This version of the form is not currently in use and is provided for reference only. Download this version of

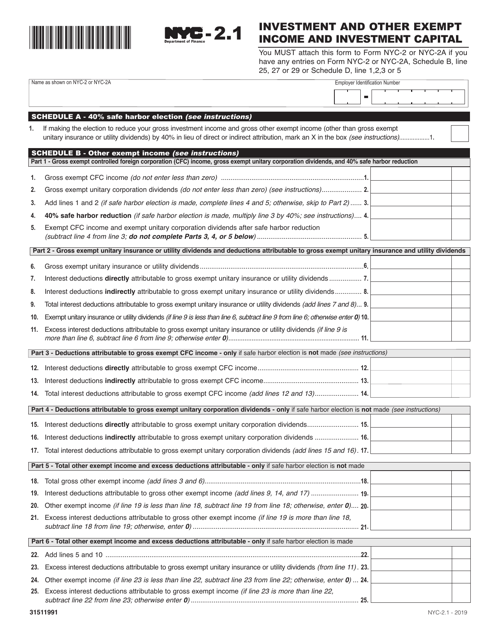

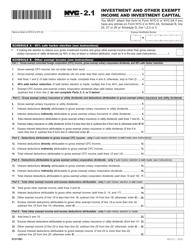

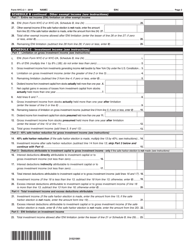

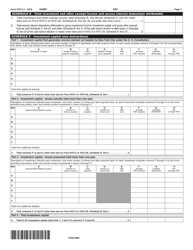

Form NYC-2.1

for the current year.

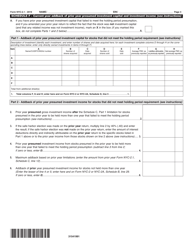

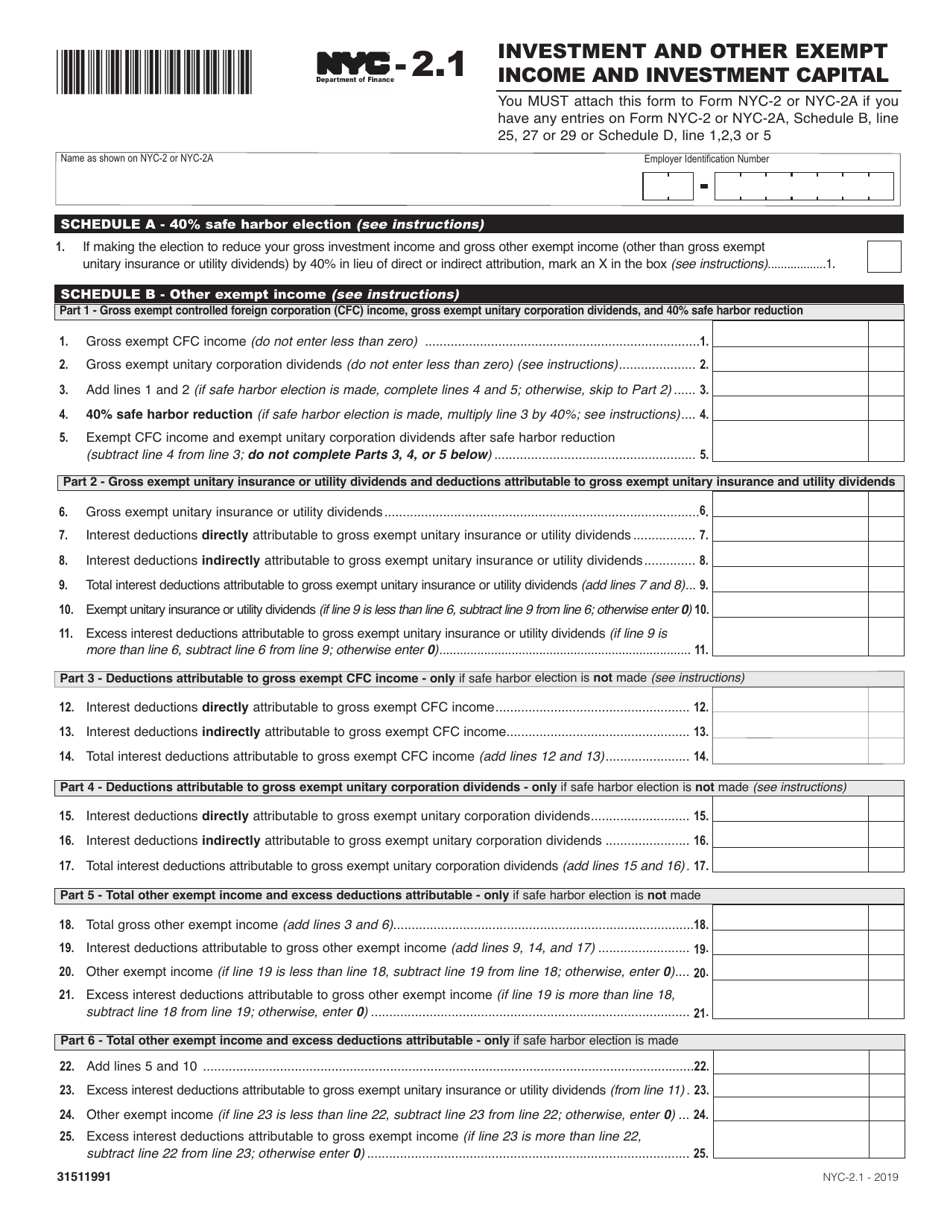

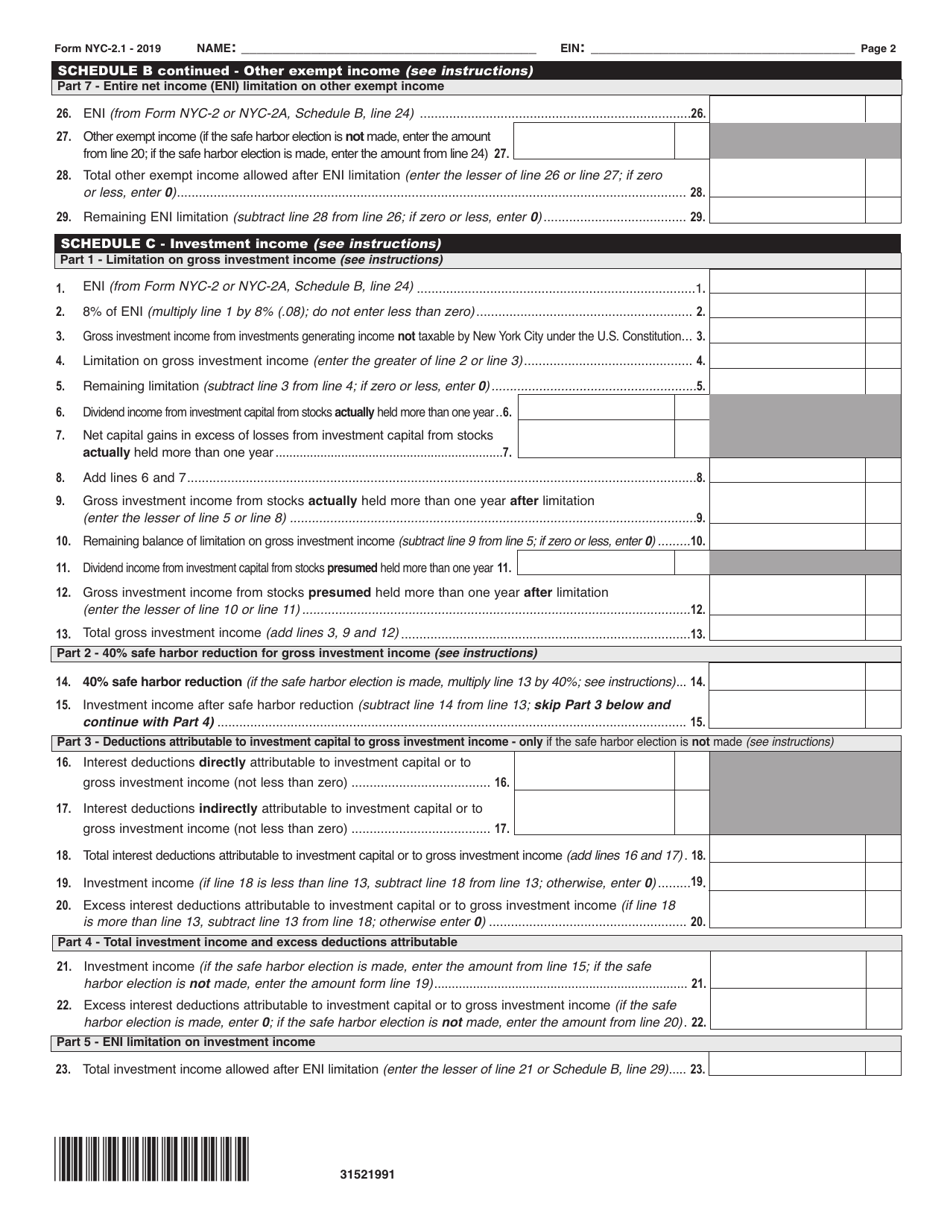

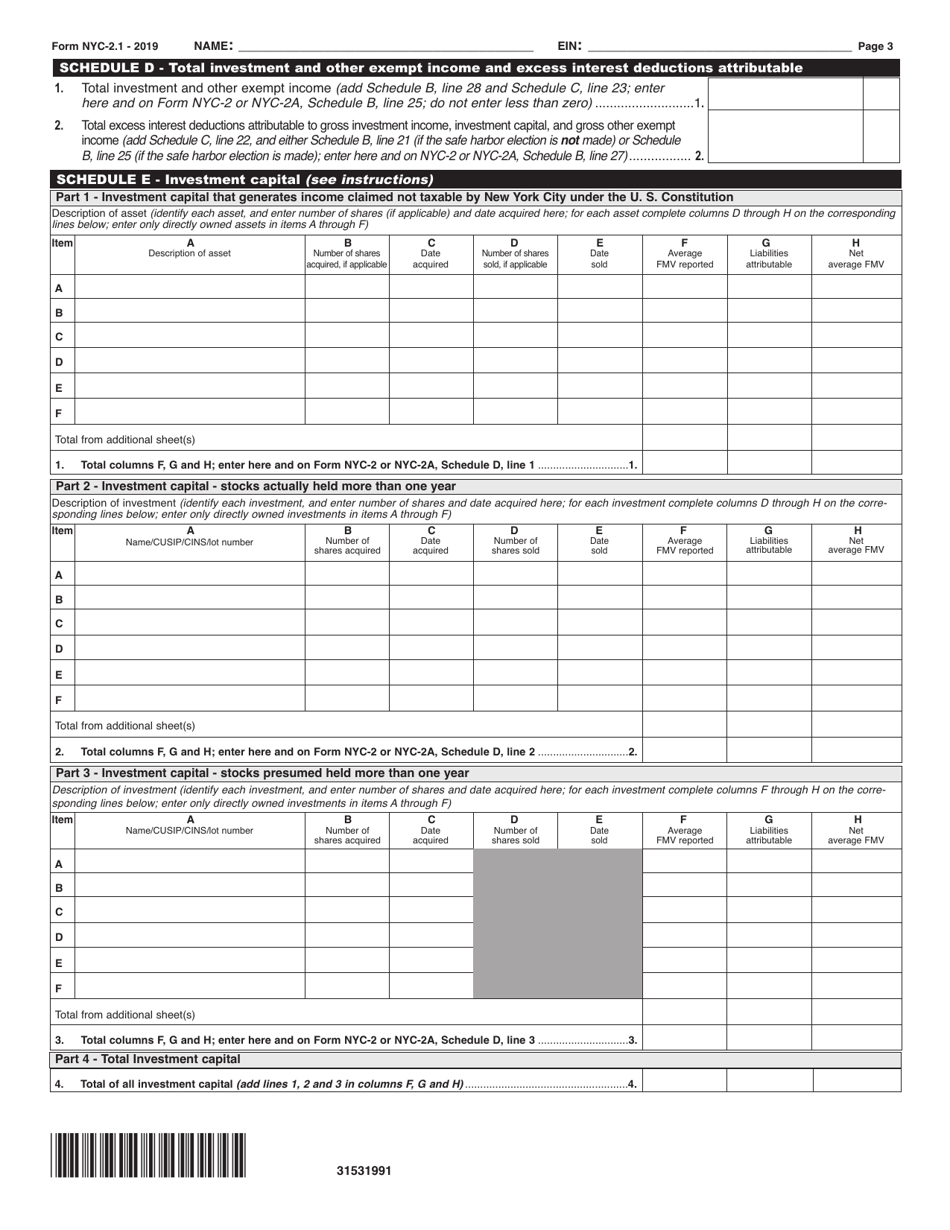

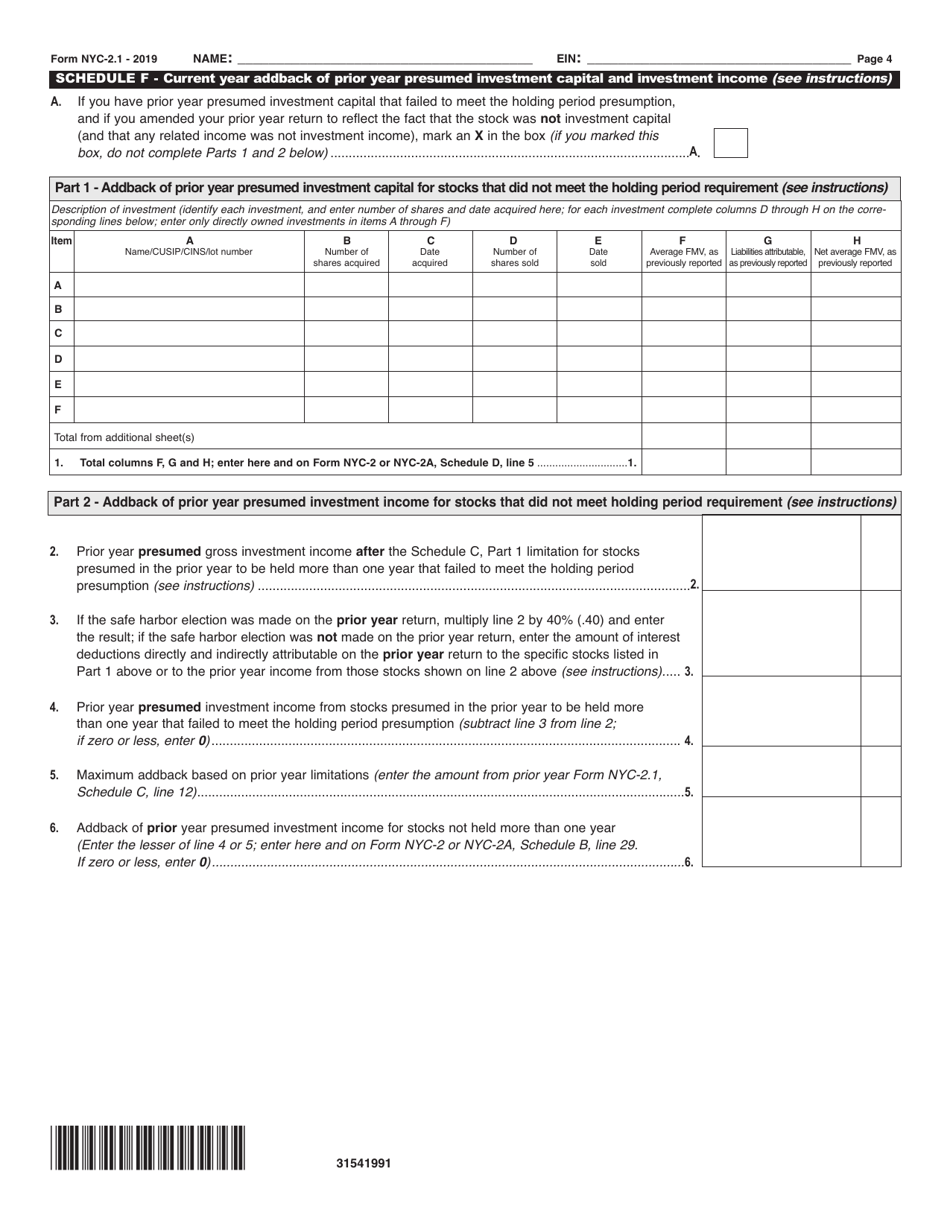

Form NYC-2.1 Investment and Other Exempt Income and Investment Capital - New York City

What Is Form NYC-2.1?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-2.1 form?

A: The NYC-2.1 form is a tax form used in New York City to report investment and other exempt income and investment capital.

Q: When is the NYC-2.1 form due?

A: The due date for the NYC-2.1 form varies each year, but it is typically due by April 15th.

Q: Who needs to file the NYC-2.1 form?

A: Individuals and businesses in New York City who have investment and other exempt income and investment capital need to file the NYC-2.1 form.

Q: What is considered investment and other exempt income?

A: Investment and other exempt income can include dividends, interest, royalties, and capital gains.

Q: What is investment capital?

A: Investment capital refers to the money or assets that are used for investment purposes, such as stocks, bonds, and real estate.

Q: Are there any exemptions or deductions available on the NYC-2.1 form?

A: Yes, there may be exemptions and deductions available depending on your specific situation. It is recommended to consult a tax professional or refer to the instructions provided with the form.

Q: What happens if I don't file the NYC-2.1 form?

A: Failure to file the NYC-2.1 form or filing it late may result in penalties and interest charges.

Q: Can I include additional attachments with the NYC-2.1 form?

A: Yes, you can attach additional schedules and documentation to support the information provided on the NYC-2.1 form if necessary.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.1 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.