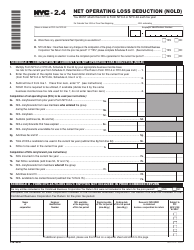

This version of the form is not currently in use and is provided for reference only. Download this version of

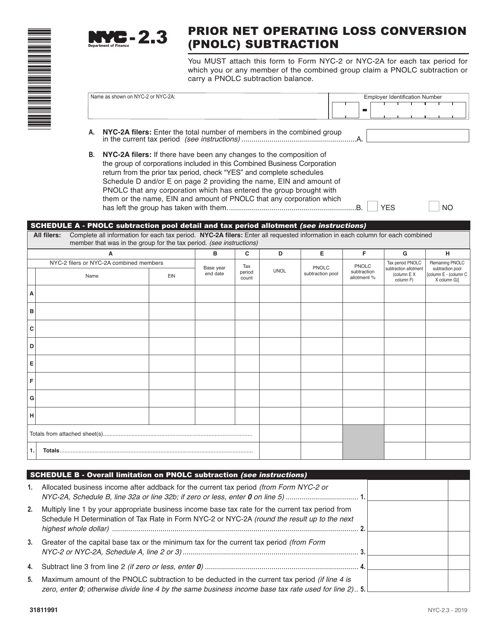

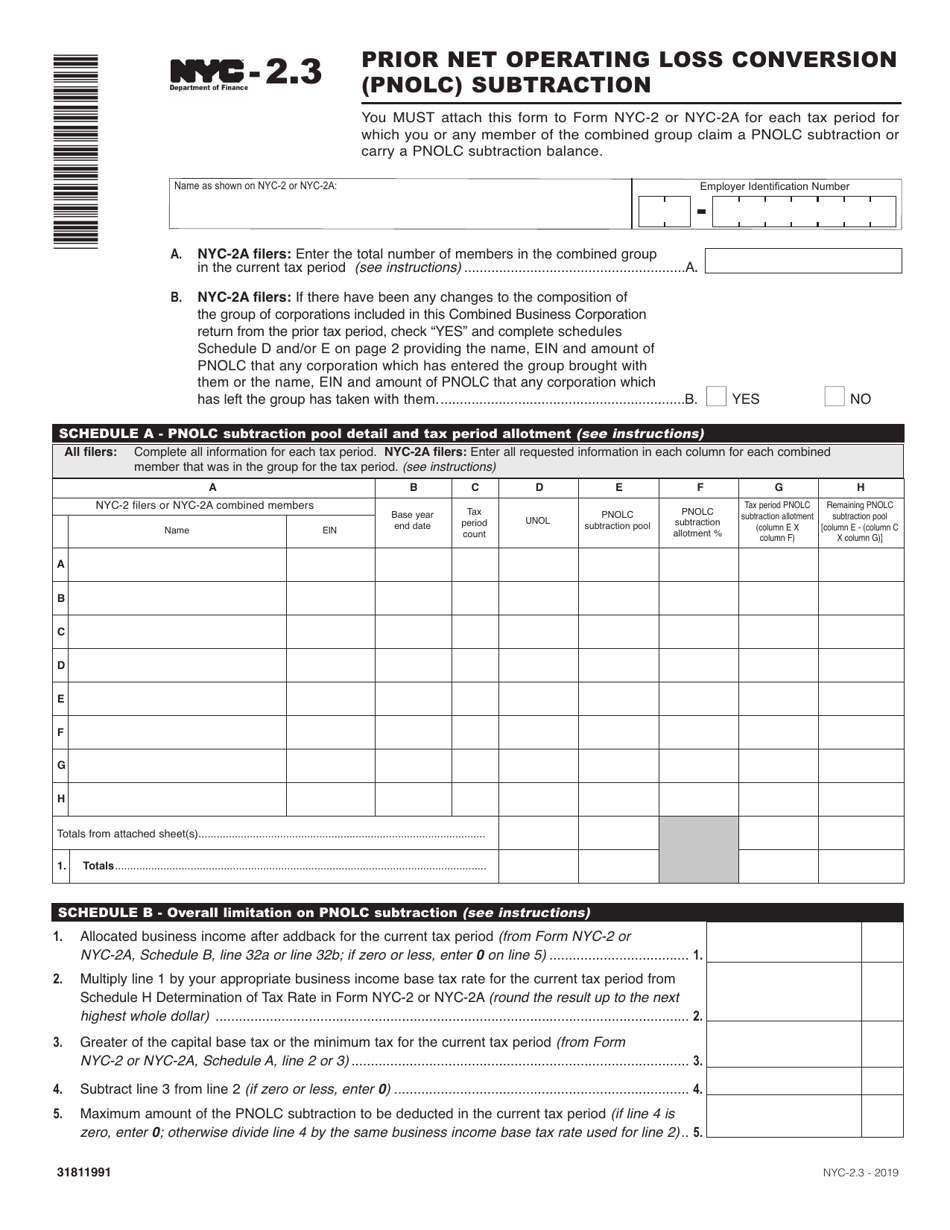

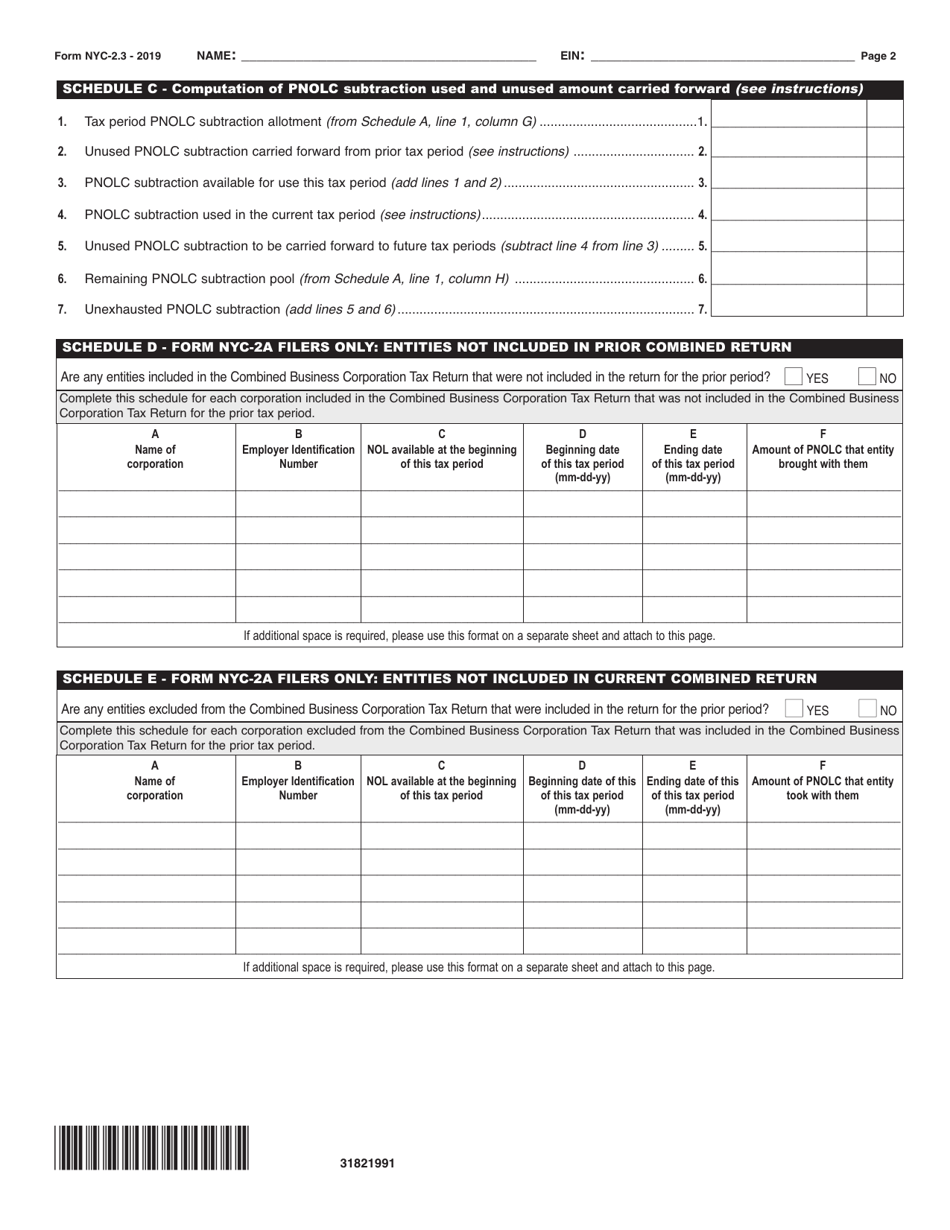

Form NYC-2.3

for the current year.

Form NYC-2.3 Prior Net Operating Loss Conversion (Pnolc) Subtraction - New York City

What Is Form NYC-2.3?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-2.3 form?

A: The NYC-2.3 form is used for Prior Net Operating Loss Conversion (PNOLC) Subtraction in New York City.

Q: What is Prior Net Operating Loss Conversion (PNOLC) Subtraction?

A: PNOLC Subtraction refers to the deduction of prior years' net operating losses from current year's income in New York City.

Q: Who needs to file the NYC-2.3 form?

A: Any individual or business that wants to claim a PNOLC Subtraction in New York City needs to file the NYC-2.3 form.

Q: What is the purpose of the NYC-2.3 form?

A: The purpose of the NYC-2.3 form is to calculate and claim the PNOLC Subtraction for tax purposes in New York City.

Q: Are there any deadlines for filing the NYC-2.3 form?

A: Yes, the NYC-2.3 form must be filed on or before the due date of your New York City tax return.

Q: Do I need to include any supporting documents with the NYC-2.3 form?

A: Yes, you may be required to attach certain documents such as federal tax returns and schedules to support your PNOLC Subtraction claim.

Q: What happens if I don't file the NYC-2.3 form?

A: Failure to file the NYC-2.3 form may result in the denial of your PNOLC Subtraction claim and potential penalties or interest charges.

Q: Is the NYC-2.3 form specific to New York City only?

A: Yes, the NYC-2.3 form is specific to calculating and claiming PNOLC Subtraction in New York City. It is not used for any other locality or jurisdiction.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-2.3 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.