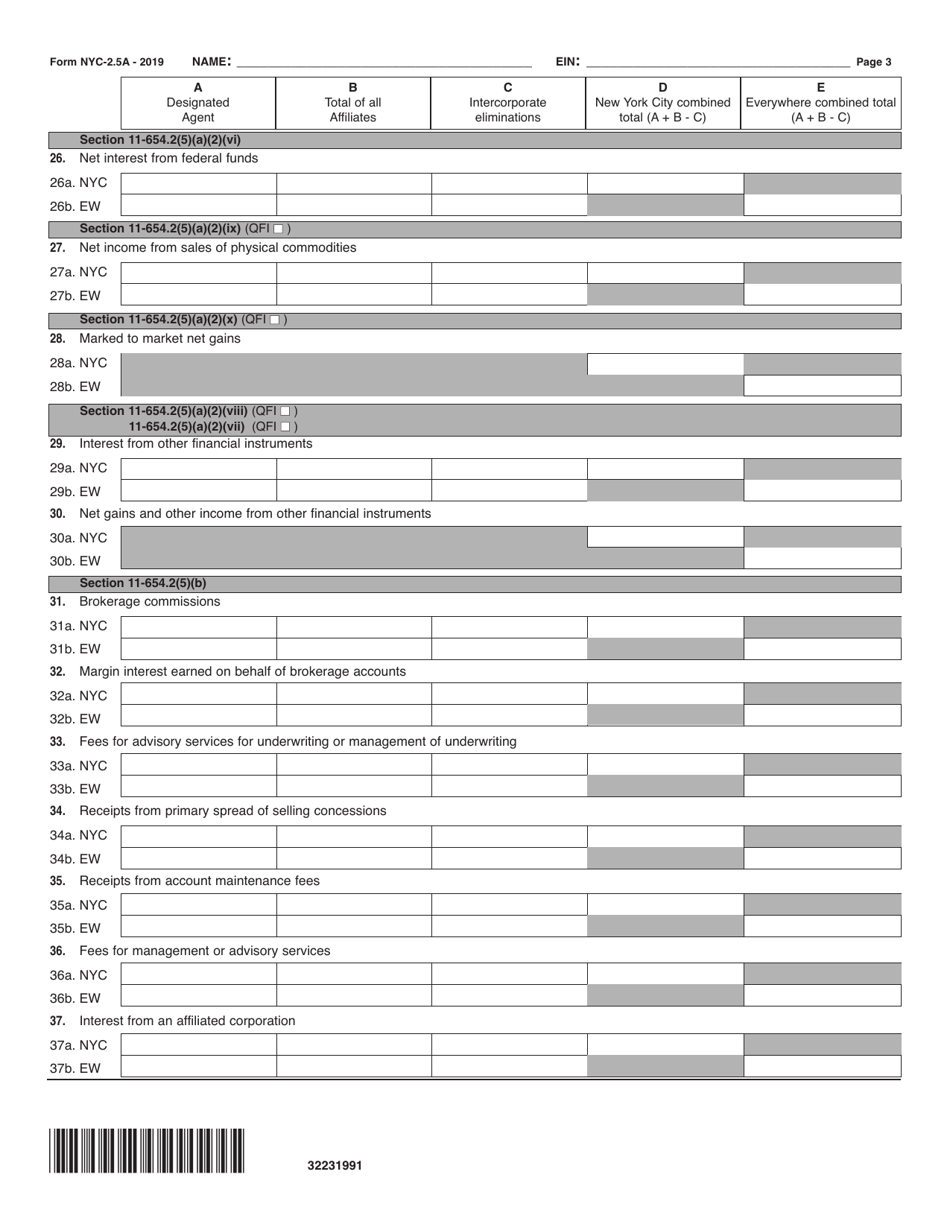

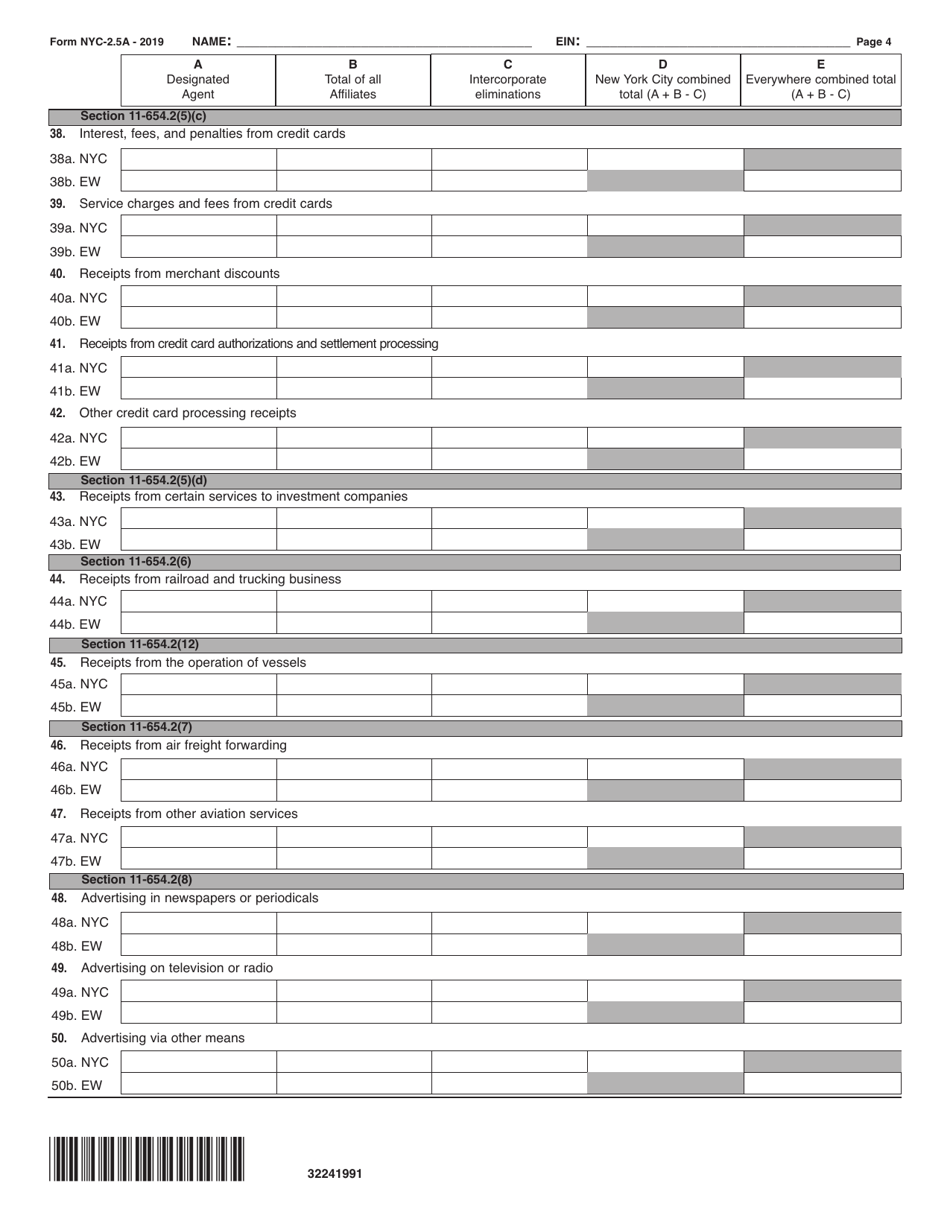

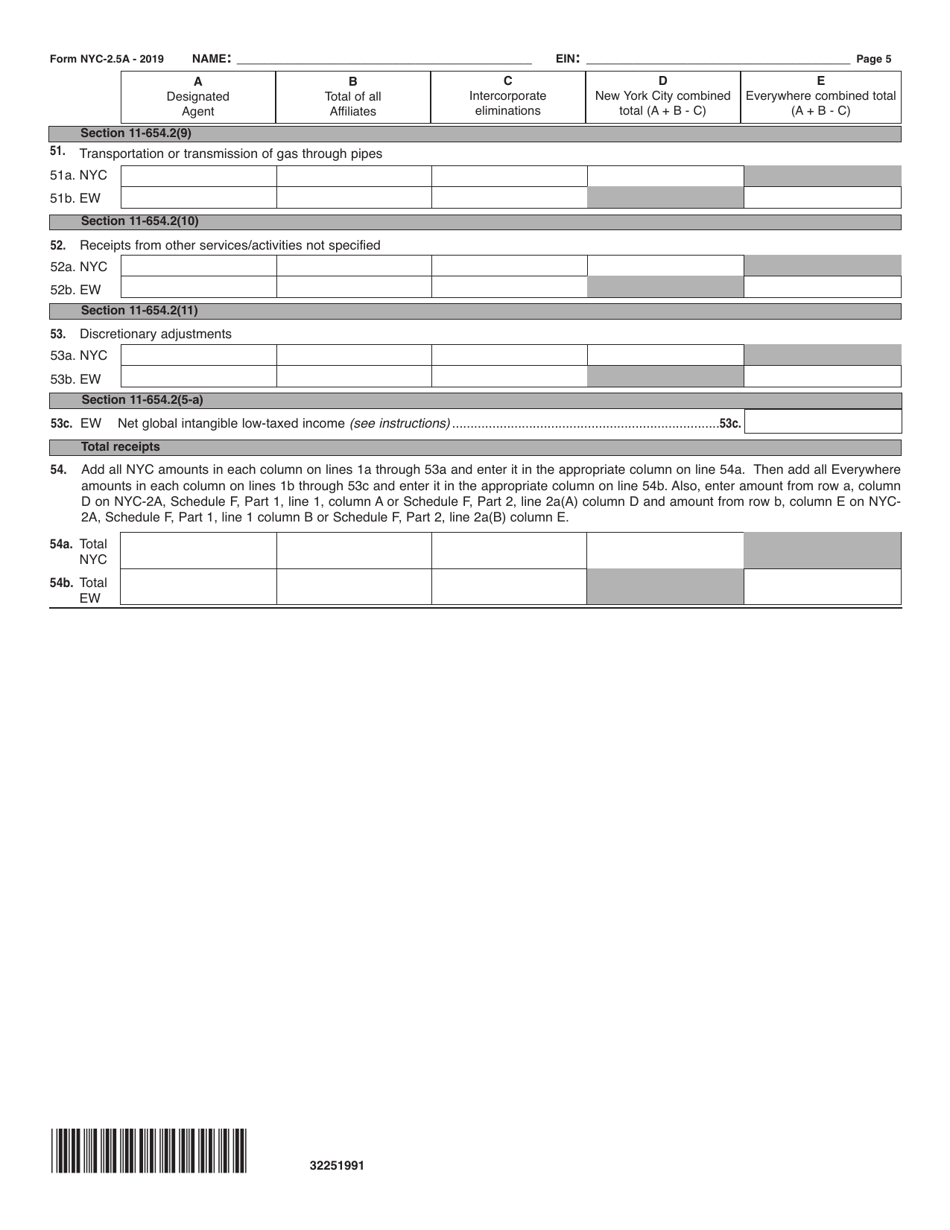

Form NYC-2.5A Computation of Receipts Factor - New York City

What Is Form NYC-2.5A?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NYC-2.5A?

A: NYC-2.5A refers to the Computation of Receipts Factor form for New York City.

Q: What is the purpose of NYC-2.5A?

A: The purpose of NYC-2.5A is to calculate the Receipts Factor for businesses operating in New York City.

Q: Who needs to file NYC-2.5A?

A: Businesses operating in New York City are required to file NYC-2.5A.

Q: What is the Receipts Factor?

A: The Receipts Factor is a measure used to determine the portion of a business's total receipts that is attributable to New York City.

Q: How is the Receipts Factor calculated?

A: The Receipts Factor is calculated by dividing the total receipts from New York City by the total receipts everywhere.

Q: What information is required to complete NYC-2.5A?

A: To complete NYC-2.5A, businesses need to provide details of their total receipts from New York City and total receipts from all locations.

Q: When is the deadline to file NYC-2.5A?

A: The deadline to file NYC-2.5A is typically March 15th of each year.

Q: Are there any penalties for not filing NYC-2.5A?

A: Yes, there are penalties for not filing NYC-2.5A, including potential fines and interest charges.

Form Details:

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.5A by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.