This version of the form is not currently in use and is provided for reference only. Download this version of

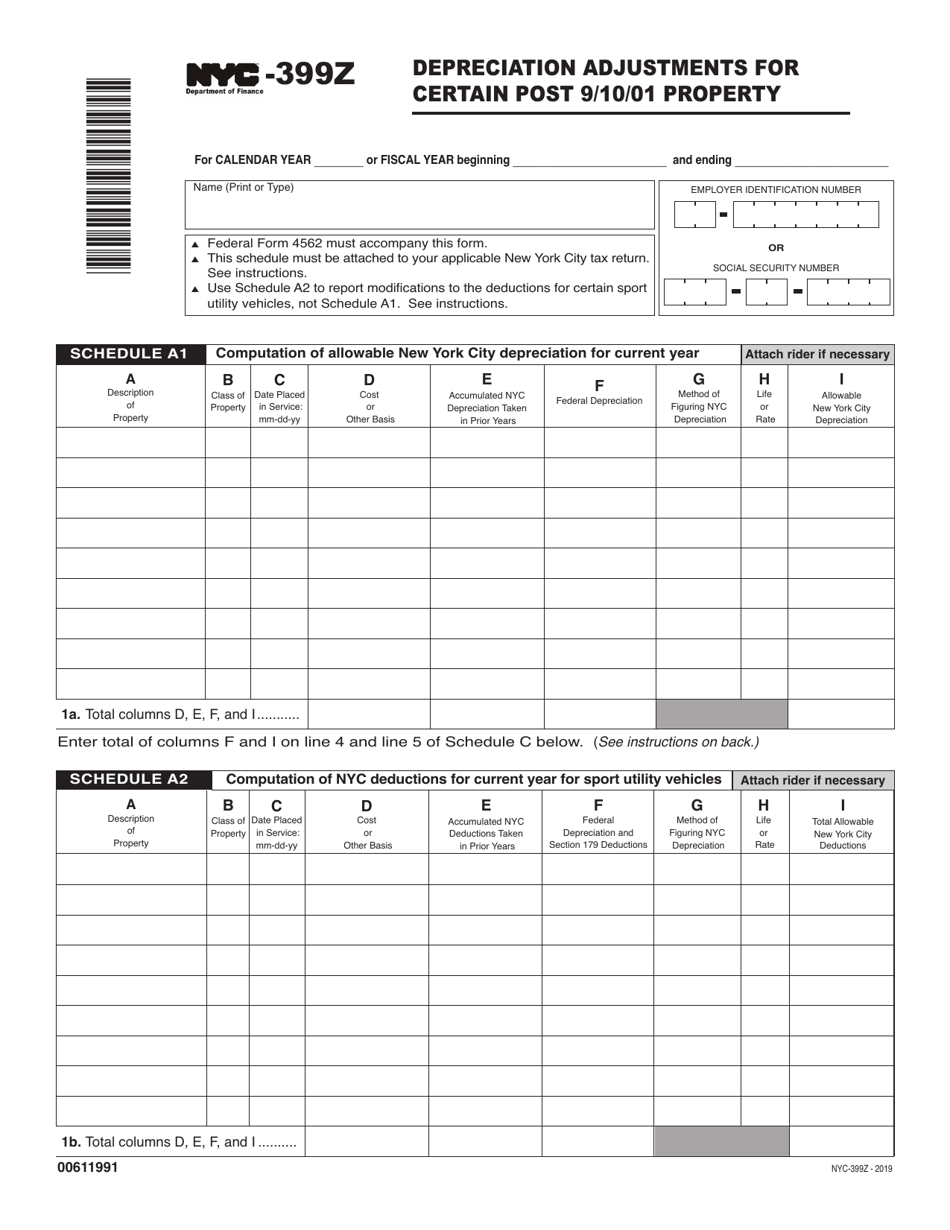

Form NYC-399Z

for the current year.

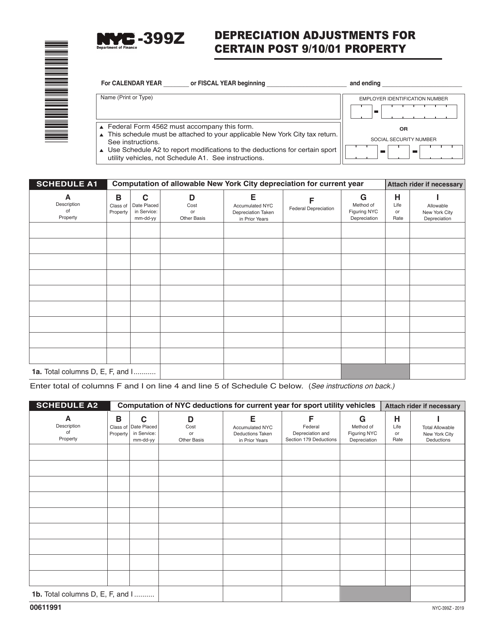

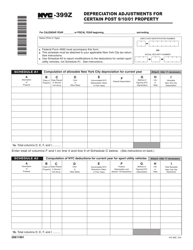

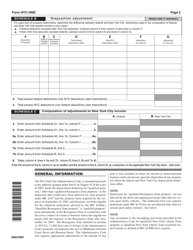

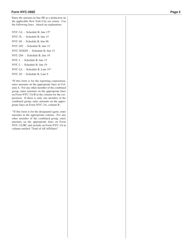

Form NYC-399Z Depreciation Adjustments for Certain Post 9 / 10 / 01 Property - New York City

What Is Form NYC-399Z?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-399Z form?

A: The NYC-399Z form is used to report depreciation adjustments for certain property in New York City.

Q: What is the purpose of the NYC-399Z form?

A: The purpose of the NYC-399Z form is to calculate and report the depreciation adjustments for specific property in New York City.

Q: What is considered 'certain property' for the NYC-399Z form?

A: 'Certain property' refers to property acquired or placed in service after September 10, 2001, in New York City.

Q: Why do I need to file the NYC-399Z form?

A: You need to file the NYC-399Z form to accurately report the depreciation adjustments for eligible property in New York City.

Q: When do I need to submit the NYC-399Z form?

A: The NYC-399Z form must be submitted annually, along with your New York City business income tax return, by the due date.

Q: What happens if I don't file the NYC-399Z form?

A: Failure to file the NYC-399Z form can result in penalties or interest on the depreciation adjustments for certain property in New York City.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-399Z by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.